PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1273334

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1273334

Food Grade Lubricants Market - Growth, Trends, and Forecasts (2023 - 2028)

The market for food-grade lubricants is expected to register a CAGR of over 5% globally during the forecast period.

The COVID-19 epidemic negatively impacted the market for food-grade lubricants. The lockdown and temporary suspensions in production facilities caused considerable damage to several applications, reducing food-grade lubricants' usage. Yet, beyond 2020, the market grew moderately due to ongoing initiatives in the main end-user categories.

Key Highlights

- The primary factor driving the market studied is increasing food safety regulations. Also, the increased processed food demand is expected to drive the market forward.

- Conversely, awareness shortage and lack of training among manufacturers are hindering the market's growth.

- The increasing concern over food and beverage safety will likely be an opportunity during the forecast period.

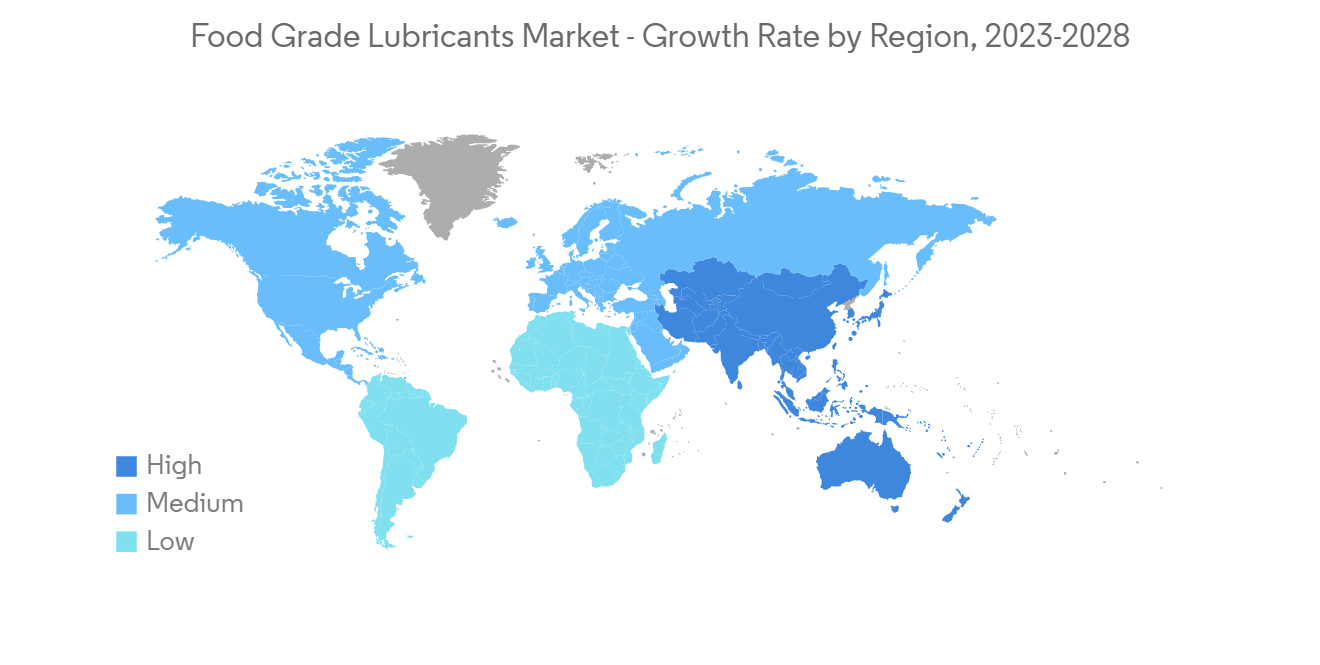

- Europe is expected to dominate the global market with the most substantial consumption from countries such as Germany, the United Kingdom, and France.

Food Grade Lubricants Market Trends

Increasing Application in Food and Beverage Industry

- Synthetic lubricants created explicitly for industrial machinery where accidental contact between food and lubricants may occur are known as food-grade lubricants.

- These oils are physiologically inert, tasteless, odorless, and accepted internationally. They also adhere to food/health/safety requirements.

- Following a leak, overflow, or lubrication malfunction, the lubricants are prone to coming into touch accidentally with the food and beverages generated by the machinery. It is where these food-grade lubricants serve a crucial role, thanks to their neutral quality.

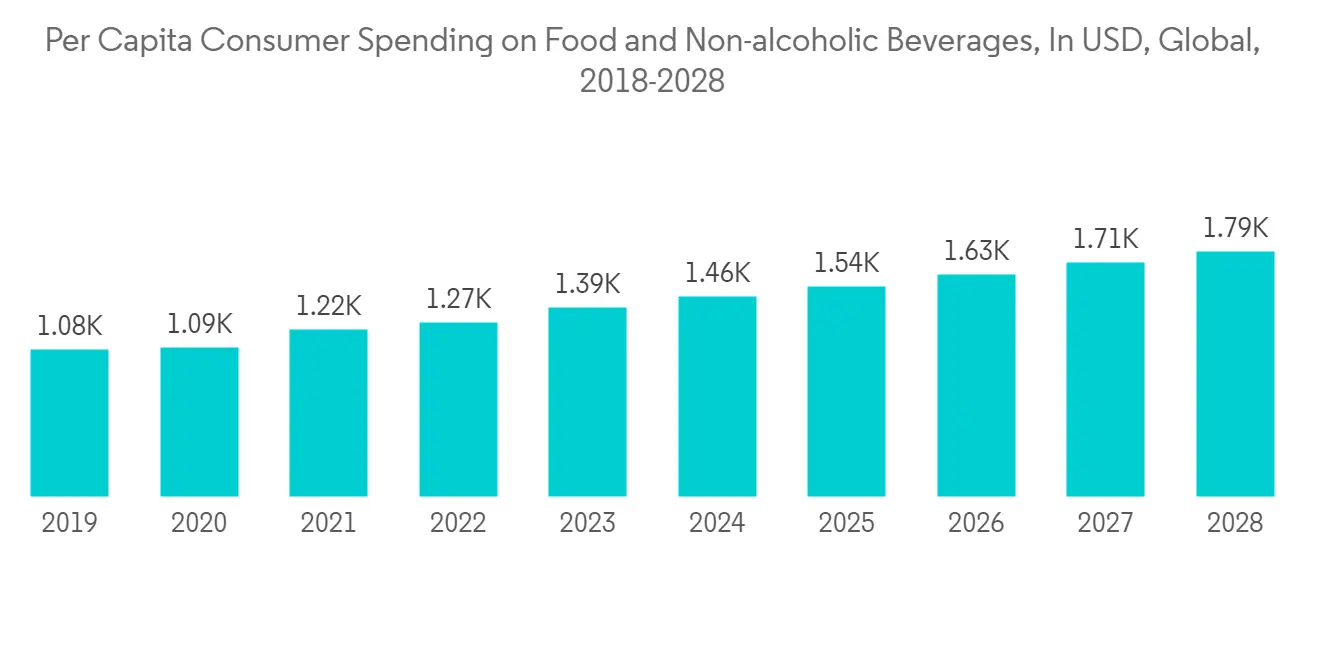

- Statista projects that the global food and beverage business will bring in USD 740 billion in revenue in 2022. The market is anticipated to expand at a CAGR of 7.14% between 2022 and 2027, with a projected market size of USD 1.10 billion by that year.

- According to the Bureau of Economic Analysis, the value contributed by the food and beverage sector in the United States during the first three quarters of 2022 was around USD 967.6 billion, 1.3% more than it was during the same time last year.

- One of Europe's most significant manufacturing sectors in 2022, the food and beverage industry employed almost 4.6 million people, brought in EUR 1.1 trillion (USD 1.159 trillion) in revenue, and added EUR 230 billion (USD 242.37 billion) in value. It is, thus, boosting the food and beverage sector in the area.

- The India Brand Equity Foundation further stated that by 2025, India's processed food sector is anticipated to reach USD 470 billion. According to the Union Budget for FY 2022-23, the Department of Food and Public Distribution has received a budget of INR 215 960 crores (USD 27.82 billion) considering the expanding food and beverage sector.

- Hence, due to the growing food and beverage manufacturing, especially in the Asia-Pacific and European regions, the demand for food-grade lubricants is expected to increase over the forecast period.

Europe Region to Dominate the Market

- Europe is expected to dominate the market for food-grade lubricants during the forecast period. Due to the high demand for applications from countries like Germany, the United Kingdom, and France, the market for food-grade lubricants is growing.

- Europe is where food-grade lubricants are used most extensively. In Europe, the CONDAT Group, Matrix Specialty Lubricants, Dow, and Clearco Products Co. Inc. are some of the top producers of food-grade lubricants.

- The food and beverage business, one of the largest manufacturing industries in Europe in 2022, added EUR 230 billion (USD 242.37 billion) in value, employed about 4.6 million people, and generated EUR 1.1 trillion (USD 1.159 trillion) in income. It is, thus, enhancing the local food and beverage industry.

- Cosmetics Europe said the European cosmetics and personal care market was valued at about EUR 80 billion (~USD 94 billion) in 2021. The largest national markets for cosmetics and personal care products within Europe are Germany (EUR 13.6 billion (~USD 16 billion)), France (EUR 12.0 billion (~USD 14 billion)), Italy (EUR 10.6 billion (~USD 12.2 billion)), the UK (EUR 9.9 billion (~USD 11.8 billion)) and Spain (EUR 7 billion (~USD 8 billion)).

- Skincare (EUR 23.2 billion (~USD 27 billion)) and toiletries (EUR 20.6 billion (~USD 24 billion)) include the most significant market share in Europe, followed by hair-care products, fragrances/perfumes, and decorative cosmetics.

- The abovementioned factors and government support will likely contribute to the increasing demand for the food-grade lubricants market during the forecast period.

Food Grade Lubricants Industry Overview

The food-grade lubricants market is fragmented, with players accounting for a marginal market share. Some of the significant companies include (not in any particular order) Dow, The Chemours Company, The Lubrizol Corporation, CONDAT Group, and Matrix Specialty Lubricants, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Food Safety Regulations

- 4.1.2 Increase in Demand for Processed Food

- 4.2 Restraints

- 4.2.1 Lack of Awareness and Shortage of Training

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Food Grade

- 5.1.1 H1

- 5.1.2 H2

- 5.1.3 H3

- 5.2 Product Type

- 5.2.1 Grease

- 5.2.2 Hydraulic Fluid

- 5.2.3 Gear Oil

- 5.2.4 Other Product Types

- 5.3 End-user Industry

- 5.3.1 Food & Beverage

- 5.3.2 Cosmetics

- 5.3.3 Edible Oil

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Calumet Specialty Products Partners, L.P.

- 6.4.2 CITGO Petroleum Corporation

- 6.4.3 Clearco Products Co., Inc.

- 6.4.4 CONDAT Group

- 6.4.5 Dow

- 6.4.6 Elba Lubes

- 6.4.7 Engen Petroleum Ltd

- 6.4.8 Lubrication Engineers

- 6.4.9 Matrix Specialty Lubricants

- 6.4.10 Petrelplus Inc.

- 6.4.11 Suncor Energy Inc. (Petro Canada)

- 6.4.12 The Chemours Company

- 6.4.13 The Lubrizol Corporation

- 6.4.14 Ultrachem Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications in the Food and Beverage Industry