PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437594

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437594

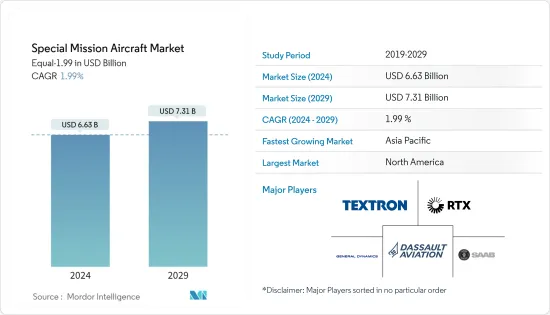

Special Mission Aircraft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Special Mission Aircraft Market size is estimated at USD 6.63 billion in 2024, and is expected to reach USD 7.31 billion by 2029, growing at a CAGR of 1.99% during the forecast period (2024-2029).

The escalating geopolitical tensions and cross-border issues across the world are driving the rapid increase in military spending by major and emerging economies. Special mission aircraft act as low-cost multi-role substitutes that support a wide range of missions like maritime patrol, electronic warfare, search and rescue, and medevac, among others. The ongoing advancements in aerospace technologies, including sensor systems, communication equipment, and stealth capabilities, drive the demand for modernized special mission aircraft with enhanced performance and capabilities. The integration of cyber warfare capabilities into special mission aircraft is becoming increasingly important as nations seek to enhance their capabilities to detect and counter cyber threats.

According to Bombardier, the demand for medevac-configured special mission aircraft increased in 2020. The evolving global security landscape, including geopolitical tensions and asymmetric threats, propels the need for special mission aircraft to enhance situational awareness and response capabilities. Moreover, growing defense expenditures worldwide are expected to accelerate the demand for special mission aircraft during the forecast period.

Special Mission Aircraft Market Trends

Intelligence, Surveillance, and Reconnaissance (ISR) Segment To Dominate Market Share

The intelligence, surveillance, and reconnaissance (ISR) segment currently dominates the market, and it is expected to continue its dominance during the forecast period. The segment includes special mission aircraft used for ISR missions and airborne early warning and control (AEW&C) applications. Similarly, the growing need for monitoring and securing borders against various threats drives the demand for special mission aircraft equipped with ISR capabilities to enhance border surveillance and control. The demand growth of the segment is majorly due to the increased demand for the acquisition of surveillance aircraft due to tensions at land and sea borders for various countries as well as other factors like drug trafficking and high-seas piracy. In November 2022, Bombardier Defense received a Global 6000 jet to its US facility, where it will be converted to fit the intelligence-gathering needs of the German military. The aircraft is the first of three Global 6000 business jets to be conjointly modified by the Bombardier and the Lufthansa Technik, as part of Germany's PEGASUS program. As per the contract, Bombardier will perform major structural modifications to make the jet capable of accommodating a "Kalatron Integral" signal intelligence (SIGINT) system developed by HENSOLDT AG. Once modifications are finished the plane will be moved to the Lufthansa Technik facility where the intelligence-gathering system will be installed. Such fleet modernization plans of the countries are anticipated to propel the growth of the segment during the forecast period.

Asia-Pacific to Witness the Highest Growth During the Forecast Period

The Asia-Pacific region is expected to grow rapidly during the forecast period due to the border tensions and geopolitical issues in the region. With the increasing military spending, countries such as China, India, and Japan are undertaking aircraft fleet modernization programs to enhance their aerial capabilities (including combat readiness and situational awareness. In September 2023, the Indian Air Force (IAF) received its first C-295 transport aircraft, reaching a major milestone in IAF's air capabilities. The aircraft is capable of special missions, disaster response, and maritime patrol duties. In September 2021, the IAF ordered a total of 56 planes from Airbus, of which 16 will be imported from Spain and the rest will be manufactured in India and delivered to IAF by 2031. IAF received the first delivery of C-295 aircraft in September 2023. C-295 aircraft will enhance IAF's tactical lift capability along the Pakistan and China border. Such planned procurements during the forecast period are expected to drive the growth of the market.

Special Mission Aircraft Industry Overview

The special mission aircraft market is fragmented due to the presence of aircraft OEMs and companies that convert commercial or general aviation aircraft into special mission aircraft. Some of the prominent players in the market for special mission aircraft are RTX Corporation, Textron Inc., Dassault Aviation, General Dynamics Corporation, and Saab AB. The companies are expanding their sales and footprint in various regions through new partnerships with the governments and armed forces. For instance, the US government was awarded a USD 1.6 billion production contract to Boeing in April 2021 for the delivery of 11 P-8A Poseidon aircraft. Out of the 11 aircraft, nine aircraft are planned to be delivered to the US Navy, and two aircraft will be delivered to the Royal Australian Air Force (RAAF). With the order, the total number of P-8A aircraft on order for the US Navy increase to 128 and the RAAF to 14. The companies are also investing in developing new special mission aircraft based on the requirements of the armed forces. In this regard, In July 2020, Textron Aviation received a contract from Sundt Air for two Beechcraft King Air 350C turboprop aircraft to support air ambulance and medevac missions throughout Greece. The new aircraft will be owned by the Greece Ministry of Health and will be operated by the Hellenic Air Force for disaster relief, medical rescue, inter-hospital transfer, and repatriation to mainland healthcare services. Such contracts from various government and armed forces will help the companies increase their footprint in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD billion)

- 5.1 Application

- 5.1.1 Intelligence, Surveillance, and Reconnaissance (ISR)

- 5.1.2 Maritime Patrol Aircraft

- 5.1.3 Other Applications

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Germany

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Australia

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Rest of Latin America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Turkey

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 RTX Corporation

- 6.1.2 IAI

- 6.1.3 Elbit Systems Ltd.

- 6.1.4 The Boeing Company

- 6.1.5 Dassault Aviation

- 6.1.6 Northrop Grumman Corporation

- 6.1.7 Lockheed Martin Corporation

- 6.1.8 Textron Inc.

- 6.1.9 General Dynamics Corporation

- 6.1.10 Airbus SE

- 6.1.11 Bombardier Inc.

- 6.1.12 Pilatus Aircraft Ltd.

- 6.1.13 Leonardo S.p.A.

- 6.1.14 Saab AB

7 MARKET OPPORTUNITIES AND FUTURE TRENDS