PUBLISHER: Roots Analysis | PRODUCT CODE: 1723661

PUBLISHER: Roots Analysis | PRODUCT CODE: 1723661

Virtual Biopsy Market by Target Therapeutic Area, Type of Cancer Targeted, Type of Imaging Technology, End Users, Geographical Regions and Leading Players: Industry Trends and Global Forecasts, till 2035

VIRTUAL BIOPSY MARKET

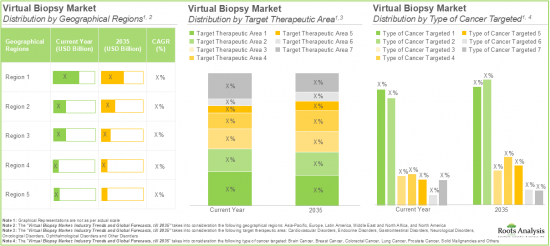

As per Roots Analysis, the virtual biopsy market, valued at USD 0.53 billion in 2019, is projected to reach USD 0.78 billion in current year and USD 3.02 billion by 2035, representing a CAGR of 14.47% during the forecast period.

The opportunity for virtual biopsy market has been distributed across the following segments:

Target Therapeutic Area

- Oncological Disorders

- Neurological Disorders

- Cardiovascular Disorders

- Ophthalmological Disorders

- Endocrine Disorders

- Gastrointestinal Disorders

- Others

Type of Cancer Targeted

- Solid Malignancies

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Colorectal Cancer

- Brain Cancer

- Others

Type of Imaging Technology

- Magnetic Resonance Imaging

- Computed Tomography

- X-ray

- Ultrasound

- Others

End Users

- Magnetic Resonance Imaging

- Computed Tomography

- X-ray

- Ultrasound

- Others

Geographical Regions

- North America (US and Canada)

- Europe (Germany, France, Italy, UK, Spain, Switzerland and Rest of Europe)

- Asia-Pacific (China, Japan, India, South Korea, Australia and Rest of Asia-Pacific)

- Middle East and North Africa (Saudi Arabia, Israel, Egypt, and Rest of Middle East and North Africa)

- Latin America (Brazil, Mexico, Argentina and Rest of Latin America)

VIRTUAL BIOPSY MARKET: GROWTH AND TRENDS

Over the years, healthcare professionals have been using conventional biopsy techniques for extracting patient samples surgically in order to analyze their condition. However, these methods are often associated with several complications, such as infections, hemorrhage after incision, and patient discomfort. In addition, conventional biopsy techniques are often cost intensive, with expenses related to sample collection, surgical interventions and operating room maintenance.

Based on estimates by the Indian Council of Medical Research (ICMR), the incidence of cancer cases is expected to increase from 1.4 million in 2022 to 1.5 million by 2025. As a result, the demand for safer and more efficient alternatives is increasing among medical professionals to enhance disease detection and patient care.

In order to meet the growing demand and mitigate the health concerns associated with the convention procedures, the virtual biopsy technique has gained traction as a non-invasive tool for disease detection and prognosis. This innovative technique provides various benefits, including reduced risks and the improved patient screening process. Further, virtual biopsy offers in-depth insights into patients' conditions by utilizing advanced artificial intelligence (AI) software that analyzes images from extracted samples in detail. Additionally, this approach plays a critical role in evaluating drug responses during treatment while mitigating the risks associated with surgical procedures, making it an essential tool for planning treatment.

Driven by the technological advancements in virtual biopsy techniques and the rising demand for effective patient care management, the adoption of virtual biopsy devices is steadily increasing and is anticipated to enable early detection and routine diagnostics in the healthcare sector.

VIRTUAL BIOPSY MARKET: KEY INSIGHTS

The report delves into the current state of the virtual biopsy market and identifies potential growth opportunities within the industry. Some key findings from the report include:

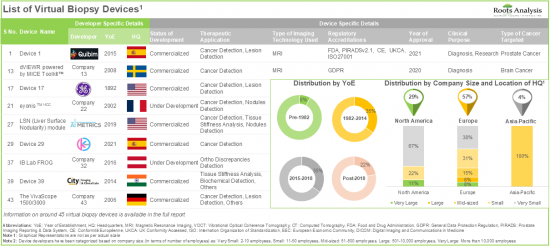

- Presently, about 45 virtual biopsy devices are being developed by various players worldwide; the innovation for 65% of these devices is being led by small players headquartered in developed regions.

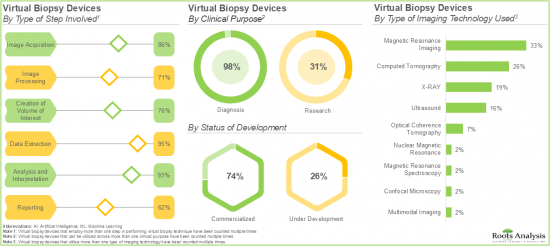

- Magnetic resonance imaging (33%) has emerged as the most widely employed technology for image acquisition purposes, owing to the fact that it uses safe magnetic and radio waves for capturing data.

- Close to 50% of the deals have been inked in the last two years, demonstrating a considerable increase in partnership activity during this period; of these, more than 65% of the partnerships were international deals.

- Given the various benefits of virtual biopsy techniques in improving healthcare outcomes, a significant number of investors have provided financial support to the companies; over USD 425 million has been invested since 2020.

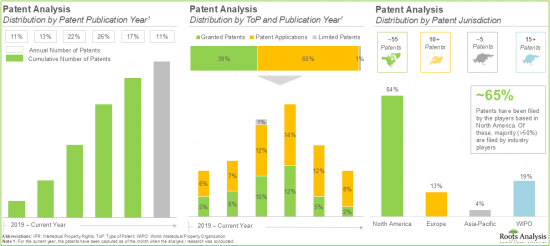

- Around 85 patents related to virtual biopsy have been filed / granted by various industry and non-industry players to protect the intellectual property generated within this field.

- More than 65 publications have been filed by scientists, focusing on recent technological advancements that contribute to the development of efficient healthcare tools.

- The virtual biopsy market is driven by an increase in the demand for safer and more efficient alternatives to conventional biopsy procedures; however, complex regulatory norms continue to pose a barrier to the industry growth.

- The market opportunity associated with virtual biopsy is likely to witness an annualized growth rate of 14.47% till 2035, owing to the growing demand for non-invasive and safer diagnostic tools.

- The overall opportunity is expected to be well distributed across different types of imaging technologies and end users.

VIRTUAL BIOPSY MARKET: KEY SEGMENTS

Oncological Disorder Segment is Likely to Dominate the Virtual Biopsy Market During the Forecast Period

Based on the target therapeutic area, the global market for virtual biopsy is segmented into oncological disorders, neurological disorders, cardiovascular disorders, ophthalmological disorders, endocrine disorders, gastrointestinal disorders and others. Currently, the majority share of the virtual biopsy market is captured by oncological disorders driven by the growing preference of physicians for non-invasive devices, such as virtual biopsy devices in cancer diagnosis. These devices meet this rising demand by using advanced technologies, such as computed tomography and magnetic resonance imaging for image capturing and analyzing the data.

Solid Malignancies Segment is Likely to Hold the Largest Share of the Virtual Biopsy Market During the Forecast Period

Based on the type of cancer targeted, the global virtual biopsy market is distributed across solid malignancies, breast cancer, lung cancer, prostate cancer, colorectal cancer, brain cancer and others. Currently, the solid malignancies segment is likely to dominate and drive the overall market growth. This can be attributed to the fact that solid tumors account for around 90% of all the adult cancer cases diagnosed, which results in increased demand for advanced diagnostic devices that can effectively diagnose such disorders.

By Type of Imaging Technology, Virtual Biopsy Devices Utilizing Magnetic Resonance Imaging Technology are Likely to Dominate the Market During the Forecast Period

Based on the type of imaging technology, the global virtual biopsy market is segmented across magnetic resonance imaging, computed tomography, X-ray, ultrasound and others. Notably, owing to the various advantages offered by magnetic resonance imaging (MRI) technology including a comprehensive 360-degree view of the sample, enabling easy and effective analysis of patient's condition, it is likely to dominate the virtual biopsy market during the forecast period.

Currently, Hospitals and Clinics Segment Holds the Largest Share of the Virtual Biopsy Market

Based on end users, the global market is segmented into hospitals and clinics, research institutions and diagnostic centers, and others. Currently, the hospitals and clinics segment holds the largest market share. This can be attributed to the increased demand for virtual biopsy devices in hospitals and clinics as these devices provide screening, diagnosis, and prognosis for various health conditions in these settings.

North America Accounts for the Largest Share of the Market

Based on geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America and Middle East and North Africa. In the current scenario, North America is likely to capture the largest market share. This can be attributed to the substantial budget amount allotted for research and development activities in the healthcare domain in this region. However, the virtual biopsy market in Latin America is expected to grow at a higher CAGR during the forecast period.

EXAMPLE PLAYERS IN THE VIRTUAL BIOPSY MARKET

- GE Healthcare

- Imaging Biometrics

- OptoVibronex

- ImageBiopsy Lab

- Median Technologies

- Quibim

- Siemens Healthineers

- City Imaging and Clinical Labs

VIRTUAL BIOPSY MARKET: RESEARCH COVERAGE

The report on the virtual biopsy market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the virtual biopsy market, focusing on key market segments, including [A] target therapeutic area, [B] type of cancer targeted, [C] type of imaging technology, [D] end users, [E] geographical regions and [F] leading players.

- Market Impact Analysis: A thorough analysis of various factors, such as drivers, restraints, opportunities, and existing challenges that are likely to impact market growth.

- Virtual Biopsy Devices Market Landscape: A comprehensive evaluation of various virtual biopsy devices, based on several relevant parameters, such as [A] status of development, [B] year of approval, [C] region of approval, [D] regulatory accreditations, [E] type of step involved, [F] clinical purpose, [G] type of imaging technology used, [H] therapeutic application, [I] target therapeutic area, and [J] type of cancer targeted. This section also features a list of players engaged in the development of virtual biopsy devices, along with analyses based on [A] year of establishment, [B] company size, [C] location of headquarters and [D] most active developers.

- Company Profiles: Detailed profiles of companies engaged in developing virtual biopsy devices across various regions, including [A] company overview, [B] financial information (if available), [C] virtual biopsy device portfolio, [D] recent developments and [E] an informed future outlook.

- Product Competitiveness Analysis: An in-depth analyses of virtual biopsy devices, based on various relevant parameters, such as [A] company strength, [B] product portfolio strength and [C] product portfolio diversity.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in virtual biopsy domain, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] type of imaging technology used, [E] therapeutic application, [F] most active players, and [G] geographical distribution of partnership activity.

- Funding and Investments: An in-depth analysis of the funding raised by companies engaged in the virtual biopsy domain, based on relevant parameters, such as [A] year of funding, [B] type of funding, [C] amount invested, [D] geographical distribution, [E] most active players and [F] most active investors.

- Patent Analysis: Detailed analysis of patents filed / granted till date in the virtual biopsy domain, based on various relevant parameters, such as [A] type of patent, [B] publication year, [B] application year, [C] CPC symbols, [D] patent jurisdiction, [E] type of applicant, [F] leading industry players, [G] patent benchmarking, [H] patent valuation analysis, and [I] leading patents.

- Publication Analysis: A comprehensive assessment of publications made in the virtual biopsy domain, based on various relevant parameters, such as [A] year of publication, [B] type of publication, [C] key copyright holders, [D] most active publishers, [E] most active publishers (in terms of number of publications and impact factor) and [F] most popular keywords used.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What is the ongoing investment trend in this market?

- What is the patent filing activity trend in the market?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross-Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Virtual Biopsy

- 6.3. Conventional Biopsy Versus Virtual Biopsy

- 6.4. Steps Involved in Performing Virtual Biopsy

- 6.4.1. Acquisition of Data

- 6.4.2. Data Harmonization

- 6.4.3. Division of Data

- 6.4.4. Region of Interests (ROI) Segmentation

- 6.4.5. Extraction and Selection of Image Features

- 6.4.6. Validation of Model

- 6.5. Applications of Virtual Biopsy

- 6.5.1. Cancer Management

- 6.5.2. Other Therapeutic Applications

- 6.6. Challenges Associated with Virtual Biopsy

- 6.7. Future Perspectives

7. MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Virtual Biopsy Devices: Overall Market Landscape

- 7.2.1. Analysis by Status of Development

- 7.2.2. Analysis by Year of Approval

- 7.2.3. Analysis by Region of Approval

- 7.2.4. Analysis by Regulatory Accreditations

- 7.2.5. Analysis by Type of Step Involved

- 7.2.6. Analysis by Clinical Purpose

- 7.2.7. Analysis by Type of Imaging Technology Used

- 7.2.8. Analysis by Status of Development and Type of Imaging Technology Used

- 7.2.9. Analysis by Therapeutic Application

- 7.2.10. Analysis by Target Therapeutic Area

- 7.2.11. Analysis by Status of Development and Target Therapeutic Area

- 7.2.12. Analysis by Type of Cancer Targeted

- 7.3. Virtual Biopsy Devices: Developer Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters (Region)

- 7.3.4. Analysis by Status of Development and Location of Headquarters (Region)

- 7.3.5. Analysis by Location of Headquarters (Country)

- 7.3.6. Analysis by Company Size and Location of Headquarters (Region)

- 7.3.7. Most Active Developers: Analysis by Number of Virtual Biopsy Devices Developed

8. PRODUCT COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Product Competitiveness Analysis: Virtual Biopsy Devices

- 8.4.1. Product Competitiveness Analysis: Virtual Biopsy Devices Developed by Players based in North America

- 8.4.2. Product Competitiveness Analysis: Virtual Biopsy Devices Developed by Players based in Europe and Asia-Pacific

9. COMPANY PROFILES: DEVELOPERS BASED IN NORTH AMERICA

- 9.1. Chapter Overview

- 9.2. GE HealthCare

- 9.2.1. Company Overview

- 9.2.2. Financial Information

- 9.2.3. Virtual Biopsy Device Portfolio

- 9.2.4. Recent Developments and Future Outlook

- 9.3. Imaging Biometrics

- 9.4. OptoVibronex

10. COMPANY PROFILES: DEVELOPERS BASED IN EUROPE

- 10.1. Chapter Overview

- 10.2. ImageBiopsy Lab

- 10.2.1. Company Overview

- 10.2.2. Virtual Biopsy Device Portfolio

- 10.2.3. Recent Developments and Future Outlook

- 10.3. Median Technologies

- 10.4. Quibim

- 10.5. Siemens Healthineers

11. COMPANY PROFILES: VIRTUAL BIOPSY PROVIDERS BASED IN ASIA-PACIFIC

- 11.1. Chapter Overview

- 11.2. City Imaging and Clinical Labs

- 11.2.1. Company Overview

- 11.2.2. Virtual Biopsy Device Portfolio

- 11.2.3. Recent Developments and Future Outlook

12. PARTNERSHIPS AND COLLABORATIONS

- 12.1. Chapter Overview

- 12.2. Partnership Models

- 12.3. Virtual Biopsy: Partnerships and Collaborations

- 12.3.1. Analysis by Year of Partnership

- 12.3.2. Analysis by Type of Partnership

- 12.3.3. Analysis by Year and Type of Partnership

- 12.3.4. Analysis by Type of Partner

- 12.3.5. Analysis by Type of Imaging Technology

- 12.3.6. Analysis by Therapeutic Application

- 12.3.7. Most Active Players: Analysis by Number of Partnerships

- 12.3.8. Analysis by Geography

- 12.3.8.1. Local and International Agreements

- 12.3.8.2. Intracontinental and Intercontinental Agreements

13. FUNDING AND INVESTMENTS

- 13.1. Chapter Overview

- 13.2. Funding Models

- 13.3. Virtual Biopsy: Funding and Investments

- 13.3.1. Analysis by Year of Funding

- 13.3.2. Analysis by Type of Funding

- 13.3.3. Analysis by Year and Type of Funding

- 13.3.4. Analysis by Amount Invested

- 13.3.5. Analysis of Amount Invested by Type of Funding

- 13.3.6. Analysis by Geography

- 13.3.7. Most Active Players: Analysis by Number of Funding Instances

- 13.3.8. Most Active Players: Analysis by Amount Raised

- 13.3.9. Leading Investors: Analysis by Number of Funding Instances

- 13.4. Concluding Remarks

14. PATENT ANALYSIS

- 14.1. Chapter Overview

- 14.2. Scope And Methodology

- 14.3. Virtual Biopsy: Patent Analysis

- 14.3.1. Analysis by Patent Publication Year

- 14.3.2. Analysis by Type of Patent and Publication Year

- 14.3.3. Analysis by Patent Application Year

- 14.3.4. Analysis by Patent Jurisdiction

- 14.3.5. Analysis by CPC Symbols

- 14.3.6. Analysis by Type of Applicant

- 14.3.7. Leading Industry Players: Analysis by Number of Patents

- 14.3.8. Leading Non-Industry Players: Analysis by Number of Patents

- 14.4. Patent Benchmarking Analysis

- 14.4.1. Analysis by Patent Characteristics (CPC Codes) by Leading Industry Players

- 14.5. Patent Valuation

- 14.6. Leading Patents by Number of Citations

15. PUBLICATION ANALYSIS

- 15.1. Chapter Overview

- 15.2. Scope and Methodology

- 15.3. Virtual Biopsy: Publication Analysis

- 15.3.1. Analysis by Year of Publication

- 15.3.2. Analysis by Type of Publication

- 15.3.3. Key Copyright Holders: Analysis by Number of Publications

- 15.3.4. Most Active Publishers: Analysis by Number of Publications

- 15.3.5. Key Journals: Analysis by Number of Publications

- 15.3.6. Key Journals: Analysis by Impact Factor

- 15.3.7. Publication Analysis: Most Popular Keywords

16. MARKET IMPACT ANALYSIS

- 16.1. Chapter Overview

- 16.2. Market Drivers

- 16.3. Market Restraints

- 16.4. Market Opportunities

- 16.5. Market Challenges

- 16.6. Conclusion

17. VIRTUAL BIOPSY MARKET

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Global Virtual Biopsy Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.3.1. Scenario Analysis

- 17.3.1.1. Conservative Scenario

- 17.3.1.2. Optimistic Scenario

- 17.3.1. Scenario Analysis

- 17.4. Key Market Segmentations

18. VIRTUAL BIOPSY MARKET, BY TARGET THERAPEUTIC AREA

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Virtual Biopsy Market: Distribution by Target Therapeutic Area

- 18.3.1. Virtual Biopsy Market for Oncological Disorders, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.3.2. Virtual Biopsy Market for Neurological Disorders, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.3.3. Virtual Biopsy Market for Cardiovascular Disorders, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.3.4. Virtual Biopsy Market for Ophthalmological Disorders, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.3.5. Virtual Biopsy Market for Endocrine Disorders, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.3.6. Virtual Biopsy Market for Gastrointestinal Disorders, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.3.7. Virtual Biopsy Market for Others, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

19. VIRTUAL BIOPSY MARKET, BY TYPE OF CANCER TARGETED

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Virtual Biopsy Market: Distribution by Type of Cancer Targeted

- 19.3.1. Virtual Biopsy Market for Solid Malignancies, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.2. Virtual Biopsy Market for Breast Cancer, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.3. Virtual Biopsy Market for Lung Cancer, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.4. Virtual Biopsy Market for Prostate Cancer, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.5. Virtual Biopsy Market for Colorectal Cancer, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.6. Virtual Biopsy Market for Brain Cancer, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.7. Virtual Biopsy Market for Others, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.4. Data Triangulation and Validation

20. VIRTUAL BIOPSY MARKET, BY TYPE OF IMAGING TECHNOLOGY

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Virtual Biopsy Market: Distribution by Type of Imaging Technology

- 20.3.1. Virtual Biopsy Market for Magnetic Resonance Imaging, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.3.2. Virtual Biopsy Market for Computed Tomography, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.3.3. Virtual Biopsy Market for X-ray, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.3.4. Virtual Biopsy Market for Ultrasound, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.3.5. Virtual Biopsy Market for Others, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.4. Data Triangulation and Validation

21. VIRTUAL BIOPSY MARKET, BY END USERS

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Virtual Biopsy Market: Distribution by End Users

- 21.3.1. Virtual Biopsy Market for Hospitals and Clinics, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.2. Virtual Biopsy Market for Research Institutes and Diagnostic Centers, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.3.3. Virtual Biopsy Market for Others, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.4. Data Triangulation and Validation

22. VIRTUAL BIOPSY MARKET, BY GEOGRAPHICAL REGIONS

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Virtual Biopsy Market: Distribution by Geographical Regions

- 22.3.1. Virtual Biopsy Market for North America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.1.1. Virtual Biopsy Market in the US, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.1.2. Virtual Biopsy Market in Canada, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.1.3. Virtual Biopsy Market in Rest of North America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.2. Virtual Biopsy Market for Europe, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.2.1. Virtual Biopsy Market in Germany, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.2.2. Virtual Biopsy Market in France, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.2.3. Virtual Biopsy Market in Italy, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.2.4. Virtual Biopsy Market in Spain, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.2.5. Virtual Biopsy Market in the UK, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.2.6. Virtual Biopsy Market in Switzerland, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.2.7. Virtual Biopsy Market in Rest of Europe, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.3. Virtual Biopsy Market for Asia-Pacific, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.3.1. Virtual Biopsy Market in Japan, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.3.2. Virtual Biopsy Market in China, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.3.3. Virtual Biopsy Market in India, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.3.4. Virtual Biopsy Market in South Korea, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.3.5. Virtual Biopsy Market in Australia, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.3.6. Virtual Biopsy Market in Rest of Asia Pacific, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.4. Virtual Biopsy Market for Middle East and North Africa, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.4.1. Virtual Biopsy Market in Saudi Arabia, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.4.2. Virtual Biopsy Market in Egypt, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.4.3. Virtual Biopsy Market in Israel, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.4.4. Virtual Biopsy Market in Rest of Middle East and North Africa, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.5. Virtual Biopsy Market for Latin America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.5.1. Virtual Biopsy Market in Brazil, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.5.2. Virtual Biopsy Market in Mexico, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.5.3. Virtual Biopsy Market in Argentina, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.5.4. Virtual Biopsy Market in Rest of Latin America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.3.1. Virtual Biopsy Market for North America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.4. Virtual Biopsy Market by Geographical Regions: Market Dynamics Assessment

- 22.4.1. Market Movement Analysis

- 22.4.2. Penetration Growth (P-G) Matrix

- 22.5. Data Triangulation and Validation

23. VIRTUAL BIOPSY MARKET, LEADING PLAYERS

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Virtual Biopsy Market: Distribution by Leading Players

- 23.4. Data Triangulation and Validation

24. CONCLUDING REMARKS

25. EXECUTIVE INSIGHTS

26. APPENDIX I: TABULATED DATA

27. APPENDIX II: LIST OF COMPANIES AND ORGANIZATION

List of Tables

- Table 7.1 Virtual Biopsy Devices: Information on Developer, Status of Development, Year of Approval, Region of Approval and Regulatory Accreditations

- Table 7.2 Virtual Biopsy Devices: Information on Type of Step Involved and Clinical Purpose

- Table 7.3 Virtual Biopsy Devices: Information on Type of Imaging Technology Used and Therapeutic Application

- Table 7.4 Virtual Biopsy Devices: Information on Target Therapeutic Area

- Table 7.5 Virtual Biopsy Devices: Information on Type of Cancer Targeted

- Table 7.6 Virtual Biopsy Devices: Information on List of Developers

- Table 9.1 Virtual Biopsy Device Developers based in North America: List of Companies Profiled

- Table 9.2 GE HealthCare: Company Overview

- Table 9.3 GE HealthCare: Virtual Biopsy Device Portfolio

- Table 9.4 GE HealthCare: Recent Developments and Future Outlook

- Table 9.5 Imaging Biometrics (Acquired by IQ-AI): Company Overview

- Table 9.6 Imaging Biometrics (Acquired by IQ-AI): Virtual Biopsy Device Portfolio

- Table 9.7 OptoVibronex: Company Overview

- Table 9.8 OptoVibronex: Virtual Biopsy Device Portfolio

- Table 10.1 Virtual Biopsy Device Developers based in Europe: List of Companies Profiled

- Table 10.2 ImageBiopsy Lab: Company Overview

- Table 10.3 ImageBiopsy Lab: Virtual Biopsy Device Portfolio

- Table 10.4 ImageBiopsy Lab: Recent Developments and Future Outlook

- Table 10.5 Median Technologies: Company Overview

- Table 10.6 Median Technologies: Virtual Biopsy Device Portfolio

- Table 10.7 Median Technologies: Recent Developments and Future Outlook

- Table 10.8 Quibim: Company Overview

- Table 10.9 Quibim: Virtual Biopsy Device Portfolio

- Table 10.10 Quibim: Recent Developments and Future Outlook

- Table 10.11 Siemens Healthineers: Company Overview

- Table 10.12 Siemens Healthineers: Virtual Biopsy Device Portfolio

- Table 11.1 Virtual Biopsy Device Developers based in Asia Pacific: List of Companies Profiled

- Table 11.2 City Imaging and Clinical Labs: Company Overview

- Table 11.3 City Imaging and Clinical Labs: Virtual Biopsy Device Portfolio

- Table 11.4 City Imaging and Clinical Labs: Recent Developments and Future Outlook

- Table 12.1 Virtual Biopsy Device Developers: List of Partnerships and Collaborations, Since 2020

- Table 12.2 Partnerships and Collaborations: Information on Location of Headquarters (Country and Region) and Type of Agreement (Country and Region)

- Table 13.1 Virtual Biopsy Devices: List of Funding and Investments, Since 2020

- Table 14.1 Patent Analysis: Top CPC Sections

- Table 14.2 Patent Analysis: Top CPC Symbols

- Table 14.3 Patent Analysis: Top CPC Codes

- Table 14.4 Patent Analysis: Summary of Benchmarking Analysis

- Table 14.5 Patent Analysis: Categorization based on Weighted Valuation Scores

- Table 14.6 Patent Portfolio: List of Leading Patents (by Highest Relative Valuation)

- Table 14.7 Patent Portfolio: List of Leading Patents (by Number of Citations)

- Table 25.1 GENECAST: Company Snapshot

- Table 25.2 Quibim: Company Snapshot

- Table 26.1 Virtual Biopsy Devices: Distribution by Status of Development

- Table 26.2 Virtual Biopsy Devices: Distribution by Year of Approval

- Table 26.3 Virtual Biopsy Devices: Distribution by Region of Approval

- Table 26.4 Virtual Biopsy Devices: Distribution by Regulatory Accreditations

- Table 26.5 Virtual Biopsy Devices: Distribution by Type of Step Involved

- Table 26.6 Virtual Biopsy Devices: Distribution by Clinical Purpose

- Table 26.7 Virtual Biopsy Devices: Distribution by Type of Imaging Technology Used

- Table 26.8 Virtual Biopsy Devices: Distribution by Status of Development and Type of Imaging Technology Used

- Table 26.9 Virtual Biopsy Devices: Distribution by Therapeutic Application

- Table 26.10 Virtual Biopsy Devices: Distribution by Target Therapeutic Area

- Table 26.11 Virtual Biopsy Devices: Distribution by Status of Development and Target Therapeutic Area

- Table 26.12 Virtual Biopsy Devices: Distribution by Type of Cancer Targeted

- Table 26.13 Virtual Biopsy Device Developers: Distribution by Year of Establishment

- Table 26.14 Virtual Biopsy Device Developers: Distribution by Company Size

- Table 26.15 Virtual Biopsy Device Developers: Distribution by Location of Headquarters (Region)

- Table 26.16 Virtual biopsy Device Developers: Distribution by Status of Development and Location of Headquarters (Region)

- Table 26.17 Virtual biopsy Device Developers: Distribution by Location of Headquarters (Country)

- Table 26.18 Virtual Biopsy Device Developers: Distribution by Company Size and Location of Headquarters (Region)

- Table 26.19 Most Active Developers: Distribution by Number of Virtual Biopsy Devices Developed

- Table 26.20 GE HealthCare: Business Segment-wise Revenues and Consolidated Financial Details (USD Million)

- Table 26.21 IQ-AI (Parent Company of Imaging Biometrics): Consolidated Financial Details (GBP Million)

- Table 26.22 Median Technologies: Consolidated Financial Details (EUR Million)

- Table 26.23 Siemens Healthineers: Business Segment-wise Revenues and Consolidated Financial Details (EUR Million)

- Table 26.24 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2020

- Table 26.25 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 26.26 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2020

- Table 26.27 Partnerships and Collaborations: Distribution by Type of Partner

- Table 26.28 Partnerships and Collaborations: Distribution by Type of Imaging Technology

- Table 26.29 Partnerships and Collaborations: Distribution by Therapeutic Application

- Table 26.30 Most Active Players: Distribution by Number of Partnerships

- Table 26.31 Partnership and Collaborations: Local and International Agreements

- Table 26.32 Partnerships and Collaborations: Intracontinental and Intercontinental Agreements

- Table 26.33 Funding and Investments: Cumulative Year-wise Trend, Since 2020

- Table 26.34 Funding and Investments: Distribution by Type of Funding

- Table 26.35 Funding and Investments: Distribution by Year and Type of Funding, Since 2020

- Table 26.36 Funding and Investments: Distribution by Amount Invested, Since 2020 (USD Million)

- Table 26.37 Funding and Investments: Distribution of Amount Invested by Type of Funding (USD Million)

- Table 26.38 Funding and Investments: Distribution by Geography (Region)

- Table 26.39 Most Active Players: Distribution by Number of Funding Instances

- Table 26.40 Most Active Players: Distribution by Amount Raised (USD Million)

- Table 26.41 Leading Investors: Distribution by Number of Funding Instances

- Table 26.42 Funding and Investment Summary, Since 2020 (USD Million)

- Table 26.43 Patent Analysis: Distribution by Type of Patent

- Table 26.44 Patent Analysis: Cumulative Distribution by Patent Publication Year, Since 2019

- Table 26.45 Patent Analysis: Distribution by Type of Patent and Patent Publication Year, Since 2019

- Table 26.46 Patent Analysis: Distribution by Patent Application Year, Since Pre-2018

- Table 26.47 Patent Analysis: Patent Jurisdiction

- Table 26.48 Patent Analysis: Cumulative Year-wise Distribution by Type of Applicant, Since 2019

- Table 26.49 Leading Industry Players: Distribution by Number of Patents

- Table 26.50 Leading Non-Industry Players: Distribution by Number of Patents

- Table 26.51 Patent Analysis: Distribution by Patent Age

- Table 26.52 Virtual Biopsy: Patent Valuation

- Table 26.53 Publication Analysis: Cumulative Year-wise Trend, Since Pre-2019

- Table 26.54 Publication Analysis: Distribution by Type of Publication

- Table 26.55 Key Copyright Holders: Distribution by Number of Publications

- Table 26.56 Most Active Publishers: Distribution by Number of Publications

- Table 26.57 Key Journals: Distribution by Number of Publications

- Table 26.58 Key Journals: Distribution by Impact Factor

- Table 26.59 Publication Analysis: Most Popular Keywords

- Table 26.60 Global Virtual Biopsy Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.61 Global Virtual Biopsy Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Table 26.62 Global Virtual Biopsy Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Table 26.63 Virtual Biopsy Market: Distribution by Target Therapeutic Area

- Table 26.64 Virtual Biopsy Market for Oncological Disorders, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.65 Virtual Biopsy Market for Neurological Disorders, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.66 Virtual Biopsy Market for Cardiovascular Disorders, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.67 Virtual Biopsy Market for Ophthalmological Disorders, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.68 Virtual Biopsy Market for Endocrine Disorders, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.69 Virtual Biopsy Market for Gastrointestinal Disorders, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.70 Virtual Biopsy Market for Others, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.71 Virtual Biopsy Market: Distribution by Type of Cancer Targeted

- Table 26.72 Virtual Biopsy Market for Solid Malignancies, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.73 Virtual Biopsy Market for Breast Cancer, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.74 Virtual Biopsy Market for Lung Cancer, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.75 Virtual Biopsy Market for Prostate Cancer, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.76 Virtual Biopsy Market for Colorectal Cancer, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.77 Virtual Biopsy Market for Brain Cancer, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.78 Virtual Biopsy Market for Others, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.79 Virtual Biopsy Market: Distribution by Imaging Technology

- Table 26.80 Virtual Biopsy Market for Magnetic Resonance Imaging, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.81 Virtual Biopsy Market for Computed Tomography, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.82 Virtual Biopsy Market for X-ray, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.83 Virtual Biopsy Market for Ultrasound, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.84 Virtual Biopsy Market for Others, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.85 Virtual Biopsy Market: Distribution by End Users

- Table 26.86 Virtual Biopsy Market for Hospitals and Clinics, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.87 Virtual Biopsy Market for Research Institutes and Diagnostic Centers, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.88 Virtual Biopsy Market for Others, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.89 Virtual Biopsy Market: Distribution by Geographical Regions

- Table 26.90 Virtual Biopsy Market in North America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.91 Virtual Biopsy Market in the US, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.92 Virtual Biopsy Market in Canada, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.93 Virtual Biopsy Market in Europe, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.94 Virtual Biopsy Market in Germany, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.95 Virtual Biopsy Market in France, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.96 Virtual Biopsy Market in Italy, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.97 Virtual Biopsy Market in the UK, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.98 Virtual Biopsy Market in Spain, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.99 Virtual Biopsy Market in Switzerland, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.100 Virtual Biopsy Market in Rest of Europe, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.101 Virtual Biopsy Market in Asia-Pacific, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.102 Virtual Biopsy Market in China, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.103 Virtual Biopsy Market in Japan, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.104 Virtual Biopsy Market in India, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.105 Virtual Biopsy Market in South Korea, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.106 Virtual Biopsy Market in Australia, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.107 Virtual Biopsy Market in Rest of Asia Pacific, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.108 Virtual Biopsy Market in Middle East and North Africa, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.109 Virtual Biopsy Market in Saudi Arabia, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.110 Virtual Biopsy Market in Israel, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.111 Virtual Biopsy Market in Egypt, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.112 Virtual Biopsy Market in Rest of Middle East and North Africa, Historical Trends (Since 2019) and Forecasted Estimates (Till 035) (USD Billion)

- Table 26.113 Virtual Biopsy Market in Latin America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.114 Virtual Biopsy Market in Brazil, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.115 Virtual Biopsy Market in Mexico, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.116 Virtual Biopsy Market in Argentina, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.117 Virtual Biopsy Market in Rest of Latin America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 26.118 Virtual Biopsy Market: Distribution by Leading Players (USD Billion)