PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643226

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643226

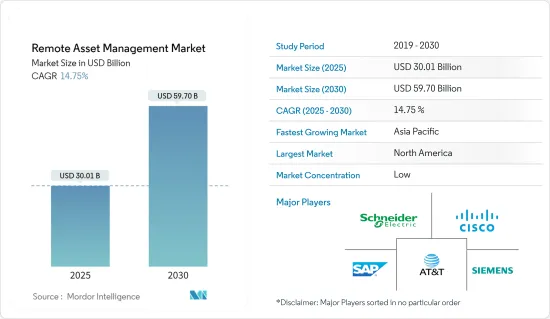

Remote Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Remote Asset Management Market size is estimated at USD 30.01 billion in 2025, and is expected to reach USD 59.70 billion by 2030, at a CAGR of 14.75% during the forecast period (2025-2030).

Remote asset management refers to remotely monitoring and managing assets, such as machines and equipment. It involves using various technologies to collect data from these assets and then analyzing them to optimize their performance and reduce downtime. In the manufacturing, energy and transport sectors, where resources can be more efficiently used as well as extending the life of important equipment, remotely managing assets has become a key issue.

Key Highlights

- The primary drivers driving the need for remote asset management are predictive maintenance, loT-enabled remote asset management solutions, and the lowering cost of IoT-based sensors, which in turn reduces operational expenses of remote assets by increasing the use of remote asset management. Remote asset management enables real-time two-way communication between the organization's assets and the central monitoring application to improve asset management and control.

- Asset Performance Management (APM) is a comprehensive collection of solutions and services that includes software for monitoring variables such as asset health and reliability. They are also used to plan asset maintenance and divestiture strategies. For example, General Electric's Predix system contains many components, such as APM Health, APM Reliability, APM Strategy, and APM Integrity. APM systems deliver numerous insights at the point of action to extend asset life, eliminate unscheduled repair work, decrease downtime, lessen maintenance costs, and reduce the chance of equipment failure.

- Further, the software used is remote asset management, allowing two-way communication between the central application and the asset for improved management control. This remote asset management industry offers a variety of potential applications for expanding business opportunities. The Management System monitors and tracks the assets over the centenary using Vodafone SIMS. The Vodafone remote asset management system aids in transacting, developing businesses, and maintaining machinery, assets, and systems.

- Moreover, cloud computing services are becoming more affordable; internet access is improving; components are becoming less expensive; and governments in both developed and developing regions are increasing their investments in ICT. These reasons are projected to fuel significant demand for remote asset management in the short and long term. Rising smartphone adoption, internet penetration, and loT advancements drive the remote asset management market.

- The high cost of asset management solutions is expected to hamper the remote asset management market expansion.

- COVID-19 caused lockdowns in many nations, resulting in a drop in demand for Real-time location system RLTS solutions from many industries like autos, supply chain, and transportation. Many logistic organizations and supply chains, as were the automobile and transportation sectors, were completely shut down, leaving only the healthcare industry to thrive. Many mechanical tools and monitoring devices were required in the healthcare business to show data on a live monitor or save it on a database log for subsequent study.

Remote Asset Management Market Trends

Manufacturing Industry is Expected to Hold Prominent Share of the Market

- The manufacturing industry increasingly turns to remote asset management solutions to optimize production, reduce costs, and improve efficiency. Remote asset management involves using sensors and other remote monitoring technologies to track the performance of equipment and machinery from a central location, enabling real-time analysis and decision-making. This technology can be instrumental in the manufacturing industry, where downtime and maintenance costs can be significant issues.

- Some benefits of remote asset management in the manufacturing industry include better visibility into operations, reduced downtime and maintenance costs, and improved safety and compliance. Some companies use digital twin technology to remotely monitor assets and enhance predictive maintenance and overall equipment effectiveness.

- Examples of solutions in this area include GE Digital's Asset Performance Management software, IBM's Maximo Application Suite, and remote asset monitoring solutions offered by companies like Birlasoft. In addition, industrial manufacturers are investing in zero-touch remote asset management solutions to enable safe, contactless monitoring and maintenance of their equipment and machinery.

- Moreover, recently, inMotionNow announced the acquisition of Lytho,an (DAM) platform provider. Lytho's digital asset management capabilities, content templating automation, and customizable brand portals complement inMotionNow's creative workflow platform, inMotion ignite. In order to plan, produce, share, store and publish content, both companies will provide a central and easily managed platform. Lytho has customers in the financial, manufacturing, and automotive industries.

- According Trading Economics, During the third quarter of 2023, the contribution of India's manufacturing industry to the country's GDP was valued at over 85 billion USD This was an increase compared to the previous quarter, but still a much higher value than the third quarter of 2020, when the value decreased due to the coronavirus (COVID-19) pandemic. India's construction and manufacturing industries were among the worst hit then. But the manufacturing industry recovered quickly and reached pre-crisis level again after one quarter.

North America is Expected to Hold Major Share

- North America is estimated to hold the highest remote asset management market share. The high adoption of advanced technology, the presence of advanced telecommunication networks for information sharing, and the availability of a skilled workforce are some factors which are driving the growth of the remote asset management market in North America.

- In addition, the growth in connected devices is expected to further propel the market for remote asset management. For instance, according to Cisco, the United States is expected to have the highest average per capita of devices and connections by 2023.

- Fleet managers, executives, and other mobile business professionals are achieving value by investing in fleet tracking technology, according to the Verizon Fleet Technology Trend Report, which includes surveys conducted by more than 700 fleet managers, executives, and other mobile business professionals in the United States.

- The 2021-2024 Digital Operations Strategic Plan (DOSP), launched recently, sets the strategic direction for the Canadian government's digital ambitions across services, information, data, IT, and cybersecurity. The DOSP consolidates six strategic themes: IT, digital identity, and institution transformation. The initiative by the government shows the importance of digital transformation, which creates a need for the storage of digital assets produced during the implementation.

- Similarly, Adobe launched a new asset management tool, Adobe Experience Manager Assets Essentials. The first tool to integrate this new experience, Adobe Journey Optimizer, has been released as well. The launch responds to the demand for digital content and the improvement of the customer experience.The launch is in response to the push towards digital content and improving customer journeys. Further, artificial intelligence remote asset management solutions Artificial intelligence (AI) has been increasingly used in remote asset management solutions to improve operational efficiency, reduce downtime, and minimize operational costs.

Remote Asset Management Industry Overview

The remote asset tracking market is fragmented, considering the presence of multiple vendors providing different solutions. The solution providers are investing in multiple R&D activities to improve existing solutions and launch new products by integrating the latest technological developments in their solutions. Furthermore, companies are viewing global expansion as a path to attracting maximum market share.

- In March 2023, Drishya AI Labs and VEERUM team up to provide enhanced asset management via digital twins. Drishya's artificial intelligence (AI)-based digital twin technology collaborates with VEERUM's ground-breaking visualization solution to assist brownfield plants in creating digital twins from engineering drawings and historical plant data. The usage of AI by Drishya and VEERUM helps to cost-effectively digitalize obsolete asset management, enable remote site management, and automate engineering deliverables while keeping inventory and tag lists up to date.

- In February 2023, Cisco introduces new cloud services in IoT Operations Dashboard to increase industrial asset visibility, securely manage assets from anywhere and provide Industrial Internet of Things (IoT) customers with a seamless path to cloud automation for Operational Technology (OT) teams

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from Third-party Logistics Players through Value-add Tracking Services

- 5.1.2 Increasing Adoption of Internet of Things Across the Supply Chain

- 5.2 Market Restraints

- 5.2.1 High Initial Investment and Training Costs

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution**

- 6.1.1.1 Real Time Location System

- 6.1.1.2 Analytics and Reporting

- 6.1.1.3 Asset Performance Management

- 6.1.1.4 Surveillance and Security

- 6.1.1.5 Other Solutions (Network Bandwidth Management, Mobile Workforce Management)

- 6.1.2 Services

- 6.1.1 Solution**

- 6.2 By Type

- 6.2.1 Fixed Asset

- 6.2.2 Mobile Asset

- 6.3 By Deployment Mode

- 6.3.1 On-Premise

- 6.3.2 Cloud

- 6.4 By End-User

- 6.4.1 Manufacturing

- 6.4.2 Healthcare

- 6.4.3 Retail

- 6.4.4 Energy and Utilities

- 6.4.5 Transportation and Logistics

- 6.4.6 Other End-Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Siemens Corporation

- 7.1.2 AT&T Inc.

- 7.1.3 Cisco Systems, Inc.

- 7.1.4 Hitachi, Ltd.

- 7.1.5 Schneider Electric SE

- 7.1.6 PTC Inc.

- 7.1.7 Bosch Software Innovations GmbH

- 7.1.8 Verizon Communications, Inc.

- 7.1.9 Rockwell Automation, Inc.

- 7.1.10 Infosys Limited

- 7.1.11 SAP SE

- 7.1.12 Meridium, Inc.

- 7.1.13 International Business Machine Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS