PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440191

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440191

Europe Bike Sharing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

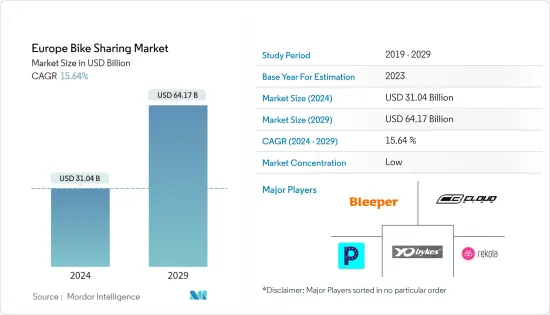

The Europe Bike Sharing Market size is estimated at USD 31.04 billion in 2024, and is expected to reach USD 64.17 billion by 2029, growing at a CAGR of 15.64% during the forecast period (2024-2029).

The Europe bike-sharing market experienced significant losses due to COVID-19. The restricted lockdown movement caused a decline in the demand for bike-sharing options. The increased risk associated with crowded places with social distancing measures harmed the market's growth as customers' preferences shifted towards personal bikes and scooters. Although, with relaxation provided by the government in lockdowns and gatherings, bike-sharing demand in Europe is again seeing a growth phase and is expected to witness prominence during the forecast period. For instance,

Key Highlights

- March 2022: Motto is a new French startup that intends to sell electric bicycles in Paris. Instead of purchasing the bikes, Motto customers will be able to rent them for a fixed monthly fee of EUR 75 (USD 79.93).

Over the medium term, rising consumer inclination in the wake of growing awareness about the benefits offered by bike-sharing services across the region, the presence of prominent players is expected to drive demand in the market. Consumers today are unwilling to invest hugely in commodities that can be used for only a brief period. Therefore players in the region are also supporting and launching new services in European Countries. For instance,

Key Highlights

- May 2022: Inurba Mobility, the new brand of Citybike Global, launched the electric public service in Stockholm (Sweden) with the first 1.000 electric bikes from a total of 5,100 to be deployed by the end of this year. It is expected to be one of Europe's most extensive public e-bike-sharing services.

The bike-sharing system is designed specifically for commuters who can pick up bicycles as per their need at convenient times and locations. With hassle-free, low maintenance, and cheap pricing, bike sharing is also becoming popular in the European markets. Chinese bike-sharing models mostly penetrated the European bike-sharing market. Today, several local operators are also starting up their bike-sharing businesses. Also, Bikes provide the added benefit of leaner volume, which significantly reduces traffic congestion.

The E-bikes rise, providing the same utility as any two-wheelers with the added benefit of reduced ill-effects on the environment, are also becoming popular amongst European countries. Many young engineers and entrepreneurs with experience in design and innovation see the E-bike industry as a massive opportunity, especially in the European markets. For instance,

Key Highlights

- August 2022: ESB eBikes is an e-bike pilot project in Dublin launched by Irish energy supplier ESB. ESB subsidized the daily hire cost, starting at EUR 5 (USD 5.33) per day for those with a EUR 30 (USD 31.97) monthly subscription. Without a subscription, a full day costs EUR 10 (USD 10.66). By midnight, users must return the bike to the same station.

Germany, the United Kingdom, Belgium, and others are expected to hold a significant market share due to rising bike-sharing activities and infrastructure development across these regions.

Europe Bike Sharing Market Trends

E-Bikes Likely to be fastest-growing segment During the Forecast Period

The rise in vehicle emissions led to the implementation of stringent laws and regulations by the governments of Europe. The automotive and automotive component manufacturers are more focused on reducing vehicle weight to improve fuel efficiency. Electric vehicles are another major step toward reducing emissions in many developing economies.

Governments are providing incentives, such as subsidies and tax exemption, to promote electric vehicles purchase. Thus, the demand for electric bike sharing is seen on the graph's positive side, seeing the government incentives.

Electric 2-wheeler is environmentally friendly, running majorly on Li-ion chargeable battery. It can offer a maximum range of 99.4 miles (160 km) on one single charge. With options of battery typing 8, 12, or 18 Amp hour batteries, it also provides the customer a choice as per their utility.

In addition, 2-wheeler electric rental companies are stepping up by providing 24/7 customer service with free pick-ups and drops at designated locations. Bikes provide helmets, first aid kits, and even mounted phone holders for navigation. Optional accessories are also famous in tourist spots, such as free 4G internet or pocket Wi-Fi to maximize customer gains. Therefore, players in the European region are launching e-bike-sharing services. For instance,

- October 2022: Barcelona's public transportation company unveiled the infrastructure for the upcoming AMBici bike-sharing service, which will cover the entire Barcelona Metropolitan Area. The new service is set to go live at the beginning of next year and will be available in 15 Catalan municipalities. AMBici will provide residents with 2,600 electric bicycles and 236 stations to provide better, more flexible, and more sustainable mobility.

Moreover, the ever-expanding on-demand commutation market also contributed to the popularity of e-scooters. eScooters are modernized versions of classic scooters that have been converted into electric vehicles by eScooter manufacturers. These are also considered a superior option as they run on electricity and can travel long distances without harming the environment.

Germany and United Kingdom Expected to Play Key role in the Market

The bike-share sector is expected to grow from 3-5 vehicles per 1000 residents in major European cities to 10-20 cars per 1000 residents in the next five years, representing a 20-30% growth per year. In Europe, Bike-sharing riders cost between EUR 0.50 to EUR 1 (USD 0.53- - USD 1.07) per trip and up to EUR 3 to 4 (USD 3.20 - 4.26) to go to work and back. A commuter spends an average of EUR 10-12 (USD 10.66 - 12.79) for a whole day commuting. As the bike-sharing market begins to issue monthly travel cards, the rates will go down significantly.

Germany led the European market, accounting for approximately 40% of the market in 2021. It was followed by the Netherlands and France, which captured more than 11% of the overall market share. Many European Bike-sharing companies have joined forces and are operating in more than 350 cities with 65 million rides. A European expert group comprising a few selected companies like BiciMAD, Donkey Republic, Mobike, and Moventiaa form powerful advocacy in the bike-sharing sector.

Some recent developments in the EU have embraced the market for E-bike sharing to witness elevated sales bar. For instance:

- In May 2022, CONEBI produced a report with the European Cyclist association to highlight better and more effective fuel tax, which shall be promised across the EU. The new fuel subsidies are now likely to pay free for 5.3 billion bike-sharing services.

Considering the development league in Germany and the UK towards electric mobility and bike-sharing incentives, demand for bike-sharing services is expected to witness an increased sales bar in Europe during the forecast period.

Europe Bike Sharing Industry Overview

The Europe Bike Sharing Market is hugely fragmented with various startups and regional players such as Byke, Urbo Solutions, Bleeper Bike, Cloudbike, Rekola, YoBike, Pony Bikes, and the Donkey Republic. Although to have the edge over their competitors, the major bike manufacturers are making joint ventures and partnerships to launch newer products. For instance,

- In March 2021, Rekola launched bike-sharing in Bratislava's forests. The initiative was developed in response to the tightened anti-coronavirus measures and the recommendations that people should get out into the countryside.

- In January 2021, Bleeper raised nearly EUR 600,000 (USD 639,411) to add more bikes to its sharing fleet, and it is plotting the roll-out of e-scooters.

Several bike manufacturers are involved in constructive alliances with fleet management operators to improve the Europe bike-sharing market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market size in Value USD Billion)

- 5.1 Duration Type

- 5.1.1 Long

- 5.1.2 Short

- 5.2 Application Type

- 5.2.1 Tourism

- 5.2.2 Commuting

6 Geography

- 6.1 Europe

- 6.1.1 Germany

- 6.1.2 United Kingdom

- 6.1.3 Italy

- 6.1.4 France

- 6.1.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share

- 7.2 Company Profiles*

- 7.2.1 YObykes

- 7.2.2 Cloudbike

- 7.2.3 Rekola Bikesharing s.r.o.

- 7.2.4 Pony Bikes

- 7.2.5 BiciMad (Avanza Bike SL)

- 7.2.6 Bleeper Active

- 7.2.7 Urbo Solutions

- 7.2.8 Donkey Republic

8 MARKET OPPORTUNITIES AND FUTURE TRENDS