PUBLISHER: Roots Analysis | PRODUCT CODE: 1725773

PUBLISHER: Roots Analysis | PRODUCT CODE: 1725773

Distributed Antenna System (DAS) Market Till 2035: Distribution by Type of Offering, Type of DAS, Type of Network, Type of Signal Source, Type of End User, and Geographical Regions: Industry Trends and Global Forecasts

Distributed Antenna System Market Overview

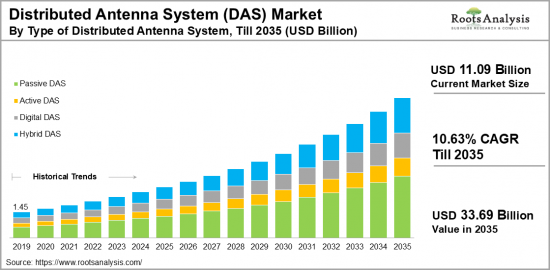

As per Roots Analysis, the global distributed antenna system market size is estimated to grow from USD 11.09 billion in the current year to USD 33.69 billion by 2035, at a CAGR of 10.63% during the forecast period, till 2035.

The opportunity for distributed antenna system market has been distributed across the following segments:

Type of Offering

- Component / Hardware

- Antenna Nodes / Radio Nodes

- Bidirectional Amplifiers

- Donor Antenna

- Head-End Units

- Radio Units

- Service

- Antenna Nodes / Radio Nodes

- Installation Services

- Pre-Sales Services

- Post- Installation Services

Type of DAS

- Active DAS

- Digital DAS

- Hybrid DAS

- Passive DAS

Type of Coverage

- Indoor

- Outdoor

Type of Ownership Model

- Carrier Ownership

- Enterprises Ownership

- Neutral-host Ownership

User Facility Area

- >500 K SQ. FT

- 200-500 K SQ. FT

- <200 K SQ. FT

Type of Vertical

- Commercial

- Public Safety

Type of Frequency Protocol

- Cellular

- VHF / UHF

- Others

Type of Network

- Public Network

- Private LTE/CBRS

Type of Signal Source

- Off-Air Antennas (repeaters)

- On-Site Base Transceiver Station (BTS)

- Small Cell

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

DISTRIBUTED ANTENNA SYSTEM MARKET: GROWTH AND TRENDS

Distributed Antenna Systems (DAS) are quickly emerging as the preferred solution for dependable, high-performance wireless coverage in expansive indoor and outdoor environments. A DAS consists of a network of spaced antenna nodes linked to a standard source through a transport medium, providing wireless service across a specified area or facility. In this DAS framework, the digital signal is converted into radio frequency (RF), and then RF back to digital using an antenna to deliver the cellular signal.

Typically, this system is installed either indoors or outdoors with compact antennas. Moreover, the system is implemented to ensure effective network coverage and capacity in buildings and locations that experience weak connectivity yet have a high demand for wireless services, such as stadiums, auditoriums, and concert halls.

As the need for uninterrupted connectivity keeps increasing, the DAS antenna system market is expected to witness steady growth. This growth is fueled by the expanding use of smartphones and data across multiple devices, along with other key factors that make it an increasingly appealing choice for businesses and infrastructure providers. Further, the ongoing demand for strong cellular and Wi-Fi coverage in venues like stadiums and airports, where DAS technology can provide reliable and widespread connectivity, is likely to propel the market growth.

Additionally, the emergence of 5G technology significantly drives demand in the DAS market, as there is a growing need for high-bandwidth, low-latency wireless services. DAS systems are particularly suited to meet the heightened capacity and coverage demands of 5G networks, making them a crucial element of the next generation of wireless infrastructure. As a result, the rising necessity for improved network coverage, along with the widespread adoption of cloud technology integrated with advanced 5G, IoT, and the growth of smart city initiatives, is expected to accelerate market growth during the forecast period.

DISTRIBUTED ANTENNA SYSTEM MARKET: KEY SEGMENTS

Market Share by Type of Offering

Based on the type of offering, the global distributed antenna system market is segmented into components / hardware (antenna nodes / radio nodes, bi-directional amplifiers, donor antenna, head-end units, radio units) and service (antenna nodes / radio nodes, installation services, pre-sales services, post-installation services).

According to our estimates, currently, component or hardware segment captures the majority share of the market, and this trend is unlikely to change in future. This can be attributed to the fact that hardware and components serve as the foundation of the system, ensuring effective signal distribution and coverage. However, the services segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Distributed Antenna System

Based on type of distributed antenna system, the distributed antenna system market is segmented into DAS, digital DAS, hybrid DAS, and passive DAS. According to our estimates, currently, hybrid DAS captures the majority share of the market. This growth can be attributed to the integration of both active and passive DAS, which offers more adaptable and efficient wireless coverage solutions.

The combination of active elements like amplifiers and passive elements such as coaxial cables and splitters enhances signal distribution and coverage, contributing to market growth. However, the digital DAS segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Type of Coverage

Based on type of coverage, the distributed antenna system market is segmented into indoor and outdoor. According to our estimates, currently, indoor segment captures the majority share of the market; further, this segment is likely to experience a higher CAGR during the forecast period. This can be attributed to the increasing demand for improved in-building coverage due to the rising usage of mobile devices within indoor settings such as offices, hospitals, stadiums, shopping malls, and residential areas that require dependable and robust network connectivity.

Market Share by Type of Ownership Model

Based on type of ownership model, the distributed antenna system market is segmented into carrier ownership, enterprise ownership, and neutral-host ownership. According to our estimates, currently, neutral-host ownership capture the majority share of the market.

The neutral-host DAS's ability to facilitate multiple wireless carriers on a single infrastructure makes it more economical for carriers, thus providing improved service for end-users. Additionally, this multi-carrier approach is particularly advantageous for large venues and commercial buildings. Consequently, due to its wider application and effectiveness in multi-carrier settings, the segment is expected to experience significant growth at a considerable CAGR during the forecast period.

Market Share by User Facility Area

Based on user facility area, the distributed antenna system market is segmented into >500 K sq, ft, 200-500 K sq. ft, and <200 K sq. ft. According to our estimates, currently, >500 K SQ segment captures the majority share of the market. This can be attributed to the fact that it necessitates more advanced and extensive DAS solutions to fulfill its coverage and capacity requirements. The specific needs for different facility sizes differ based on location types, industry focus, and compliance regulations. However, medium range of 200-500 K sq. is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Vertical

Based on vertical, the distributed antenna system market is segmented into commercial and public safety. According to our estimates, currently, commercial segment captures the majority share of the market. Several factors contribute to the growth of this segment. Firstly, in the commercial sector, telecom operators and service providers are crucial to the DAS market, as they frequently implement DAS to improve network coverage and capacity in urban locations, large buildings, and venues experiencing high cellular traffic. However, the public safety segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Frequency Protocol

Based on frequency protocol, the distributed antenna system market is segmented into cellular, VHF / UHF, and others. According to our estimates, currently, cellular DAS segment captures the majority share of the market. This can be attributed to the increasing adoption of 5G networks by mobile network operators utilizing 4G LTE globally. Notably, these frequencies facilitate rapid data transmission and voice call support, making them crucial for contemporary cellular communication. However, the VHF / UHF segment is anticipated to grow at a higher CAGR during the forecast period.

Market Share by Network

Based on network, the distributed antenna system market is segmented into public networks and private LTE / CBRS. According to our estimates, currently, public network segment captures the majority share of the market. Public cellular networks are generally managed by mobile network operators, offering extensive coverage and accessibility for consumers, businesses, and government agencies through commercial service plans. Additionally, private LTE / CBRS is experiencing increasing popularity due to the rising demand for improved security, control, and customization across various industries, including industrial IoT and private enterprise networks, which will contribute to higher market growth rates.

Market Share by Signal Source

Based on signal source, the distributed antenna system market is segmented into off-air antennas (repeaters), on-site base transceiver stations (BTS), and small cells). According to our estimates, currently, off-air antennas segment captures the majority share of the market. This can be attributed to their cost-effectiveness, ease of integration, scalability for multiple carriers, and capability to utilize existing outdoor cellular networks.

Market Share by End User

Based on end user, the distributed antenna system market is segmented into manufacturing end-users, healthcare, government, transportation, sports & entertainment, telecommunications, and other end-users. According to our estimates, currently, sports & entertainment segment captures the majority share of the market. This can be attributed the rising need for uninterrupted wireless connectivity among sports and entertainment fans who want to stay connected with friends and family via the growing use of social media platforms that demand high-speed internet.

Furthermore, DAS primarily supports large infrastructure venues like sports arenas and stadiums, where these systems provide reliable wireless coverage and help ensure that emergency services remain in contact during crises, especially in crowded locations.

Market Share by Geographical Regions

Based on geographical regions, the distributed antenna system market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and Rest of the World. According to our estimates, currently, North America captures the majority share of the market. This can be attributed to higher levels of technological innovation and the uptake of advanced wireless technologies such as 4 LTE and 5G, which boost the need for enhanced indoor coverage solutions in the region. However, the market in Asia is anticipated to grow at a higher CAGR during the forecast period.

Example Players in Distributed Antenna System Market

- American Tower

- AT&T

- Bird Technologies

- Boingo Wireless,

- BTI Wireless

- Comba Telecom Systems

- Commscope

- Corning

- Dali Wireless

- JMA Wireless

- PBE Axell

- Solid Technologie

- Westell Technologies

- Whoop Wireless

- Zinwave

DISTRIBUTED ANTENNA SYSTEM MARKET: RESEARCH COVERAGE

The report on the distributed antenna system market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the distributed antenna system market, focusing on key market segments, including [A] type of offering, [B] type of DAS, [C] type of coverage, [D] type of ownership model, [E] user facility area, [F] type of vertical, [G] type of frequency protocol, [H] type of network [I] type of signal source [J] type of end-user and [K] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the distributed antenna system market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the distributed antenna system market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] distributed antenna system portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in distributed antenna system market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Distributed Antenna System (DAS)

- 6.2.1. Type of DAS

- 6.2.2. Type of Coverage

- 6.2.3. Type of Ownership

- 6.2.4. Type of User Facility Area

- 6.2.5. Type of Vertical

- 6.2.6. Type of Frequency Protocol

- 6.2.7. Type of Network

- 6.2.8. Type of Signal Source

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Distributed Antenna System (DAS): Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. American Tower*

- 8.2.1. Company Overview

- 8.2.2. Company Mission

- 8.2.3. Company Footprint

- 8.2.4. Management Team

- 8.2.5. Contact Details

- 8.2.6. Financial Performance

- 8.2.7. Operating Business Segments

- 8.2.8. Service / Product Portfolio (project specific)

- 8.2.9. MOAT Analysis

- 8.2.10. Recent Developments and Future Outlook

- 8.3. AT&T

- 8.4. Bird Technologies

- 8.5. Boingo Wireless,

- 8.6. Comba Telecom Systems

- 8.7. Commscope

- 8.8. Corning

- 8.9. Dali Wireless

- 8.10. JMA Wireless

- 8.11. Westell Technologies

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL DISTRIBUTED ANTENNA SYSTEM (DAS) MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Distributed Antenna System (DAS) Market Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF OFFERING

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Distributed Antenna System (DAS) Market for Component / Hardware: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. Distributed Antenna System (DAS) Market for Service: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF DAS

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Distributed Antenna System (DAS) Market for Active DAS: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Distributed Antenna System (DAS) Market for Digital DAS: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Distributed Antenna System (DAS) Market for Hybrid DAS: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Distributed Antenna System (DAS) Market for Passive DAS: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.10. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF COVERAGE

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Distributed Antenna System (DAS) Market for Indoor: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Distributed Antenna System (DAS) Market for Outdoor: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF OWNERSHIP MODEL

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Distributed Antenna System (DAS) Market for Carrier Ownership: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Distributed Antenna System (DAS) Market for Neutral-Host Ownership: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF USER FACILITY AREA

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Distributed Antenna System (DAS) Market for (>500 K SQ FT: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Distributed Antenna System (DAS) Market for 200-500 K SQ. FT: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Distributed Antenna System (DAS) Market for<200 K SQ. FT: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.9. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TYPE OF VERTICAL

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Distributed Antenna System (DAS) Market for Commercial: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Distributed Antenna System (DAS) Market for Public Safety: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON TYPE OF FREQUENCY PROTOCOL

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Distributed Antenna System (DAS) Market for Cellular: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Distributed Antenna System (DAS) Market for VHF / UHF: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON TYPE OF NETWORK

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Distributed Antenna System (DAS) Market for Public Network: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Distributed Antenna System (DAS) Market for Private LTE/CBRS: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Data Triangulation and Validation

20. MARKET OPPORTUNITIES BASED ON TYPE OF SIGNAL SOURCE

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Distributed Antenna System (DAS) Market for Off-Air Antennas (repeaters): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Distributed Antenna System (DAS) Market for On-site Base Transceiver Station (BTS): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Distributed Antenna System (DAS) Market for Small Cell: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.9. Data Triangulation and Validation

21. MARKET OPPORTUNITIES BASED ON TYPE OF END USER

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Distributed Antenna System (DAS) Market for Education: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Distributed Antenna System (DAS) Market for Government: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Distributed Antenna System (DAS) Market for Healthcare: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.9. Distributed Antenna System (DAS) Market for Manufacturing End-Users: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.10. Distributed Antenna System (DAS) Market for Sports and Entertainment: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.11. Distributed Antenna System (DAS) Market for Telecommunications: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.12. Distributed Antenna System (DAS) Market for Transportation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.13. Data Triangulation and Validation

22. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Distributed Antenna System (DAS) Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Distributed Antenna System (DAS) Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.8. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR DISTRIBUTED ANTENNA SYSTEM IN NORTH AMERICA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Distributed Antenna System (DAS) Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.1. Distributed Antenna System (DAS) Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.2. Distributed Antenna System (DAS) Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.3. Distributed Antenna System (DAS) Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.6.4. Distributed Antenna System (DAS) Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR DISTRIBUTED ANTENNA SYSTEM IN EUROPE

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Distributed Antenna System (DAS) Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Distributed Antenna System (DAS) Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Distributed Antenna System (DAS) Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Distributed Antenna System (DAS) Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Distributed Antenna System (DAS) Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.5. Distributed Antenna System (DAS) Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.6. Distributed Antenna System (DAS) Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.7. Distributed Antenna System (DAS) Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.8. Distributed Antenna System (DAS) Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.9. Distributed Antenna System (DAS) Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.10. Distributed Antenna System (DAS) Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.11. Distributed Antenna System (DAS) Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.12. Distributed Antenna System (DAS) Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.13. Distributed Antenna System (DAS) Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.14. Distributed Antenna System (DAS) Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.15. Distributed Antenna System (DAS) Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR DISTRIBUTED ANTENNA SYSTEM IN ASIA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Distributed Antenna System (DAS) Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Distributed Antenna System (DAS) Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. Distributed Antenna System (DAS) Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Distributed Antenna System (DAS) Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Distributed Antenna System (DAS) Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Distributed Antenna System (DAS) Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Distributed Antenna System (DAS) Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR DISTRIBUTED ANTENNA SYSTEM IN MIDDLE EAST AND NORTH AFRICA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Distributed Antenna System (DAS) Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Distributed Antenna System (DAS) Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 26.6.2. Distributed Antenna System (DAS) Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Distributed Antenna System (DAS) Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. Distributed Antenna System (DAS) Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. Distributed Antenna System (DAS) Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. Distributed Antenna System (DAS) Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.7. Distributed Antenna System (DAS) Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.8. Distributed Antenna System (DAS) Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR DISTRIBUTED ANTENNA SYSTEM IN LATIN AMERICA

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Distributed Antenna System (DAS) Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. Distributed Antenna System (DAS) Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.2. Distributed Antenna System (DAS) Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. Distributed Antenna System (DAS) Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.4. Distributed Antenna System (DAS) Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.5. Distributed Antenna System (DAS) Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.6. Distributed Antenna System (DAS) Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR DISTRIBUTED ANTENNA SYSTEM IN REST OF THE WORLD

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. Distributed Antenna System (DAS) Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.1. Distributed Antenna System (DAS) Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.2. Distributed Antenna System (DAS) Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.3. Distributed Antenna System (DAS) Market in Other Countries

- 28.7. Data Triangulation and Validation

29. TABULATED DATA

30. LIST OF COMPANIES AND ORGANIZATIONS

31. CUSTOMIZATION OPPORTUNITIES

32. ROOTS SUBSCRIPTION SERVICES

33. AUTHOR DETAIL