PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642129

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642129

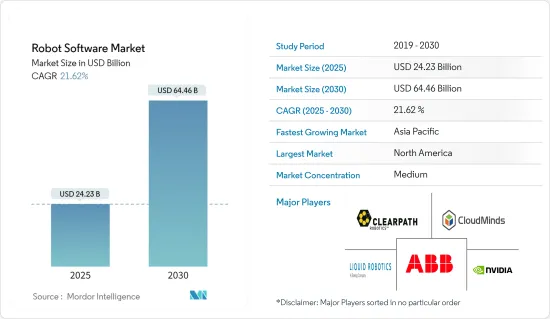

Robot Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Robot Software Market size is estimated at USD 24.23 billion in 2025, and is expected to reach USD 64.46 billion by 2030, at a CAGR of 21.62% during the forecast period (2025-2030).

Robot software enables functions for intelligence, motion, safety, and productivity and gives the power to get the robots to see, feel, learn, and maintain security. These characteristics and benefits allow users to instantly and easily get their robots up and running at optimum productivity.

Key Highlights

- The major factors driving the robot software market are the adoption of artificial intelligence, enhanced speed, improved quality, reduced labor cost, increased accuracy, and production scalability.

- Rising adoption of robots across various end-user industries such as manufacturing, electrical and electronics, automotive, food and beverage, and process controls are seen as primary growth drivers for the robotics software platforms market. The growing utilization of robots in varied end-user industries helps meet customized demand while simultaneously helping lower labor costs.

- Since the invention of robots, software has played a key role in the field of robotics. With the introduction of new software features that enable better control of the robot, quick customization of sequences, and ease of use, the software is expected to further boost the adoption of robotics in the coming years.

- However, data security and increasing cyberattacks are hindering market growth. Also, increasing robot crimes are impeding the adoption of robots in various sectors, thus, reducing the robot software adoption prospects. Also, the lack of skilled expertise is another major restraining factor for this market.

- COVID-19 provided a solid push to expand the usage of robot software and improve robotics research. During the pandemic, various companies have installed robots to disinfect areas and deliver food to quarantined people. Some companies designed robot software to help people track COVID-19 in their communities.

Robot Software Market Trends

Industrial Robots to Have the Majority Application

- With the advent of technologies like the Industrial Internet of Things (IIoT), vital to the smart factory concept coupled with Industry 4.0, industrial robot adoption is increasing across the manufacturing industries. An industrial robot is generally used in place of human laborers to perform dangerous or repetitive tasks with high accuracy. and According to IFR It is projected that by 2024, industrial robot installations in Asia/Australia will reach 370,000 units.

- In order to make the robots perform efficiently, robot software is essential to operate the robots according to the needs of the manufacturers. This software is an extension of human capability. It reflects the human vision that gets keener with every generation and every technological leap. With the enormous growth of robotics in the industrial sector, the need for robotic software is also increasing substantially.

- Moreover, Artificial Intelligence and machine learning capabilities have been rapidly making their way into industrial robotics technology. One of the most significant benefits derived from the merging of robotics and AI technology is increased uptime and productivity from predictive maintenance.

- With AI integrated with industrial robotics technology, robots are able to monitor their own accuracy and performance, providing signals when maintenance is required to avoid expensive downtime.

- Furthermore, in May 2023, Alphabet launched the first product under its industrial robotics business unit Intrinsic, called Flowstate, which is an intuitive, web-based developer environment where companies can create robotic workflows, offering users the foundation to begin building robotic systems, as well as simulation capabilities to test designs. In particular, the software is aimed at helping non-experts understand and leverage robotic systems.

The Asia-Pacific Region Expected to Register Significant Growth

- The Asia-Pacific region is expected to exhibit significant growth opportunities over the forecast period. The major economies contributing to the growth of the robot software market in this region are China, Japan, Singapore, South Korea, and India. The countries in this region are increasingly adopting robotics across industries.

- The Chinese market is expected to increase its expenditure on AI and robotics, as the country has categorically prioritized its focus on AI and robotics in its 13th five-year plans. China's National Development and Reform Commission has announced an AI three-year implementation program expected to accelerate the adoption of advanced technologies to help the country become a superpower by 2030.

- Rise in demand for automation and safety in organization for hazardous works like chemical plants and others, is driving the growth of the market. Furthermore, with the rising adoption of cutting-edge technologies like the Industrial Internet of Things (IIoT) vital to the smart factory concept coupled with Industry 4.0, and industrial robot is driving the growth of the market

- In addition, the cost of robot work cells has decreased by 5-10% per year since few years and the speed and throughput of robot has increased significantly; due to which there is an increase in adoption of robots, which in turns drives the growth of the market across the region.

Robot Software Industry Overview

The Robot Software Market is semi-conslodiated owing to the penetration of robotics globally with applications in various industries. Robotic software companies are constantly focusing on developing advanced technologies that would enhance the robotic processes and help the manufacturing industries to intensify their process. Some of the prominent vendors in the market include ABB Ltd, Clearpath Robotics, NVIDIA Corporation, and CloudMinds Technology Inc.

- December 2023 - ABB Ltd has announced the strengthening of its long-standing partnership with Volvo Cars to supply more than 1,300 robots and functional packages to build the next generation of electric vehicles. This will support the Swedish car manufacturer to achieve its ambitious sustainability targets.

- October 2023 - NVIDIA announced launch of its to two frameworks on the Jeston Platform for edge AI and robotics the NVIDIA Isaac ROS robotics framework for Robotics Platform to Meet the Rise of Generative AI, More than 10,000 companies building on the NVIDIA Jetson platform can now use new generative AI, APIs and microservices to accelerate industrial digitalization.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in need for automation and safety in organizations

- 5.1.2 Rapid adoption of robot software by SMEs to reduce labor and energy costs

- 5.2 Market Challenges

- 5.2.1 High cost of implementation and rise in malware attacks on the software

6 MARKET SEGMENTATION

- 6.1 By Software Type

- 6.1.1 Recognition Software

- 6.1.2 Simulation Software

- 6.1.3 Predictive Maintenance Software

- 6.1.4 Data Management and Analysis Software

- 6.1.5 Communication Management Software

- 6.2 By Robot Type

- 6.2.1 Industrial Robots

- 6.2.2 Service Robots

- 6.3 By Deployment

- 6.3.1 On-Premise

- 6.3.2 On-Demand

- 6.4 By Enterprise Size

- 6.4.1 Small and Medium Enterprises

- 6.4.2 Large Enterprises

- 6.5 By End-user Vertical

- 6.5.1 Automotive

- 6.5.2 Retail and E-commerce

- 6.5.3 Government and Defense

- 6.5.4 Healthcare

- 6.5.5 Transportation and Logistics

- 6.5.6 Manufacturing

- 6.5.7 IT and Telecommunications

- 6.5.8 Other End-user Verticals

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Latin America

- 6.6.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Clearpath Robotics

- 7.1.3 NVIDIA Corporation

- 7.1.4 CloudMinds Technology Inc.

- 7.1.5 Liquid Robotics Inc.

- 7.1.6 Brain Corporation

- 7.1.7 AIBrain Inc.

- 7.1.8 Furhat Corporation

- 7.1.9 Neurala Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS