PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643133

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643133

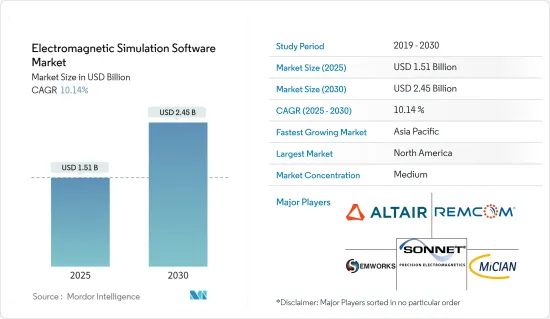

Electromagnetic Simulation Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Electromagnetic Simulation Software Market size is estimated at USD 1.51 billion in 2025, and is expected to reach USD 2.45 billion by 2030, at a CAGR of 10.14% during the forecast period (2025-2030).

A simulation-driven approach toward product development primarily offers an effective solution to multiple challenges. The usage of simulation enables the engineering teams to quickly assess the performance of their designs under a wide range of operating conditions, at both the component and systems levels. This software can also rapidly analyze dozens of preliminary design choices and then subject a chosen few to the rigorous testing that must precede any market launch.

Key Highlights

- The rapidly rising demand for consumer durables, electronics goods, and high-end technology products owing to technological advancement and increased dependency on automation is expected to drive the market. The increasing penetration of the internet across the world has encouraged vendors to improve their speed and connectivity, which has led to the development of 5G. The demand for low-cost, accurate, electromagnetic simulation software has also grown rapidly during the past few years in the industrial, commercial, automotive, and communications systems.

- Moreover, the power grid infrastructure is increasingly becoming digitized and connected, ensuring the reliable and secure flow of critical digital communications. Thus, smart grid infrastructure, whether in a power substation or residential setting, is vital. Smart meters enabling the real-time measurements needed to monitor equipment health, grid congestion, and stability, and system control form an integral part of smart grids. The electromagnetic simulation software is primarily being used to analyze the interference of the power-frequency magnetic field from the key parts of these smart meters. It is expected to witness further demand owing to the large-scale deployment of these smart meters.

- According to the US Department of Energy, investment on smart grid devices or systems, such as advanced metering infrastructure (AMI), was expected to reach USD 6.4 billion by 2024 in the United States. As several countries have made substantial investments in smart grids, the global market is expected to continue to grow throughout the decade.

- The multiple-input and multiple-output (MIMO) technology is the most recent iteration of antennas. With a wide range of advantages, such as increased range and 3D beamforming, it is expected that this technology will rapidly expand the adoption rates of this technology, especially in the advanced telecommunication markets, like North America and Europe.

- The ongoing pandemic of COVID-19 has propelled the organizations in all the sectors to either stop their manufacturing completely or grant work from homes to all of their employees. This has significantly increased internet usage for multiple purposes, such as browsing online media content, increased calling among other works, and some of the factors that are putting a burden on the existing networks. Therefore, it has become imperative for the telecom industry players to look for solutions like MIMO to provide uninterrupted services to its consumers.

Electromagnetic Simulation Software Market Trends

Telecommunication Sector is Expected to Drive the Market Growth

- The ongoing deployment of LTE and advancements in the field of wireless connectivity technologies, such as general packet radio service (GPRS), Wi-Fi, and worldwide interoperability for microwave access (WiMax) in various fields have boosted the number of connected devices and has led to the growth of electromagnetic simulation software, as they are used to conduct high-fidelity 3-D EM simulations, analyze geometric-scale variations, perform thermomechanical stress analysis, and optimize antenna design.

- The majority of mobile network operators in mature markets are planning to upgrade into 5G in the next few years due to spectrum availability and the sheer time and costs involved in rolling out the next generation of mobile networks. Major players partner with the technology provider to speed up the process and be competitive in the telecom market.

- For instance, in February 2020, Samsung Electronics Co. Ltd collaborated with US Cellular for 5G and 4G LTE network solutions. Through the agreement US Cellular, a key provider of mobile services to millions of customers across the United States, can purchase Samsung's commercially-proven network solutions, including 5G New Radio (NR) technology, and will extend groundbreaking 4G LTE and 5G technology to its customers base, expanding in consumer and business applications.

- Moreover, electronic companies are focusing on new product development, such as 5G MIMO microstrip antenna, to consider a wide variety of structures to meet the often-conflicting needs for different applications. For instance, in February 2020, Fractus Antennas launched a new multi-band 5G and cellular IoT antenna booster as tiny as a rice grain. It provides global connectivity and solves the common challenge of size as it is of only 7.0 mm x 3.0 mm x 1.0 mm in size. A single antenna can cover 2G, 3G, 4G, and 5G frequency bands from 824 MHz to 5 GHz. More advancement in the antenna design will propel the simulation software market significantly.

North America to Hold a Significant Market Share

- North America is considered to be one of the most advanced markets for mobile communications and MIMO technology in the world. According to the GSMA, the number of unique mobile subscribers in the United States was 281 million in 2019 and is expected to increase by up to 297 million by 2025.

- In the United States, major players, such as AT&T, Verizon, T-Mobile, and Sprint, account for nearly 95% of all subscriptions. With most of the firms making significant investments in 5G technology, MIMO's usage is expected to witness a surged rate of adoption in this region during the forecast period, thereby driving the market.

- Owing to such developments, the multiple input multiple output technologies in the North American region are expected to showcase a prominent position in the foreseen period. Adding to the scenario, Galtronics USA, a subsidiary of Baylin Technologies, has introduced a six-foot, 12-Port base station (macro) antenna for major North American carriers. The base station antenna supports all of the North American mid-band frequencies on eight of its ports and true 4X4 MIMO on the existing Cellular 850 band, LTE 700 band, and the new 600 MHz band.

- Smartphones, tablets, and AI-assisted electronics are experiencing high growth in the region. This is expected to influence the growth of the market in the region. According to the US Consumer Technology Sales and Forecast study conducted by the Consumer Technology Association (CTA), the revenue generated by smartphones was valued at USD 79.1 billion and USD 77.5 billion in 2018 and 2019, respectively. Canada is also one of the largest producers of consumer electronics in the world.

- The region's automotive sector is expected to offer significant opportunities to the market. With changing dynamics in the industry, automotive manufacturers are moving toward electric vehicles to meet next-generation consumers' needs.

- However, automakers in the United States have faced increased pressure to shut down their factories owing to the COVID-19 pandemic. After the federal, state, and local governments started recommending people stay in their homes as much as possible. This has caused supply chain disruptions across various industries.

Electromagnetic Simulation Software Industry Overview

The electromagnetic simulation software market is concentrated and dominated by a few major players, like Remcom Inc., Altair Engineering Inc., Mician GmbH, Sonnet Software, Inc., and ElectroMagneticWorks, Inc. The major players, with a prominent share of the market, are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies increase their market presence by securing new contracts and tapping new markets. Some of the key developments in the market are:

- January 2023 - Remcom announced the release of XFdtd 3D electromagnetic simulation software, which enables users to easily adjust component values in order to meet design objectives and understand circuit behavior, when adding an analysis tool into the schematic editor of XFdtd, further expands this software's toolset for comprehensive matching network designs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Electromagnetic Simulation Software Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Utilization of Solver Tools to Handle a Multitude of Component Shapes and Sizes

- 5.1.2 Increasing Applications in RF Module, MMIC, and RFIC Design

- 5.2 Market Restraints

- 5.2.1 Complexity Regarding Computationally-Intensive Processing Required by Simulators

6 METHODS OF ELECTROMAGNETIC SIMULATION

- 6.1 Integral or Differential Equation Solvers

- 6.1.1 Methods of Moments (MOM)

- 6.1.2 Multilevel Fast Multipole Method (MLFMM)

- 6.1.3 Finite Difference Time Domain (FDTD)

- 6.1.4 Finite Element Method (FEM)

- 6.2 Asymptotic Techniques

- 6.2.1 Physical Optics (PO)

- 6.2.2 Geometric Optics (GO)

- 6.2.3 Uniform Theory of Diffraction (UTD)

- 6.3 Other Numerical Methods

7 RELEVANT USE-CASES AND CASE STUDIES (Major use-cases and case studies, such as Surrogate Models for Antenna Placement on Large Platforms and Development of Wireless Sensors to Detect Lightning, will be discussed)

8 KEY APPLICATION AREAS (Qualitative Analysis pertaining to major applications such as 5G MIMO, Circuit co-simulation, among others, will be provided)

- 8.1 Antenna Design and Analysis

- 8.2 Mobile Device

- 8.3 Automotive Radar

- 8.4 Biomedical

- 8.5 Wireless Propagation

- 8.6 Other Applications

9 MARKET SEGMENTATION

- 9.1 Geography

- 9.1.1 North America

- 9.1.2 Europe

- 9.1.3 Asia-Pacific

- 9.1.4 Rest of the World

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 Remcom Inc.

- 10.1.2 EMPIRE (IMST GmbH)

- 10.1.3 Altair Engineering Inc.

- 10.1.4 WIPL-D d.o.o.

- 10.1.5 Mician GmbH

- 10.1.6 Sonnet Software Inc.

- 10.1.7 ElectroMagneticWorks Inc.

- 10.1.8 COMSOL Inc.

- 10.1.9 Keysight Technologies

- 10.1.10 ANSYS Inc.

- 10.1.11 Dassault Systmes SE

- 10.1.12 Cadence Design Systems Inc.

- 10.1.13 ESI Group

11 COMPARATIVE ANALYSIS (Comparison of Major Electromagnetic Simulation software will be provided, based on metrics such as License, GUI, and Algorithm)

12 INVESTMENT ANALYSIS

13 FUTURE OF THE MARKET