PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910831

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910831

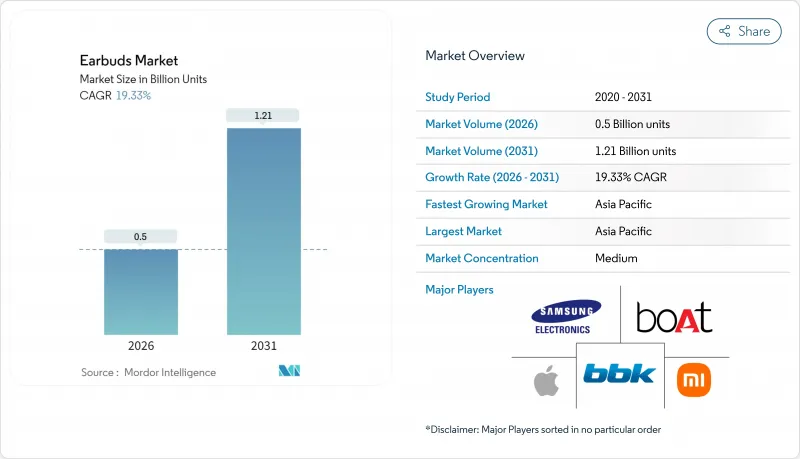

Earbuds - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The earbuds market is expected to grow from 0.42 billion units in 2025 to 0.5 billion units in 2026 and is forecast to reach 1.21 billion units by 2031 at 19.33% CAGR over 2026-2031.

Growth reflects rising demand for wellness-centric features, enterprise-grade communications, and premium acoustics woven into compact form factors. Fitness tracking, hybrid-work audio needs, and faster smartphone replacement cycles create multiple tailwinds. Manufacturers leverage Asia Pacific's supply-chain depth to scale component integration while simultaneously reshoring strategic battery sub-assemblies. Competitive rivalry intensifies as smartphone brands, legacy audio players, and direct-to-consumer specialists introduce advanced noise cancellation, MEMS speakers, and AI-driven personalization, prompting steady feature migration from premium to value tiers.

Global Earbuds Market Trends and Insights

Rising Fitness-Centric Audio Consumption

The shift toward preventive health elevates earbuds from passive listening devices to active biometric monitors. Nokia Bell Labs' OmniBuds research platform illustrates the trajectory with integrated 9-axis IMUs, multi-wavelength PPG, and medical-grade temperature sensors that enable continuous heart-rate variability, SpO2, and cuff-less blood-pressure tracking. Commercial pipelines mirror the laboratory: Synseer targets late-2025 FDA clearance for HealthBuds, pairing ultrasonic in-ear sensing with privacy-preserving edge processing. These capabilities dovetail with the USD 4.4 trillion global wellness economy, supporting a 19.73% CAGR in fitness applications by transforming earbuds into indispensable workout companions and round-the-clock health sentinels.

Smartphone and 5G Penetration Boost

Global 5G rollouts and higher smartphone refresh rates unlock new audio workloads. Qualcomm's S7 Pro XPAN platform enables high-resolution 96 kHz/24-bit streams over Wi-Fi with Bluetooth-like power draw, first commercialized in Xiaomi's 2025 Buds 5 Pro press release. Low-latency, high-bandwidth links support spatial audio, real-time translation, and cloud-assisted AI soundscapes. Regulatory tailwinds reinforce the trend: the U.S. Federal Communications Commission mandates 100% hearing-aid compatibility for handsets by 2028, prompting tighter handset-earbud integration.

Counterfeit Low-Cost Product Influx

Customs agencies report rising seizures of fake branded earbuds that undercut legitimate players and expose consumers to safety risks. U.S. Customs and Border Protection valued recent confiscations at USD 62.6 million, representing nearly 360,000 counterfeit units, underscoring the scale of illicit trade. E-commerce marketplaces remain the primary conduit. Brand owners respond with blockchain-anchored authenticity tags and machine-vision scrapers that recognize infringements at listing upload, though the solutions are viable mainly for mid- and premium price tiers where margins offset compliance costs.

Other drivers and restraints analyzed in the detailed report include:

- Premium Features Filtering into Low-Price Tiers

- Enterprise Adoption for Hybrid-Work Audio

- Rare-Earth Magnet Supply Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Truly wireless models represented 73.55% of 2025 shipments, and their 19.92% CAGR positions them as the backbone of the earbuds market. Earbuds market size for truly wireless types is on track to double by 2031 as innovations in solid-state batteries, reverse-charging cases, and low-power Wi-Fi chipsets enhance user convenience. HMD Global's 1,600 mAh Amped Buds case triples average pack capacity without increasing thickness, underlining progress in energy density. Continuous removal of 3.5 mm ports across smartphones hastens wired attrition, concentrating R&D on untethered designs.

The technology roadmap pivots toward shape-flexible solid-state cells and ultra-wideband (UWB) radios that bolster location services. Samsung's pilot lines for oxide-based solid-state modules forecast 20% energy-density gains, foundational for sub-4 gram earbud shells. While legacy neckband styles retain a foothold in developing markets where 30-hour runtime remains compelling, their share erodes as truly wireless bill-of-materials costs fall below USD 12.

The mid-price band maintained 45.05% of the earbuds market share in 2025 owing to equilibrium between feature depth and affordability. Earbuds market size for this tier is projected to grow at a steady clip as ANC, spatial audio, and PPG sensors migrate downward. JLab's GO Pods ANC provide hybrid noise cancellation and 26-hour playtime at USD 36.99, demonstrating the squeeze on mid-tier differentiation.

Low-price models surge at 21.34% CAGR as component commoditization collides with emerging-market demand. Meanwhile, premium units above USD 150 face slower growth even though Apple's AirPods line generated USD 18 billion in 2024 revenue. Sustained premium traction now depends on breakthroughs such as camera-equipped stems or AI-led adaptive acoustics rather than incremental codec upgrades. Designers therefore segment portfolios with eco-friendly materials and wellness analytics to uphold price ceilings.

The Earbuds Market Report is Segmented by Feature (Wired Earbuds, and Wireless Earbuds [Truly Wireless, and More]), Price Range (Premium Over USD 150, Mid USD 50-150, and Low Under USD 50), Distribution Channel (Offline, and Online), Application (Fitness and Sports, Gaming and Esports, Professional and Office, and Music and General Consumer Entertainment), and Geography. The Market Forecasts are Provided in Terms of Volume (Units)

Geography Analysis

Asia Pacific leads with 36.80% share and sustains a 19.15% CAGR through 2031. Earbuds market size in the region reflects deep contract-manufacturing clusters and rising middle-class spending. Goertek's USD 280 million Vietnam expansion adds 30 million annual earphone units for Samsung and Apple. India's offline audio market reached INR 5,000 crore (USD 600 million) in 2024, logging 61% volume growth and signaling robust appetite for true wireless formats.

North America maintains high premium penetration, propelled by accessory attach rates among smartphone flagships. Policy-driven inclusivity also shapes demand: the FCC's 2028 hearing-aid compatibility mandate fosters new SKUs with ambient-sound amplification and self-fitting audiogram apps. Sustainability preferences steer European consumers toward recycled-plastic housings; Sony reports earbuds using 85% recycled ABS polymers.

Latin America, the Middle East, and Africa register double-digit unit growth off a smaller base, aided by value-tier models embedding ANC and MEMS speakers. Counterfeit infiltration remains acute, prompting customs partnerships and regional warranty centers to reinforce brand trust. Infrastructure gaps in last-mile logistics and digital payments moderate online channel expansion, but smartphone uptake paves the way for accelerated adoption as economic conditions improve.

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Xiaomi Corp.

- Imagine Marketing Ltd. (boAt)

- Huawei Device Co. Ltd.

- Sony Group Corp.

- Bose Corp.

- Skullcandy Inc.

- Edifier International Ltd.

- QCY Electronics Co. Ltd.

- JLab Audio LLC

- BBK Electronics Corp. Ltd.

- GN Store Nord A/S

- Shokz Holding Ltd.

- Anker Innovations Ltd. (Soundcore)

- Logitech International S.A. (Jaybird)

- Plantronics Inc. (Poly)

- Bowers and Wilkins Group Ltd.

- Sennheiser electronic GmbH and Co. KG

- Harman International Industries Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising fitness-centric audio consumption

- 4.2.2 Shorter replacement cycles for wired earphones

- 4.2.3 Smartphone and 5G penetration boost

- 4.2.4 Premium features filtering into low-price tiers

- 4.2.5 Battery component reshoring in Asia Pacific

- 4.2.6 Enterprise adoption for hybrid-work audio

- 4.3 Market Restraints

- 4.3.1 Ergonomic limits for long-hour wear

- 4.3.2 Hearing-health compliance tightening

- 4.3.3 Counterfeit low-cost product influx

- 4.3.4 Rare-earth magnet supply volatility

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (UNITS)

- 5.1 By Feature

- 5.1.1 Wired Earbuds

- 5.1.2 Wireless Earbuds

- 5.1.2.1 Truly Wireless

- 5.1.2.2 Other Wireless Earbuds

- 5.2 By Price Range

- 5.2.1 Premium (> USD 150)

- 5.2.2 Mid (USD 50 - 150)

- 5.2.3 Low (< USD 50)

- 5.3 By Distribution Channel

- 5.3.1 Offline

- 5.3.2 Online

- 5.4 By Application

- 5.4.1 Fitness and Sports

- 5.4.2 Gaming and Esports

- 5.4.3 Professional and Office

- 5.4.4 Music and General Consumer Entertainment

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Kenya

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Apple Inc.

- 6.4.2 Samsung Electronics Co. Ltd.

- 6.4.3 Xiaomi Corp.

- 6.4.4 Imagine Marketing Ltd. (boAt)

- 6.4.5 Huawei Device Co. Ltd.

- 6.4.6 Sony Group Corp.

- 6.4.7 Bose Corp.

- 6.4.8 Skullcandy Inc.

- 6.4.9 Edifier International Ltd.

- 6.4.10 QCY Electronics Co. Ltd.

- 6.4.11 JLab Audio LLC

- 6.4.12 BBK Electronics Corp. Ltd.

- 6.4.13 GN Store Nord A/S

- 6.4.14 Shokz Holding Ltd.

- 6.4.15 Anker Innovations Ltd. (Soundcore)

- 6.4.16 Logitech International S.A. (Jaybird)

- 6.4.17 Plantronics Inc. (Poly)

- 6.4.18 Bowers and Wilkins Group Ltd.

- 6.4.19 Sennheiser electronic GmbH and Co. KG

- 6.4.20 Harman International Industries Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment