PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435918

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435918

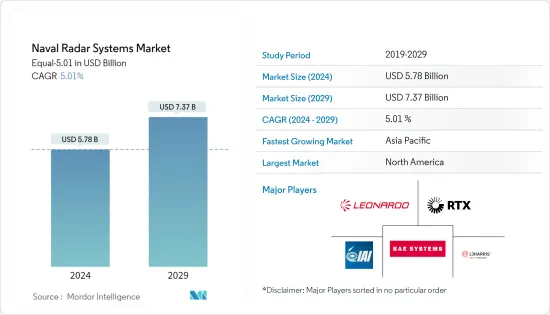

Naval Radar Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Naval Radar Systems Market size is estimated at USD 5.78 billion in 2024, and is expected to reach USD 7.37 billion by 2029, growing at a CAGR of 5.01% during the forecast period (2024-2029).

Development and procurement of new frigates have gained importance in the past few years due to the increasing border issues and territorial conflicts at sea. Escalating geopolitical tensions globally underscores the strategic importance of naval forces, fostering a heightened demand for military frigates. Nations seek to bolster their maritime capabilities to secure vital sea routes, protect territorial waters, and respond effectively to evolving geopolitical challenges, thereby driving the procurement of frigates.

The surge in military modernization initiatives plays a pivotal role in driving the market for military frigates. As nations prioritize upgrading their defense capabilities, surveillance emerges as an integral component of comprehensive naval modernization programs. The incorporation of state-of-the-art radar systems aligns with broader military strategies, contributing to sustained demand in the market.

Due to growth in geopolitical tensions, maritime border tension, and the growing importance of anti-submarine warfare, countries like China, India, the United States, the United Kingdom, Spain, etc., are increasing their investments towards strengthening their surveillance capabilities.

The increasing investments by the companies to develop new and advanced radar systems for surveillance (counter-stealth technologies) are anticipated to bolster the growth of the market in the coming future.

Naval Radar Systems Market Trends

Surveillance Segment Will Dominate the Market During the Forecast Period

The surveillance segment provides comprehensive threat detection capabilities, encompassing both surface and airborne threats. With an increasing emphasis on early warning and threat identification, naval forces prioritize surveillance radar systems to enhance their situational awareness and response capabilities. Surveillance radar systems are designed to operate effectively in diverse maritime environments, including open seas, littoral zones, and congested waterways. Their adaptability makes them indispensable for naval operations across a spectrum of scenarios, contributing to their prevalence in the market.

Moreover, the integration of surveillance radar systems with advanced command and control systems enhances the overall effectiveness of naval operations. Real-time data provided by these systems enables naval commanders to make informed decisions, coordinate responses, and optimize the allocation of resources, reinforcing the significance of the surveillance segment in the market. For instance, in March 2022, The US Navy awarded a USD 651 million contract to RTX corporation for SPY-6 radars. As per the plans, the US Navy is outfitting new surface ships in its fleet with new radars that can find and track enemy missiles and planes simultaneously. With the award, Raytheon Technologies' business will provide hardware, production, and sustainment for the SPY-6 family of radars. The SPY-6 radars will allow naval vessels to find threats, including hypersonic weapons, at greater distances and to react faster to them. The Navy began installing the first SPY-6 radar on its high-tech Aegis Flight III, the USS Jack H. Lucas (DDG 125), in 2021.

Asia-Pacific is Expected Show Remarkable Growth During the Forecast Period

The escalating tensions between the various countries in this region due to the increasing dominance of China in the South China Sea have led to an increase in naval investments by the neighboring countries to procure and modernize their naval fleet. Countries like South Korea, Australia, India, China, and Indonesia are primarily investing in the development and procurement of new naval vessels. China's navy is undergoing a huge naval fleet expansion, which is projected to help China surpass Russia as the largest navy in the world in terms of frigates and submarines in the near future. China is continually emphasizing increasing its anti-submarine warfare (ASW) capabilities from coastal defense to blue-water operations. Similarly, out of the total modernization budget as a percentage of India's capital outlay budget, the Indian Navy was allocated 30.35%, i.e., USD 5.88 billion, for the fiscal year 2023-2024. The Indian Navy's modernization budget has seen a 13.25% increase from the FY 2022-2023 budget. Increasing investments into the procurement of new-generation naval vessels are expected to accelerate the growth of the naval radars market during the forecast period.

Naval Radar Systems Industry Overview

The naval radar systems market is highly competitive, with many major defense manufacturers catering to the radar requirements of various naval programs. Some of the prominent players in the market of naval radar systems are RTX Corporation, L3Harris Technologies Inc., Israel Aerospace Industries Ltd, Leonardo SpA, and BAE Systems PLC. The companies are partnering for various naval programs, which are helping the companies increase their presence in various regions. Also, the radar manufacturers are collaborating to develop new radar solutions.

For instance, in September 2021, HENSOLDT introduced the Quadome radar system for naval surveillance and target acquisition. The new-generation technology modernizes one of HENSOLDT's key radar product lines and further enhances the group's extensive radar portfolio. Similarly, in June 2021, the US Navy's destroyer, USS Paul Ignatius, conducted a Standard Missile 3 (SM-3) Launch on Remote test using data from Thales' SMART-L Naval Multi-Mission (SMART-L MM/N) radar. Such developments are anticipated to help the companies increase their share in the market as well as increase their cashflows in the coming years. Similarly, to ensure that British naval radar technology remains a global market leader, the UK Ministry of Defence (MoD) and BAE Systems plc invested USD 55 million to develop the next generation of radar technology which the Royal Navy requires to tackle emerging threats, including ballistic missiles and drones.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Surveillance

- 5.1.2 Missile Guidance

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Australia

- 5.2.3.6 Taiwan

- 5.2.3.7 Rest of Asia-Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of Latin America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Turkey

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 RTX Corporation

- 6.2.2 Terma Group

- 6.2.3 Leonardo SpA

- 6.2.4 Israel Aerospace Industries Ltd

- 6.2.5 THALES

- 6.2.6 BAE Systems PLC

- 6.2.7 HENSOLDT AG

- 6.2.8 Saab AB

- 6.2.9 Rosoboronexport

- 6.2.10 L3Harris Technologies Inc.

- 6.2.11 Bharat Electronics Limited (BEL)

- 6.2.12 Northrop Grumman Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS