PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640701

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640701

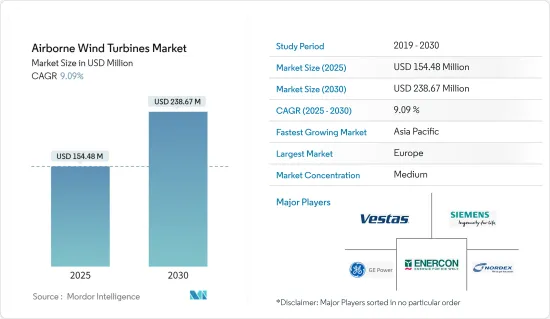

Airborne Wind Turbines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Airborne Wind Turbines Market size is estimated at USD 154.48 million in 2025, and is expected to reach USD 238.67 million by 2030, at a CAGR of 9.09% during the forecast period (2025-2030).

Factors such as low maintenance costs for wind energy technologies and the rise of companies using airborne wind energy systems across the world are expected to drive the market between 2024 and 2029.

On the other hand, the high cost of building and installing turbines and the lack of proper developers are expected to hinder the market's growth.

Nevertheless, technological advancements like airborne wind energy (AWE) technologies, which are fundamentally new and require significant further development, are expected to create several future market opportunities from 2024 to 2029.

Europe is expected to be the largest and fastest-growing region in the global airborne wind energy market between 2024 and 2029.

Airborne Wind Turbines Market Trends

Companies Focused on Enhance Airborne Wind Energy are Driving the Market

- Countries worldwide are trying to increase the installed capacity of airborne wind energy. By investing in AWE technology, nations can diversify their energy sources and contribute to a cleaner and more sustainable future. Additionally, the scalability and flexibility of airborne wind energy systems make them suitable for a wide range of applications, from powering remote off-grid communities to supporting large-scale grid integration.

- For instance, according to BVG Associates, the globally installed capacity of airborne wind energy is expected to reach 0.02 GW in 2025, compared to 0.25 GW in 2030.

- Furthermore, leading companies worldwide are also enabling the use of airborne wind energy systems to power gas storage facilities. By utilizing AWE systems to generate electricity, companies can reduce reliance on traditional fossil fuel-based power sources and lower their carbon footprint. The ability of AWE systems to operate at higher altitudes where wind speeds are more significant and consistent makes them an attractive option for powering gas storage facilities in remote or off-grid locations.

- For instance, in February 2024, ENGIE Group and SkySails Power GmbH made significant progress in their joint venture to utilize high-altitude winds for renewable energy. The partners have garnered favorable initial responses from local authorities for a pilot initiative aimed at supplying the gas storage facility Peckensen with sustainable energy derived from Airborne Wind Energy (AWE) and solar photovoltaic energy.

- The leading organizations involved in the development of kite-like devices for airborne wind energy are focusing on improving the efficiency, reliability, and scalability of their systems. They are conducting research and testing to optimize the design and performance of these devices, with the goal of achieving longer flight durations and greater power output.

- For instance, in May 2023, Kitemill, a Norwegian renewable energy company, announced that its KM1 pilot system achieved a significant milestone. The system covered more than 500 kilometers during five hours of continuous operation, setting a new record in the field of Airborne Wind Energy (AWE).

- Therefore, owing to the above factors, companies focused on enhancing airborne wind energy are expected to drive the market between 2024 and 2029.

Europe Dominates the Airborne Wind Turbines Market

- Europe has 207 GW of onshore wind capacity, and the European Commission plans to increase it to 1,000 GW by 2050 as part of its net-zero vision. Developing more wind sites to cater to this demand will drive the growth of the airborne wind turbine market in the region.

- Companies across the region are increasingly attracted to airborne wind energy systems due to their potential for cost savings and improved performance. By focusing on implementing these innovative technologies, companies can reduce their reliance on fossil fuels and contribute to a more sustainable energy future. This increased efficiency leads to a lower levelized cost of energy (LCOE), making airborne wind energy systems an attractive option for companies looking to invest in renewable energy sources. For instance, according to BVG Associates, in 2025, the levelized cost of energy (LCOE) for airborne wind power reached 99 EUR/MWh, whereas it was 45 EUR/MWh in 2030.

- AWE can provide energy at a lower cost than established wind technology. By the early 2030s, AWE could compete at an average price lower than established wind technology. By harvesting more wind resource potential up to 300-500 meters, AWE is viable in more locations that are not viable for established wind technology.

- About 20 small companies, most located in Europe, are developing devices for AWE, and some hope to have commercially operational ground systems by 2025.

- In Norway, companies are actively involved in developing utility-scale airborne wind systems to capitalize on the abundant wind resources available in the region. The manufacturing process for these systems is progressing rapidly as companies strive to meet the increasing demand for renewable energy solutions.

- For instance, in July 2023, Kitemill, a company specializing in airborne wind energy systems, announced the launch of its first utility-scale airborne wind system. This milestone was achieved through the company's participation in the Norse Airborne Wind Energy Project, which the EU Innovation Fund supports with a total investment of USD 8.42 million. As part of this initiative, Kitemill will be installing at most minuscule 12 KM2 units in an array located in Holtalen, Norway.

- Therefore, owing to the above factors, Europe is expected to dominate the airborne wind turbines market between 2024 and 2029.

Airborne Wind Turbines Industry Overview

The airborne wind turbine market is semi-consolidated with key players such as GE Power, Enercon GmbH, Nordex SE, Vestas Wind Systems AS, and Siemens AG. These companies are investing in various applications to gain market share and expand the scope of their service offerings. Businesses have remained competitive in the market by utilizing joint ventures, mergers, and acquisitions.

In January 2023, TUV SUD, the German Audit and certification service provider, signed a deal with Ventus Group to provide services to a wind energy company in India. As part of the deal, the duo will assist energy companies in India with technologies for measuring, analyzing, and optimizing the performance of wind farms and wind turbines utilizing wind turbine generators (WTG). The clients would get guidance on maximizing safety and production from their existing and future wind energy investments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Companies Focused to Enhance Airborne Wind Energy

- 4.5.1.2 Low Maintenance Costs of Wind Energy Technologies

- 4.5.2 Restraints

- 4.5.2.1 Cost of Building and Installing Turbines

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Larger Turbines (above 3 MW)

- 5.1.2 Smaller Turbines (Less than 3 MW)

- 5.2 Application

- 5.2.1 Offshore

- 5.2.2 Onshore

- 5.3 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Turkey

- 5.3.2.7 Nordic

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Thailand

- 5.3.3.7 Malaysia

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Colombia

- 5.3.4.5 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Qatar

- 5.3.5.5 Nigeira

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems AS

- 6.3.2 Nordex SE

- 6.3.3 Enercon GmbH

- 6.3.4 GE Power

- 6.3.5 Siemens AG

- 6.3.6 Senvion SA

- 6.3.7 Goldwind

- 6.3.8 United Power Inc.

- 6.3.9 Envision Energy

- 6.3.10 Suzlon Energy Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements