PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851088

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851088

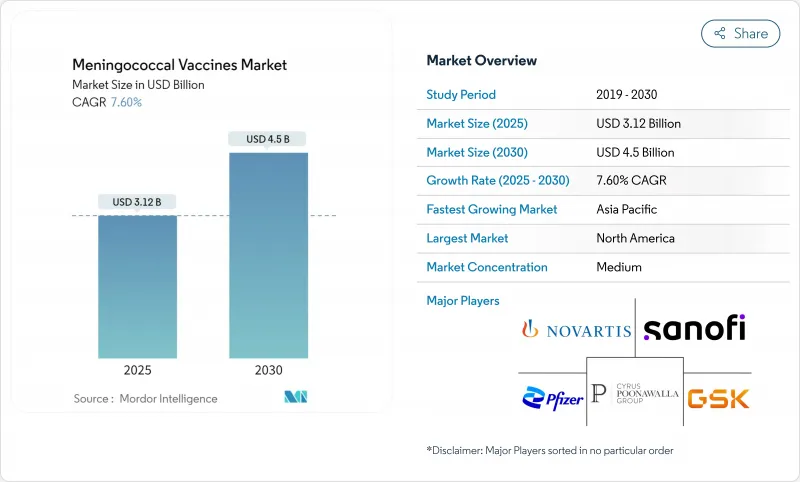

Meningococcal Vaccines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The meningococcal vaccines market is valued at USD 3.12 billion in 2025 and is forecast to reach USD 4.5 billion by 2030, advancing at a 7.60% CAGR.

Pentavalent platforms that combine serogroups A, B, C, W and Y are redefining product strategy, compressing multi-shot schedules into single injections and shifting demand away from older monovalent and quadrivalent brands. GSK registered the first FDA nod for a five-component shot, Penmenvy, in February 2025 , closely following Pfizer's Penbraya launch; both approvals have accelerated portfolio realignment among incumbents. Manufacturers now weigh the lure of premium pricing for combination vaccines against the cannibalization of legacy lines. Regionally, North America retains purchasing power, but Asia-Pacific delivers the fastest volume gains on the back of widening national immunization programs and emerging last-mile delivery models such as room-temperature-stable Men5CV in Nigeria. Competitive intensity is rising as biotechnology entrants leverage public-private partnerships and technology transfers to narrow time-to-market.

Global Meningococcal Vaccines Market Trends and Insights

Rising Immunization Programs & Government Initiatives

Government-financed vaccine roll-outs are scaling demand by integrating meningococcal shots into routine schedules and travel requirements. China's National Immunization Program has moved several WHO-endorsed vaccines, including meningococcal conjugates, into fully funded status, widening access across rural provinces . France convened WHO's first high-level forum on the "Defeating Meningitis by 2030" roadmap in 2024, unlocking new pledges for affordable supply and surveillance harmonisation. Saudi Arabia's requirement for MenACWY proof among Hajj and Umrah pilgrims continues to stimulate global demand, even though compliance audits show only 54% adherence among foreign travellers. These coordinated programs create predictable tender cycles that allow manufacturers to optimise batch sizes and forecast revenue horizons.

Increase in Public-Private Partnerships Lowering Development Costs

Vaccine developers are increasingly co-funded through alliances that blend academic discovery with industrial scale-up. Serum Institute of India licensed a chimeric protein MenB candidate from the University of Oxford, aiming to supply lower-cost boosters to Gavi-eligible markets . Gavi's African Vaccine Manufacturing Accelerator earmarked USD 1.2 billion in 2024 to local production, a shift expected to stabilize long-term supply and reduce lead times. PATH's collaboration with Serum Institute brought Men5CV to market at roughly USD 3 per dose, well below Western benchmarks, illustrating how risk-sharing compresses end-user prices. These models redistribute R&D exposure, enabling smaller biotechnology firms to advance novel platforms without prohibitive capital outlays.

High Cost of Cold-Chain Storage & Supply Logistics

Full-range refrigeration remains a principal cost driver, especially where ambient temperatures exceed 30 °C. Field studies in Nepal reported the average shipment value per insulated carrier at USD 1,704, with nearly one-third subject to freeze damage during transit. Controlled temperature chain pilots in India cut logistics expense from USD 0.063 to USD 0.026 per dose but demanded capital upgrades and extensive training. Drone-enabled distribution with active thermal containers shows promise yet faces regulatory clearance hurdles and limited payload capacity. Persistent infrastructure gaps translate into higher landed costs and periodic stockouts, constraining timely coverage.

Other drivers and restraints analyzed in the detailed report include:

- Growing Incidence of Serogroup W & Y Outbreaks in High-Income Nations

- Introduction of Multivalent Men5CV & Pentavalent Conjugate Platforms

- Waning Adolescent Booster Compliance Post-COVID Vaccine Fatigue

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Quadrivalent formulations generated 53.98% revenue in 2024, maintaining primacy across adolescent booster programs in North America and Europe. This leadership reflects long-standing clinical familiarity, extensive insurance coverage and robust tender frameworks anchoring the meningococcal vaccines market. Yet bivalent solutions, prized for targeted protection and lower cost, post an 8.24% CAGR through 2030. Pentavalent pipelines represent the fastest-rising "other" category as providers seek single-visit coverage for all five major serogroups.

Momentum around pentavalent approvals marks a structural pivot. Confluences of simplified schedules and broader strain breadth have prompted several states in the United States to reassess school requirements. Early modelling suggests pentavalent uptake could displace nearly 30% of quadrivalent demand by 2028, reshaping revenue distribution inside the meningococcal vaccines market. CanSino Biologics highlighted this shift with RMB 561.7 million (USD 78.5 million) bivalent sales in 2023, a 266% annual rise, signalling how local champions exploit domestic tenders for share gains.

Conjugate products held a 46.47% stake in 2024, underpinned by enduring immunogenicity and herd-immunity benefits that dovetail with paediatric protocols. Combination formats combining conjugate backbones with protein antigens are on a trajectory to post an 8.39% CAGR, opening capacity for higher-margin SKUs within the meningococcal vaccines market size. Polysaccharide shots retain a tactical role in outbreak surges because of cost advantages and quicker release timelines.

Cutting-edge conjugation chemistries now fuse five polysaccharide moieties to mutant diphtheria proteins, preserving antigen integrity while sustaining memory responses for a decade or longer. Men5CV's room-temperature profile adds a distribution benefit, particularly for Gavi-funded drives in Africa. Outer-membrane vesicle (OMV) and protein-nanoparticle constructs remain developmental but promise thermostability and cross-protection, potentially widening the meningococcal vaccines industry's future tool kit.

The Meningococcal Vaccines Market is Segmented by Product Type (Bivalent, Quadrivalent, and More), Vaccine Type (Polysaccharide Vaccines, and More), Sales Channel (Public and Private), Age Group (Infants (Aged 0-2 Years), and Children and Adults (Aged 2 Years and Above)) and Geography (North America, Europe, Asia-Pacific, and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 40.41% of global revenue in 2024 on the back of universal adolescent scheduling, broad payer coverage and rapid outbreak detection systems. The United States implements a two-dose MenACWY series at 11-12 and 16 years and recommends MenB for high-risk populations; Canada and Mexico track similar approaches with provincial variations. FDA approval of Penmenvy is expected to catalyse formulary reviews and private-payer negotiations, potentially accelerating pentavalent uptake. Recent ST-1466 outbreaks underscore residual vulnerability in older adults, prompting discussions on extending booster age brackets.

Europe displays mature uptake yet dynamic serogroup trends. Surveillance captured 1,149 invasive cases in 2022, of which serogroup B remained dominant at 62%. France's hosting of WHO's meningitis summit re-energised regional co-ordination, while Germany's inclusion of MenB into routine recommendations highlights policy evolution. Travel-linked clusters from Middle East pilgrimages continue to spur demand for quadrivalent boosters at point-of-departure clinics. Reimbursement frameworks remain robust, but incremental growth hinges on integrating pentavalent shots into joint procurement contracts.

Asia-Pacific is the fastest-expanding region at an 8.56% CAGR, driven by China's policy upgrades, India's logistic strengthening and Southeast Asian outbreak vigilance. The "meningococcal vaccines market" narrative in the region focuses on equitable access: China's national plan targets full conjugate coverage by 2028, while Indonesia pilots drone-delivery corridors to remote islands. Domestic producers such as CanSino and Chengdu Institute supply cost-adjusted bivalents and quadrivalents, whereas multinationals prepare local fill-finish lines to sidestep import tariffs. Successful pneumococcal roll-outs provide a replicable blueprint for cross-disease scale-up.

Africa and the Middle East represent sizeable latent demand, with Nigeria's Men5CV introduction providing proof of concept for thermostable campaigns in the meningitis belt. Gavi, UNICEF and WHO maintain emergency stockpiles, yet funding gaps persist for routine programs outside epidemic-prone corridors. South America records modest growth, constrained by surveillance disparities but buoyed by regional expert consensus on expanding MenACWY coverage, particularly in Brazil and Chile.

- GlaxoSmithKline

- Pfizer

- Sanofi

- Merck

- Novartis

- Cyrus Poonawala Group (Serum Institute of India Ltd.)

- Bio-Manguinhos

- Biomed Pvt. Ltd.

- Johnson & Johnson (Janssen Vaccines)

- Bharat Biotech Int. Ltd.

- CSL Seqirus

- Bavarian Nordic

- CanSino Biologics Inc.

- Incepta Vaccines Ltd.

- Moderna

- Valneva

- Chongqing Zhifei Biological Products Co.

- Sichuan Clover Biopharmaceuticals

- Panacea Biotec Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising immunization programs & government initiatives

- 4.2.2 Increase in public-private partnerships lowering development costs

- 4.2.3 Growing incidence of serogroup W & Y outbreaks in high-income nations

- 4.2.4 Introduction of multivalent Men5CV & pentavalent conjugate platforms

- 4.2.5 Room-temperature-stable Men5CV enabling last-mile delivery in Africa

- 4.2.6 mRNA / protein-nanoparticle pipeline accelerating MenB boosters

- 4.3 Market Restraints

- 4.3.1 High cost of cold-chain storage & supply logistics

- 4.3.2 Stringent regulatory & liability hurdles for novel serogroup combos

- 4.3.3 Waning adolescent booster compliance post-COVID vaccine fatigue

- 4.3.4 Cannibalization risk from pentavalent vaccines on legacy ACWY & B brands

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Bivalent

- 5.1.2 Quadrivalent

- 5.1.3 Others

- 5.2 By Vaccine Type

- 5.2.1 Polysaccharide Vaccines

- 5.2.2 Conjugate Vaccines

- 5.2.3 Combination Vaccines

- 5.2.4 Other Types

- 5.3 By Sales Channel

- 5.3.1 Public

- 5.3.2 Private

- 5.4 By Age Group

- 5.4.1 Infants (Aged 0-2 Years)

- 5.4.2 Children and Adults (Aged 2 Years and above)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GSK plc

- 6.3.2 Pfizer Inc.

- 6.3.3 Sanofi SA

- 6.3.4 Merck & Co., Inc.

- 6.3.5 Novartis AG

- 6.3.6 Cyrus Poonawala Group (Serum Institute of India Ltd.)

- 6.3.7 Bio-Manguinhos

- 6.3.8 Biomed Pvt. Ltd.

- 6.3.9 Johnson & Johnson (Janssen Vaccines)

- 6.3.10 Bharat Biotech Int. Ltd.

- 6.3.11 CSL Seqirus

- 6.3.12 Bavarian Nordic A/S

- 6.3.13 CanSino Biologics Inc.

- 6.3.14 Incepta Vaccines Ltd.

- 6.3.15 Moderna Inc.

- 6.3.16 Valneva SE

- 6.3.17 Chongqing Zhifei Biological Products Co.

- 6.3.18 Sichuan Clover Biopharmaceuticals

- 6.3.19 Panacea Biotec Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment