PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642960

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642960

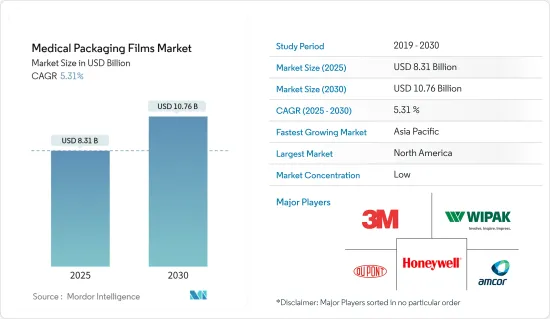

Medical Packaging Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Medical Packaging Films Market size is estimated at USD 8.31 billion in 2025, and is expected to reach USD 10.76 billion by 2030, at a CAGR of 5.31% during the forecast period (2025-2030).

The market size reflects the value of packaging film products across medical packaging industry applications and is computed in the real term. Packaging films are made from plastic materials, such as polyethylene, polypropylene, biaxially oriented polyethylene terephthalate, polyphenylene ether, polyvinyl chloride, EVOH, polystyrene (PS), nylon, and various metals are considered as per the scope of the market study.

Key Highlights

- Governments worldwide are heavily investing in medical and pharmaceutical products and solutions in damage control and the prevention of any potential resurgence of the COVID-19 pandemic. For instance, according to the Institute for Health Metrics and Evaluation (IHME), published in September 2021, the global per capita health expenditure was USD 1,129 in 2019, and it is projected to increase to USD 1,515 by 2050. Innovative packaging and preemptive measures are expected to become the norm in the medical industry, driving the demand for medical packaging films.

- The market studied is a burgeoning segment of the packaging sector, with many drivers accelerating the growth amid the challenges in the form of supply chain security woes, changing regulatory demands, and supply and demand imbalances. During the forecast period, bioplastic films are expected to increase their share on account of several initiatives taken by various market entities to curb the use of plastic materials. However, owing to the severe nature of the market studied, these initiatives are likely to have less impact on replacing plastic films with sustainable packaging films compared to other end-user industries of plastic films, thereby sustaining the market growth.

- The market is expected to experience significant growth, owing to the increase in therapeutics for chronic illnesses, such as cancer and the increasing demand for pouches, bags, and sachets for therapeutic medicines. Additionally, the aging population and the incidence of diabetes are projected to present new opportunities for market expansion.

- Some of the major challenges for the market growth are the volatility of raw material prices, the ongoing drive for sustainability, which includes replacing plastic-based packaging products with biodegradable materials, and mandates of using post-consumer recycled (PCR) plastics in plastic packaging. Usually, raw material costs are attributed to 55-60% of sales in this industry. Therefore, profitability is vulnerable to volatility in raw material prices. The key input cost for flexible packaging film is crude derivatives, which have been inherently volatile.

- During the COVID-19 pandemic, packaging film manufacturers were flooded with a pool of issues that lasted long for nearly one or two years. Some of the effects of lockdown included supply chain disruptions, labor shortages, lack of availability of raw materials used in the manufacturing process, fluctuating prices that caused the production of the final product to inflate and go beyond budget, transportation problems, etc.

Medical Packaging Films Market Trends

Increasing Demand for Bioplastic Material and Recyclable Packaging Material Drives the Medical Packaging Films Market

- Bioplastics are being used in the market studied to reduce environmental impact. The amount of waste increased dramatically due to the extensive use of plastics in the industry. Thus, using biodegradable plastic in medical applications contributes to environmental protection.

- Medical bags are widely used in medical applications, particularly when low-cost packaging in large quantities is required, owing to the primary benefits, such as medical product protection, ease of transportation, and brand promotion. These bags are frequently used to store first aid kits, medications, and medical equipment. Pouches can be used to store tools or liquid medications.

- Moreover, packaging film manufacturers are focusing on innovating medical packaging solutions with recyclable materials to achieve greater sustainability in their product offerings. For instance, in November 2021, Coveris, a sustainable packaging solution provider, launched recyclable mono-PE film based on mono films branded Flexopeel T and Formpeel T for medical packaging. The company combined an uncoated Tyvek 1073B from DuPont and a mono-structure film from Coveris, based on PE resins.

- The increasing demand for bioplastic material in the packaging segment has been driving the market study, as packaging product producers have alternatives for polymer-based plastic in the form of bioplastic. Using bioplastic reduced the impacts of bans and an anticipated reduction in polymer plastic-based packaging usage in medical packaging, owing to sustainability concerns. According to European Bioplastics, in 2021, the global production capacity of bioplastics for flexible packaging was 665,000 metric tons.

- Key players in the market studied are launching new products to cater to changing consumer preferences and stay relevant to market demand. For instance, the Canadian packaging and medication dispenser company Jones Healthcare Group expanded the Qube and FlexRx medication adherence product lines for pharmacies with sustainable packaging products in December 2021. The company launched Qube Pro, FlexRx One, and FlexRx Reseal blister packs made of Bio-PET, a bioplastic that received medical approval.

Asia Pacific is Expected to be the Fastest Growing Market

- The Asia Pacific is expected to expand with the highest growth rate in the market studied, majorly due to the increasing middle-class population, disposable incomes, and demand for medical and pharmaceutical products in developing economies such as China, India, Indonesia, and Malaysia. The booming pharmaceutical production in the region is significantly driving the growth of the barrier film market in the region.

- The increasing prevalence of kidney disease in Asia necessitated the development of new therapies, including sophisticated devices to improve treatment. The prevalence of kidney disease in Asia is increasing due to increasing rates of diabetes and hypertension. Furthermore, the emphasis on extending the shelf life of medical devices and products and eliminating the possibility of bacterial or viral contamination increased the demand for packaging film in the medical and healthcare industries.

- As medical packaging film solutions offer benefits, like cost savings, sustainability, and safety of packaged products, significant growth has been seen for medical packaging films from populated developing countries, such as China and India. Moreover, the Asia-Pacific region is anticipated to lead the market studied in terms of value and volume due to the solid industrial base, increased demand for sustainable packaging solutions, and the presence of key manufacturers in the region.

- The demand for medical packaging films is also fueled by the increasing demand for implantable devices and the booming healthcare market. The market expanded due to the escalating demand for implantable devices and increasing public awareness in developing nations like China and India.

- Along with the expanding healthcare sector, China's medical device market is increasing at an incredible pace. This specific sector is one of the fastest-increasing sectors in China. The sector is increasing at a double-digit growth rate, driven by dynamic regulations, nearly 70% of which was contributed to by hospital procurement. Traditionally China's medical devices market is well known for large volumes of low-end consumables, mechanotherapy devices, and aids. There has been large dependence on imports for procuring required high-end consumables as they were not traditionally manufactured in the country.

- Currently, there has been a shift toward domestically made high-value and high-risk medical devices, which are expected to drive the Chinese medical packaging film market. Moreover, the aging population is one of the driving factors for the increase in demand for high-end Chinese devices. According to the World Health Organization (WHO), the population aged more than 60 years is expected to reach 28% in China by 2040. This increasing demographic, which is increasingly affluent, is expected to be able to spend more on healthcare services than before.

Medical Packaging Films Industry Overview

The Medical Packaging Films Market is fragmented in nature, and the major players such as Honeywell, 3M, Amcor, etc. have used various strategies such as new product launches, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market.

- April 2022 - Amcor, one of the global leaders in developing and producing responsible packaging solutions, announced the addition of sustainable high shield laminates to its pharmaceutical packaging portfolio. The new low carbon, recycle-ready packaging options deliver on two fronts, providing the high barrier and performance requirements needed for the industry while supporting pharmaceutical companies' recyclable objectives.

- January 2022 - Klockner Pentaplast, a leading company in recycled content products and high-barrier protective packaging, announced its plans to expand its post-consumer recycled content (PCR) PET capacity in the North America region with a significant investment to further increase its sustainable innovation offering in consumer health and pharmaceutical food packaging markets. The company has the capacity, with more than 20% of its volumes made from PCR material. The expansion is set to add an extrusion line and two thermoformers, providing a total of 15,000 metric tons of new rPET or PET capacity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Bioplastic and Recyclable Packaging Material

- 5.1.2 Increased Spending on Healthcare Facilities, Primarily Owing to Increase in Chronic Diseases

- 5.2 Market Restraints

- 5.2.1 Fluctuation in the Prices of Raw Materials

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Plastic Film

- 6.1.1.1 PE

- 6.1.1.2 PP

- 6.1.1.3 PVC

- 6.1.1.4 PC

- 6.1.2 Metallic Film

- 6.1.1 Plastic Film

- 6.2 Application

- 6.2.1 Bags & Pouches

- 6.2.2 Tubes

- 6.2.3 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell International Inc.

- 7.1.2 3M Company

- 7.1.3 Wipak Oy

- 7.1.4 Amcor Plc

- 7.1.5 DuPont de Nemours, Inc.

- 7.1.6 Renolit Medical

- 7.1.7 PolyCine GmbH

- 7.1.8 Glenroy, Inc.

- 7.1.9 Toray Industries, Inc.

- 7.1.10 Klockner Pentaplast Group

- 7.1.11 Dunmore Corporation

- 7.1.12 Covestro AG

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS