PUBLISHER: Roots Analysis | PRODUCT CODE: 1721367

PUBLISHER: Roots Analysis | PRODUCT CODE: 1721367

Display Market, Till 2035: Distribution by Type of Product, Type of Technology, Feature, Panel Size, End User, Brightness, Viewing Angle, Key Geographical Regions: Industry Trends and Global Forecasts

GLOBAL DISPLAY MARKET: OVERVIEW

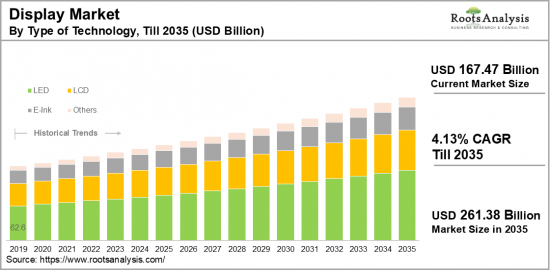

As per Roots Analysis, the global display market size is estimated to grow from USD 167.47 billion in the current year to USD 261.38 billion by 2035, at a CAGR of 4.13% during the forecast period, till 2035.

The opportunity for display market has been distributed across the following segments:

Type of Product

- Automotive Display

- Digital Signage & Large Format Displays

- Interactive Monitor

- Interactive Table

- Interactive Video Wall

- Interactive Whiteboard

- PC Monitor and Laptop

- Smartphones

- Smart Wearable

- Tablet

- Television

- Others

Type of Technology

- Direct-View LED

- E-Paper/E-Ink Display

- Liquid Crystal Display (LCD)

- IPS LCD

- TFT-LCD

- TFT-LCD

- VA LCD

- Others

- LED

- Micro-LED

- Organic Light-Emitting Diode (OLED)

- AMOLED

- Micro-LED

- Mini-LED

- PMOLED

- Others

- OLEDQuantum DOT

- Quantum Dot Display

- Others

Feature

- Flat Panel Display

- Flexible Panel Display

- Non-Touch Display

- Touch Display

- Transparent Panel Display

Panel Size

- Large display

- Medium display

- Micro-display

- Small display

End-User

- Aerospace / Defense

- BFSI

- Consumer Electronic

- Corporate / Industrial Enterprises

- Education

- Healthcare

- Retail

- Sports & Entertainment

- Transport

- Others

Type of Resolution

- Full HD (FHD)

- HD (High Definition)

- 4K (Ultra High Definition)

- 8K (Super High Definition)

- Other Resolution

Aspect Ratio

- 4:3

- 16:9

- 16:10

- Other Aspect Ratios

Type of Touch Technology

- Capacitive Touch

- Infrared Touch

- Resistive Touch

- Other Touch Technologies

Brightness

- High Brightness (More than 500 cd/m2)

- Low Brightness (Less than 200 cd/m2)

- Medium Brightness (200-500 cd/m2)

Viewing Angle

- Narrow Viewing Angle

- Ultra-Wide Viewing Angle

- Wide Viewing Angle

Power Consumption

- High Power Consumption (More than 5W)

- Low Power Consumption (Less than 1W)

- Medium Power Consumption (1-5W)

Durability

- High Durability

- Scratch Resistant,

- Water Resistant

- Medium Durability

- Low Durability

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

DISPLAY MARKET: GROWTH AND TRENDS

The evolution of digital technology in the display sector has opened up unparalleled opportunities for companies to connect with and engage their intended audiences. The increasing trend towards larger screens across various fields, coupled with the introduction of innovative display technologies from advanced 3D displays to next-generation digital signage and video surveillance systems is transforming how people interact with information and visual content. Displays serve as devices that present information, data, images, and videos in a visual or tactile manner for users. Over the years, the rise of sophisticated technology has resulted in a range of technologies, including liquid crystal displays (LCDs), light-emitting diode displays (LEDs), organic light-emitting diode displays (OLEDs), and more. These displays are widely used in numerous devices, encompassing tablets, laptops, televisions, monitors, and digital signage.

Moreover, the role of displays in providing visual feedback and facilitating interaction between users and electronic devices enhances user experience across various applications and sectors, making them a favored option among users and businesses alike. The appeal of foldable displays, flat panels, and touchscreen functionality also attract consumers in search of high-quality displays for their commercial needs. Additionally, the rising trend of digital display solutions in the retail industry has generated new avenues for companies to improve their in-store experiences. Intelligent, data-driven retail displays that offer personalized product suggestions, real-time inventory updates, and seamless integration with e-commerce platforms ultimately boost sales and foster customer loyalty. Given these factors, industry participants are adopting these state-of-the-art display solutions to create a memorable impact and establish their brand value for sustainable success in the ever-evolving digital environment, which will likely enhance the market's growth potential during the forecast period, till 2035.

DISPLAY MARKET: KEY SEGMENTS

Market Share by Type of Product

Based on the type of product, the global display market is segmented into automotive displays, digital signage & large format displays (interactive kiosks, interactive monitors, interactive tables, interactive video walls, interactive whiteboards), PC monitors and laptops, smart wearables, tablets, television, and others. According to our estimates, currently, smartphones segment captures the majority share of the market. This can be attributed to the growing adoption of OLED and flexible displays in smartphones, which provide outstanding color precision and vibrancy, delivering richer and more lifelike visuals. However, wearable segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Technology

Based on the type of technology, the display market is segmented into direct-view LED, E-Paper / E-Ink, Liquid Crystal Display (LCD) (IPS LCD, TFT-LCD, TFT-LCD, VA LCD, Others) LED, Micro-LED, Organic Light-Emitting Diode (OLED), AMOLED, Micro-LED, Mini-LED, PMOLED), quantum dot, and others. According to our estimates, currently, OLED displays segment captures the majority share of the market. This can be attributed to the fact that major smartphone manufacturers, including Apple, Samsung, and Google, are increasingly incorporating OLED displays into their devices such as mobiles, tablets, and TVs due to their superior display quality and design versatility, which boosts demand for OLED technology. However, micro-LED segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Feature

Based on the feature, the display market is segmented into flat panel display, flexible panel display, non-touch display, touch display, and transparent panel display. According to our estimates, currently, flat panels segment captures the majority share of the market, owing to the fact that flat panels have become standard displays widely used in TVs, monitors, laptops, and tablets. However, touchscreen displays segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Panel Size

Based on the panel size, the display market is segmented into large display, medium display, micro-display, and small display. According to our estimates, currently, micro display segment captures the majority share of the market. The use of micro-displays in wearable technology like smartwatches and near-to-eye devices, which require compact screens, greatly benefits from the advantages offered by micro-displays. Additionally, specialized medical devices that utilize micro-displays are anticipated to contribute to market expansion. However, medium display panels segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by End User

Based on end user, the display market is segmented into aerospace / defense, BFSI, consumer electronics, corporate / industrial enterprises, education, healthcare, retail, sports & entertainment, transport, and others. According to our estimates, currently, consumer electronic segment captures the majority share of the market. This can be attributed to several factors, including the increasing demand for smartphones and consumers' growing preference for larger screens that offer a more immersive viewing experience, especially with the increasing availability of high-definition and ultra-high-definition (4K and 8K) content, along with gamers' preferences for larger displays to enhance their gaming experiences. However, sports and entertainment segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Resolution

Based on type of resolution, the display market is segmented into HD, 4K (ultra high definition), 8K (super high definition), and other resolutions. According to our estimates, currently, 4K (ultra-high definition) segment captures the majority share of the market. This can be attributed to the increasing demand for 4K resolution displays, particularly for streaming services and content creation. However, full HD resolution displays segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Aspect Ratio

Based on aspect ratio, the display market is segmented into 4:3, 16:9, 16:10, and others. According to our estimates, currently, 16:9 aspect ratio segment captures the majority share of the market. This can be attributed to its status as the standard aspect ratio widely utilized in most consumer electronics such as televisions, monitors, and smartphones. Additionally, it is the most frequently supported aspect ratio for both content consumption and creation. However, 16:10 aspect ratio segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Touch Technology

Based on type of touch technology, the display market is segmented into capacitive touch, infrared touch, resistive touch, and other touch technologies. According to our estimates, currently, capacitive touch segment captures the majority share of the market. The rise in consumer electronics, such as smartphones, computers, tablets, and other devices that demand high performance in touch sensitivity and user experience, drives the expansion of this segment. As a result, the segment is projected to grow during the forecast period.

Market Share by Brightness

Based on brightness, the display market is segmented into high brightness (more than 500 cd/m2, low brightness (less than 200 cd/m2), and medium brightness (200-500 cd/m2). Medium brightness (200-500 cd/m2) is particularly dominant in consumer electronics such as TVs, mobile devices, tablets, and iPads, leading to its majority share in the market. Additionally, its benefits in providing better visibility in bright and outdoor settings, as well as improved high dynamic range (HDR) performance, are expected to lead to significant growth at a considerable CAGR during the forecast period.

Market Share by Type of Viewing

Based on type of viewing, the display market is segmented into narrow viewing angles, ultra-wide viewing angles, and wide viewing angles. According to our estimates, currently, wide viewing angles segment captures the majority share of the market. Wide viewing angles are commonly used in consumer electronics where shared viewing happens frequently, and their varied color brightness consistency contributes to them holding the largest market share in this segment. Moreover, the demand for high-end and professional screens boosts market growth. However, ultra-wide viewing angles segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Power Consumption

Based on power consumption, the display market is segmented into high power consumption (more than 5W), low power consumption (less than 1W), and medium power consumption (1-5W). According to our estimates, currently, medium power consumption (1-5W) segment captures the majority share of the market. This can be attributed to their well-rounded performance and efficiency, making them well-suited for a variety of consumer electronics, with designs that enhance energy efficiency.

Market Share by Durability

Based on durability, the display market is segmented into high durability (scratch-resistant, water-resistant), low durability, and medium durability. According to our estimates, currently, high-durability displays segment captures the majority share of the market. This can be attributed to the rising consumer demand for robust, reliable devices that can withstand daily wear and accidental damage. This feature is especially important in mobiles, wearables, and tablets, as these devices are particularly vulnerable to scratches and water exposure.

Market Share by Geographical Regions

Based on the geographical regions, the display market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. According to our estimates, currently, North America captures the majority share of the market. This can be attributed to the strong demand for interactive displays in corporate, retail, and educational sectors due to their high resolution and enhanced audience engagement. Further, the presence of industry leaders with a diverse range of products contributes to the growth of the market in this region. However, the market share in Asia is anticipated to grow at a higher CAGR during the forecast period.

Example Players in Display Market

- AUO Corporation

- BOE Technology Group

- Box Light Corporation

- Chi Mei Corporation

- Innolux Corporation

- Japan Display

- Leyard Optoelectronic

- LG Display

- Marvel Technology

- Minda Industries

- Mitsubishi Electric

- NEC Corporation

- Panasonic Corporation

- Samsung Electronics

- Sharp Corporation

- Sony Corporation

DISPLAY MARKET: RESEARCH COVERAGE

The report on the display market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the display market, focusing on key market segments, including [A] type of products, [B] type of technology, [C] feature, [D] panel size, [E] type of end-user, [F] type of resolution, [G] aspect ratio, [H] type of touch technology, [I] brightness, [J] viewing angle, [K] power consumption, [L] durability and [M] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the Display market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the Display market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] display portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in display market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

- Which type of display is expected to dominate the market?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.4. Research and Development Heads

- 2.4.2.5.2. Technical Experts

- 2.4.2.5.3. Subject Matter Experts

- 2.4.2.5.4. Scientists

- 2.4.2.5.4. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.2.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7 Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.5.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.5.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Display

- 6.2.1. Type of Product

- 6.2.2. Type of Technology

- 6.2.3. Type of Feature

- 6.2.4. Type of Resolution

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Display: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2.1. AUO Corporation*

- 8.2.1.1. Company Overview

- 8.2.1.2. Company Mission

- 8.2.1.3. Company Footprint

- 8.2.1.4. Management Team

- 8.2.1.5. Contact Details

- 8.2.1.6. Financial Performance

- 8.2.1.7. Operating Business Segments

- 8.2.1.7. Service / Product Portfolio (project specific)

- 8.2.1.9. MOAT Analysis

- 8.2.1.10. Recent Developments and Future Outlook

- 8.2.2. BOE Technology Group

- 8.2.3. Box Light Corporation

- 8.2.4. Chi Mei Corporation

- 8.2.5. Innolux Corporation

- 8.2.6. Japan Display

- 8.2.7. Nippon Sheet Glass

- 8.2.8. Marvel Technology

- 8.2.9. Minda Industries

- 8.2.10. Samsung Electronics

- 8.2.1. AUO Corporation*

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL Display MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Display Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF PRODUCT

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Display Market for Automotive Display: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. Display Market for Digital Signage & Large Format Displays: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. Display Market for PC Monitor and Laptop: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.9. Display Market for Smartphones: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.10. Display Market for Smart Wearable: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.11. Display Market for Tablet: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.12. Display Market for Television: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.9. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF TECHNOLOGY

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Display Market for Direct-View LED: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Display Market for E-Paper / E-Paper Ink: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Display Market for LCD: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Display Market for Micro-LED: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.10. Display Market for OLED: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.11. Display Market for Quantum DOT: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.12. Display Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.13. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON FEATURE

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Display Market for Flat Panel Display: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Display Market for Flexible Panel Display: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Display Market for Non-Touch Display: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.9. Display Market for Touch Display: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.10. Display Market for Transparent Panel Display: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.11. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON PANEL SIZE

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Display Market for Large Display: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Display Market for Medium Display: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Display Market for Micro-display: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.9. Display Market for Small Display: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.10. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON END-USER

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Display Market for Aerospace/ Defense: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Display Market for BFSI: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Display Market for Consumer Electronic: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Display Market for Corporate/ Industrial Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.9. Display Market for Education: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.10. Display Market for Healthcare: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.11. Display Market for Retail: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.12. Display Market for Sports & Entertainment: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.13. Display Market for Transport: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.14. Display Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.15. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TYPE OF RESOLUTION

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Display Market for 4K (Ultra High Definition): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Display Market for 8K (Super High Definition): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Display Market for Full HD: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.9. Display Market for HD (High Definition): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.10. Display Market for Other Resolutions: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.11. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON ASPECT RATIO

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Display Market for 4:3: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Display Market for 16:9: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Display Market for16:10: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.9. Display Market for Other Aspect Ratios: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.10. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON TYPE OF TOUCH TECHNOLOGY

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Display Market for Capacitive Touch: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Display Market for Infrared Touch: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Display Market for Resistive Touch: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.9. Display Market for Other Touch Technologies: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.10. Data Triangulation and Validation

20. MARKET OPPORTUNITIES BASED ON BRIGHTNESS

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Display Market for High Brightness (More than 500 cd/m2): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Display Market for Low Brightness (Less than 200 cd/m2): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Display Market for Medium Brightness (200-500 cd/m2): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.9. Data Triangulation and Validation

21. MARKET OPPORTUNITIES BASED ON VIEWING ANGLE

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Display Market for Narrow Viewing Angle: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Display Market for Ultra-Wide Viewing Angle: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Display Market for Wide Viewing Angle: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.9. Data Triangulation and Validation

22. MARKET OPPORTUNITIES BASED ON POWER CONSUMPTION

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Display Market for High Power Consumption (More than 5W): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Display Market for Low Power Consumption (Less than 1W): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.8. Display Market for Medium Power Consumption (1-5W): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.9. Data Triangulation and Validation

23. MARKET OPPORTUNITIES BASED ON DURABILITY

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Display Market for High Durability: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Display Market for Low Durability: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.8. Display Market for Medium Durability: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.9. Data Triangulation and Validation

24. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Display Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Display Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.8. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR DISPLAY IN NORTH AMERICA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Display Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Display Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. Display Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Display Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Display Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR DISPLAY IN EUROPE

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Display Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Display Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. Display Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Display Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. Display Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. Display Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. Display Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.7. Display Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.8. Display Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.9. Display Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.10. Display Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.11. Display Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.12. Display Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.13. Display Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.14. Display Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.15. Display Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR DISPLAY IN ASIA

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Display Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. Display Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.2. Display Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. Display Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.4. Display Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.5. Display Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.6. Display Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR DISPLAY IN MIDDLE EAST AND NORTH AFRICA

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. Display Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.1. Display Market in Egypt: Historical Trends (Since 218) and Forecasted Estimates (Till 205)

- 28.6.2. Display Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.3. Display Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.4. Display Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Display Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.6. Display Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.7. Display Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.8. Display Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.7. Data Triangulation and Validation

29. MARKET OPPORTUNITIES FOR DISPLAY IN LATIN AMERICA

- 29.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 29.3. Revenue Shift Analysis

- 29.4. Market Movement Analysis

- 29.5. Penetration-Growth (P-G) Matrix

- 29.6. Display Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.1. Display Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.2. Display Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.3. Display Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.4. Display Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.5. Display Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.6. Display Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.7. Data Triangulation and Validation

30. MARKET OPPORTUNITIES FOR DISPLAY IN REST OF THE WORLD

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Revenue Shift Analysis

- 30.4. Market Movement Analysis

- 30.5. Penetration-Growth (P-G) Matrix

- 30.6. Display Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 30.6.1. Display Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 30.6.2. Display Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 30.6.3. Display Market in Other Countries

- 30.7. Data Triangulation and Validation

31. TABULATED DATA

32. LIST OF COMPANIES AND ORGANIZATIONS

33. CUSTOMIZATION OPPORTUNITIES

34. ROOTS SUBSCRIPTION SERVICES

35. AUTHOR DETAIL