PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690161

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690161

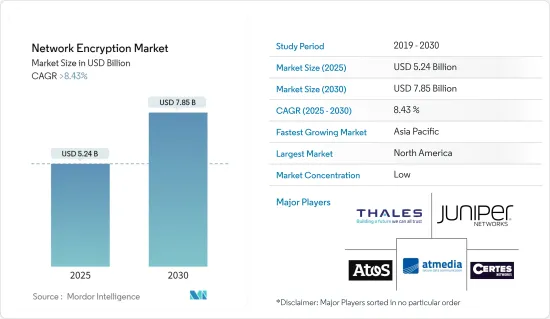

Network Encryption - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Network Encryption Market size is estimated at USD 5.24 billion in 2025, and is expected to reach USD 7.85 billion by 2030, at a CAGR of greater than 8.43% during the forecast period (2025-2030).

The growth of network encryption is primarily attributed to the increasing concern for data security and privacy in organizations.

Key Highlights

- The growth of the internet, cloud computing, and the increasing number of cyberattacks have led to the need for more secure data communication and storage. Additionally, increasing government regulations, such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS), require organizations to implement secure data transmission methods, further driving the growth of network encryption.

- Furthermore, the growth in adopting Internet of Things (IoT)-based solutions by the various end-user industries in their operations has increased the need for encryption to secure data transmitted over IoT networks, supporting market growth.

- The network encryption industry has grown because new encryption algorithms and better encryption software have been made. For example, using encryption algorithms that quantum computers can't break is becoming more important because quantum computers could break traditional encryption methods.

- Putting encryption solutions into place can be hard and expensive, especially for businesses with few IT resources. For some organizations, the cost of buying and setting up encryption solutions and training staff to use and maintain them can be a reason not to use them. Also, some encryption algorithms may have technical problems that make them unsuitable for s networks. Such factors are expected to challenge the market's growth during the forecast period.

- The most important factors affecting the market's growth are the growing number of network security breaches, the increasing use of cloud technologies by many organizations, and the growing need to meet ever-changing regulatory standards for better data protection.

- The COVID-19 pandemic significantly affected the network encryption market. As the trend toward working from home grew, there was more demand for secure remote work solutions. With more people working from home, there was a need for secure and reliable virtual private networks (VPNs) and remote desktop solutions to protect sensitive corporate data. This led to a surge in demand for network encryption products and services, boosting growth in the industry. Additionally, businesses increased their investment in cybersecurity to address the rise in cyber-attacks and security breaches related to the pandemic.

Network Encryption Market Trends

Telecom and IT Sector is Expected to Hold a Significant Share of the Market

- Some of the main things pushing the IT and telecom industries worldwide to use network encryption are the growing use of the cloud, increasing investment in optical communication, growing network data breaches, and strict government regulations.

- Furthermore, the growing adoption of a private network, trends in network automation, and the rollout of 5G networks are expected to significantly increase network traffic, requiring more advanced security measures. Network encryption will keep sensitive data safe on these networks, opening up new business opportunities.

- According to VIAVISION, as of April 2023, with the highest 5G network access, it was available in 503 cities in the United States; with 5G availability in 356 cities, China followed in second.

- Emerging ICT technologies such as smart factories, intelligent transportation systems, the 5th generation of cellular networks and beyond, the Internet of Things, distributed ledger technologies, and quantum-safe communication need technical and organizational measures to address various threats and risks.

- The deployment of 5G technology will probably lead to increased Internet of Things (IoT) devices connected to networks, opening up new chances for hackers to conduct more extensive and sophisticated assaults. According to Ericsson, Total mobile data traffic is expected to grow from 26 EB per month in 2023 to 73 EB per month in 2029, growing at a CAGR of 19 percent. All these factors are expanding the scope of network automation among telecom vendors, fueling the demand in the studied market.

- Furthermore, the innovation expansion launch and adoption of security services across the globe have further boosted the demand for network encryption techniques. Threats against telecommunications result from a combination of typical IP-based threats in an industry with legacy technology. As 5G technology advances, the threat surface will only expand, giving attackers more opportunities. This leaves cybersecurity teams at telecom companies looking for ways to leverage new technology and automation to streamline workflows to stay ahead of attackers in the face of new threats and an increasing number of alerts to triage.

North America is Expected to Hold Significant Market Share

- North America is a well-equipped region in terms of technology. It has a significant market share because of developed economies like the United States and Canada, and it has the right platforms for businesses of all sizes to follow government rules and regulations.

- The government of North America has put in place rules that require sensitive data to be protected while in transit. This has driven the need for network encryption solutions to meet these regulatory requirements.

- Furthermore, in September 2023, Arqit Quantum Inc., one of the global leaders in quantum-safe encryption, and Exclusive Networks North America, a global trusted cybersecurity specialist for digital infrastructure, announced an agreement for Arqit's unique Symmetric Key Agreement Platform. Joining Networks' portfolio of vendors and channel partners can provide Arqit's technology that protects against current and future cyber threats, including the risk from quantum computing.

- As the tech industry in the region continues to grow, there is more demand for network encryption solutions. This is because cloud computing is becoming more popular, and organizations want to protect sensitive data while it is being sent to and from the cloud. The companies also spend money on research and development to develop more advanced ways to encrypt networks. This investment is contributing to the growth of the industry.

- While the recently amended EARN IT Act would leave strong encryption on unstable ground if passed into law, The Lawful Access to Encrypted Data Act (LAEDA) is a direct assault on the tool millions of people rely on for personal and national security each day.

Network Encryption Industry Overview

The network encryption market is fragmented, with several players operating. The major players with a prominent share in the market are focusing on expanding their customer base across foreign countries by leveraging strategic collaborative initiatives to increase their market share and profitability. Thales Trusted Cyber Technologies, Atos SE, Juniper Networks, Inc., Certes Networks, Inc., Senetas Corporation Ltd., Viasat Inc., Raytheon Technologies Corporation, Securosys SA., and Packetlight Networks are some of the major players present in the current market and undergoing strategic initiatives such as mergers, acquisitions, collaboration, product innovation, and others.

In February 2023, Atos announced the launch of its new '5Guard' security offering for organizations looking to deploy private 5G networks and for telecom operators looking to enable integrated, automated. They orchestrated security to protect and defend their assets and customers. Atos'product portfolio is Atos'encryption solutions (Trustway), identity and access management software; public critical infrastructure solutions (IDnomic); and Atos Managed Detection and Response (MDR) platform that elevates the security of 5G network elements, applications, and workloads by detecting and responding to potential threats in near real-time.

In January 2023, Equinix, a company that makes digital infrastructure, worked with Aviatrix, which makes cloud services, to make high-performance encryption for enterprise environments. This partnership will make the Aviatrix Edge software available in over 25 of Equinix's global business exchange data centers. The combined solution, which uses Equinix's Network Edge and Equinix Fabric, gives you the fastest, most secure connection to the cloud to see what's happening in multiple clouds.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Network Security Breaches

- 5.1.2 Increasing Adoption of Cloud Technologies by Numerous Organizations

- 5.2 Market Challenges

- 5.2.1 High Implementation Cost of Network Encryption Solutions

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By Component

- 6.2.1 Hardware

- 6.2.2 Solutions & Services

- 6.3 By Organization Size

- 6.3.1 Small and Medium-sized Enterprises

- 6.3.2 Large-sized Enterprises

- 6.4 By End-user Industry

- 6.4.1 Telecom & IT

- 6.4.2 BFSI

- 6.4.3 Government

- 6.4.4 Media & Entertainment

- 6.4.5 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thales Trusted Cyber Technologies

- 7.1.2 ATMedia Gmbh

- 7.1.3 Atos SE

- 7.1.4 Juniper Networks Inc.

- 7.1.5 Certes Networks Inc.

- 7.1.6 Senetas Corporation Ltd.

- 7.1.7 Viasat Inc.

- 7.1.8 Raytheon Technologies Corporation

- 7.1.9 Securosys SA

- 7.1.10 Packetlight Networks

- 7.1.11 Rohde & Schwarz Cybersecurity GmbH

- 7.1.12 Colt Technology Services Group Ltd.

- 7.1.13 Ciena Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET