PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690698

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690698

Europe Roofing Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

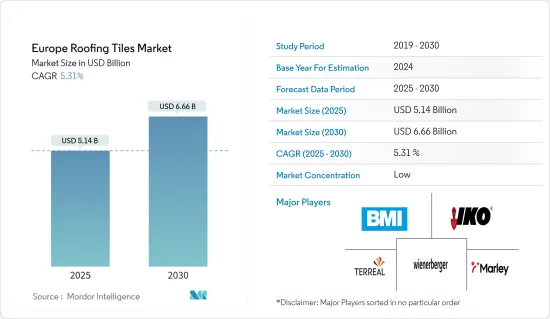

The Europe Roofing Tiles Market size is estimated at USD 5.14 billion in 2025, and is expected to reach USD 6.66 billion by 2030, at a CAGR of 5.31% during the forecast period (2025-2030).

In line with the COVID-19 outbreak in 2020, nationwide lockdowns around the globe, disruptions in manufacturing activities and supply chains, and production halts negatively impacted the European roof tiles market. However, the market recovered from 2021 to 2022 and is expected to continue its growth trajectory during the forecast period.

Key Highlights

- Besides, major factors driving the market studied include increasing demand from the construction industry and favorable government policies for green buildings.

- Roof tiles tend to be more expensive than a few other options, which is likely to hamper the market's growth. The lack of skilled workers in the construction industry is also anticipated to impede market expansion.

- Nevertheless, the development of solar roof tiles is expected to offer various lucrative opportunities for the market's growth.

- Among the European countries, Germany is expected to dominate the regional market due to the growth in its construction industry.

Europe Roofing Tiles Market Trends

Consistent Growth of the Residential Segment

- The usage of roofing tiles for residential applications is increasing because they can reduce the overall heat transfer into the attic by almost 70%, compared to an asphalt shingle roof. Roofing tiles are available for various residences, including single-family homes, townhomes, condominiums, and apartment buildings. The installation of roofing tiles in residential applications is one of the most cost-effective choices due to their long lifespan.

- Strong demand from various European countries makes residential construction one of the significant markets in Europe. According to the UK government, it is on track to meet its manifesto commitment to build 1 million homes in the current parliament with the support of the GBP 10 billion (USD 12.7 billion) investment allocated to boost housing supply.

- In February 2024, an increase of GBP 3 billion (USD 3.8 billion) was made in a government-backed loan fund to build 20,000 new affordable homes across the United Kingdom to help more people own a house.

- As per the European Commission, under its Housing First Plan (Le Logement D'abord), the French government announced tax waivers. Under the budget, the housing tax was entirely removed for 80% of French households. With regard to the remaining 20%, the country's wealthiest households, there was a gradual decrease in this tax rate from 2021, followed by a complete cessation of housing tax by 2023.

- According to Spain's National Statistics Institute (INE), the net household construction is anticipated to increase at an average pace of around 135,000 units every year from 2019 to 2025. Thus, the residential construction industry is expected to grow significantly over the latter period of the forecast period.

- The above-mentioned trends and facts indicate a strong demand for European roof tiles in the residential segment during the forecast period.

Germany to Dominate the Market

- The German economy is the largest in Europe and among the top five largest in the world. It also has the largest housing stock among European countries, which indicates its dominance over the demand for European roof tiles.

- According to the Federal Statistical Office (Destatis) report, in March 2023, the construction of 24,500 dwellings was permitted in Germany, a decrease of 10,300 (approx. 29.6%) in building permits compared with March 2022.

- The turnover in building completion work fell by 4.8% in 2022 compared to 2021 because of the substantial increase in construction prices.

- According to Deutsche Welle, Germany is expected to see a 32% drop in new housing construction between 2023 and 2025. Furthermore, it is estimated that only 200,000 homes will be completed in 2025 compared to 295,000 in 2022, which could lead to an increase in housing prices.

- Germany's residential construction industry has also witnessed new orders being considerably slower and existing orders being canceled much more frequently. For instance, according to the IFO Institute, around 22% of German companies witnessed orders getting canceled in October 2023, about 48.7% of companies also mentioned a lack of new orders in October 2023, and 46.6% mentioned the same in September 2023.

- Considering the above-mentioned facts and figures, even though the German housing construction industry seems to shrink, the country's dominance over the European roof tiles market is expected to be maintained during the forecast period.

Europe Roofing Tiles Industry Overview

The European roof tiles market is fragmented in nature. The major companies in the market studied (in no particular order) include Wienerberger AG, BMI Group, TERREAL, IKO Industries Ltd, and Marley.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Favorable Government Policies for Green Buildings

- 4.1.2 Increasing Demand from Construction Industry

- 4.2 Restraints

- 4.2.1 Higher Price Among Other Roofing Options

- 4.2.2 Lack of Skilled Workers in the Construction Sector

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Clay

- 5.1.2 Concrete

- 5.1.3 Other Types

- 5.2 End-user Industry

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Infrastructure

- 5.2.4 Industrial and Institutional

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Russia

- 5.3.7 NORDIC

- 5.3.8 Turkey

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BMI Group

- 6.4.2 Crown Roof Tiles

- 6.4.3 Fornace Laterizi Vardanega Isidoro SRL

- 6.4.4 IKO Industries Ltd

- 6.4.5 INDUSTRIE COTTO POSSAGNO SpA

- 6.4.6 Marley

- 6.4.7 TERREAL

- 6.4.8 Vortex Hydra SRL Italy

- 6.4.9 Wienerberger AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Solar Roof Tiles