PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643235

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643235

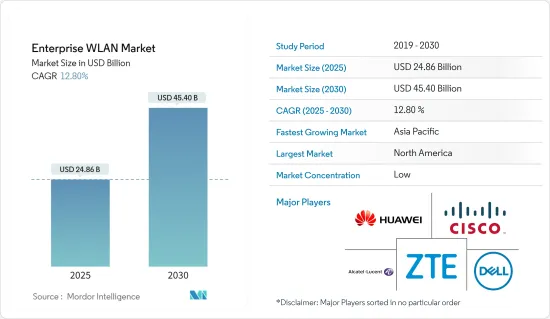

Enterprise WLAN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Enterprise WLAN Market size is estimated at USD 24.86 billion in 2025, and is expected to reach USD 45.40 billion by 2030, at a CAGR of 12.8% during the forecast period (2025-2030).

The Enterprise WLAN market continues to grow rapidly, emphasizing the importance of wireless technology in the network and digital transformation goals of organizations across the globe.

Key Highlights

- The growth of the Enterprise WLAN market is attributed to the increasing demand for reliable, high-speed, and secure wireless networks that can support the growing number of connected devices in the workplace.

- As many organizations are moving their applications and data to the cloud, the requirement for a robust wireless network that can handle the increased traffic and bandwidth demands is increased. Also, as the number of devices connected to a wireless network increases, so does the risk of security breaches that can be protected using advanced security features provided by Enterprises' WLAN solutions.

- The continuous growth of network infrastructure, increased demand for high-speed internet, and introduction of new wireless standards named WIFI6, also known as 802.11ax, is expected to impact the market positively. Also, regularly updating standards improves network throughput in terms of maximum speeds and transmission capabilities.

- The high cost associated with the deployment and maintaining Enterprise WLAN for small and medium-sized businesses is challenging for the growth of the Enterprise WLAN market.

- COVID-19 impacted Enterprise WLAN usage and deployment. The pandemic accelerated the adoption of enterprise WLAN solutions that support remote work and provide greater flexibility and scalability. It also highlighted WLAN security and the need for organizations to be able to adapt to changing traffic patterns. However, the pandemic also caused delays and challenges for WLAN deployment projects, which long-term impacted WLAN adoption and usage.

Enterprise WLAN Market Trends

Increasing Data Traffic and Demand for High Speed Data Connectivity to Drive the Growth of the Market

- With the growing adoption of cloud-based applications, the demand for data traffic has increased tremendously. As more and more businesses move their applications to the cloud, they require reliable and fast internet connectivity to ensure their operation runs smoothly. Enterprise WLAN solutions provide this connectivity by offering high-speed data transmission rates, which allow businesses to transfer data quickly and efficiently.

- Business internet data traffic is growing as more businesses adopt digital technologies in their operations. In 2022, the business internet data traffic in the United States reached 178.21 billion gigabytes from 141.73 billion gigabytes in 2021.

- In addition, the demand for high-speed data has increased substantially in recent years due to the growing number of devices connected to enterprise networks. Employees now use multiple devices to access company data and applications, which requires robust and high-speed data transmission capabilities that can be achieved with enterprise WLAN solutions.

- Moreover, the increased emphasis of organizations on creating a digital and wireless workplace within premise mobility has become a major driving factor for the market's growth. Also, the increasing trend of BYOD and digital transformation is making enterprises consider broader enterprise campuses, which will fuel the market's growth in the coming year.

- Due to increased demand, several media and telecom companies are investing in high-speed data services. For instance, in December 2022, Social media giant Meta and Bharti Airtel collaborated to invest in telecom infrastructure to cater to the rising demand for high-speed data and digital services in India to support the emerging requirements of customers and enterprises.

North America is Expected to Hold the Largest Market Share

- North America has a high adoption rate of mobile devices such as smartphones, tablets, and laptops, which has led to an increased demand for wireless connectivity. This has driven the growth of the enterprise WLAN market as businesses seek to provide reliable, high-speed wireless connectivity to their employees and customers. Also, the high level of internet penetration, with a large percentage of the population having access to the internet, led to higher demand for wireless connectivity, supporting the market's growth.

- The continuously increasing consumption of smartphones has led organizations in the region to adopt BYOD on a large scale; therefore, good coverage inside office spaces becomes essential. This represents a potential opportunity for the in-building office providers, fueling the market's growth over the forecast period.

- The growing deployment of 5G in North America is helping to drive the growth of the Enterprise WLAN market by providing increased network capacity, faster speed, improved reliability, enhanced security, and improved IoT capabilities. This creates new opportunities for Enterprise WLAN vendors and drives demand for their products and services.

- According to CTIA's 2022 Annual Wireless Industry Survey, The United States wireless industry invested nearly USD 35 billion to grow, improve and run their networks in 2021. This investment drives unparalleled results of 5G networks covering over 315 million Americans. Also, the survey states that wireless capital investment is speeding up 5G deployment.

- Moreover, the growing adoption of cloud computing in North America is increasing rapidly. Businesses rely on cloud-based applications and services, which need reliable and high-speed wireless connectivity, leading to increased demand for WLAN solutions to support cloud-based applications.

Enterprise WLAN Industry Overview

The enterprise WLAN market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with prominent shares in the market are focusing on expanding their customer base worldwide.

In September 2023 - Huawei announced to launch of three Product Portfolios for the Commercial Market to Build High-Quality Connections, including Huawei Zero-Roaming Distributed Wi-Fi solution, Huawei High-Quality Simplified Data Center Network Solution, High-Quality SME Office as there are a large number of SMEs, which are critical to economic development. Huawei will develop more marketable products and portfolios to help partners win more customers and succeed in the commercial market.

In October 2022, IO by HFCL launched the Wi-Fi 7 enterprise-grade Wi-Fi access points revealing the two new devices (indoor and outdoor versions) at the India Mobile Congress. The new access points are designed for open-source networking, are OpenWiFi-ready, and are powered by Qualcomm's Networking Pro platform.

In August 2022, Extreme Networks Inc., one of the leaders in cloud networking, introduced the Extreme AP5050: the industry's first outdoor Wi-Fi 6E Outdoor Access Point (AP) optimized for installation at outdoor venues, convention centers, hospital and university campuses, and large stadiums, among others. It delivers enhanced wireless experiences, faster speeds, and reduced interference. It enables large outdoor venues to operate across up to three times as much spectrum as previous generations of Wi-Fi.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Adoption of BYOD

- 5.1.2 Increasing Data Traffic and Demand for High Speed Data Connectivity

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization in Enterprise WLAN Technology

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 By Hardware

- 6.1.1.1 Access points

- 6.1.1.2 WLAN Controllers

- 6.1.1.3 Wireless Hotspot Gateways

- 6.1.2 By Software

- 6.1.2.1 WLAN Security

- 6.1.2.2 WLAN Management

- 6.1.2.3 WLAN Analytics

- 6.1.2.4 Other Softwares

- 6.1.3 By Services

- 6.1.3.1 Professional Services

- 6.1.1 By Hardware

- 6.2 By Organization Size

- 6.2.1 Large Enterprises

- 6.2.2 Small and Medium-Sized Enterprises

- 6.3 By End-user Verticals

- 6.3.1 Banking, Financial Services and Insurance

- 6.3.2 Healthcare

- 6.3.3 Retail

- 6.3.4 IT and Telecommunications

- 6.3.5 Other End-user Verticals

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Juniper Networks Inc.

- 7.1.3 Huawei Technologies Co. Ltd.

- 7.1.4 Alcatel Lucent Enterprises (ALE International)

- 7.1.5 Aruba Networks (Hewlett Packard Enterprise Development LP)

- 7.1.6 Ruckus Wireless, Inc.

- 7.1.7 Aerohive Networks Ltd.

- 7.1.8 Dell Inc.

- 7.1.9 Extreme Networks Inc.

- 7.1.10 ZTE Corporation

- 7.1.11 Fortinet Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET