PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910667

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910667

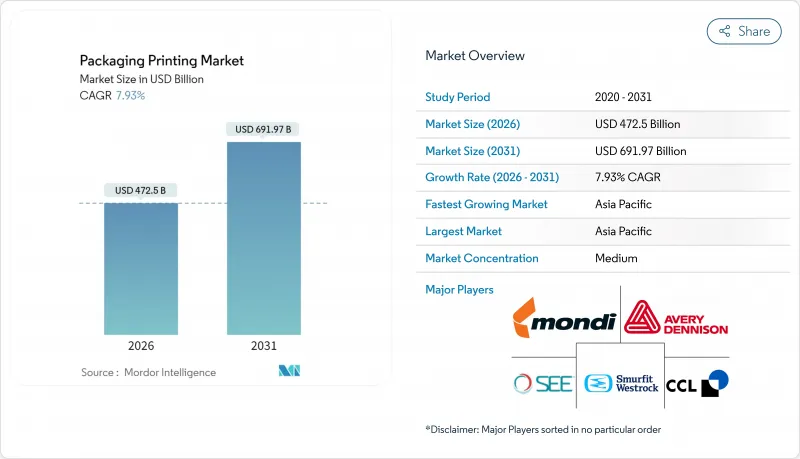

Packaging Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

packaging printing market size in 2026 is estimated at USD 472.5 billion, growing from 2025 value of USD 437.78 billion with 2031 projections showing USD 691.97 billion, growing at 7.93% CAGR over 2026-2031.

Rapid digital transformation, soaring e-commerce activity, and stringent sustainability policies are reshaping technology selection, substrate choice, and regional investment priorities. Flexography keeps its volume edge thanks to productivity on long runs, yet brand owners now favor digital platforms for short batches that support SKU proliferation, variable data, and smart-pack functionality. UV-curable ink chemistry gains ground as converters look for lower energy use and faster throughput, while RFID-enabled packs strengthen supply-chain visibility. At a strategic level, converters combine hybrid press lines, localized micro-factories, and closed-loop material programs to defend margins in a market where brand loyalty depends on print quality, speed, and environmental footprint.

Global Packaging Printing Market Trends and Insights

Demand for RFID-enabled and Digital Printing

Widespread IoT connectivity is turning each package into a data node, and pressure-sensitive labels embedded with RFID are now common on high-value pharmaceuticals. Digital presses integrate serialized codes without plate changes, cutting unit costs and enabling real-time authentication. Consumer-facing apps read these identifiers to reveal provenance or loyalty offers, deepening engagement while assisting recall management. Converters that combine flexo efficiency with inline inkjet modules meet traceability mandates and win contracts that reward responsiveness.

Expansion of E-commerce Packaging Volumes

Direct-to-consumer logistics prioritize lightweight formats that protect goods, showcase graphics, and arrive swiftly. Print-on-demand networks such as Gelato's cut shipping distance by 90%, proving localized production scales once digital workflows replace analog set-up. Shorter run lengths - often below 10,000 units - push traditional offset out of contention, encouraging investment in high-speed inkjet and toner machines that deliver shelf-ready quality overnight. The packaging printing market benefits as every unboxing video becomes free advertising, pushing brands to refresh artwork more often.

High Capital Investment Requirements

A high-speed eight-color flexo line costs up to USD 2.94 million and demands auxiliary slitters, plate mounters, and solvent-recovery units. Smaller converters in Southeast Asia delay upgrades, risking obsolescence as brand owners insist on tighter tolerances. Leasing programs exist, but interest rates elevate the total cost of ownership. Consolidation, therefore, accelerates deep-pocketed groups buying family-run shops to unlock scale and negotiate better substrate contracts.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Push for Eco-friendly Inks and Substrates

- Emerging-Market Consumption Boom

- Complex and Varying Global Printing Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexography held a 34.78% share of the packaging printing market size in 2025, supported by unrivaled speed on film and paper webs. Hybrid press platforms now layer inkjet stations onto flexo units, enabling serial codes and regional graphics without slowing the run. Digital equipment records a 10.15% CAGR through 2031 as converters chase shorter cycles and SKU proliferation. Rotogravure retains a niche status in premium tobacco and cosmetics, where image fidelity justifies cylinder engraving costs. Offset lithography concentrates on folding cartons, while screen printing and other niche methods address tactile varnishes and metallic effects.

Investment data confirms the trajectory. Pack lines installed in 2025 feature predictive-maintenance sensors that cut unplanned downtime by 18%, and cloud-based color servers align artwork across plants in real time. Converters adopting the hybrid model report making ready waste down by 28% and TTM (time to market) halved for promotional packs. As such, equipment suppliers bundle workflow software with presses, locking in service revenue and strengthening aftermarket margins within the packaging printing market.

Solvent systems maintained a 39.62% share of the packaging printing market size in 2025. Yet UV-curable ink volumes rise at 9.52% CAGR as LED lamps curb power draw to 0.3-0.5 kWh per square meter versus 1.2-1.8 kWh for thermal ovens. Aqueous formulations grow fastest in paper-heavy segments where food contact regulations restrict VOCs. Latex and LED-UV chemistries address shrink labels and heat-sensitive films once off-limits to mercury-lamp curing.

Total-cost models favor UV in high-mix environments: plate washout stations disappear, inventory of solvents shrinks, and cure-on-demand lowers WIP. Resin volatility remains a risk, but multi-sourcing and in-house blending partly offset spikes. Ink suppliers invest in bio-based monomers and photoinitiators that pass compostability tests, aligning chemistry advances with the sustainability agenda permeating the packaging printing market.

The Packaging Printing Market Report is Segmented by Printing Technology (Offset Lithography, Rotogravure, and More), Ink Type (Solvent-Based Ink and More), Packaging Material (Labels, Plastic Containers and Films, Glass Containers, Metal Cans and Foils, and More), End-Use Industry (Food and Beverage, Pharmaceutical and Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads global output, housing more than half of new press installations in 2024. China's converters add multi-layer pouch lines to feed domestic snack demand, while India offers incentives for capital purchases under its Production-Linked Incentive scheme. Flexible packaging makers in Vietnam and Thailand gain from near-shoring, serving apparel exporters that need rapid swing tags and polybags. Cross-border investments elevate regional know-how, and joint ventures with Japanese ink suppliers improve quality consistency.

North American operators' position on technology and compliance. Investments in digital corrugated presses triple capacity for same-day e-commerce boxes, and state legislatures adopt extended producer responsibility fees that reward recyclable prints. U.S. converters also pioneer UV-LED retrofits, claiming 25% energy savings. Canada harmonizes food-contact limits with the FDA, easing cross-border sourcing, while Mexico attracts Tier-1 brands searching for tariff-free access under USMCA.the

Europe sets the regulatory tempo. The bloc's 88% packaging recycling target nudges brand guidelines toward mono-material laminates that rely on specialized inks. German machinery exports leverage Industrie 4.0 features such as real-time viscosity control, and Italian press builders bundle in-line cold-foil to court luxury houses. Eastern Europe, notably Poland, captures overflow work as labor rates undercut Western peers, yet workforce skills remain high. Innovation grants in the Netherlands fund pilot lines for paper-based barrier packs, sustaining momentum in the packaging printing market.

- Amcor plc

- Smurtfit WestRock

- Tetra Pak Group

- Mondi plc

- Huhtamaki Oyj

- CCL Industries Inc.

- Avery Dennison Corporation

- Sealed Air Corporation

- International Paper Company

- Stora Enso Oyj

- Sonoco Products Company

- Georgia-Pacific LLC

- Constantia Flexibles GmbH

- Mayr-Melnhof Karton AG

- Ahlstrom-Munksj Oyj

- Clondalkin Group Holdings BV

- Autajon Group SA

- SATO Holdings Corp.

- Rotocontrol GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for RFID-enabled and Digital Printing

- 4.2.2 Expansion of E-commerce Packaging Volumes

- 4.2.3 Sustainability Push for Eco-friendly Inks and Substrates

- 4.2.4 Emerging-market Consumption Boom

- 4.2.5 Brand-owner Adoption of Smart Pack Serialization

- 4.2.6 Rise of Localised Print-on-Demand Micro-Factories

- 4.3 Market Restraints

- 4.3.1 High Capital Investment Requirements

- 4.3.2 Complex and Varying Global Printing Regulations

- 4.3.3 Volatile Photoinitiator and Resin Prices

- 4.3.4 Shortage of Skilled Flexographic Press Operators

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 The Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Industry Ecosystem Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Printing Technology

- 5.1.1 Offset Lithography

- 5.1.2 Rotogravure

- 5.1.3 Flexography

- 5.1.4 Digital Printing

- 5.1.5 Other Printing Technologies

- 5.2 By Ink Type

- 5.2.1 Solvent-based Ink

- 5.2.2 UV-curable Ink

- 5.2.3 Aqueous Ink

- 5.2.4 Latex Ink

- 5.2.5 LED-UV Ink

- 5.3 By Packaging Material

- 5.3.1 Labels

- 5.3.2 Plastic Containers and Films

- 5.3.3 Glass Containers

- 5.3.4 Metal Cans and Foils

- 5.3.5 Paper and Paperboard Cartons

- 5.3.6 Flexible Pouches

- 5.3.7 Corrugated Boxes and Trays

- 5.4 By End-Use Industry

- 5.4.1 Food and Beverage

- 5.4.2 Pharmaceutical and Healthcare

- 5.4.3 Cosmetics and Personal Care

- 5.4.4 Household and Industrial

- 5.4.5 Electronics and Electrical

- 5.4.6 Other End-Use Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Vietnam

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 Smurtfit WestRock

- 6.4.3 Tetra Pak Group

- 6.4.4 Mondi plc

- 6.4.5 Huhtamaki Oyj

- 6.4.6 CCL Industries Inc.

- 6.4.7 Avery Dennison Corporation

- 6.4.8 Sealed Air Corporation

- 6.4.9 International Paper Company

- 6.4.10 Stora Enso Oyj

- 6.4.11 Sonoco Products Company

- 6.4.12 Georgia-Pacific LLC

- 6.4.13 Constantia Flexibles GmbH

- 6.4.14 Mayr-Melnhof Karton AG

- 6.4.15 Ahlstrom-Munksj Oyj

- 6.4.16 Clondalkin Group Holdings BV

- 6.4.17 Autajon Group SA

- 6.4.18 SATO Holdings Corp.

- 6.4.19 Rotocontrol GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment