Need help finding what you are looking for?

Contact Us

PUBLISHER: Parks Associates | PRODUCT CODE: 1223517

PUBLISHER: Parks Associates | PRODUCT CODE: 1223517

Security Monitoring: Business Models, Pricing, Attrition

PUBLISHED:

PAGES: 76 Slides

DELIVERY TIME: 1-2 business days

SELECT AN OPTION

SYNOPSIS:

The residential security market is in a moment of fundamental realignment. Self-install and self-monitoring system options have expanded the market and resulted in millions of new security households. This flagship study quantifies and examines security system owners' preferred business models, preferred price points, and reasons for attrition.

ANALYST INSIGHT:

"In 2023, residential security providers will continue to push the envelope on product innovation and services they provide in order to increase revenue in a market of slowing adoption." - Ryan Hulla , Research Analyst, Parks Associates.

Table of Contents

Executive Summary

- Security System Ownership

- Installation Among Recent Security System Buyers

- Adoption of Security Services

- High Likelihood to Switch Monitoring Provider

- Demographics of Security Households in US Internet Households

- Technology Affinity by Security Monitoring Services

- Installation Method for All Home Security Systems

- Installation Method for Home Security Systems Acquired within the Past 12 Months

- High Likelihood of Adopting New Services

- Likelihood of Cancelling Security System Contract by Age Group

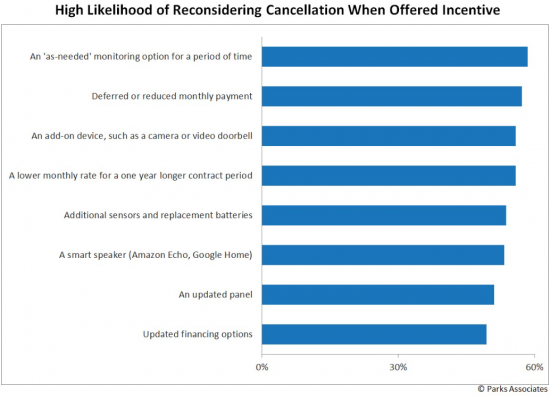

- High Likelihood of Reconsidering Cancellation When Offered Incentive

An Overview of Security Systems in US Internet Households - 2022

- Home Security System Ownership

- Interactive Systems Among Home Security Households

- Security Solution Adoption

- Security Service Adoption

- Home Security System & Service Adoption

- Home Security System Installation

- Installation Method for All Home Security Systems

- Installation Method for Home Security Systems Acquired within the Past 12 Months

- Alternative Security Solutions Considered, Among Recent System Buyers

- Demographics of Security Households in US Internet Households

Residential Security Services

- Adoption of Security Services

- Security Monitoring Service by Installation Method

- Top Security System Brands

- Top Professional Monitoring Service Providers, YoY

- Paid Home Security Service, YoY

- Paid Home Security Service by Service Provider

- Professional Monitoring Service Provider Net Promoter Score (NPS)

- Top 10 Brands by NPS, July 2022

- NPS of Top Professional Monitoring Providers, QoQ

Equipment Financing and Preferred Business Models for Security Monitoring

- Average Upfront Fees for Home Security Systems

- Security System Equipment Payment Method

- Security System Equipment Payment Method by Installation Method

- Security System Equipment Payment Method by Security Service Fees

Security Service Fees & New Services

- Average Monthly Fee for Home Security Service, YoY

- Avg Monthly Fee by Top 10 Brands, July 2022

- Home Security Service ARPU by Generation

- Home Security Service ARPU by Age Group

- Home Security Service ARPU by Family Size

- Security System Owner High Interest in Additional Services

Acquisition Channels and Triggers

- Security System Purchase Channels Among Recent Buyers

- Security System Purchase Location Among Recent Buyers

- Triggers of Security System Acquisition

- Security Monitoring Service by Purchase Triggers

- Experience of Accident or House Damage

- Beyond Intrusion: Top 3 Conditions for Security System to Detect

- Top Three Desired Features Beyond Intrusion Protection

Monitoring Provider Churn

- Changes Made to Home Security System in the Past 12 Months

- Reason for Switching Professional Monitoring Provider

- Reason for Cancelling Professional Monitoring Service

- High Likelihood of Switching to New Professional Monitoring Service Provider

- High Likelihood of Subscribing to Professional Monitoring Service

- High Likelihood of Switching Monitoring Providers by Monthly Home Security Service Cost

Cancellations and Retention Incentives

- High Likelihood of Cancelling Pro-Monitoring Service

- Likelihood of Cancelling Security System by Generation

- Likelihood of Cancelling Security System Contract by Age Group

- Left Length of Contract, Among Intended Cancellers

- Impact of Contract Terms on Cancellation Plans

- Impact of Retention Incentive on Cancellation Plans

- Impact of Service Pricing Discount as Retention Tool

Self-monitoring: Reasons and Selection

- Reason for Choosing Self Monitoring Service

- Reason for Choosing Specific Monitoring Service Than Other Options

- Attitudes toward Self-Monitored Security System

- Would these prompt you to subscribe to professional monitoring?

- Reason for Switching from Self to Professional Monitoring

Security System Intentions

- Security System Purchase and Intention to Buy

- Method of Security System Monitoring and Responding

- High Likelihood of Change to My Pro-Monitored Security System

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.