PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642978

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642978

Plant Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

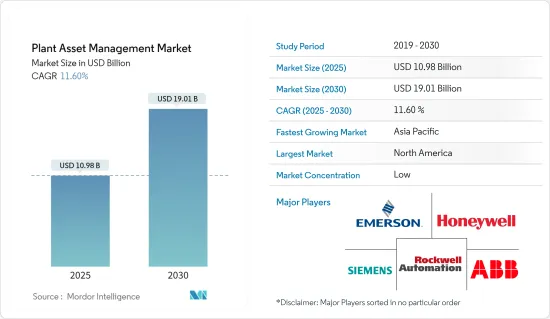

The Plant Asset Management Market size is estimated at USD 10.98 billion in 2025, and is expected to reach USD 19.01 billion by 2030, at a CAGR of 11.6% during the forecast period (2025-2030).

Using plant-based asset management systems, manufacturing firms may conduct routine equipment inspections to reduce the likelihood of failures. A plant asset management system enables companies to track every location where machines are being used. Field technicians can regulate equipment usage and ensure it stays with the authorized employees using real-time location tracking. The ability to track locations also ensures the equipment is handled within the plant's safety guidelines for production.

Advantage Automotive Analytics launched Revo Asset Management, a platform for innovative location-based technology. The application will track, monitor and locate valuable assets in real-time. The application safeguards construction equipment, generators, and other valuables with low-cost, smart GPS technology.

Sudden equipment downtime can affect production schedules, which can delay order fulfillment, lead to unhappy customers, and result in income loss. Recognizing this challenge, Aptean introduced a cloud-based enterprise asset management solution (EAM) to handle work orders, automate approvals, track spare parts inventories, schedule preventative maintenance, allocate appropriately skilled workers, and conduct mobile compliance inspections. CoreFx, the early adopters of Aptean EAM, observed a reduction in overall accidents leading to less downtime on the floor.

If a company keeps assets of the warranty status or avail assets, it could save the business real money by paying for unnecessary repairs. According to ServiceChannel research, firms lose almost 35% of potential warranty savings from paying for repair on under-warranty equipment. Such defaults can be managed with the help of Asset management software.

Data Security can affect the growth of the Plant Asset Management Market. Cloud facilities are a great way to store enormous amounts of data, but if managed well, it is safe from theft. The company can not only suffer financial loss, but a negative reputation can also damage a company's profile.

With lockdowns around the globe, most industries suffered a loss of revenue during the COVID-19 outbreak. One such sector was the construction business, where companies were hit hard because the industry needed to be data-driven. Some companies recognized this challenge and adopted asset management software like Go Codes tool tracking software. The app listed all the information about company assets for better productivity. For instance, a technician could check equipment availability in real time by checking in the app.

Plant Asset Management Market Trends

Oil and Gas Accounts For Significant Market Growth

Oil and gas are high-functioning assets traded internationally and used across multiple industries. It becomes complicated to manually track all the activities of this trade, from procurement to selling. The asset management software plays an important role here, ensuring operational costs are kept marginally low. Predictive maintenance is a crucial asset management feature that helps track and schedule repair cycles, lowering labor costs and utilizing company funds.

Real-time monitoring of all assets' location, performance, and safety is critical in the oil and gas industry, as most of the equipment used in this sector is owned or leased by the companies. Pressure control equipment, logging equipment, storage containers, pipes, and crossings are some of the instruments that require constant monitoring and maintenance for the smooth functioning of day-to-day operations and business.

The process plants in the oil and gas industry are complex and consist of expensive and critical equipment. As the plant's condition and performance degrade over time due to wear from several factors, this harms the production and the associated costs. Asset management strategies aim to counter this impact by systematically monitoring equipment conditions, avoiding unplanned production downtime, and reducing operational expenses by optimizing maintenance planning.

The upstream oil and gas industry companies undergo at least 27 days of unplanned downtime each year, costing them 38 million USD. Predictive Analysis uses Machine learning (ML) techniques to forecast when machinery and equipment need repairs. Thus it can reduce the overall downtime cost, thereby saving a lot of unnecessary expenses for the company.

Environmental risks, like oil spills or any other accident at the production facility, can be averted with the help of effective maintenance plans and asset registries. A company can save up to 18% with the help of preventive maintenance. British Petroleum (BP) has partnered with Microsoft for its Azure artificial intelligence (AI) and Machine Learning solutions to transform oil and gas operations. Artificial intelligence (AI) will increase safety measures for employees working in remote locations.

In the previous year, Baker Hughes signed a contract with C3 AI, Accenture, and Microsoft to provide industrial asset management (IAM) solutions for clients in the energy and industrial sectors. The enhanced digital technologies of the solution will improve the safety, efficiency, and emissions profile of industrial machines, field equipment, and other physical assets.

North America to Hold Significant Market Share

There were 122 oil and gas contracts in North America in the previous year, US contribution being the highest with 113 contracts, representing a 93% share of all the oil and gas contracts, followed by Mexico at 3% and Canada at only a 2% share. Operations & maintenance covered 99 of these contracts, which shows Oil and Gas companies are investing in asset management.

According to Westwood's onshore pipeline forecast, companies are expected to invest around 370 billion USD between 2022 and 2028 on new oil and gas pipelines. It is projected 310,000km of new oil and gas pipelines will be built during this period. China and North America are expected to lead the charge. North America will account for 205,000km of total installments for gas pipelines. North America became the largest LNG (liquified natural gas) exporter in the previous year, as the demand surged from Europe and Asia due to the Russia- Ukraine conflict.

Plant Asset Management is becoming more accessible due to advancements in the cloud in this region. These solutions can help plants refine maintenance schedules to cut costs, track and manage inventory and equipment usage, adapt to labor shortages, and more. Companies are introducing new cloud solutions exhibiting to improve productivity.

US-based Honeywell introduced a sustainability solution for carbon emissions monitoring and optimization. The sensor-based solution will enable organizations to monitor and visualize emissions in near real-time. Industrial sectors will benefit from the new key as they work to cut their greenhouse gas (GHG) emissions and achieve their carbon reduction targets.

Plant Asset Management Industry Overview

There is intense competition with several providers of Asset Management Services. The major players include ABB Group, Emerson Electric Co., Siemens AG, Rockwell Automation, and Honeywell International. Because manufacturing sectors invest extensively in artificial intelligence (AI), there is a high demand for Asset Management Services. To maintain consistency in the business and expand services further, asset management providers are making acquisitions and investments in new companies and technologies.

November 2022 - Vizient, the healthcare performance improvement company, collaborated with Handle Global, the healthcare supply chain analytics, to help Vizient member healthcare organizations manage their capital expenses and equipment through the capital asset management system. This system will offer healthcare organizations data, analytics, and insights for improved equipment lifecycle planning, procurement, and asset utilization that will ultimately reduce costs.

February 2023 - Arcadis design and consultancy organization for natural and built assets collaborated with Canada-based digital technology start-up Niricson. Using robotics, computer vision, and acoustic technology with artificial intelligence (AI), Arcadis can make predictive maintenance of bridge infrastructure safer, faster, and more cost-effective.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption Of Real-Time Data Analytics

- 4.2.2 Adoption of Lean Manufacturing Practices

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Personnel

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Offerings

- 5.1.1 Software

- 5.1.2 Services

- 5.2 Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 End-User

- 5.3.1 Energy and Power

- 5.3.2 Oil & Gas

- 5.3.3 Petrochemical

- 5.3.4 Mining & Metal

- 5.3.5 Aerospace & Defense

- 5.3.6 Automotive

- 5.3.7 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Group

- 6.1.2 Emerson Electric Co.

- 6.1.3 Honeywell International Inc.

- 6.1.4 Rockwell Automation, Inc.

- 6.1.5 Siemens AG

- 6.1.6 SFK Group

- 6.1.7 Ramco Systems

- 6.1.8 General Electric Co.

- 6.1.9 Endress+Hauser AG

- 6.1.10 Schneider Electric SE

- 6.2 Investment Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS