PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1524206

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1524206

Ride-Hailing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

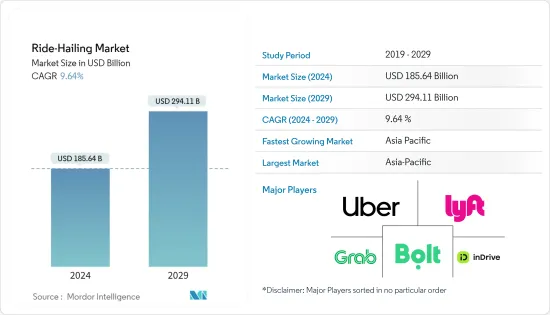

The Ride-Hailing Market size is estimated at USD 185.64 billion in 2024, and is expected to reach USD 294.11 billion by 2029, growing at a CAGR of 9.64% during the forecast period (2024-2029).

Over the long term, the increasing urbanization rate worldwide, the growing tourism industry, and the rising traffic congestion in urban cities will be major factors driving the growth of the ride-hailing market.

The increasing urbanization has led to a higher demand for ride-hailing services as more people seek better job opportunities in cities. These consumers prefer affordable commuting options over owning a vehicle. In addition, with growing traffic congestion, people who need to travel long distances daily prefer to avoid having to drive themselves, as it can be physically exhausting.

In recent years, there has been a growing preference for ride-hailing services in developing countries like India, China, and Vietnam, as well as in developed regions such as the United States and Europe. This trend has prompted companies to improve their services and expand their operations through mobile applications to compete effectively in the market.

Ride-hailing companies are working to reduce vehicle carbon emissions globally by converting gasoline vehicles to electric, aiming to eliminate tailpipe emissions. Fleet conversion offers direct environmental benefits and indirect advantages for other markets. The integration of electric vehicles in ride-hailing fleets is expected to drive substantial market growth.

Ride-Hailing Market Trends

The Cars Segment is Expected to Gain Traction During the Forecast Period

The increasing preference of consumers toward using private transportation for traveling purposes, owing to the rising need for convenience in personal mobility and the growing number of tourists worldwide, serve as major determinants of the rising demand for the cars segment.

Tourists are increasingly turning to ride-hailing services due to their convenience. These services allow them to access transportation as and when they need it, without the need to book a car for an entire day or a specific period.

In the age of environmentally friendly transportation, policymakers across the world are prioritizing advancements in transportation solutions to combat environmental pollution from vehicles and address climate change issues.

Governments globally are advocating for the electrification of vehicle fleets to minimize carbon emissions. New players in the market are investing substantial amounts in introducing an all-electric vehicle fleet for their ride-hailing services. They are actively forming partnerships to strengthen their brand presence.

- In December 2023, electric mobility startup BluSmart announced that it had raised USD 24 million in a fresh round of funding to build large-scale charging superhubs that would enable the expansion of its electric ride-hailing services.

Additionally, several companies in the market are actively incorporating advanced features, such as the "emergency button," into their passenger car fleet to improve customer safety. This, in turn, is expected to drive demand for this segment. Furthermore, with the growing tourism industry and the advancement of ride-hailing platforms, the cars segment of the market is anticipated to experience significant growth during the forecast period.

Asia-Pacific to Become the Fastest-growing Market During the Forecast Period

The growth of the ride-hailing service market in Asia-Pacific is driven by increasing traffic congestion and low fares compared to other modes of transportation. In addition, the rising urban population in countries like India and China is leading to a higher demand for fast transportation solutions, which is positively impacting the ride-hailing market in Asia-Pacific.

In recent years, the ride-hailing market in Asia-Pacific has seen the emergence of new players such as BluSmart in India and GSM in Vietnam. With India and China being the world's most populous countries, the demand for ride-hailing services in these nations is on the rise.

Various companies operating in the ecosystem are forming collaborations and partnerships, expanding their fleets, and strategizing for new initiatives to enhance their brand's presence in this competitive market. For instance,

- In November 2023, Uber partnered with the IAS Secretary of the Transport Department, Government of West Bengal, India, to launch a bus shuttle service in Kolkata. This initiative aims to enhance public transport services and provide more commuting options to make travel easier.

- In May 2023, Uber announced its plan to introduce 25,000 electric cars in partnership with fleet providers such as Lithium, Everest, and Moove for the Indian market. In addition, the company stated that it would roll out 10,000 electric two-wheelers in Delhi by the end of 2024 in collaboration with Zypp Electric, another EV startup.

With the growing urban population, rising integration of new entrants in the market, and the consumers' increasing preference for convenience in personal mobility, the demand for ride-hailing services in the Asia-Pacific market is anticipated to surge rapidly over the coming years.

Ride-Hailing Industry Overview

The ride-hailing market is dominated by several key players, such as Didi Chuxing Technology Co., Uber Technologies Inc., Lyft Inc., Grab Holdings Inc., Cabify, Bolt, inDrive, Gett, and Ani Technologies Pvt. Ltd (OLA). These players are actively engaging in mergers and acquisitions, geographical expansions, and introducing advanced features in their ride-hailing platforms to enhance customers' convenience. For instance,

- In June 2023, the South Korean ride-hailing platform TADA, operated by VCNC, introduced an English-language service to its app to simplify the user experience for international customers. The English-language functionality also extends to situations where a foreign user is not directly hailing the taxi, but a friend or acquaintance uses the "call for me" feature on their behalf.

- In December 2023, the Karnataka government in India planned to launch its ride-hailing app, similar to Ola and Uber, which was expected to be open to the public by February 2024. This decision came after taxi and auto drivers voiced grievances against private ride-hailing platforms in August 2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth

- 4.2 Market Restraints

- 4.2.1 Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Motorcycles

- 5.1.2 Cars

- 5.1.3 Vans

- 5.1.4 Buses

- 5.2 By Propulsion Type

- 5.2.1 Internal Combustion Engine (ICE)

- 5.2.2 Electric

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Didi Chuxing Technology Co.

- 6.2.2 Uber Technologies Inc.

- 6.2.3 Lyft Inc.

- 6.2.4 Grab Holdings Inc.

- 6.2.5 Maxi Mobility SL (Cabify)

- 6.2.6 BlaBla Car

- 6.2.7 GoTo Group (GoJek)

- 6.2.8 Xanh SM (GSM)

- 6.2.9 Bolt Technology OU

- 6.2.10 Gett Group

- 6.2.11 Ani Technologies Pvt. Ltd (OLA)

- 6.2.12 SUOL INNOVATIONS LTD (inDrive)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 GOVERNMENT REGULATIONS FOR RIDE-HAILING INDUSTRY ACROSS THE WORLD**