PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643102

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643102

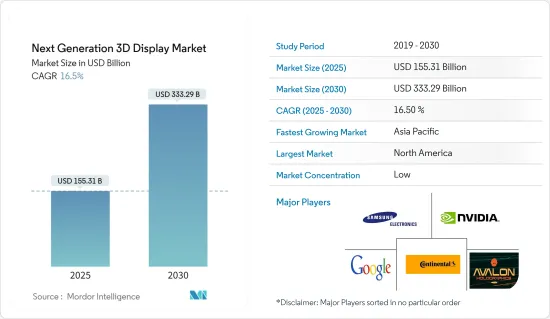

Next Generation 3D Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Next Generation 3D Display Market size is estimated at USD 155.31 billion in 2025, and is expected to reach USD 333.29 billion by 2030, at a CAGR of 16.5% during the forecast period (2025-2030).

The emphasis on developing multi-user displays and, in particular, using the refractive optics approach by the majority of companies, such as Samsung Electronics, Nvidia, Microsoft, etc., is also boosting the growth of the market.

Key Highlights

- The continuous development in panel manufacturing, the introduction of 8K television, and the increasing emphasis on visual comfort are some of the factors driving the growth of the market. The increase in smart TV use throughout the globe drives market growth. According to Ofcom, in the last year, 67% of homes in the UK owned a Smart TV.

- For the purpose of gaining an competitive advantage on the market, some companies have already incorporated glassless 3D into their products. For instance, in March 2023, ZTE, a China-based tech company, announced introducing of its latest innovation, the Nubia pad 3D, which offers glass-free 3D visuals. This tablet features a 12.4-inch LCD screen with a native resolution of 2560x1600px with a 120Hz refresh rate and 16:10 aspect ratio. Furthermore, brands like Acer and Asus have already announced laptops with glass-less 3D technology.

- Moreover, the growth in the 5G deployment in industries as part of industrial automation also contributes to developing a connected ecosystem where 3D-displayed smartphones and computers play a vital role. According to HMS Networks, the industrial automation networking market grew by 6% in 2021, with wireless waiting for 5G in factories.

- PC gaming has become a favorite choice among millennial gaming enthusiasts. This shift is primarily due to multiple factors, such as the quality of gameplay, availability of high-end software and hardware, and improved internet bandwidth. Newer exciting, and demanding technology, such as VR and 3D displays, are available today. As a result, PC gamers are expected to upgrade their equipment accordingly, which is also one of the reasons for helping to drive the sales of gaming-specific PCs and accessories such as gaming screens.

- Moreover, the high cost of assembling 3D display devices is restraining the market growth. The procedure entails the production and construction of novel technologies, which could prove to be financially burdensome for smaller enterprises. Moreover, the pricing may appear expensive for consumers in less developed countries, constraining the expansion of the market.

Next Generation 3D Display Market Trends

Consumer Electronics to Provide Growth Opportunities

- With the vigorous development of VR, augmented reality (AR) is also gradually emerging. The future of VR/AR technology based on holographic display is predicted by analogy with the VR/AR based on binocular vision display and light field display, thus creating growth opportunities for next-generation 3D display in the consumer electronics industry. For instance, in June 2023, Apple Inc. announced the introduction of its first-ever mixed-reality headset, ' Vision Pro.' The headset is primarily positioned as an Augmented Reality device but switches between AR and VR effortlessly using a dial.

- The consumer electronics segment in the next-generation 3D display market will witness high growth due to rising technological advancement, and the industry stands to gain significantly if glassless 3D technology gains wider acceptance.

- In addition, the market will grow steadily over the forecast period due to an increasing uptake of these screens in various consumer electronic devices such as monitors, TVs, smartphones, digital photo frames and notebook computers. The glassless 3D display in consumer electronics allows viewers to adjust the image's viewing depth, giving them greater control over their viewing experience.

- According to Ericsson, worldwide network subscriptions is expected to reach 7.95 billion units by 2028. Thus, the increasing adoption of high-end smartphones has led smartphone manufacturers to introduce advanced smartphone features to stay ahead of the competitors, which in turn has contributed to the market growth and is expected to do so over the study period.

- Furthermore, several leading manufacturers are focusing on developing new products to meet the growing demand. For instance, in April 2023, Sony Corporation announced to introduce new 3D display, the ELF-SR2, which displays a stereoscopic image where viewers can see without needing special glasses.

Asia Pacific to Witness Largest Growth in The Market

- Asia Pacific presents a very lucrative market for the holographic display market owing to the presence of developing economies as well as Countries like Taiwan have made great strides in the area of consumer electronics. Taiwan, China, , and South Korea. While the market in India is at a very nascent stage, however with a developing economy buoyed by a retail sector, increasing advertising expenditures, and improving public and private infrastructure in India, the demand for next-generation displays is expected to grow over the forecast period.

- Several leading players are focusing on bringing new and advanced technologies to the region, further supporting the market growth. For instance, in April 2022, Laqshya Media Group, a marketing communication group in India, announced to bring the immersive 3D display to India for Tanishq's season of bloom collection, Live a Dream. The display is installed at Bandstand Promenade, Bandra, in Mumbai. This 3D installation is a senatorial experience of fantastical realm of dreams and brings to life the elegance, complexity, and artistry of the assortment.

- Moreover, in May 2023, Motorola, a global smartphone brand, announced to launch of a new smartphone, "Edge 40," with a 3D curved display in India. The new smartphone is the perfect blend of cutting-edge technology, impeccable design, and software experiences that cater to the ever-evolving demands of consumers. Such introduction by the players will support the market growth.

- Further, the expansion of consumer electronics manufacturing capacities, The adoption of holographic displays is projected to grow especially in China's South Central Region due to the increasing exports into neighbouring Southeast Asian countries and lower average selling prices for various display technologies such as 4K, LCD, LED or OLED. among the different 3D display devices in the region.

- The easy availability of 3D gaming hardware and software in the region will boost the growth opportunities for next-generation 3D displays, as most of the prime vendors like Nintendo are based in the region, providing the region with a competitive edge over others.

Next Generation 3D Display Industry Overview

The next generation 3D display market is highly fragmented because of the presence of large number of players in the market. The major market players are focusing on technological advancements and the players are adopting different strategies namely acquisitions, partnerships, joint ventures, by which only top players are gaining the market share.

- February 2023- Continental AG announced to expand its 3D display solutions portfolio with 5K natural 3D display, an innovative display solution for a three-dimensional and immersive user experience. The display is illuminated through a matrix backlight with 3,000 LEDs, which results in excellent picture quality with high contrast, further helping to save power and improve readability.

- January 2023- Samsung Electronics announced to introduce its new Neo QLED, MICRO LED, and Samsung OLED lineups alongside lifestyle products and accessories. It features a 3D map view, designed for users to conveniently control and monitor connected devices; Samsung's 3D Map View provides users a bird's eye view of consumers' homes and all of their SmartThings devices at-a-glance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Growth of Automotive and Consumer Electronics Market

- 5.1.2 Rising Adoption of Digital Photo Frames and Head-mount Displays

- 5.2 Market Restraints

- 5.2.1 Lack of 3D Content Development

- 5.2.2 Cost-Intensive 3D Displays

- 5.3 Assessment of Impact of COVID-19 on the Industry

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 3D Holographic Display

- 6.1.2 Head Mounted Displays (HMD)

- 6.1.3 Static Volume Displays

- 6.1.4 Stereoscopy

- 6.1.5 Swept Volume Displays

- 6.1.6 Volumetric Displays

- 6.2 By Technology

- 6.2.1 Digital Light Processing Rear-Projection Television (DLP RPTV)

- 6.2.2 Light Emitting Diode (LED)

- 6.2.3 Organic Light Emitting Diode (OLED)

- 6.2.4 Plasma Display Panel (PDP)

- 6.2.5 Liquid Crystal Display (LCD)

- 6.3 By Access Method

- 6.3.1 Micro Display

- 6.3.2 Conventional/Screen Based Display

- 6.4 By End User Industry

- 6.4.1 Consumer Electronics

- 6.4.2 Automotive and Transportation

- 6.4.3 Medical

- 6.4.4 Aerospace & Defense

- 6.4.5 Industrial

- 6.4.6 Others

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avalon Holographics Inc.

- 7.1.2 Avegant Corp.

- 7.1.3 Robert Bosch GmbH

- 7.1.4 Continental AG

- 7.1.5 Fovi 3D

- 7.1.6 Samsung Electronics

- 7.1.7 Nvidia

- 7.1.8 Google

- 7.1.9 Coretronic Corporation

- 7.1.10 Creal 3D

- 7.1.11 SHARP Corporation

- 7.1.12 LG Electronics

- 7.1.13 AU Optronics Corp.

- 7.1.14 Panasonic Corporation

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS