Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690781

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690781

United States (US) Data Center Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

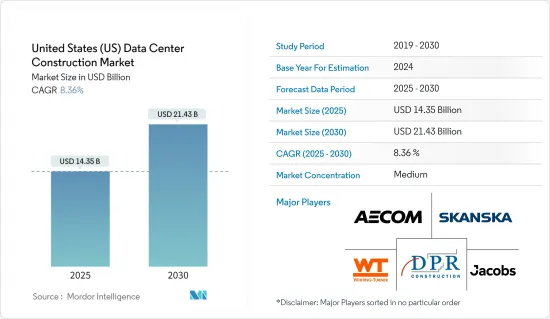

The United States Data Center Construction Market size is estimated at USD 14.35 billion in 2025, and is expected to reach USD 21.43 billion by 2030, at a CAGR of 8.36% during the forecast period (2025-2030).

Key Highlights

- The US market is the most mature and shows steady growth in terms of growth and operations. The growth of the US data center construction market is attributed to the increasing adoption of IoT, the development of 5G networks, and the adoption of cloud-based services by businesses. Adopting digitalization across industries would contribute to a rise in data center investments by colocation, cloud, internet, and telecommunication providers, as well as the demand for the streaming of online entertainment content at high speeds.

- The country's data center market is expected to grow owing to a rise in rack power density, connectivity improvements with other nations, the installation of microgrids in data centers, 5G connectivity, edge data center technology, and new UPS battery technologies.

- The US government is encouraging data center investments by a various means, including increasing the availability of land for development, lowering electricity tariffs, and encouraging the procurement of renewable energy.

- For example, Arizona state offers various incentives to businesses that operate in the foreign trade zone. Businesses in a trade zone are entitled to a 72.9% exemption in state real and personal property taxes. Consequently, such initiatives would contribute to the growth of the data center construction market in the United States over the next decade.

- Despite the escalating demand, the data center industry is found to be prone to some challenges when it comes to satisfying high demand. The data center industry faces new construction delays due to supply chain disruptions, as in many other real estate verticals. Increasing labor, building materials, and other costs have also boosted capital expenditures.

- The COVID-19 pandemic placed additional pressure on the overall economy across sectors and highlighted the value and potential of the cloud-based work environment provided by data centers. During the COVID-19 pandemic, 53% of Americans said that the internet had been vital. This has increased the use of more data centers in the country.

United States (US) Data Center Construction Market Trends

UPS Systems to Lead the Electrical Infrastructure Segment

- An uninterruptible power supply (UPS) system is imperative for data centers to ensure that servers and all sensitive computing equipment are never susceptible to power line fluctuations and power quality issues. Any power failure can result in data center downtime, affecting the data center's efficiency. UPS systems also assist in saving valuable data automatically during a power outage. On average, a UPS system offers backup for 8-10 minutes.

- Lately, the unfavorable weather conditions in the country have caused interruptions in data center operations. From January 2024 to March 2024, the country was hit by freezing weather, which affected the grid generation capacity and operating frequency of California and Texas. The disruption in the power supply led to issues with the state's operation of data centers. The adoption of UPS systems results in mitigating such damages by weather changes. Various companies nationwide rely on data centers, which makes an uninterrupted power source crucial.

- There is a trend in adopting lithium-ion UPS systems in data centers due to several factors, such as longer life, small form factor, etc. The increasing consumption of energy by data centers in the country has been promoting the adoption of lithium-ion UPS systems.

- As per the Lawrence Berkeley National Laboratory, while the hyperscalers typically need 10-14 kW per rack in existing data centers, this is likely to rise to 40-60 kW for AI-ready racks equipped with resource-equipped GPUs. This means that overall consumption of data centers across the United States is expected to reach 35 GW by 2030, up from 17 GW in 2022. Lithium-ion UPS systems are set to revolutionize UPS systems for large and micro data centers.

- The government has also been taking new initiatives toward energy consumption by data centers, triggering modular UPS systems. In the USD 2.3 trillion-backed Consolidated Appropriations Act 2021, the US government included data center energy efficiency targets and metrics. The act calls for a new study on energy and water consumption by data center use and ways to improve the efficiency of such data centers.

- The financial impact for data center management is also huge as a data center spends between 30% and 50% of its operational expenditure on electricity. According to the United States National Resources Defense Council, the combined electricity consumption capacity of data centers in Northern Virginia, United States, amounted to 2.6 GW in 2023, the highest globally. According to Cloudscene, the United States also has the largest number of data centers globally with 5381 currently ccompared to 5375 data centers in the previous year.

Healthcare Sector to Witness Major Growth

- Digitization of consumer health records in the form of electronic medical records (EMR) has significantly contributed to massive data generation. The latest innovations in the medical equipment and the modernization of legacy operating systems, such as management of personnel and improvement in patient response systems, generate multitude of data, further boosting the demand for secured data centers.

- Technologies like IoT have a lot of applications in healthcare, from remote monitoring to medical device integration. It has also potential to keep patients healthy and safe and improve how physicians deliver care. However, a massive amount of data is being produced by sensors, wearables, remote monitors, and other medical devices.

- Telemedicine is increasing in usage in the United States, owing to various advantages, such as consumers from any region being able to gain access to required doctors. It is an efficient method, as both money and time are being saved due to the change in typically scheduled visits, thereby generating a lot of data and thus emphasizing the need for data centers and data center construction initiatives.

- As per the National Institutes of Health, between March 2020 and February 2022, more than 850,000 telemedicine visits occurred, with approximately 62% of visits by video and 38% by telephone. Besides, according to a survey of 398 healthcare professionals conducted by the Pharmaceutical Executive magazine, it has been predicted that after the coronavirus (COVID-19) pandemic, almost 20% of patient appointments will still be conducted via telemedicine compared to 2% beforehand and 61% perhaps during the pandemic.

- At the technical level, advances in medical imaging and genomic research are introducing new types of file types that are larger in size. These factors contribute to the increasing amount of data in the healthcare industry, which boosts the data center construction developments in the region during the forecast period.

- Moreover, the government of the country continuously recognizes the role of digital health and technological innovation in healthcare as an integral part of successful healthcare infrastructure. The government is making significant strides to make the healthcare sector technologically advanced and continuously increasing its healthcare expenditure to support the healthcare sector. For instance, according to the data from CMS (Office of the Actuary), the forecasted U.S. national health expenditure was expected to reach USD 6.751 trillion in 2030 from USD 4.29 trillion in 2021.

United States (US) Data Center Construction Market Overview

The US data center construction market is semi-consolidated with the presence of major players like AECOM, Whiting-turner Contracting Company, Jacobs Solutions Inc., DPR Construction, and Skanska USA. The market players are adopting various strategies, including acquisitions and partnerships to enhance their product offerings and remain competitive in the market.

- In March 2024, Sweden-based Skanska, a prominent construction and development company, announced a new contract worth approximately USD 242 million in Virginia, the United States.

- In January 2024, Design LLC, a wholly-owned subsidiary of Google, selected Baltimore, Maryland, based Whiting-Turner Contracting Co. to build a USD 600 million data center in Wasco County, Oregon. The facility is planned for 290,000 sq. ft. and will be the latest in a string of similar investments in Ohio, Iowa, Missouri, and Arizona.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71600

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Growing Cloud Applications, AI, and Big Data

- 4.2.1.2 Rising Adoption of Hyperscale Data Centers

- 4.2.2 Market Restraints

- 4.2.2.1 Increase in Real Estate Costs

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Key United States Data Center Construction Statistics

- 4.4.1 Number of Data Centers in the United States

- 4.4.2 Data Center Under Construction in the United States, in MW

- 4.4.3 Average Capex and Opex for the United States Data Center Construction

- 4.4.4 Data Center Power Capacity Absorption, in MW, Selected Cities, United States

- 4.5 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Infrastructure

- 5.1.1 Electrical Infrastructure

- 5.1.1.1 UPS Systems

- 5.1.1.2 Other Electrical Infrastructure

- 5.1.2 Mechanical Infrastructure

- 5.1.2.1 Cooling Systems

- 5.1.2.2 Racks

- 5.1.2.3 Other Mechanical Infrastructure

- 5.1.3 General Construction

- 5.1.1 Electrical Infrastructure

- 5.2 By Tier Type

- 5.2.1 Tier-I and -II

- 5.2.2 Tier-III

- 5.2.3 Tier-IV

- 5.3 By End User

- 5.3.1 Banking, Financial Services, and Insurance

- 5.3.2 IT and Telecommunications

- 5.3.3 Government and Defense

- 5.3.4 Healthcare

- 5.3.5 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AECOM

- 6.1.2 Whiting-turner Contracting Company

- 6.1.3 Jacobs Solutions Inc.

- 6.1.4 DPR Construction

- 6.1.5 Skanska USA

- 6.1.6 Balfour Beatty US

- 6.1.7 Hensel Phelps

- 6.1.8 McCarthy Building Companies Inc.

- 6.1.9 Gilbane Building Company

- 6.1.10 Brasfield & Gorrie LLC

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.