PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910898

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910898

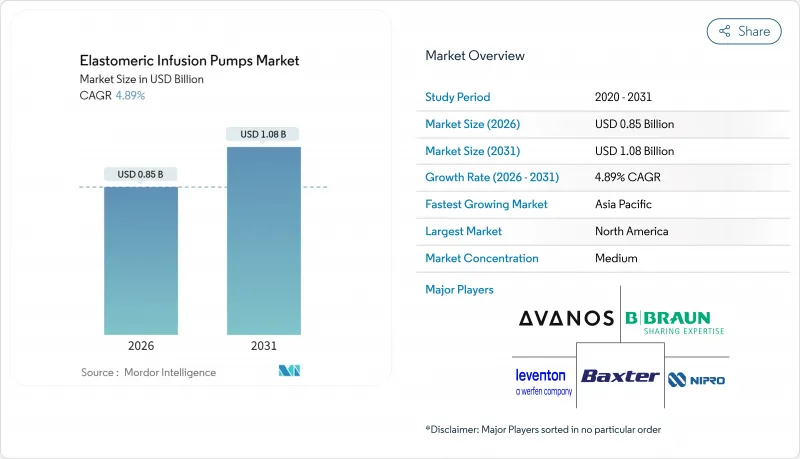

Elastomeric Infusion Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The elastomeric infusion pumps market size in 2026 is estimated at USD 0.85 billion, growing from 2025 value of USD 0.81 billion with 2031 projections showing USD 1.08 billion, growing at 4.89% CAGR over 2026-2031.

Robust demand stems from the expanding shift toward ambulatory and home-based care, supportive reimbursement for non-opioid pain control, and continuous innovation in elastomeric membrane materials. Continuous-rate pumps dominate because clinicians value their mechanical simplicity, while reimbursement changes under the 2025 NOPAIN Act reinforce adoption for post-surgical analgesia. Competitively, the landscape remains moderately fragmented as global multinationals compete with niche specialists, yet product recalls and sustainability pressures temper growth. North America retains clear leadership, whereas Asia-Pacific shows the fastest trajectory as hospitals modernize and outpatient services spread.

Global Elastomeric Infusion Pumps Market Trends and Insights

Growing Home Healthcare Adoption

Home-based infusion therapy gains ground as payers seek lower costs and patients prefer familiar settings. U.S. Medicare increased 2025 home-health payments by 2.7%, while separate reimbursement codes now cover home intravenous immune-globulin services. Portable, battery-free elastomeric pumps minimize caregiver training, making them ideal for hospital-at-home programs that rose sharply after the pandemic. With chronic disease prevalence high among seniors, demand for devices combining reliability and independence continues to climb. Manufacturers focusing on fill-at-home designs and simplified instructions strengthen their competitive position.

Technological Improvements in Elastomeric Membranes

Recent patents introduce check-valve geometries and barrier films that curb leakage during shipping while preserving constant pressure delivery. Medical-grade silicone blends with polyurethane enhance flow stability; polyisoprene variants exhibit shorter relaxation times, limiting start-up surges documented in earlier designs. Controlled environment testing now demonstrates +-12% accuracy across the full reservoir life, narrowing the historical gap against electronic pumps. Temperature stability remains under active research, with additive packages targeting less than 2% flow variance between 20 °C and 30 °C.

Product Safety Concerns and Recalls

The FDA issued multiple Class I recalls in 2024-2025, including 52,000 Nimbus pumps after 3,698 complaints of battery failure and flow inaccuracies, with one death reported. Medtronic recalled more than 526,000 insulin pumps over potential electrical damage. Such events heighten regulator vigilance and prompt hospitals to tighten procurement criteria, raising certification costs for suppliers and possibly delaying purchase cycles.

Other drivers and restraints analyzed in the detailed report include:

- Rising Incidence of Chronic Diseases

- Expansion of Outpatient Oncology Services

- Competition from Smart Electronic Infusion Devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Continuous-rate pumps generated 53.92% of elastomeric infusion pumps market share in 2025. The segment benefits from straightforward calibration and minimal user error risk. PCA variants, however, post a 6.24% CAGR to 2031 as surgeons adopt opioid-sparing regimens under the NOPAIN Act. Continuous models often carry 240 mL reservoirs delivering 2-5 mL/h, aligning to antibiotic and analgesic protocols. Start-up variability declines with modern membranes, boosting clinician confidence. PCA devices now integrate color-coded clamps and lock-out valves, giving patients autonomy without electronic complexity.

The elastomeric infusion pumps market size for PCA is projected to reach USD 0.30 billion by 2031, riding expanded Medicare coverage. Conversely, variable-rate models serve chemotherapy titration but remain niche due to higher per-unit costs. As ISO-13485 alignment tightens in 2026, uniform documentation across models should reduce recall frequency and further consolidate supplier reputations.

Pain management secured 41.12% of elastomeric infusion pumps market share in 2025 as orthopedic and general surgery departments standardized take-home analgesia packs. Hospitals cite a 25% drop in readmissions for pain crises when using elastomeric pumps versus oral medication alone. Antibiotic therapy, though smaller, accelerates at 7.62% CAGR, supported by OPAT clinics targeting multidrug-resistant infections. The elastomeric infusion pumps market size for outpatient antibiotics is forecast at USD 0.24 billion by 2031. Studies of continuous piperacillin/tazobactam delivery recorded therapeutic plasma levels in 97% of samples over 24 hours, validating mechanical pump suitability.

Chemotherapy accounts for a meaningful share because 5-fluorouracil regimens require 46-hour infusions. Patients favor soft reservoirs they can wear under clothing, reporting superior quality of life metrics. Regulatory guidance now obliges drug-device compatibility verification before oncology home administration, pushing manufacturers to publish stability dossiers.

The Elastomeric Infusion Pumps Market Report is Segmented by Product Type (Continuous-Rate, Variable-Rate, and PCA Pumps), Application (Pain Management, and More), End User (Hospitals, Ascs, Home-Healthcare, and Others), Flow-Rate (<2, 2-5, and >5 ML/H), Distribution Channel (Direct Sales and Third-Party), and Geography (North America, Europe, Asia-Pacific, MEA, South America). Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the elastomeric infusion pumps market with 41.90% revenue in 2025. Generous reimbursement, aging demographics and a mature outpatient oncology network underpin demand. The NOPAIN Act delivers dedicated Medicare payment, cementing pump economics for non-opioid pain control. U.S. FDA Quality System Regulation harmonization in 2026 should streamline cross-border supply from Mexican plants that already serve U.S. buyers. Canada is rolling out national OPAT hubs, while Mexico's public hospitals procure elastomeric kits to lower surgical length-of-stay. Europe ranks second. Germany and France institutionalized OPAT guidelines in 2024, catalyzing adoption. The EU's circular-economy policy encourages pumps with recyclable shells, creating a point of differentiation for B. Braun's PVC-free DUPLEX platform. United Kingdom NHS frameworks stipulate non-electronic devices for certain day-case surgeries to reduce discharge delays. The upcoming 2030 recyclability target spurs supplier research into bio-based elastomers.

Asia-Pacific is the fastest-growing, at 5.57% CAGR to 2031. China's Healthy China 2030 plan expands community care, encouraging home infusions for chronic hepatitis therapies. Japan's super-aged society drives demand for dementia-friendly, silent pumps. India includes disposable elastomeric devices in fledgling hospital-at-home schemes across tier-two cities. South Korea's reimbursement for outpatient oncology tightened in 2025, prompting clinics to favor lower total-cost mechanical infusors. Regulatory heterogeneity requires local dossiers; companies with regional subsidiaries secure quicker approvals and service support. South America posts steady mid-single-digit growth as private insurers pilot post-arthroplasty take-home analgesia. Brazilian ANVISA's 2024 rule mandating clear flow-rate labeling raised import compliance costs but improved transparency. Middle East & Africa remain nascent but gain traction via government cancer centers adopting ambulatory 5-FU protocols in Gulf states.

- Ambu

- Avanos Medical

- Baxter

- B. Braun

- Werfenlife SA (Leventon SAU)

- Nipro

- Woo Young Medical Co., Ltd.

- Epic Medical

- Daiken Medical Co., Ltd.

- Smiths Medical (-ICU Medical)

- Fresenius

- Moog Inc. (Curlin Systems)

- Promecon Medical GmbH & Co KG

- Spirit Medical Ltd.

- Nanchang Biotek Medical Device Co.

- Terumo

- Pajunk GmbH

- Vygon

- Panjet Ltd.

- Beckton Dickinson

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Home Healthcare Adoption

- 4.2.2 Technological Improvements In Elastomeric Membranes

- 4.2.3 Rising Incidence Of Chronic Diseases

- 4.2.4 Expansion Of Outpatient Oncology Services

- 4.2.5 Cost Efficiency Versus Electronic Pumps

- 4.2.6 Favorable Reimbursement Policies For Ambulatory Infusion

- 4.3 Market Restraints

- 4.3.1 Product Safety Concerns And Recalls

- 4.3.2 Competition From Smart Electronic Infusion Devices

- 4.3.3 Limited Drug Stability In Elastomeric Reservoirs

- 4.3.4 Environmental Impact Of Single-Use Devices

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Continuous-Rate Elastomeric Pumps

- 5.1.2 Variable-Rate Elastomeric Pumps

- 5.1.3 Patient-Controlled Analgesia (PCA) Pumps

- 5.2 By Application

- 5.2.1 Pain Management

- 5.2.2 Chemotherapy

- 5.2.3 Chelation Therapy

- 5.2.4 Antibiotic / Antimicrobial Therapy

- 5.2.5 Others

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Home-healthcare Settings

- 5.3.4 Others

- 5.4 By Flow-Rate (mL/h)

- 5.4.1 <2 mL/h

- 5.4.2 2-5 mL/h

- 5.4.3 >5 mL/h

- 5.5 By Distribution Channel

- 5.5.1 Direct Sales

- 5.5.2 Third-party Distributors

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Ambu A/S

- 6.3.2 Avanos Medical Inc.

- 6.3.3 Baxter International Inc.

- 6.3.4 B. Braun Melsungen AG

- 6.3.5 Werfenlife SA (Leventon SAU)

- 6.3.6 Nipro Corporation

- 6.3.7 Woo Young Medical Co., Ltd.

- 6.3.8 Epic Medical Pte Ltd

- 6.3.9 Daiken Medical Co., Ltd.

- 6.3.10 Smiths Medical (-ICU Medical)

- 6.3.11 Fresenius Kabi AG

- 6.3.12 Moog Inc. (Curlin Systems)

- 6.3.13 Promecon Medical GmbH & Co KG

- 6.3.14 Spirit Medical Ltd.

- 6.3.15 Nanchang Biotek Medical Device Co.

- 6.3.16 Terumo Corporation

- 6.3.17 Pajunk GmbH

- 6.3.18 Vygon SA

- 6.3.19 Panjet Ltd.

- 6.3.20 Becton, Dickinson & Company

7 Market Opportunities & Future Outlook