PUBLISHER: Parks Associates | PRODUCT CODE: 1394230

PUBLISHER: Parks Associates | PRODUCT CODE: 1394230

Security Dealer Perspectives: Views from the Front Line

SYNOPSIS:

Dealers are branching out into new areas to bolster revenues and to find applications that require or value professional installation and monitoring.

The 11th annual release of this survey investigates how dealers see the market today and the strategies that show opportunity for growth. It assesses the most important business drivers for dealers' residential business and the challenges that dealers face today. It quantifies shifting demand for smart home devices during the initial sale and as an aftermarket upgrade, and it highlights dealer perspectives on how artificial intelligence (AI) and the Matter standard will impact their businesses.

SAMPLE VIEW

Table of Contents

About the 2023 Surveyed Security Dealers

- Top Five Business Regions

- Average Residential Sales vs. Non-Residential Sales as a Percentage of the Dealers' Total Sales Units

Key Findings and Implications

- Revenue Expectations - % Change Over Prior Year

- Commercial Sales Growth, YoY

- Interest in Partnership with Vendors for New Service Opportunities

- Dealer-Reported Methods of Selling Security System

- Familiarity with Matter Initiative

- Top Three Business Impacts Dealers Expect from Matter

- Impact of AI on Business

2023 Industry Benchmarks and Trends

- Annual Revenues, YoY

- 2022 Annual Revenues

- Expected Changes in Revenues: 2023 vs. 2022

- Changes in Residential Revenues

- Dealer-Reported Average Installations Per Month

- Consumer-Reported Home Security System Ownership, YoY

- Type of Residential Security System Sold

- Company's Strategic Positioning

Business Drivers and Inhibitors

- Business Driver for Security Dealers

- Business Inhibitors for Security Dealers

- Approaches Used to Overcome Staffing Challenges

- Dealer-Reported Methods of Selling Security System

Monitoring, System Pricing, and Interactive Services

- Contract Term of Professional Monitoring Services, YoY

- Percentage of Residential Security System Sales

- Percentage of Firms Selling Specified Service

- Dealer Reported ARPU for Professional Monitoring

- Average Monthly Fee for Home Security Service, YoY reported by Consumers

- Average Monthly Fees for Various Professional Monitoring Services

- High Intention of Offering Add-On Services to Professional Monitoring

- Likelihood of Offering Add-On Services to Professional Monitoring in the Next 12 Months

- Interest in Partnership with Vendors for New Service Opportunities

- Inhibitors for New Value-added Service

- Subcontract Work to Others

Security Dealers & Smart Home Devices

- Security System Installations Including Smart Home Devices

- Installation of Smart Home Devices

- Security System Integration with Customer Owned Smart Home Devices, YoY

- Average Upfront Price by Type of Security Systems

- Difficulty of Integrating Smart Home Devices with Security System

Expected Impact of Matter and AI

- Familiarity with Matter Initiative

- Home Automation Standards, X10 to Matter

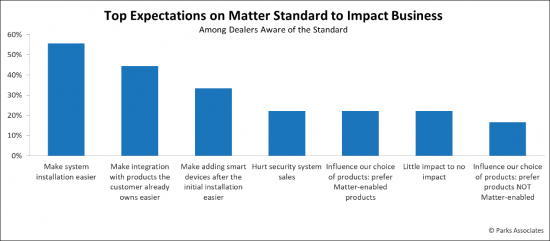

- Expectations on Matter Standard to Impact Business

- Impact of AI on Business

- AI as Selling Point for Smart Home Device Solution

Infrastructure & Ecosystem

- Method of Providing Professional Monitoring Services

- Companies Providing Professional Monitoring System

- Top Ranked Considerations in Selecting a Central Monitoring Station

- Primary Communication Path for Security Systems

- Installation % for Various Control Panel Brands, YoY

- High Importance of Control Panel Features

DIY/Self-Installed Security Systems

- % of Dealers Selling Self-Install Systems

- Method of Installation: Residential Security Sales by DIY System Dealers

- Installation Method for All Home Security Systems

- Installation Method for Home Security Systems Acquired within the Past 12 Months

- Reasons for Selling DIY Security Systems - % Ranking Reason Most Important

- Average % Professional Monitoring Service Adding After Self-Install System Sale

- Impact of DIY Systems on Residential Security Dealers

- Dealers Reporting Losing Sales to DIY Security Systems & Devices

Dealer Business Strategies: Commercial Growth & Succession

- Business Operating Length

- Business Owner

- Commercial Sales Growth, YoY

- Reasons to Increase Commercial Sales

- Succession Plan of Company

- Company Succession Statement

Appendix