PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690193

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690193

Italy Pharmaceutical - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

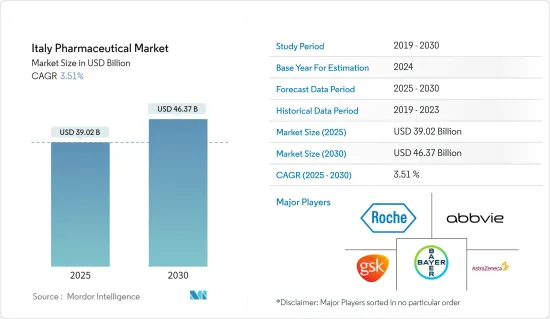

The Italy Pharmaceutical Market size is estimated at USD 39.02 billion in 2025, and is expected to reach USD 46.37 billion by 2030, at a CAGR of 3.51% during the forecast period (2025-2030).

Italy is one of the world's leading pharmaceutical markets.

The COVID-19 pandemic is an unprecedented health concern and is adversely affecting communities, industries, businesses, and lives around the world. Many companies have already received approval for their vaccines against the Sars-CoV-2 virus and still focusing their research and development on the development of therapeutics against the COVID-19. COVID-19's immediate and direct potential impact has already led to the loss of millions of lives and a considerable increase in healthcare costs. As multiple potential medicines were tried before the development of vaccines and are used to treat the coronavirus-induced infection, other medical conditions arise due to it which is expected to complement the market. For instance, the medications such as Lopinavir/Ritonavir, hydroxychloroquine (HCQ), and Remdesivir are being repurposed to treat coronavirus infection in many countries around the world. As the country has the maximun number of production facilites, the lockdown reduced the production due to the less workforce presence which hampered the market growth of the industry.

In recent years, the Italian drug industry has expanded significantly in terms of growth, value-added, trade, and investment. With respect to research, Italy holds around 18% of the overall number of clinical trials authorized throughout the European Union. Over the years, the prevalence and incidence of many chronic and infectious diseases such as diabetes, cancer, and others, have increased many folds around the world which led to the high demand of the pharmaceutical products around the world and thus, driving the growth in the studied market.

However, In the next few years, the pharmaceutical sector in Italy may undergo a variety of obstacles. The rise in the Italian country's debt compared to GDP, and the country's underprivileged growth track may reduce the flow of money in the country, which means that the industry may falter, thus the development of the industry in the country can be hampered.

Italy Pharmaceutical Market Trends

Prescription Drugs segment Holds the Largest Share and Expected to do Same in the Forecast Period

Italy Prescription Drugs category is estimated to account for the largest share over the forecast period. The growth drivers for this sector are technology, the supportive regulatory landscape, the preference of pharmaceutical manufacturers towards Rx medicines, and new drug launches have also led to this rising trend.

Prescription drugs are available with a valid prescription from a prescriber. These drugs are heavily regulated and require a visit to a doctor, a diagnosis and monitoring by a doctor to ensure the medication is working and that it is working safely. These drugs are intended for use by one individual patient to treat a specific condition and when doctors write prescriptions, they take into consideration a lot of information about their patients, including their current condition, other medications they may be taking, their vital statistics, and drug allergies they may have. That's why a prescription medication that is safe and effective for one person may be dangerous for another. Furthermore, the increasing growth in population and rise in the chronic disease such as cardiovascular and cancer which is the leading cause of death in the country, have also contributed to the growth of this market. Moreover, along with a growth in the per-capita healthcare spending in the country, the rise in people's discretionary income is also expected to drive the market growth of the Prescription drugs segment during the forecast period from 2020-2025.

The new clinical trials, increased research and development expenditure, increased product launches, growing burden of diseases globally are the factors which are expected to drive the prescription drugs segment during the forecast period. For instance, in August 2021, Zydus Pharmaceuticals Inc, USA entered into a license and supply agreement with CHEMI SpA of Italy, a subsidiary of Italfarmaco Group, to launch the generic equivalent of Lovenox (Enoxaparin Sodium Injection) in seven dosage strengths in the United States. It is used in patients undergoing abdominal, hip or knee replacement surgery. Thus, owing to the above-mentioned factors, prescription drugs segment is expecetd to contribute significantly to the market growth.

Italy Pharmaceutical Industry Overview

The Italy pharmaceutical market is highly competitive and consists of several major players. In terms of market share, few of the major players are currently dominating the market. And some prominent players are vigorously making acquisitions and joint ventures with the other companies to consolidate their market positions in the country. Some of the Key companies which are currently dominating the market are AbbVie Inc., AstraZeneca plc, Bayer AG, C.H. Boehringer Sohn AG & Ko. KG, and GlaxoSmithKline plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising R&D Expenditure

- 4.2.2 Rising Incidence of Chronic Disease

- 4.3 Market Restraints

- 4.3.1 High Cost of Drugs

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By ATC/Therapeutic Class

- 5.1.1 Blood and Hematopoietic Organs

- 5.1.2 Cardiovascular System

- 5.1.3 Dermatological

- 5.1.4 Gastrointestinal System and Metabolism

- 5.1.5 Nervous System

- 5.1.6 Respiratory System

- 5.1.7 Others

- 5.2 By Drug Type

- 5.2.1 Branded

- 5.2.2 Generic

- 5.3 By Prescription Type

- 5.3.1 Prescription Drugs (Rx)

- 5.3.2 OTC Drugs

6 COMPETITIVE LANDSCAPE & COMPANY PROFILES

- 6.1 Company Profile

- 6.1.1 AbbVie Inc.

- 6.1.2 AstraZeneca plc

- 6.1.3 Bayer AG

- 6.1.4 C.H. Boehringer Sohn AG & Ko. KG

- 6.1.5 GlaxoSmithKline plc

- 6.1.6 F. Hoffmann-La Roche AG

- 6.1.7 Bristol Myers Squibb Company

- 6.1.8 Eli Lilly and Company

- 6.1.9 Merck & Co., Inc.

- 6.1.10 Sanofi S.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS