PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435962

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435962

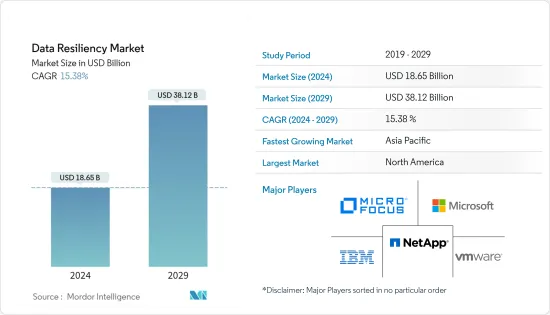

Data Resiliency - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Data Resiliency Market size is estimated at USD 18.65 billion in 2024, and is expected to reach USD 38.12 billion by 2029, growing at a CAGR of 15.38% during the forecast period (2024-2029).

With the rapidly increasing penetration of the internet among developed and developing countries, also the expanding wireless network for all the mobile devices has primarily increased the vulnerability of data, which is expected to make data resiliency an essential and integral part of every single organization across the globe.

Key Highlights

- The previous year has seen a rapid increase in the number of cyberattacks. This has forced companies to adopt security-first thinking. The service providers are now putting much more effort in order to secure the service infrastructure of their clients. The solutions are not only about having a security solution in place but also the ability to defend and recover fast against any type of attack.

- Enterprises and government organizations across the globe are moving from test environments to placing more of their work-critical workloads and compute instances into the cloud. Further, owing to the rapidly increasing adoption of IoT, cloud, and big data analytics across multiple organizations as a major part of their digital transformation strategy, the burden on the data centers is also increasing leading to the growth of the market.

- According to Datrium Inc. report, 'The State of Enterprise Data Resiliency and Disaster Recovery 2019, more than 50% of the respondents indicated that their organization experienced a DR event in the past 24 months. Moroever, 89% of the IT leaders reported that ransomware is the major threat to organizations' data security. The IT leaders also expressed that their top concerns regarding this was the loss of productivity (74%) and the inability to operate their businesses (65%) under these circumstances.

- Whether on-premise, public, private, or a hybrid model, the move towards a multi-cloud architecture is increasingly becoming popular. A research from Teradici Corporation has revealed that more than half of the IT professionals are currently operating in a multi-cloud environment, with almost one in every ten using five or more clouds within their organizations.

- Various enterprises across the globe are currently focused on managing the impact of the coronavirus pandemic and are looking at newer and robust practices in order to help ensure their business resiliency now and during any other future disruptive events. A proactive business continuity and resiliency strategy is becoming very crucial to enable digital businesses, which primarily requires building a robust resiliency into the infrastructure, while reducing downtime and associated costs.

Data Resiliency Market Trends

BFSI Segment is Expected to Witness Significant Growth

- The financial industry has been one of the critical sectors that suffer several data breaches and cyber-attacks, owing to the large customer base that the industry serves and the financial information that is at stake.

- Data breaches lead to an exponential rise in costs and loss of valuable customer information. According to the data breach investigations report, 2019, released by Verizon, 88 percent of all cyber incidents in the financial services and insurance sector were done with financial motivation. Cyber attackers in pursuit of the easiest path possible to financial gain attack the financial services industry.

- With an aim to secure their IT processes and systems, secure customer critical data, and comply with government regulations, both private and public banking institutes are focused on implementing the latest technology to prevent these attacks and recover faster. Additionally, with greater customer expectation, growing technological capabilities, and regulatory requirements, banking institutions are pushed to adopt a proactive approach to security.

- Moreover, the recent coronavirus outbreak has affected the financial markets and institutions across the globe. In these times, the BFSI sector's must have contingency plans put in place in order to meet all the threats that is being posed posed by this pandemic, which is expected to drive the demand for data resiliency solutions in the industry.

North America is Expected to Hold a Significant Market Share

- The North American region has been a primary hub for all the major organizations across the globe. The expansion of the multiple industries and the rapid growth of connected devices is driving the demand for resiliency solutions in the region.

- The rising risks of such attacks that can impact the market vary from individuals to corporates to the governments. Thus, securing crucial data has become very crucial in the region. According to the White House Council of Economic Advisers, the United States economy loses approximately USD 57 billion to USD 109 billion per year to harmful cyber activity.

- Recently in October 2019, the three healthcare providers operated by DCH Health Systems in the country were attacked by ransomware strain known as Ryuk. All these healthcare centers have implemented emergency procedures to ensure the safety of their patients, and the company is working on the attack diagnosis. Such cyber-attacks are expected to increase in the country across the domains, which may fuel the demand for resiliency solutions in the market.

- Moreover, in Mar 2020, Datrium, a provider of the secure multicloud data platform for the resilient enterprise, announced it has been awarded with five new US patents for data resiliency and durability, advancements in server-powered deduplication, enhanced storage performance, encryption and compression, and data path monitoring for improved network resilience.

Data Resiliency Industry Overview

The Data Resiliency Market is highly competitive owing to the presence of multiple vendors in the market providing services to domestic and international markets. The market appears to be moderately concentrated with players adopting strategies such as product innovation, mergers, and acquisitions, strategic partnerships in order to expand their reach and stay competitive in the market. Some of the players in the market are IBM Corporation, Microsoft Corporation, NetApp, Inc., among others.

- Jun 2020 - Commvault, a prominent global enterprise software provider in the management of data across the cloud and on-premise environments, announced that it has entered into a multi-year agreement with Microsoft that will integrate the go-to-market, engineering and sales of the company's Metallic Software-as-a-Service (SaaS) data protection portfolio with Microsoft Azure, primarily delivering scale and trusted security with simple SaaS management.

- Jun 2020 - Acronis, a player in the cyber protection domain, announced the signing of a multiyear partnership with ACE Pacific Group, which is one of the APAC region's cybersecurity distributors. The partnership will primarily enable the full access to Acronis' cyber protection solutions across the ACE Pacific Group's wide distribution channels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Growth in Data being Generated from Multiple Sources

- 4.2.2 Increasing Privacy Concerns and Rising Need for Data Security

- 4.3 Market Restraints

- 4.3.1 Availability of open-source alternatives

- 4.4 Porters 5 Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By End-user Vertical

- 5.2.1 BFSI

- 5.2.2 IT & Telecommunication

- 5.2.3 Government

- 5.2.4 Manufacturing

- 5.2.5 Healthcare

- 5.2.6 Other End-user Vertical

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Acronis International GmbH

- 6.1.2 Asigra Inc.

- 6.1.3 Carbonite, Inc. (OpenText Corporation)

- 6.1.4 CenturyLink, Inc.

- 6.1.5 Commvault Systems, Inc.

- 6.1.6 IBM Corporation

- 6.1.7 Microsoft Corporation

- 6.1.8 NetApp, Inc.

- 6.1.9 Veritas Technologies LLC

- 6.1.10 VMware, Inc. (Dell Technologies Inc.)

- 6.1.11 Micro Focus International plc

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS