PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435950

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435950

United States Heparin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

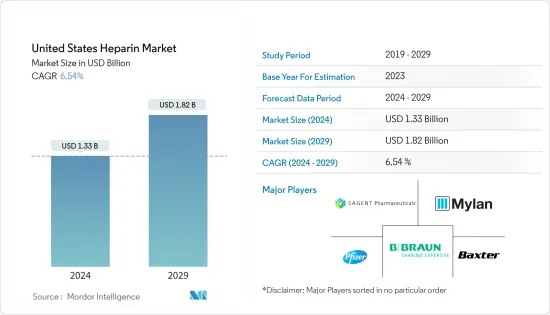

The United States Heparin Market size is estimated at USD 1.33 billion in 2024, and is expected to reach USD 1.82 billion by 2029, growing at a CAGR of 6.54% during the forecast period (2024-2029).

The COVID-19 pandemic has significantly impacted the United States heparin market. According to an article titled, 'Response of US hospitals to elective surgical cases in the COVID-19 pandemic' published in October 2020, an early rapid decrease in United States surgical case volumes beginning mid-March 2020 was observed by the researchers. It found out that during the week of April, it was observed that there was a 71% reduction compared with the same week in 2019. Thus, the COVID-19 pandemic has affected surgical procedures tremendously which might impact the demand for heparin. Additionally, in September 2020, as a part of its 'Accelerating COVID-19 Therapeutic Interventions and Vaccines (ACTIV)' initiative, the National Institutes of Health launched two of three adaptive Phase 3 clinical trials that will evaluate the safety and effectiveness of blood thinners (including heparin) to treat adults diagnosed with COVID-19. Positive results might prove advantages for COVID-19 patients who suffer from life-threatening blood clots.

The market is primarily driven by the rising geriatric population and an increase in incidences of chronic diseases like cardiovascular diseases and cancers. The United States has a huge burden of cancer cases. The high burden of cancer can be explained by the latest statistics provided by the International Agency for Research on Cancer, which states that in 2020, there was an estimated 2 281 658 new cancer cases diagnosed and 612 390 cancer deaths in the United States. Heparin can affect the angiogenesis, proliferation, migration and invasion of cancer cells via multiple mechanisms. The high cancer burden is expected to boost market growth.

The major market players are focusing on research and development activities to bring new and reliable treatments in the market, and they are also focusing on the product launches to effectively treat chronic diseases in the country. For instance, in March 2021, researchers from the Rhode Island Hospital started a study that determineshow quicklyheparin induced anticoagulation occurs when two different point of care activated clotting technologies (iSTATand Hemochron)are used in patients.This is an important study since promptness of heparin anticoagulation is essentialduring moststructural heart procedures.rdiology's 70th Annual Scientific Session (ACC.21).

However, side-effects of heparin are refraining the patients from its use that is hindering the market growth.

United States Heparin Market Trends

Deep Vein Thrombosis (DVT) is expected to dominate the market

By application, deep-vein thrombosis is expected to witness significant growth. A deep-vein thrombosis (DVT) is defined as a blood clot that forms within the deep veins that might occur in the veins of the arms and the mesenteric and cerebral veins. As of 2020, according to the Centers for Disease Control and Prevention (CDC), the exact number of people infected with deep vein thrombosis was unknown, although about 900,000 people were expected to be affected each year in the United States. According to the CDC, one-third of about 33% of people with deep vein thrombosis will have a recurrence within ten years. The Centers for Disease Control and Prevention (CDC) also estimated that 60,000-100,000 Americans die of deep vein thrombosis each year while 10 to 30% of people can die within one month of diagnosis.

Thus, the increasing prevalence of deep vein thrombosis is expected to fuel the production of demand for heparin-based products, thereby augmenting the market growth over the forecast period.

United States Heparin Industry Overview

The United States Heparin market is a consolidated market, owing to the presence of a few major players in the market. The major market players, such as Baxter International Inc., Pfizer Inc., Sagent Pharmaceuticals, Mylan N.V., Bayer AG hold a significant market share in the country.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Chronic Diseases

- 4.2.2 Rise in Geriatric Population

- 4.3 Market Restraints

- 4.3.1 Side Effects of Heparin

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value-USD Million)

- 5.1 By Product

- 5.1.1 Unfractionated Heparin

- 5.1.2 Low Molecular Weight Heparin (LMWH)

- 5.1.3 Ultra-Low Molecular Weight Heparin (ULMWH)

- 5.2 By Source

- 5.2.1 Bovine

- 5.2.2 Porcine

- 5.3 By Application

- 5.3.1 Atrial Fibrillation and Heart Attack

- 5.3.2 Stroke

- 5.3.3 Deep Vein Thrombosis (DVT)

- 5.3.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Baxter International Inc.

- 6.1.2 Pfizer Inc.

- 6.1.3 Sagent Pharmaceuticals

- 6.1.4 Mylan N.V.

- 6.1.5 Bayer AG

- 6.1.6 B. Braun Melsungen AG

- 6.1.7 Scientific Protein Laboratories LLC

- 6.1.8 Sanofi S.A

- 6.1.9 Merck & Co. Inc

- 6.1.10 Meitheal Pharmaceuticals

- 6.1.11 Leo Pharma A/S

- 6.1.12 Nanjing King-Friend Biochemical Pharmaceutical

- 6.1.13 Amphastar Pharmaceuticals

- 6.1.14 Shenzhen Hepalink

7 MARKET OPPORTUNITIES AND FUTURE TRENDS