PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437611

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437611

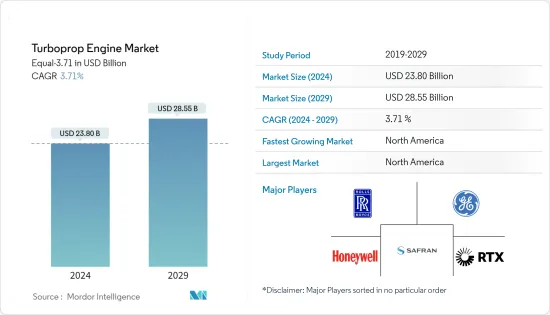

Turboprop Engine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Turboprop Engine Market size is estimated at USD 23.80 billion in 2024, and is expected to reach USD 28.55 billion by 2029, growing at a CAGR of 3.71% during the forecast period (2024-2029).

The preference for turboprop engine-powered aircraft in commercial aviation is growing with the introduction of new regional routes. The turboprop engines are highly efficient in short-distance and low-altitude flying, which is helping their growth in the commercial aviation sector. In the military and general aviation segments, the growth in demand is mainly due to the introduction of new aircraft models that are powered by turboprop engines.

The increrasing demand of turboprop aircraft are due to the introduction of newly developed shorter routes and the ability to fly at low altitudes, coupled with cost efficiency. Within the turboprop engine market, the hybrid variety holds dominance owing to its increasing popularity in the civil aviation sector. Furthermore, the deployment of turboprop engines is extensive as older aircraft are retrofitted with these hybrid engines. In addition, newer aircraft are already equipped with this modern turboprop engine.

The turboprop engines prove to be highly efficient in low altitude flying, short distance travel, requiring minimal airstrip space for take-off and landing, and enhancing fuel efficiency. These factors contribute to making air travel more accessible and convenient for individuals, thereby driving the market demand for turboprop engines.

Turboprop Engine Market Trends

General Aviation Segment is Expected Witness Significant Growth During the Forecast Period

With the growth in demand for newer aircraft models featuring the latest avionics and technological advancements in terms of performance, several turboprop aircraft manufacturers are developing new aircraft. Growth in the HNWI and UHNWI populations globally is acting as a catalyst for the increased demand for private travel, subsequently driving the procurement of turboprop aircraft globally. For instance, from 2017 to 2022, the HNWI population increased by 83% globally. In July 2022, Pratt & Whitney Canada announced a new engine model for its PT6 E-Series engine family. The PT6E-66XT engine is purpose-built for Daher's latest single-engine turboprop airplane, the TBM 960.

In January 2022, Pratt & Whitney Canada that Diamond Aircraft had selected the PT6A-25C engine for its new DART-750 aircraft. DART-750 aircraft is an all-carbon fiber tandem turboprop trainer aircraft. Thus, the growth in demand for newer turboprop aircraft, especially in the general aviation segment is expected to drive the innovations in turboprop engines which is expected to help the market growth during the forecast period.

North America Projected to Dominate the Market During the Forecast Period

North America is the largest market for Turboprop Engines in 2022. The region is also expected to grow with the highest CAGR during the forecast period, due to large-scale demand for turboprop aircraft from the United States. In the General Aviation segment, North America alone accounted for about 56% of the turboprop aircraft deliveries in 2022 in which the U.S. has having contribution of around 79%. The region is also generating demand for new turboprop aircraft in the commercial aircraft segment, with the growth in the demand for regional aircraft.

It is expected that by 2039 there will be a requirement of 79,000 pilots in the business aviation and civil helicopter sector in the North American region. The positive economic recovery trend along with the fleet expansion plans of flight training institutes is expected to aid the growth of other categories during the forecast period. It is expected around 1,400 turboprops will be delivered during 2023-2028 in North America.

In November 2023, RTX's Pratt & Whitney received a contract valued up to USD 870 million for TF33 engines powering B-52s, and E-3s by the Defense Logistics Agency of the U.S. Such kind of development will drive the demand for turboprop engine market during the forecast period in North America.

Turboprop Engine Industry Overview

The turboprop engine market is consolidated, with the presence of a few turboprop engine OEMs which occupy a majority of the market share. Some of the prominent players in the market are RTX Corporation, Rolls-Royce plc, Safran, General Electric Company, and Honeywell International, Inc. The engine manufacturers and OEMs enjoy long-term contracts, for providing products and their services, thereby, making it difficult for new players to enter and sustain in the market. Significant investment into R&D of advanced technologies like additive manufacturing and incorporation of automation and AI to increase the production rate of the engines are expected to help the players to ramp up their production capacity, thereby, helping their growth during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porters Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Commercial Aircraft

- 5.1.2 Military Aircraft

- 5.1.3 General Aviation Aircraft

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia Pacific

- 5.2.4 Latin America

- 5.2.4.1 Brazil

- 5.2.4.2 Rest of Latin America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Israel

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 RTX Corporation

- 6.2.2 Rolls-Royce plc

- 6.2.3 Safran

- 6.2.4 General Electric Company

- 6.2.5 Honeywell International, Inc.

- 6.2.6 MTU Aero Engines AG

- 6.2.7 PBS AEROSPACE Inc.

- 6.2.8 Motor Sich JSC

- 6.2.9 TUSAS Engine Industries, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS