PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642974

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642974

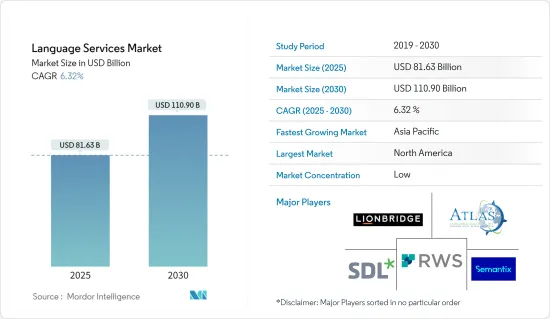

Language Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Language Services Market size is estimated at USD 81.63 billion in 2025, and is expected to reach USD 110.90 billion by 2030, at a CAGR of 6.32% during the forecast period (2025-2030).

Key Highlights

- The primary factors driving the demand for language services include the rapidly increasing globalization among businesses, the incremental rise of digitizing content, and the increased customer service that's becoming more personalized and international.

- Iflytek, a speech recognition company based out of China that provides translation services, successfully raised USD 407 million (CNY 2.8 billion) from its investors, including the state-run investment fund China Reform Holdings and the Anhui Railway Development Fund. The company claims that the funding will be used to enhance the translation output, along with the output of the AI translation engine. Such developments provide significant scope for the market's growth during the forecast period, especially for startups.

- The demand for language services is no longer concentrated on large multinational corporations. Still, small and large businesses and local and state governments, including other organizations, have increased their use of translation, interpretation, and other language services.

- International trade has steadily expanded over the past few decades, including the proliferation of free trade agreements that have led to a virtual explosion of global trade worldwide. Moreover, the increasing foreign competition and various government initiatives have led all kinds of businesses, irrespective of size, to take initiatives regarding opportunities available to them in foreign markets.

- The ongoing trends in international marketing are also expected to accelerate the growth in the language services market. With these services, companies are now able to reach increasing audiences across the globe at a lower cost through the web. The market is expected to grow even further as these audiences are increasingly composed of foreign people.

- The increase in internet usage, combined with the trend toward content marketing, has opened up new avenues for the language industry. PPC advertising and social media marketing aimed at foreign audiences are also expanding at remarkable rates. Social networking sites and multiple blogs that are active across the world are also providing platforms for effective content marketing that include articles, infographics, videos, and multimedia productions. All this content is localized for optimum effectiveness, which is one of the major factors driving the market.

- Moreover, the market is witnessing multiple M&A activities by the players to strengthen their market positions. For instance, in October this year, in order to assist life sciences organizations with their needs for international communication, including over-the-phone interpreting (OPI) for global call centers, Acolad Life Sciences teamed up with Alphanumeric.

- The lockdown restrictions amidst the pandemic forced the entire world to stay at home, which gave a strong impetus to developing trade and entertainment on the Internet. YouTube, Netflix, social media, and Amazon witnessed a surge in the number of users, producing the need for more content globally. That implies a higher demand for the services of translators, whose work is much easier to organize remotely.

- Another reason is the active exchange of experiences in fighting against the virus and treating patients, which drove the global discussion and information exchange between researchers in healthcare, virology, immunology, epidemiology, etc. The highest demand for translators may be expected from the medical sector.

- In March 2024, ABC Language Services merged with Language Link of Connecticut. The merger enabled ABC Language Services to better meet the translation needs of its clients, which comprise government agencies, law firms, medical practices, social services, corporations, and other businesses. Both companies continued to operate under their existing names, but now, they share all of their resources and operations.

- The lockdown restrictions amidst the COVID-19 pandemic forced the entire world to stay at home, which has given a solid impetus for developing trade via the Internet. Applications like Netflix, YouTube, Amazon Prime, and social media have witnessed a user surge. This has resulted in an increased need for more content globally and has served as good news for translators, owing to increased demand for their services while providing the ease of being organized remotely.

Language Services Market Trends

Translation Services is Expected to Witness Significant Growth

- Within language services translation services play a key role in facilitating communication between users of different languages. These services encompass both spoken and signed communication and follow the International Standards Organization (ISO) definition that states the rendering of a spoken or signed message into another language by preserving the meaning of the source language content.

- The growing customer outreach has enhanced the scope of translation services to fulfill the customers' needs, barring language preferences. Historical data signifies that various companies are opting for translation services to provide comfort to their national and international clients.

- Translation services usually require an integrated cloud computing platform and big data analytics to ensure data access from anywhere. This also results in increased storage capacity and more efficiency.

- With more and more companies offering their services online, the need for websites and web content translation has grown. Businesses globally are seeking translation services to serve their customers and keep up with their demands. While individuals are also using this type of service, the share of such usage is minimal.

- According to the latest figures, around 300 hours of video content is being uploaded to YouTube every minute, and approximately 5 billion videos are being watched daily by users. Also, about 70% of YouTube viewers are from outside the United States and are non-English speaking people. This trend is increasing the demand for video translations and localizations on a large scale. The post-editing of machine translations (PEMT) is expected to be a major trend in the translation services domain during the forecast period.

North America Holds Largest Market Share

- The language services market in the North American region is expected to witness significant growth owing to its increasing diversity. As the region's population continues to shift and become more diverse, the need for effective language services is expected to increase in all industries across the region, and qualified translators and interpreters are crucial in serving the needs of this increasingly diverse population.

- The advent of multicultural marketing has become an important topic these days, and it is expected to drive the demand for language services. The region's changing demographics have made marketing strategies to diverse communities a priority for multiple businesses that previously relied only on a single language.

- According to the US Census Bureau, more than 350 languages are spoken in the United States. The Asian population is also rising owing to increased immigration. New immigration trends are expanding the language services market to serve these populations.

- Understanding the current language trends in their region and how they continue to shape the market and the country helps organizations understand the rapidly rising need for providing multicultural consumers with much more effective communication through professional language services.

- The players in the market are looking to strengthen their competitiveness through various efforts such as multiple M&A activities, product innovation, increased R&D, and exploration of overseas markets. For instance, AppTek, a leader in AI, Machine Learning ML, Automatic Speech Recognition (ASR), Neural Machine Translation (NMT), and Natural Language Understanding (NLU) technologies, announced a new partnership with TransPerfect. The combined capabilities of AppTek's powerful ASR engine and TransPerfect's specialized translation and localization services will further improve customer workflows by reducing project turnaround times.

Language Services Industry Overview

The language services market is highly competitive as multiple vendors provide their services in domestic and international markets. The market appears to be fragmented, with the significant players adopting strategies, like product innovation and mergers and acquisitions, primarily to expand their service portfolio and to stay competitive in the market landscape. Some of the major players in the market are Atlas Language Service Inc., Lionbridge Technologies Inc., RWS Holdings PLC, and SDL PLC, among others.

In June 2024, a LIMERICK-based company joined the UK-based Valorem Group. Translate, an interpreter software company headquartered in Limerick, joined the Valorem Group while also merging with fellow group member DA Languages, a Manchester-based interpreting service provider. Their partnership with DA Languages reinforces Translit's commitment to providing exceptional language solutions.

In February 2024, BLEND recently acquired Manpower Language Solutions (MLS), Israel's key localization provider. By combining MLS's expertise in the Israeli market with BLEND's global proficiency, they aim to enhance their services and empower clients to succeed in any locale. MLS's clients will benefit from improved offerings, including video and audio localization in over 120 languages.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Global Corporate Presence will flourish the market.

- 5.1.2 Increase in Online and Offline Content will drive the market.

- 5.2 Market Challenges

- 5.2.1 Growth of Open-source Language Service Tools

- 5.3 Impact of COVID-19 on Language Service Market

6 KEY TECHNOLOGY INVESTMENTS

- 6.1 Cloud Technology

- 6.2 Artificial Intelligence

- 6.3 Cyber Security

- 6.4 Digital Services

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Translation Services

- 7.1.2 Localization Services

- 7.1.3 Interpreting Services

- 7.1.4 Other Services

- 7.2 By End-user Vertical

- 7.2.1 Life Sciences (Pharmaceuticals, Medical Devices, Biotechnology, CROs)

- 7.2.2 Media and Entertainment (OTT, Games, Box Office, Pay TV)

- 7.2.3 Legal, Finance, and Patents

- 7.2.4 E-commerce

- 7.2.5 Other End-user Verticals

- 7.3 By Geography

- 7.3.1 North America

- 7.3.1.1 United States

- 7.3.1.2 Canada

- 7.3.2 Europe

- 7.3.2.1 Germany

- 7.3.2.2 United Kingdom

- 7.3.2.3 France

- 7.3.2.4 Italy

- 7.3.3 Asia

- 7.3.3.1 India

- 7.3.3.2 China

- 7.3.3.3 Japan

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

- 7.3.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Atlas Language Services Inc.

- 8.1.2 Globe language Services Inc.

- 8.1.3 Lionbridge Technologies Inc.

- 8.1.4 RWS Holdings PLC

- 8.1.5 SDL PLC

- 8.1.6 Semantix AB

- 8.1.7 Summa Linguae Technologies

- 8.1.8 Teleperformance SE

- 8.1.9 TransPerfect Global Inc.

- 8.1.10 Welocalize Inc.

9 INVESTMENT ANALYSIS

10 MARKET OPPORTUNITIES AND FUTURE TRENDS