PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910858

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910858

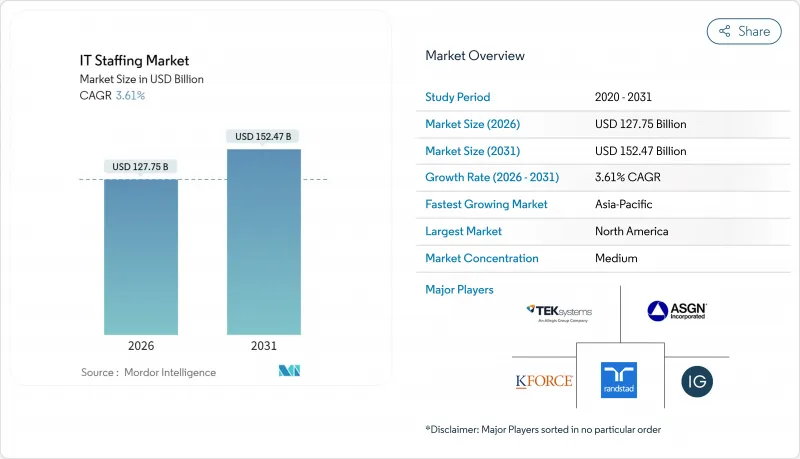

IT Staffing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The IT staffing market is expected to grow from USD 123.30 billion in 2025 to USD 127.75 billion in 2026 and is forecast to reach USD 152.47 billion by 2031 at 3.61% CAGR over 2026-2031.

This steady expansion reflects enterprises realigning talent strategies toward specialized skill acquisition rather than volume hiring, a change reinforced by cloud, artificial intelligence, and cybersecurity spending priorities. Temporary and contract engagements remain the dominant hiring mechanism, yet growth is gravitating toward Statement-of-Work models that shift delivery risk to providers. Generative-AI engineering, edge computing, and cyber-resilience needs are reshaping job requisitions, while persistent global skill shortages sustain upward wage pressure. At the same time, vendor consolidation across Global-2000 clients compresses margins for managed service providers but also deepens their wallet share with retained customers.

Global IT Staffing Market Trends and Insights

Accelerated Adoption of AI-, Cloud- and IoT-Centric Digital-Transformation Projects

Fourteen percent of global tech job postings now demand AI or machine-learning skills, up from 9% a year earlier . Cloud migrations call for specialized DevOps engineers and security architects, while edge-computing investments that are projected to reach USD 139.58 billion by 2030 require blended infrastructure-plus-IoT talent. NTT DATA's program to train 200,000 employees in generative AI further underscores the scale of reskilling underway . Interdisciplinary project teams that connect AI algorithms, cloud resources, and device networks are therefore driving sustained expansion in the IT staffing market.

Expansion of Remote and Hybrid Work Models Requiring Distributed Talent

Sixty-five percent of Dell Technologies personnel use formal flexibility arrangements, signaling lasting normalization of location-agnostic hiring. Employers gain access to broader talent pools, yet must navigate cross-border compliance and rising pay parity expectations. ManpowerGroup's 2025 outlook shows 41% of firms plan to add headcount, with technology roles topping demand charts. Competitive bidding now spans continents, increasing compensation levels and compelling agencies to enhance retention packages that extend beyond salary.

Persistent Global Skill Shortages in Niche Technologies

It is estimates that unresolved digital-skills gaps could cost the global economy by 2034, underscoring structural supply constraints for quantum, advanced AI, and zero-trust security expertise. Universities have not kept curriculum pace, creating multiyear lags before new graduates enter these specializations. The scarcity elevates compensation packages and lengthens project timelines, compelling enterprises to bankroll intensive reskilling initiatives that erode near-term ROI.

Other drivers and restraints analyzed in the detailed report include:

- Surging Demand for Cyber-Resilience Staff Driven by Cyber-Insurance Mandates

- Digital-Transformation Budget Rebound Post-Pandemic Fuels Staff-Augmentation Demand

- Wage Inflation Compressing MSP Bill-Rate Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software developers accounted for 37.05% of IT staffing market share in 2025, reflecting entrenched application modernization projects. Generative-AI engineers are projected to register a 11.75% CAGR through 2031, underscoring growing demand for prompt design, model auditing, and LLM fine-tuning. The IT staffing market size for data and AI engineering is projected to escalate sharply as edge-cloud pipelines scale. Salary corridors signal premium pricing that providers can command when supplying hybrid AI-development expertise.

Traditional testers and QA roles face automation headwinds, pushing many professionals toward AI-enabled verification tools. Systems analysts are pivoting to integration architecture, and network specialists are upskilling in AI-driven threat monitoring. Emerging skills-quantum development, blockchain architecture, and IoT device security-collectively remain a small but rapidly expanding slice of the IT staffing market.

BFSI remained the largest adopter with 24.15% share in 2025, driven by open-banking compliance and fintech platform upgrades. Healthcare emerges as the fastest-growing vertical at 10.25% CAGR, propelled by electronic-health-record modernization and AI-assisted diagnostics. The IT staffing market size for healthcare projects is expected to widen as telemedicine and patient-data interoperability standards take hold.

Manufacturing prioritizes smart-factory deployments requiring IoT and predictive-maintenance talent. Retail and e-commerce continue omnichannel build-outs, while public sector agencies earmark cybersecurity and citizen-service digitization budgets. Energy, automotive, and smart-city programs fill the "Other Industries" category, each demanding bespoke skill combinations and feeding diverse pipelines for the IT staffing market.

IT Staffing Market Report is Segmented by Skill Set (Software Developer, Testers and QA Engineers, Systems Analyst, Technical Support Professionals, Networking and Security Experts, and More), End-User Industry (Telecom, BFSI, and More), Staffing Service Type (Contract Staffing, and More), Enterprise Size (Large Enterprises, and SMEs), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 44.05% share in 2025, supported by deep tech ecosystems, large digital budgets, and rigorous security mandates. Continuous visa policy shifts and wage escalation challenge talent availability, prompting more near-shoring to Canada and Latin America. The United States leads demand due to Silicon Valley software projects and Wall Street cloud overhauls, while Canada provides cost-advantaged hubs in Toronto and Montreal.

Asia-Pacific is the fastest-growing region at an 8.15% CAGR, buoyed by India's IT services scale-up, Japanese reskilling initiatives, and Singapore's regional headquarters attraction. Managed-services annual contract value in the region rose 32% in 2024 as multinationals diversified sourcing. China's platform rebound and Korea's semiconductor R&D add further pull on specialist headcount.

Europe posts stable demand in Germany and the United Kingdom, even as Eastern European destinations evolve from pure cost-arbitrage to niche specialist centers. GDPR compliance maintains high cybersecurity uptake. Middle East and Africa trail but register steady growth; Saudi Arabia's smart-city projects and South Africa's English-language service hubs are notable demand pockets. Currency-adjusted wage differentials across these markets shape provider margin strategies within the global IT staffing market.

- TEKsystems Inc. (Allegis Group Holdings Inc.)

- ASGN Incorporated

- Insight Global LLC

- Randstad N.V.

- Kforce Inc.

- Artech Information Systems LLC

- Consulting Solutions International Inc.

- MATRIX Resources Inc.

- NTT DATA Corporation

- Beacon Hill Staffing Group LLC

- Experis IT (ManpowerGroup Global Inc.)

- Akkodis (Adecco Group AG)

- Kelly Services Inc.

- Motion Recruitment Partners LLC

- Robert Half International Inc.

- Genesis10 Inc.

- Collabera LLC

- PERSOL Holdings Co., Ltd.

- Aquent LLC

- CGI Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated adoption of AI-, Cloud- and IoT-centric digital-transformation projects

- 4.2.2 Expansion of remote and hybrid work models requiring distributed talent

- 4.2.3 Surging demand for cyber-resilience staff driven by cyber-insurance mandates

- 4.2.4 Digital-transformation budget rebound post-pandemic fuels staff-augmentation demand

- 4.2.5 Generative-AI supervision roles (prompt engineers, model auditors) emerge

- 4.2.6 Vendor consolidation among Global-2000 clients boosts MSP-led volume deals

- 4.3 Market Restraints

- 4.3.1 Persistent global skill shortages in niche technologies

- 4.3.2 Wage inflation compressing MSP bill-rate margins

- 4.3.3 AI-based self-service hiring platforms disintermediate agencies

- 4.3.4 Tightening data-sovereignty laws restrict cross-border staff deployment

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porterss Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Key Use Cases and Case Studies

- 4.10 Assessment of Macroeconomic Trends

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Skill Set

- 5.1.1 Software Developers

- 5.1.2 Testers and QA Engineers

- 5.1.3 Systems Analysts / Business Analysts

- 5.1.4 Technical Support Professionals

- 5.1.5 Networking and Security Experts

- 5.1.6 Data and AI Engineers

- 5.1.7 Other Skill Sets

- 5.2 By End-User Industry

- 5.2.1 Telecom

- 5.2.2 Banking, Financial Services and Insurance (BFSI)

- 5.2.3 Healthcare and Life Sciences

- 5.2.4 Manufacturing

- 5.2.5 Retail and e-Commerce

- 5.2.6 Government and Public Sector

- 5.2.7 Other Industries

- 5.3 By Staffing Service Type

- 5.3.1 Temporary / Contract Staffing

- 5.3.2 Permanent Placement

- 5.3.3 Statement-of-Work (SOW) / Project-based

- 5.3.4 Managed Service Provider (MSP) / Outsourced Staffing

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Netherlands

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TEKsystems Inc. (Allegis Group Holdings Inc.)

- 6.4.2 ASGN Incorporated

- 6.4.3 Insight Global LLC

- 6.4.4 Randstad N.V.

- 6.4.5 Kforce Inc.

- 6.4.6 Artech Information Systems LLC

- 6.4.7 Consulting Solutions International Inc.

- 6.4.8 MATRIX Resources Inc.

- 6.4.9 NTT DATA Corporation

- 6.4.10 Beacon Hill Staffing Group LLC

- 6.4.11 Experis IT (ManpowerGroup Global Inc.)

- 6.4.12 Akkodis (Adecco Group AG)

- 6.4.13 Kelly Services Inc.

- 6.4.14 Motion Recruitment Partners LLC

- 6.4.15 Robert Half International Inc.

- 6.4.16 Genesis10 Inc.

- 6.4.17 Collabera LLC

- 6.4.18 PERSOL Holdings Co., Ltd.

- 6.4.19 Aquent LLC

- 6.4.20 CGI Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment