PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406184

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406184

Asia-Pacific Naval Vessels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

The Asia-Pacific naval vessels market was valued at USD 40.07 billion in 2024 and is projected to grow to USD 88.44 billion by 2029, registering a CAGR of 14.48% during the forecast period.

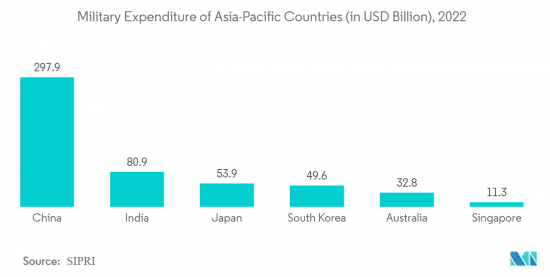

The increasing terrorism, maritime border security tensions between Asia-Pacific countries, piracy, and trafficking in the Indian Ocean, South China Sea, Arabian Sea, and South Pacific Ocean are prompting countries to deploy more naval vessels and coast guard patrol boats in the region. Increased defense spending and budget allocation for naval forces are supporting the growth of the naval vessels market in this region as countries look to modernize their naval vessel fleets.

Countries such as Japan and China are heavily integrating advanced technologies such as robotics and automation to develop a more cohesive naval force that can work simultaneously with the army and air force, thus enhancing situational awareness and battle management. This factor will likely further propel the growth of the naval vessels market in the Asia-Pacific region.

However, stringent rules and regulations to reduce emissions and pollution in the ocean are a challenge for naval vessel manufacturers.

Asia-Pacific Naval Vessels Market Trends

Destroyers to Exhibit the Highest Growth Rate During the Forecast Period

Escalating tensions in the South China Sea have resulted in several countries in that region strengthening their naval capabilities. This has also resulted in countries increasing their annual defense budget in the construction of destroyers. Many small nations with limited capabilities in naval shipbuilding are purchasing destroyers from other markets, such as Europe, the United States, China, Japan, and South Korea. The Philippine Navy announced its plans to buy 25-30 warships, including destroyers, to modernize and increase its existing fleet by 2030. In December 2022, the second of the Project 15B stealth-guided missile destroyers built by Mazagon Dock Shipbuilders Limited (MDSL) was inducted into the Indian Navy. The destroyers are being built under Project 15-B, and the Indian government has signed a deal to acquire an advanced sensor and weapon systems package for under-construction warships for nearly USD 800 million. The replacement programs in various countries to replace the current aging fleet of destroyers with modern detection and weapon systems are also propelling the demand for destroyers. According to the Defense Buildup Program, the Japan Maritime Self-Defense Force (JMSDF) will likely increase the number of Aegis destroyers (DDG) from the current fleet of eight to ten. The Japanese government has also decided to purchase 500 Tomahawk cruise missiles, which will likely be installed on JMSDF Aegis destroyers.

India to Exhibit the Highest Growth Rate During the Forecast Period

Amidst tensions and disputes with China, India has significantly stepped up its naval capabilities through huge investments and advancements in engineering and technology. In the 2023 budget announcement, an allocation of USD 6.35 billion was set aside as the capital outlay for the Indian Navy as against USD 5.72 billion given to the force in 2022-23. As of November 2022, the Indian Navy had 45 vessels of various types under construction, including destroyers, frigates, corvettes, conventional-powered and nuclear-powered submarines, and various other ships, and plans to build a strong navy of 200 vessels by 2050. Recently, in August 2023, the government cleared a USD 2.4 billion deal to manufacture fleet support vessels (FSVs), which the Indian Navy urgently requires. Under the Make in India initiative, the country is rapidly increasing its indigenously produced warships and initiated Project 75 Alpha. Under this project, six submarines will be designed by the Navy's in-house Directorate of Naval Design and built by the Shipbuilding Centre at Visakhapatnam. The construction is expected to commence on 2023-24, while the first submarine is expected to enter service in 2032. These developments will likely lead to the significant growth of the naval vessels market in India.

Asia-Pacific Naval Vessels Industry Overview

The naval vessel market in the Asia-Pacific region is competitive and is expected to remain semi-consolidated in the forecasted years. The market is heavily dominated by prominent players such as Cochin Shipyard Limited, HD Hyundai, LARSEN & TOUBRO LIMITED. Mitsubishi Heavy Industries Limited and Kawasaki Heavy Industries, Ltd. These corporations own a large number of shipbuilding docks for naval vessel developments while collaborating with privately owned companies for technological and project management assistance. The key players in the region generate revenue by completing orders largely from national governments. European naval shipbuilders also have a presence in the region in the form of joint ventures and collaboration. Other key players in the region include Singapore Technologies Engineering Limited, ASC Pty Ltd., etc., and PT PAL Indonesia, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vessel Type

- 5.1.1 Submarines

- 5.1.2 Frigates

- 5.1.3 Corvettes

- 5.1.4 Aircraft Carrier

- 5.1.5 Destroyers

- 5.1.6 Other Vessel Types

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Australia

- 5.2.1.6 Singapore

- 5.2.1.7 Rest of Asia-Pacific

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 China State Shipbuilding Corporation

- 6.1.2 Garden Reach Shipbuilders and Engineers Limited

- 6.1.3 LARSEN & TOUBRO LIMITED

- 6.1.4 Mazagon Dock Shipbuilders Limited

- 6.1.5 Cochin Shipyard Limited

- 6.1.6 PT PAL Indonesia

- 6.1.7 Boustead Heavy Industries Corporation Berhad

- 6.1.8 Singapore Technologies Engineering Limited

- 6.1.9 Bangkok Dock Company Limited

- 6.1.10 HD Hyundai

- 6.1.11 Mitsubishi Heavy Industries Limited

- 6.1.12 Kawasaki Heavy Industries, Ltd.

- 6.1.13 ASC Pty Ltd.

- 6.1.14 FINCANTIERI S.p.A.

- 6.1.15 thyssenkrupp AG

- 6.1.16 Navantia S.A. SM.E

7 MARKET OPPORTUNITIES AND FUTURE TRENDS