PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438461

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438461

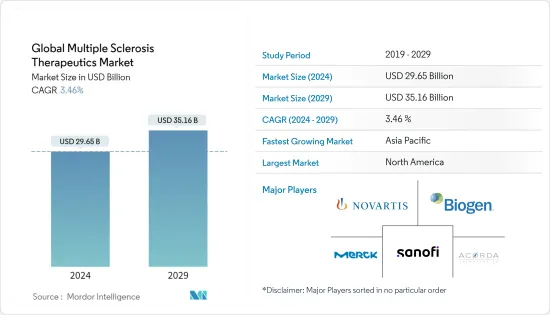

Global Multiple Sclerosis Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Global Multiple Sclerosis Therapeutics Market size is estimated at USD 29.65 billion in 2024, and is expected to reach USD 35.16 billion by 2029, growing at a CAGR of 3.46% during the forecast period (2024-2029).

COVID-19 has become a big concern for medical professionals across the board. Patients with multiple sclerosis (MS), commonly on immunosuppressive medicines, have expressed concern about the higher mortality rate among patients with chronic conditions. The rise of Coronavirus disease-19 (COVID-19) creates new challenges for patients with multiple sclerosis (PwMS). As per the research study published in January 2022 titled 'Impact of COVID-19 on multiple sclerosis care and management: Results from the European Committee for Treatment and Research in Multiple Sclerosis survey', Telemedicine was used to overcome the limited access to care and was newly activated or widely implemented.

Also, in another research article published in 2021 on 'Impact of COVID-19 lockdown on a population of progressive multiple sclerosis patients in Northern Italy', during the lockdown period (March 2020-May 2020), most patients were solely screened via telemedicine rather than being visited at the MS Center. In June 2020, regular visits to the MS Center were resumed. During the Covid-19 lockdown, many Progressive Multiple Sclerosis (pMS) patients had to deteriorate neurological disability, weariness, depression, and weight gain, likely due to reduced physical activity and the inability to maintain regular physiotherapy. These findings highlight the slight negative impact of public health measures implemented to contain the pandemic on pMS patients.

Furthermore, MS patients have requested advice on taking disease-modifying treatments (DMTs) during the COVID-19 epidemic. Representatives of the National MS Society and the National Medical Advisory Committee participated in a committee to revise the Multiple Sclerosis International Federation (MSIF) global COVID-19 advice for people living with MS. Some preliminary evidence suggested that interferons may reduce the need for hospitalization due to COVID-19. Hence, the evidence suggested continuous medications for multiple sclerosis during the pandemic.

The market studied is expected to witness a rapid growth rate in the future, owing to factors such as the rising prevalence of multiple sclerosis (MS). As per the study published in December 2020 titled 'Rising prevalence of multiple sclerosis worldwide: Insights from the Atlas of MS, third edition,' A total of 2.8 million people are estimated to live with MS worldwide (35.9 per 100,000 population). MS prevalence has increased in every region since 2013, but gaps in prevalence estimates persist. The pooled incidence rate across 75 reporting countries was 2.1 per 100,000 persons/year, and the mean age of diagnosis was 32years. Females are twice as likely to live with MS as males.

Besides, the growing focus of companies on pipeline products for MS is also boosting the market growth. Biogen, a leading player in the market, has been developing Orelabrutinib, which is currently in phase II of development; similarly, Novartis has been developing remibrutinib, which is in Phase III. Also, in September 2021, TG Therapeutics announced the submission of a Biologics License Application (BLA) to the U.S. Food and Drug Administration (FDA) requesting approval of ublituximab, the Company's investigational glycoengineered anti-CD20 monoclonal antibody, as a treatment for patients with relapsing forms of multiple sclerosis (RMS).

Similar to the companies mentioned above, other pharmaceutical players, such as Bristol-Myers Squibb Company, have been developing drugs for MS. This indicates that pipeline drugs for MS may boost the studied market's growth in the forecast period.

Big pharmaceutical companies have also been investing heavily in the drug development process. They are planning to target as many indications as possible to cater to a large number of customers. Owing to this, the MS market has also been benefiting. For instance, the drugs developed for multiple sclerosis include Relapsing-remitting MS, Secondary progressive MS, Primary progressive MS, and Myelin repair or neuroprotection. For Instance, in March 2021, Novartis received European Commission approval for Kesimpta (ofatumumab) for treating relapsing forms of multiple sclerosis (RMS) in adults with active disease defined by clinical or imaging features.

Thus, owing to the abovementioned factors, the market is expected to project growth over the forecast period. However, side effects associated with medications and the high cost of drugs may hinder the growth of the market.

Multiple Sclerosis Therapeutics Market Trends

The Oral Route of Administration is Expected to Witness Rapid Growth in Future

Classical multiple sclerosis (MS) treatments using first-line injectable drugs, despite being widely applied, remain a foremost concern regarding therapeutic adherence and efficacy. Novel oral drugs recently approved for treating MS represent significant advances in therapy. The oral route of administration supports patient satisfaction and increases therapeutic compliance.

If someone is uncomfortable with needles, oral options are also available for treating MS. Taken daily or twice daily; oral medications require one to maintain a regular dosing schedule. These are the easiest to self-administered. The currently available oral multiple sclerosis drugs include Aubagio (teriflunomide), Gilenya (fingolimod), and Tecfidera (dimethyl fumarate).

In June 2021, The European Commission (EC) approved Aubagio (teriflunomide) for the treatment of pediatric patients 10 to 17 years of age with relapsing-remitting multiple sclerosis (RRMS). The approval confirms Aubagio as the first oral multiple sclerosis (MS) therapy for first-line treatment of children and adolescents with MS in the European Union. Also, in March 2020, Bristol-Myers Squibb Company received United States Food and Drug Administration approval for ZEPOSIA (ozanimod) 0.92 mg for the treatment of adults with relapsing forms of multiple sclerosis (RMS), including clinically isolated syndrome, relapsing-remitting disease, and active secondary progressive disease. ZEPOSIA is an oral medication taken once daily. Hence, approval and launch of innovative oral medicines for the treatment of multiple sclerosis are driving segmental growth.

North America is Expected to Hold a Significant Share in the Market and Expected to do Same Over the Forecast Period

The COVID-19 pandemic has severely impacted the care of patients living with Multiple Sclerosis during the pandemic. As per the research study published in December 2020 titled 'Impact of COVID-19 on the United States and Canadian neurologists' therapeutic approach to multiple sclerosis: a survey of knowledge, attitudes, and practices', patient volume decreased by an average of 79%. 23% were aware of patients self-discontinuing a DMT due to fear of COVID-19, with 43% estimated to be doing so against medical advice. Also, in another study published in 2021 on 'The impact of COVID-19 on consultations between relapsing-remitting multiple sclerosis (RRMS) patients and their neurologists in Europe and United States', in Q2 2020, 31% of United States (US) respondents reported that RRMS patients saw their neurologist in person as compared to 19% where the consultation was conducted by phone, 42% by telemedicine and 68% via internet. By Q4 2020, the proportion of reported RRMS patients in person significantly increased to 68% in the US.

The market for multiple sclerosis therapeutics is expected to show high growth in the North American region, which is majorly attributed to the presence of key players and the rising prevalence of the disease in this region. The United States is the primary market for companies such as Biogen, Novartis AG, and Sanofi SA, among others. Therefore, these companies have been focusing more on establishing their new drugs in this market study, contributing to this region's growth.

Furthermore, as per the Atlas of Multiple Sclerosis, 3rd Edition, published in September 2020, the prevalence of multiple sclerosis in the Americas is 112 per 100,000. Such a high prevalence of multiple sclerosis in North America is expected to drive the growth of the market.

Additionally, the approval by the regulatory authorities is also propelling the growth of the market. For Instance, in August 2020, Novartis received United States Food and Drug Administration approval for Kesimpta (ofatumumab, formerly OMB157) as an injection for subcutaneous use for the treatment of relapsing forms of multiple sclerosis (RMS). Kesimpta is the first B-cell therapy that can be self-administered once monthly at home via the Sensoready autoinjector pen.

Thus, owing to the abovementioned the North American multiple sclerosis therapeutics market is expected to drive the growth of the market.

Multiple Sclerosis Therapeutics Industry Overview

The market for Multiple sclerosis therapeutics is consolidated, as there are few players in this market. These companies are the big pharmaceutical companies focusing on pipeline drugs for multiple sclerosis. With the rising R&D investment in the pharmaceutical industry, it is believed that more companies may enter the market studied in the future, and the competition may increase.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Raised Cases of Multiple Sclerosis across the World

- 4.2.2 Growing Focus of Companies on Pipeline Products for MS

- 4.3 Market Restraints

- 4.3.1 Side Effects Associated with the Medication

- 4.3.2 High Cost of the Drugs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Drug Type

- 5.1.1 Large-molecule Drugs

- 5.1.2 Small-molecule Drugs

- 5.2 By Route of Administration

- 5.2.1 Oral

- 5.2.2 Injectable and Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Teva Pharmaceuticals

- 6.1.2 Novartis AG

- 6.1.3 Bristol-Myers Squibb Company

- 6.1.4 Biogen Idec

- 6.1.5 Bayer AG

- 6.1.6 Sanofi SA

- 6.1.7 Mylan NV

- 6.1.8 Merck KGaA (Serono)

- 6.1.9 F. Hoffmann-La Roche AG

- 6.1.10 Acorda Therapeutics Inc.

- 6.1.11 Johnson & Johnson

- 6.1.12 Genentech, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS