Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690059

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690059

3D Sensing And Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

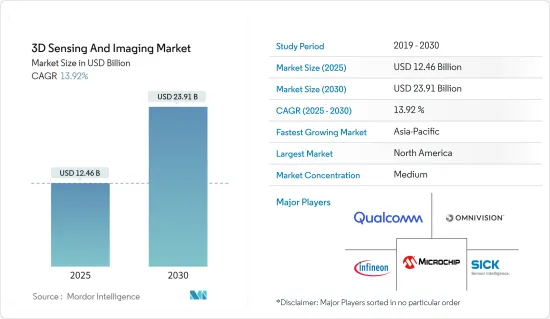

The 3D Sensing And Imaging Market size is estimated at USD 12.46 billion in 2025, and is expected to reach USD 23.91 billion by 2030, at a CAGR of 13.92% during the forecast period (2025-2030).

Key Highlights

- The increasing adoption of sensors in various industry verticals has led to the overall development of 3D technology that can measure shapes in real-time scenarios. The 3D sensing market is primarily driven by integrating 3D smartphone sensors for facial recognition and AR, enhancing security and user experience.

- The home gaming industry presented one of the first practical applications of 3D sensing technology for consumers, with time-of-flight (ToF) sensors that capture players' gestures and movements to build a new interactive gaming experience. However, 3D sensing is most noticeable in today's smartphone technology. User-facing 3D scanning increases security through facial recognition while world-facing 3D sensing establishes new opportunities for high-performance depth-sensing photography and augmented reality.

- In the healthcare sector, 3D sensing improves medical imaging and surgical precision. Additionally, industrial automation benefits from 3D sensors for quality control and robotics, while the gaming and entertainment industries use them for immersive AR and VR experiences. Technological advancements and decreasing costs are expected to further propel the market's growth opportunities significantly.

- Moreover, the growing application of image sensors in automobiles is considerably pushing the market's growth. Some of the key application areas of these automobile sensors involve dash cameras, advanced driver assistance systems (ADAS), LiDAR driver monitoring, and gesture recognition systems, among others. In the current market situation, the automotive industry features advanced driver-assistance systems (ADAS) and autonomous vehicles enabled by 5G and the IoT, making 3D sensing a vital part of transportation safety. The LiDAR systems also provide short- and long-range 3D sensing that allows vehicles to assess their surroundings in real-time scenarios independently.

- The major market players in the industry are focusing on introducing new products. For instance, in April 2024, Quanergy Solutions Inc., a provider of 3D LiDAR technology for physical security and business intelligence applications, launched two new additions to its portfolio of 3D LiDAR solutions. The new Q-Track HD and Q-Track Dome 3D LiDAR sensors join Quanergy's Q-Track LR (Long Range) offering to comprise the industry's most comprehensive portfolio of high-performance 3D LiDAR solutions. Quanergy 3D LiDAR detection, classification, and tracking technology provides 20X the accuracy of legacy technologies at less than half the cost.

- However, factors like the high manufacturing cost of image sensors, limited integration options with other devices, and the involvement of high costs required to maintain these devices are some factors that can restrain the market's growth opportunities during the forecast period.

- The 3D sensing market for industrial and consumer applications was negatively affected during the COVID-19 period due to the decline in consumer spending trends that led to the macro slowdown of the economy across the world. However, during the post-COVID-19 environment, the increasing adoption of 3D sensing and imaging technology, especially in smartphones, gaming consoles, and the automotive industry, is expected to increase the demand for 3D sensing technology applications.

3D Sensing and Imaging Market Trends

The Automotive Segment is Expected to Drive the Market's Growth

- Capturing a wide range of data, from what is happening within hundreds of meters down the road to how cautious the driver is, is required to build a comprehensive 3D map of the environment. LiDAR (light detection and ranging), which catches more detailed information and delivers more accuracy than classic scanning-based sensors like camera and radar-based imaging, is one of the vital technologies for long and short-range scanning.

- LiDAR is mainly used in automobiles for advanced driver assistance systems (ADAS) to facilitate driver convenience. These systems use a human-machine interface for smooth and safe guidance operations. The vehicle's autonomous nature requires considerably high accuracy and assistance, especially for obstacle detection, to ensure safe navigation and avoidance through the roadways.

- The growing use of lidar in the automotive industry significantly boosts the 3D sensing market. It enhances the demand for high-resolution, real-time environmental mapping essential for advanced driver assistance systems (ADAS) and autonomous vehicles. Lidar's superior accuracy and reliability over other sensing technologies enhance vehicle safety and navigation capabilities. This industry focus encourages technological advancements, reducing costs and making 3D sensing solutions more accessible. As automotive manufacturers and tech firms invest heavily in lidar for self-driving cars, the overall market for 3D sensing expands, stimulating further innovation and adoption across various sectors.

- In July 2023, Optical semiconductor pioneer Lumotive signed a commercial agreement with camera module specialist Namuga, which would leverage Lumotive's Light Control Metasurface (LCM) chipsets to build solid-state lidar module solutions for a range of 3D sensing applications in the industrial, consumer, and automotive markets.

- According to the OICA, in 2023, around 65.27 million passenger cars were sold globally, whereas around 58.64 million passenger cars were sold globally in 2022, representing a significant rise in the sales of the total number of passenger cars across the world. This significant rise in passenger cars and vehicles is thus expected to drive the market's growth opportunities significantly during the forecast period.

North America is Expected to Hold a Significant Share in the Market

- North America is expected to hold a significant share of the market. The United States is the most significant market in the region. There is a high demand from the consumer automotive and electronics sectors that employ 3D sensors for various applications in their domains. Canada is another significant 3D sensing market, owing to the increasing adoption of advanced technologies, especially in the entertainment, advertising, and medical industries.

- The 3D sensing market in North America is driven by several factors, primarily the quick adoption of advanced driver assistance systems (ADAS) and autonomous vehicles, the proliferation of smartphones and consumer electronics with 3D sensing capabilities (e.g., facial recognition and augmented reality), and significant investments in healthcare applications like medical imaging and diagnostics. The increasing investments in IoT in the region also aid in the market's growth. IoT has been identified as one of the developing areas of federal R&D investments.

- Additionally, strong R&D initiatives, a robust technology ecosystem, and increasing demand for security and surveillance solutions further propel the market's growth in the region. These drivers, coupled with technological advancements and innovation, ensure the continued expansion of the market's growth opportunities.

- The gaming industry in the region has been recording steady growth, especially due to customers spending a significant amount of time at home and the huge developments in gaming equipment in recent times. The United States has one of the most significant markets in the gaming industry. AR/VR devices, handheld joysticks, and other gaming equipment widely use 3D sensors and 3D imaging cameras for on-screen interactions.

- In February 2024, Polyga launched the Compact S5 Macro 3D Sensor For Scanning Small Objects, the next generation of its popular desktop 3D scanners. The Compact S5 Macro is primarily an industry-ready 3D scanner that allows engineers to digitize parts from 1 to 5 centimeters in size with about 5 microns accuracy. It creates high-resolution 3D scans in under a second and comes in a rugged enclosure.

3D Sensing and Imaging Industry Overview

The 3D sensing market is semi-consolidated with many regional and global players. Moreover, with increased innovations and sustainable products, many companies are expanding their overall market presence by securing new contracts and tapping new markets to maintain their position in the global market. Some of the key developments are:

- May 2024: Lumotive, a pioneer in optical semiconductor technology, and Hokuyo Automatic Co. Ltd, a global provider of sensors and automation, commercially introduced the YLM-10LX 3D lidar sensor. This product is primarily powered by Lumotive's Light Control Metasurface (LCM) optical beamforming technology that represents a major leap forward in terms of applying solid-state, programmable optics to transform 3D sensing throughout service robotics and industrial automation applications.

- February 2024: STMicroelectronics, a global semiconductor provider serving customers across the spectrum of electronics applications, launched an all-in-one, direct Time-of-Flight (dToF) 3D LiDAR (Light Detection and Ranging) module with 2.3k resolution. It can be used in multiple applications, such as camera assist, virtual reality, 3D webcams, robotics, and smart buildings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 69681

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of the Aftereffects of the COVID-19 Pandemic and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Integration of Optical and Electronic Components in Miniaturized Electronics Devices

- 5.1.2 Rising Demand for 3D-enabled Devices in Consumer Electronics

- 5.1.3 Growing Penetration of Image Sensors in Automobiles

- 5.1.4 Growing Requirement of Security and Surveillance Systems

- 5.2 Market Restraints

- 5.2.1 High Manufacturing Cost of Image Sensors

- 5.2.2 Limited Integration With Other Devices

- 5.2.3 High Cost Required for the Maintenance of these Devices

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Technology

- 6.2.1 Ultrasound

- 6.2.2 Structured Light

- 6.2.3 Time of Flight

- 6.2.4 Stereoscopic Vision

- 6.2.5 Other Technologies

- 6.3 By Type

- 6.3.1 Position Sensor

- 6.3.2 Image Sensor

- 6.3.3 Temperature Sensor

- 6.3.4 Accelerometer Sensor

- 6.3.5 Proximity Sensor

- 6.3.6 Other Types

- 6.4 By Connectivity

- 6.4.1 Wired Network Connectivity

- 6.4.2 Wireless Network Connectivity

- 6.5 By End-user Industry

- 6.5.1 Consumer Electronics

- 6.5.2 Automotive

- 6.5.3 Healthcare

- 6.5.4 Aerospace and Defense

- 6.5.5 Security and Surveillance

- 6.5.6 Media and Entertainment

- 6.5.7 Other End-user Industries

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia-Pacific

- 6.6.4 Middle East and Africa

- 6.6.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Microchip Technology Inc.

- 7.1.3 Omnivision Technologies Inc.

- 7.1.4 Qualcomm Inc.

- 7.1.5 Sick AG

- 7.1.6 Keyence

- 7.1.7 Texas Instruments Incorporated

- 7.1.8 GE Healthcare

- 7.1.9 STMicroelectronics

- 7.1.10 Google Inc.

- 7.1.11 Adobe Inc.

- 7.1.12 Autodesk Inc.

- 7.1.13 Panasonic Corporation

- 7.1.14 Trimble

- 7.1.15 Faro

- 7.1.16 Lockheed Martin

- 7.1.17 Dassault Systems

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.