PUBLISHER: Parks Associates | PRODUCT CODE: 1469329

PUBLISHER: Parks Associates | PRODUCT CODE: 1469329

Smart Home: Integration, Automation, and Control

SYNOPSIS:

The smart home is at a moment of maturity, where nearly half of US internet households own a core smart home device. Smart home players need to rethink their products and strategies for a more mass market buyer. At the same time, many consumers experience the "smart home" through one or more point solutions solving unique pain points - rather than a coordinated intelligent home experience.

SAMPLE VIEW

This flagship consumer study provides the latest trending data on smart home trends influencing consumer purchase behavior and preferences that provide critical intelligence for smart home business strategies. Topics include smart product adoption and purchase intention across multiple product categories, segmentation profiles, purchase channels and installation preferences, voice and control platforms, NPS by product category, and attitudes about interoperability.

Key questions addressed:

- 1. How is smart home device adoption trending overall and among specified product categories?

- 2. How were recently added devices acquired and installed?

- 3. How has the makeup of the adopter base changed since last year?

- 4. What are the leading smart home control platforms?

- 5. Do consumers coordinate their smart home devices to work together?

- 6. What are the top smart home use cases driving device integrations and routines?

"As the market expands into the mainstream, there is more urgency than ever to deliver on the integrated, automated, intelligent vision of the smart home." - Jennifer Kent, VP, Research, Parks Associates.

ABOUT THE AUTHORS:

Elizabeth Parks , President and Chief Marketing Officer.

As the President and Chief Marketing Officer at Parks Associates, Elizabeth Parks plays a pivotal role at Parks Associates. With over two decades of dedication to the company, she has been instrumental in shaping its growth and success, along with the continued focus of delivering timely and quality industry and consumer insights on the connected home and SMB industries.

Elizabeth's leadership extends across a diverse range of responsibilities. She is a driving force behind the company's research focus and coverage areas, ensuring that Parks Associates remains at the forefront of industry trends and insights for the broadband, consumer electronics, and home service markets. Her expertise is showcased in the strategic communication plan she orchestrates, encompassing advertising, public relations, and marketing efforts.

A cornerstone of her role is as the key organizer of Parks Associates' prestigious events, including Parks Associates signature event, CONNECTIONS(TM), Smart Energy Summit, Future of Video, Connected Health Summit, and Smart Spaces.

Jennifer Kent, Vice President, Research.

INDUSTRY EXPERTISE: Connected Health, Connected Home Technologies and Services, Connected Entertainment Products and Services

Jennifer manages the research department and Parks Associates' process for producing high-quality, relevant, and meaningful research. Jennifer also leads and advises on syndicated and custom research projects across all connected consumer verticals and guides questionnaire development for Parks Associates' extensive consumer analytics survey program. Jennifer is a certified focus group moderator, with training from the Burke Institute.

Table of Contents

Executive Summary

- Smart Home Device Ownership

- Growing Device Categories

- Tech Affinity, Among Smart Home Device Owners

- Number of Smart Home Devices Owned

- Smart Home Device Affordable & Value Groups

- Smart Home Device Purchases and Intentions to Buy

- Smart Camera or Smart Video Doorbell Ownership

- Paid Services for Stand-alone Video Products

- Purpose of Smart Home Device Integration

- Connected Device Owners with Coordinated Devices Working Together

- Top 10 Appealing Actions/Routines

- Preferred Methods of Initiating a Routine

- Purchase and Ecosystem Integration Considerations

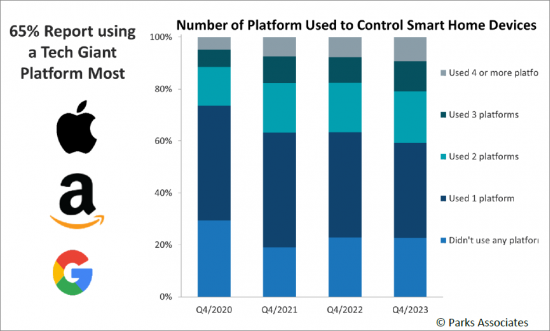

- Number of Platform Used to Control Smart Home Devices

- Smart Home Product Purchase Channel

- Smart Security & Safety Devices: Professional Installation

- Smart Energy Devices: Professional Installation

Smart Home Adoption

- Smart Home Device Ownership

- Smart Home Devices Adoption

- Average Smart Home Devices Owned

- Number of Smart Home Devices Owned

- Tech Affinity, by Smart Home Device Ownership

- Tech Affinity, Among Smart Home Device Owners

- Geoffrey Moore's "Crossing the Chasm" Theory

- Diffusion of Innovation: Tech Adopter Segments

Individual and Category Device Adoption

- Smart Safety & Security Device Ownership

- Smart Energy, Lighting, Water Device Ownership

- Smart Appliance Ownership

- Smart Speaker or Smart Display Ownership

The Business of Video Devices

- Smart Camera or Smart Video Doorbell Ownership

- Average # of Smart Cameras and Smart Video Doorbells Owned

- Video Doorbell Brand Purchased

- Smart Camera Brand Purchased

- Paid Services for Video Doorbells

- Paid Services for Network Cameras

- Smart Video Doorbell: Monthly Service Fees

- Smart Camera: Monthly Service Fees

Multifamily and Smart Home Adoption

- Smart Home Device Adoption & Intention by Type of Residents

- Smart Home Device Adoption & Intention by Type of Building

- Smart Home Device Owners/User Segments

- Smart Home Device Owners/User Segments

Smart Devices: Familiarity, Value, Affordability

- Parks Associates Theory of Relevancy

- Smart Devices: Familiarity vs. Value vs. Affordability

- Smart Devices: Familiarity

- Smart Device: Perceived Value of Benefit

- Smart Devices: Affordability

Device Purchases and Triggers

- Smart Home Device Purchases and Intentions to Buy

- Smart Security & Safety Device Purchases

- Smart Energy, Lighting, Water Device Purchases

- Smart Appliance Purchases

- Average Selling Price: Select Smart Home Devices

- Reasons for Purchasing Smart Home Devices

Purchase Intentions

- Smart Home Devices Purchase Intention: Safety & Security, Energy, Lighting, Water, Smart Appliance, Smart Home Control

- Purchase Intention: Smart Safety & Security Devices

- Purchase Intention: Smart Energy, Lighting, Water Device

- Purchase Intention: Smart Appliance

Purchase Channels and Replacements

- Smart Home Device Acquisition Method

- Smart Home Device Acquisition Method - Purchases

- Smart Home Device Acquisition Method - Gifts and Pre-installation

- Smart Home Product Purchase Channel

- Smart Home Devices Purchases: First Time vs. Repeat Purchases

- Smart Home Devices Purchase: First Time vs. Repeat Purchase

- Smart Security & Safety Devices: Professional Installation

- Smart Energy Devices: Professional Installation

Smart Home Control Trends

- Home Control App Usage

- Primary Control Method of Smart Home Devices Units

- Primary Control Method of Smart Safety & Security Device

- Primary Control Method of Energy, Lighting, Water Device

Smart Home Platform Preferences

- Platforms Used to Control Smart Home Devices

- Number of Platform Used to Control Smart Home Devices

- Most Used Platform Used to Control Smart Home Device

- Number of Platform Used to Control Smart Home Devices by Smart Home Device Ownership

- Preferred Provider for a Single Unified App

- Future Purchase and Ecosystem Integration Considerations Among Intenders

- Ecosystem Integration as Critical Consideration to Future Smart Home Device Purchase

Smart Home Routines/Integrations

- Balance of Automation & Personal Preferences

- Current Integration of Multiple Smart Home Devices Working Together

- Purpose of Smart Home Device Integration

- Appealing Actions/Routines Category

- Top Appealing Actions/Routines

- Appealing Actions/Routines Around Entrance

- Appealing Actions for a "Away" Routine

- Appealing Actions for a "Bedtime" Routine

- Appealing Actions for a "Wake-up" Routine

- Appealing Actions for a "Entertainment" Routine

- Appealing Actions for a "Dinner Time" Routine

- Appealing Actions for a "Work at Home" Routine

- US Internet HHs with a Remote Worker at Home

- Appealing Actions for Helping Care for Loved Ones

- Preferred Methods of Initiating a Routine

User Experience: NPS & Returns

- Net Promoter Score: Smart Home Devices 2024

- Smart Home Device NPS: Households with Children

- Smart Home Device NPS by Tech Affinity

- Net Promoter Score: Smart Safety & Security Devices

- Net Promoter Score: Energy, Lighting, Water Device

- Net Promoter Score: Smart Appliance

- Smart Home Device Purchases and Return

- Smart Home Device Return Rate in the Last 12 Months vs Purchase rate in the Past 6 Months

- Reasons for Returning Smart Home Devices

Appendix

- Demographic Breakdown of Tech Adopter Segments

- Housing-related Demographic Breakdown of Tech Adopter Segments

- Defining Heads of Internet Households