PUBLISHER: Roots Analysis | PRODUCT CODE: 1721372

PUBLISHER: Roots Analysis | PRODUCT CODE: 1721372

Industrial Automation Market, Till 2035: Distribution by Type of Component, By Mode of Automation, By Area of Application, By Company Size, End User, Business Model, and Key Geographical Regions : Industry Trends and Global Forecasts

Industrial Automation Market Overview

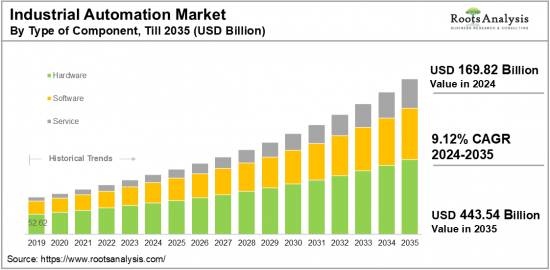

As per Roots Analysis, the global industrial automation market size is estimated to grow from USD 169.82 billion in the current year to USD 443.54 billion by 2035, at a CAGR of 9.12% during the forecast period, till 2035.

The opportunity for industrial automation market has been distributed across the following segments:

Type of Component

- Hardware

- Software

Mode of Automation

- Flexible

- Fixed

- Integrated

- Programmable

Type of Industry

- Discrete Industry

- Automotive

- Process Industry

- Food & Beverage

- Healthcare

- Manufacturing

- Oil & Gas

Type of Offering

- Services

- Solutions

- Enterprise-level Controls

- Plant Instrumentation

- Plant-level Controls

Type of Deployment

- Cloud-based

- On Premises

Type of Product

- Distributed Control System

- Human-Machine Interface

- Industrial Robots

- Machine Vision Systems

- Manufacturing Execution Systems (MES)

- Programmable Logic Controller (PLC)

- Supervisory Control and Data Acquisition (SCADA)

Area of Application

- Distributed Control System

- Human-Machine Interface

- Industrial Robots

- Machine Vision Systems

- Manufacturing Execution Systems (MES)

- Programmable Logic Controller (PLC)

- Supervisory Control and Data Acquisition (SCADA)

Company Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

End User

- Automotive

- Chemicals & Petrochemicals

- Electronics & Semiconductors

- Food & Beverage

- Mining & Metals

- Oil & Gas

- Pharmaceuticals

- Power Generation

- Pulp & Paper

- Water and Wastewater

- Others

Business Model

- B2B

- B2C

- B2B2C

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

INDUSTRIAL AUTOMATION MARKET: GROWTH AND TRENDS

The industrial automation market is a vibrant and swiftly changing field that transforms traditional manufacturing methods by incorporating state-of-the-art technologies. This market plays a crucial role in improving operations, efficiency, and economies across various business sectors. It includes a diverse array of automation solutions such as robotics, control systems, sensors, and software, all designed to enhance effectiveness and safety within the production process while guaranteeing consistency and dependability of manufactured goods.

The rising demand for industrial products has prompted a transition from traditional industrial methods to fully automated systems that boost efficiency and reduce operational costs for both processes and products. This transition has resulted in decreased labor needs and expenses, as well as increased goods production, further invigorating the industry. For example, in 2024, Piaggio Fast Forward (PFF), the Boston subsidiary of the Italian automotive firm Piaggio, launched kilo, a factory robot equipped with artificial intelligence.

The growing necessity for high-quality products that comply with stringent regulatory and government standards encourages businesses to embrace automation solutions. These technologies aid in maintaining product uniformity and compliance with regulatory mandates. It is noteworthy that various acquisitions are contributing to a significant investment aimed at improving the overall market. For instance, in April 2024, Lear bolstered its automation and artificial intelligence capabilities through the strategic acquisition of WIP industrial automation.

The rising expense of machinery can pose challenges in the short term, and small and medium-sized enterprises (SMEs) find it difficult to invest in machinery due to its high acquisition and maintenance costs. Moreover, machinery that operates over the internet faces obstacles because of cyber security threats. Despite the challenges presented by the expenses and vulnerabilities associated with machinery in industrial environments, the market is growing exceptionally well, driven by opportunities for expansion and the introduction of innovative solutions.

Further, the advent of advanced tools and technologies, like Industrial Internet of Things (IIoT) technology and integrated Artificial Intelligence (AI) algorithms, provides further possibilities for predictive maintenance, analytics, and informed decision-making. These innovations can improve operational efficiency, minimize losses, and enhance potential profit margins, suggesting that the market is experiencing exponential growth and is expected to continue expanding in the future.

INDUSTRIAL AUTOMATION MARKET: KEY SEGMENTS

Market Share by Type of Component

Based on the type of component, the global industrial automation market is segmented into hardware, software, and services. According to our estimates, currently, hardware segment captures the majority share of the market, owing to the growing demand for physical components necessary for establishing automation systems. However, software segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Mode of Automation

Based on the mode of automation, the industrial automation market is segmented into fixed, programmable, flexible, and integrated automation systems. According to our estimates, currently, programmable automation captures the majority share of the market. This can be attributed to its capability to swiftly adjust to various product designs and high demand for flexible automation in the electronics, automotive, and consumer goods sectors.

Market Share by Type of Industry

Based on the type of industry, the industrial automation market is segmented into process industries and discrete industries. According to our estimates, currently, oil and gas sector captures the majority share of the market. This can be attributed to substantial investments in automation, driven by the complexity of operations and the necessity for efficient resource management. Additionally, the manufacturing sector includes a wide array of industries that heavily depend on automation for enhancing operational efficiency and productivity, thereby significantly propelling overall market growth

Market Share by Type of Offering

Based on the type of offering, the industrial automation market is segmented into solutions and services, which are further split into enterprise-level controls, plant instrumentation, consulting services and others. According to our estimates, currently, plant-level controls, which consist of control systems like PLCs (Programmable Logic Controllers), DCS (Distributed Control Systems), and HMI (Human-Machine Interface) systems, captures the majority share of the market. This can be attributed to their essential role in the real-time control and monitoring of manufacturing processes.

Market Share by Type of Deployment

Based on the type of deployment, the industrial automation market is segmented into cloud based and on-premises. According to our estimates, currently, cloud-based deployment captures the majority share of the market. This can be attributed to its remote accessibility, adaptability, and lower maintenance needs. The choice between these deployment types can differ based on the unique requirements and preferences of organizations in each industry sector. Although on-premises solutions were historically more prevalent, the shift towards cloud-based options is progressively increasing owing to advantages such as scalability, flexibility, and cost efficiency. The deployment market is continually demonstrating exponential growth driven by automation and is expected to expand further in the future.

Market Share by Type of Product

Based on the type of product, the industrial automation market is segmented into DCS, HMI, MES, PLC, SCADA, and others. According to our estimates, currently, distributed control systems (DCS) and programmable logic controllers (PLC), captures the majority share of the market, owing to their broad application in intricate industrial processes and manufacturing.

However, there are several other product components that are also prevalent in the market. Key examples include SCADA systems, which are extensively employed across various industries for real-time data gathering and management. These systems are particularly important in sectors such as oil and gas, water treatment, and energy. Further, the increasing use of industrial robots and machine vision systems is fueled by technological advancements and the rising need for automation in manufacturing, propelling market growth.

Market Share by Area of Application

Based on the area of application, the industrial automation market is segmented into assembly line automation, material handling, packaging, QC, inspection, supply chain automation, and others. According to our estimates, currently, assembly line automation captures the majority share of the market. This can be attributed to its inclusion of automated systems for product assembly, primarily employed in sectors such as automotive, electronics, and manufacturing. Moreover, there has been a notable increase in the growth of material handling automation, which occupies a considerable portion of the market owing to the use of robotic arms, automated guided vehicles (AGVs), and conveyor systems for the movement, storage, and management of goods.

Market Share by Company Size

Based on the company size, the industrial automation market is segmented into large, small, and medium enterprises. According to our estimates, currently, large companies captures the majority share of the market. This can be attributed to various reasons, such as their resources and scale advantages. These companies possess substantial assets, including financial resources, research and development capabilities, and well-established manufacturing facilities. Their size enables them to invest in advanced technologies, offer a diverse product range, and connect with a larger customer base.

Market Share by End User

Based on the end user, the industrial automation market is segmented into automotive, chemicals & petrochemicals, electronics & semiconductors, food & beverage, mining & metals, oil & gas, pharmaceuticals, power generation, pulp & paper, water and wastewater, and others. According to our estimates, currently, automotive sector captures the majority share of the market. This can be attributed to strong dependence on automation for manufacturing processes, quality assurance, and assembly lines, which boosts productivity and ensures accuracy.

Additionally, the food and beverage sector is witnessing increased market value due to the necessity for hygiene, effective packaging, and consistent product quality. Industrial automation plays a vital role in the manufacturing, packaging, and distribution of various products, including pharmaceuticals, which further drives growth and results in a significant upward trend in the overall segment.

Market Share by Type of Business Model

Based on the type of business model, the industrial automation market is segmented into B2B, B2C and B2B2C. According to our estimates, currently, B2B captures the majority share of the market. This can be attributed to the rising adoption of global industrial automation technologies across various industries, including manufacturing, healthcare, finance, and more. Additionally, the B2C model is projected to experience a significant CAGR throughout the forecast period, as global industrial automation technologies are becoming increasingly user-friendly, and consumers are adopting these technologies for manufacturing and managing products.

Market Share by Geographical Regions

Based on the geographical regions, the industrial automation market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. According to our estimates, currently, North America captures the majority share of the market. This can be attributed to various factors increased awareness, leading to a higher demand in commercial sectors such as retail, banking, and corporate environments. Additionally, government investment aimed at enhancing public safety and safeguarding critical infrastructure has surged significantly. Moreover, the adoption of advanced video analytics and integrated surveillance systems has played a crucial role in increasing demand for global industrial automation solutions. However, market in Asia is anticipated to grow at a higher CAGR during the forecast period.

Example Players in Industrial automation Market

- Accuron Technologies

- Automi AI

- B&R

- Danaher Industrial

- Electrotek

- Elaratech Automation

- Emerson

- FANUC America Corporation

- Festo

- Flexciton

- General Electric

- Hitech Digital Solutions

- Honeywell

- JM VisTec System

- Kawasaki Heavy Industries

- Metis Labs

- Mitsubishi Electric

- Omron Automation

- PHOENIX CONTACT

- Quadrant Technologies

- Rockwell Automation

- SAVCOS AUTOMATION

- Schneider Electric

- SESTO Robotics

- Siemens

- SmartClean Technologies

- SMEC Automation

- TVARIT

- Xiaoxin Machines

- Yokogawa Electric

INDUSTRIAL AUTOMATION MARKET: RESEARCH COVERAGE

The report on the industrial automation market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the industrial automation market, focusing on key market segments, including [A] type of component, [B] modes of automation, [C] type of industry, [D] type of offering, [E] type of deployment, [F] type of product, [G] area of application, [H] company size, [I] end user, [J] business model and [K] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the industrial automation market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the industrial automation market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] industrial automation portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in industrial automation market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Global Industrial Automation

- 6.2.1. Key Characteristics of Global Industrial Automation market

- 6.2.2. Type of Component

- 6.2.3. Mode of Automation

- 6.2.4. Type of Industry

- 6.2.5. Type of Offering

- 6.2.6. Type of Deployment

- 6.2.7. Type of Product

- 6.2.8. Area of Application

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Global Industrial Automation: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Accuron Technologies*

- 8.2.1. Company Overview

- 8.2.2. Company Mission

- 8.2.3. Company Footprint

- 8.2.4. Management Team

- 8.2.5. Contact Details

- 8.2.6. Financial Performance

- 8.2.7. Operating Business Segments

- 8.2.8. Service / Product Portfolio (project specific)

- 8.2.9. MOAT Analysis

- 8.2.10. Recent Developments and Future Outlook

- Similar detail is presented for other below mentioned companies based on information in the public domain

- 8.3. Hitech Digital Solutions

- 8.4. Honeywell

- 8.5. JM VisTec System

- 8.6. Kawasaki Heavy Industries

- 8.7. Metis Labs

- 8.8. Mitsubishi Electric

- 8.9. Omron Automation

- 8.10. PHOENIX CONTACT

- 8.11. Siemens

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. INDUSTRIAL AUTOMATION MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Industrial Automation Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF COMPONENT

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Industrial Automation Market for Hardware: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. Industrial Automation Market for Software: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON MODE OF AUTOMATION

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Industrial Automation Market for Flexible: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Industrial Automation Market for Fixed: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Industrial Automation Market for Integrated: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Industrial Automation Market for Programmable: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.10. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF INDUSTRY

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Industrial Automation Market for Discrete: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.6.1. Industrial Automation Market for Automotive: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Industrial Automation Market for Process Industry: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7.1. Industrial Automation Market for Food & Beverage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7.2. Industrial Automation Market for Healthcare: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7.3. Industrial Automation Market for Manufacturing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7.4. Industrial Automation Market for Oil and Gas: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF OFFERING

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Industrial Automation Market based on Solutions: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.6.1. Industrial Automation Market based on Enterprise-level Controls: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.6.2. Industrial Automation Market based on Plant Instrumentation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.6.3. Industrial Automation Market based Plant-level Controls: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Industrial Automation Market based on Services: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF DEPLOYMENT

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Industrial Automation Market for Cloud-based: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Industrial Automation Market for On-Premises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TYPE OF PRODUCT

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Industrial Automation Market based on Distributed Control System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Industrial Automation Market based on HMI: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Industrial Automation Market based on Industrial Robots: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.9. Industrial Automation Market based on MVS: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.10. Industrial Automation Market based on Manufacturing Execution Systems: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.11. Industrial Automation Market based on PLC: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.12. Industrial Automation Market based on SCADA: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.13. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON TYPE OF APPLICATION

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Industrial Automation Market based on Assembly Line Automation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Industrial Automation Market based on Material Handling: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Industrial Automation Market based on Packaging: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.9. Industrial Automation Market based on Quality Control & Inspection: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.10. Industrial Automation Market based on Supply Chain Automation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.11. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Industrial Automation Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Industrial Automation Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Data Triangulation and Validation

20. MARKET OPPORTUNITIES BASED ON END USER

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Industrial Automation Market for Automotive: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Industrial Automation Market for Chemicals & Petrochemicals: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Industrial Automation Market for Electronics and Semiconductors: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.9. Industrial Automation Market for Food & Beverage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.10. Industrial Automation Market for Mining and Metals: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.11. Industrial Automation Market for Oil & Gas: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.12. Industrial Automation Market for Pharmaceuticals: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.13. Industrial Automation Market for Power Generation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.14. Industrial Automation Market for Pulp & Paper: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.15. Industrial Automation Market for Water and Wastewater: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.16. Industrial Automation Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.17. Data Triangulation and Validation

21. MARKET OPPORTUNITIES BASED ON BUSINESS MODEL

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Industrial Automation Market for B2B: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Industrial Automation Market for B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Industrial Automation Market for B2B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035))

- 21.9. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR INDUSTRIAL AUTOMATION IN NORTH AMERICA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. LMS Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.1. LMS Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.2. LMS Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.3. LMS Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.6.4. LMS Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR INDUSTRIAL AUTOMATION IN EUROPE

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Industrial Automation Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Industrial Automation Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Industrial Automation Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Industrial Automation Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Industrial Automation Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.5. Industrial Automation Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.6. Industrial Automation Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.7. Industrial Automation Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.8. Industrial Automation Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.9. Industrial Automation Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.10. Industrial Automation Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.11. Industrial Automation Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.12. Industrial Automation Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.13. Industrial Automation Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.14. Industrial Automation Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.15. Industrial Automation Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR INDUSTRIAL AUTOMATION IN ASIA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Industrial Automation Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Industrial Automation Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Industrial Automation Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Industrial Automation Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Industrial Automation Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. Industrial Automation Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. Industrial Automation Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR INDUSTRIAL AUTOMATION IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Industrial Automation Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Industrial Automation Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 25.6.2. Industrial Automation Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Industrial Automation Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Industrial Automation Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Industrial Automation Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Industrial Automation Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.7. Industrial Automation Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.8. Industrial Automation Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR INDUSTRIAL AUTOMATION IN LATIN AMERICA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Industrial Automation Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Industrial Automation Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. Industrial Automation Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Industrial Automation Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. Industrial Automation Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. Industrial Automation Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. Industrial Automation Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR INDUSTRIAL AUTOMATION IN REST OF THE WORLD

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Industrial Automation Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. Industrial Automation Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.2. Industrial Automation Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. Industrial Automation Market in Other Countries

- 27.7. Data Triangulation and Validation

28. TABULATED DATA

29. LIST OF COMPANIES AND ORGANIZATIONS

30. CUSTOMIZATION OPPORTUNITIES

31. ROOTS SUBSCRIPTION SERVICES

32. AUTHOR DETAILS