PUBLISHER: Roots Analysis | PRODUCT CODE: 1771295

PUBLISHER: Roots Analysis | PRODUCT CODE: 1771295

Biospecimen Procurement Market: Industry Trends and Global Forecasts - Distribution by Therapeutic Area, Type of Biospecimen for Oncological Studies, Type of Biospecimen for Non-Oncological Studies and Key Geographical Regions

GLOBAL BIOSPECIMEN PROCUREMENT MARKET: OVERVIEW

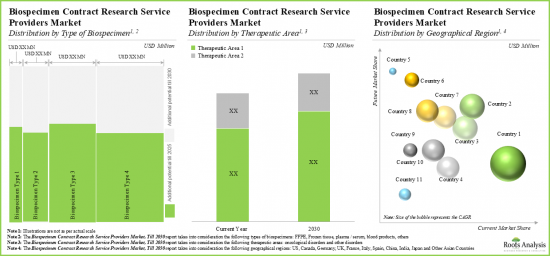

As per Roots Analysis, the global biospecimen procurement market valued at USD 52 million in the current year is anticipated to grow at a CAGR of 16% during the forecast period.

The market sizing and opportunity analysis has been segmented across the following parameters:

Therapeutic Area

- Oncological Disorders

- Other Disorders

Type of Biospecimen for Oncological Studies

- FFPE

- Frozen Tissue

- Plasma / Serum

- Other Biospecimens

Type of Biospecimen for Non-Oncological Studies

- Blood Products

- Human Tissues

- Other Biospecimens

Key Geographical Regions

- North America (US and Canada)

- Europe (Germany, France, Italy, UK, Spain and Other European Countries)

- Asia-Pacific (China, India, Japan and Other Asia-Countries)

- Rest of the World

GLOBAL BIOSPECIMEN PROCUREMENT MARKET: GROWTH AND TRENDS

Biomedical research is a dynamic and evolving field that encompasses a broad spectrum of experimental studies aimed at understanding diseases and developing effective treatments. Central to this process are biospecimens, which play a vital role from the initial stages of drug discovery to clinical trials and large-scale epidemiological studies. Notably, the growing number of research and development initiatives in the pharmaceutical industry, and the rising number of clinical trials has led to an increasing demand for high-quality biological samples. However, obtaining and preserving high-quality biospecimens and conducting accurate analyses remains a significant challenge within the pharmaceutical industry.

Ensuring reliable and efficient traceability of biospecimens requires the implementation of unique identifiers, sophisticated data management systems, and rigorous quality control measures. As a result, several researchers and pharmaceutical and biopharmaceutical players have opted to outsource their biospecimen analytical services. In fact, recently there has been significant technological progress in biospecimen research, which enabled precise molecular studies with improved preservation and sharing of biological samples. Further, the industry has also adopted new best practices and enhanced techniques for the procurement, processing, and storage of biospecimens, further elevating the standards of research quality and reliability.

GLOBAL BIOSPECIMEN PROCUREMENT MARKET: KEY INSIGHTS

The report delves into the current state of global biospecimen procurement market and identifies potential growth opportunities within industry. Some key findings from the report include:

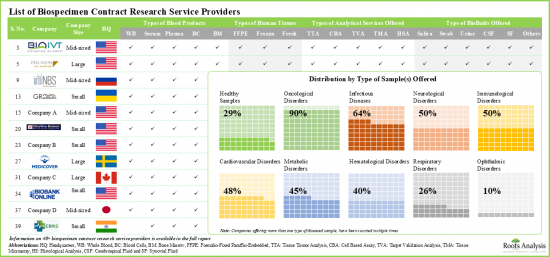

- Presently, more than 40 companies claim to have the required capabilities to offer a wide range of research and analytical services for various types of biospecimens.

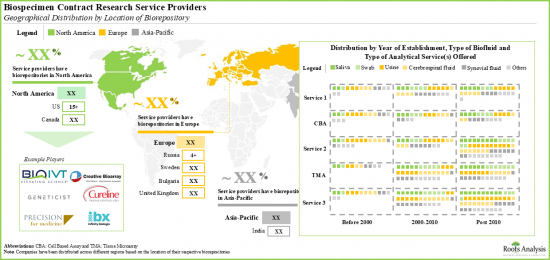

- The biospecimen contract research services market is highly fragmented, featuring a mix of small, mid-sized and large players. Of these, more than 70% of the biospecimen contract research service providers are headquartered in North America and majority claim of offer services for both plasma and serum.

- Most of the small players in this domain are based in North America; examples include Capital Biosciences, Cureline Translational, iSpecimen and Trans-Hit Biomarkers.

- Around 60% of the stakeholders claim to offer both urinary and cerebrospinal fluid samples; interestingly, over 35% of players offer healthy samples.

- Close to 60% of players based in North America offer both FFPE and fresh tissues; more than 30% of these players claim to provide all types of analytical services.

- Several service providers have established in-house biorepositories in order to cater to the demand for various types of biospecimens across the globe; North America has emerged as the hub for these biorepositories.

- In order to gain a competitive edge, service providers are expanding their existing capabilities to enhance their portfolio of offerings.

- The increasing demand for biospecimens brings new challenges and opportunities along with it; to deal with such challenges, several commercial banks have stepped in to offer procurement services.

- Majority (~40%) of biobanks were established post-2009; examples include (in alphabetical order) Atreide Biosamples, Ardent Clinical Research Services and Dx Biosamples.

- Close to 90% of the biobanks have capabilities to offer both biofluids and human tissues; of this, ~70% offer biospecimens for both oncological disorders and infectious diseases.

- Since 2019, there has been a surge in the partnership activity in this domain; a relatively higher proportion of instances involved the acquisition of biospecimen-related capabilities / assets of the partner firm.

- The partnership activity in this domain has increased at a CAGR of around 50% in the past few years; it is worth mentioning that a significant proportion of the partnerships were inked in the last three years.

- 25% of the partnerships inked in the last three years were signed by players headquartered in Europe.

- Majority of the deals (~30%) were inked for the acquisition / merger purposes, followed by service agreements, accounting for more than 20% of the partnerships.

- With North America being the hub for biospecimen research service providers, several innovators from other regions of the world have partnered with the players based in this region.

- Over the next decade, the majority of service revenues are expected to be generated from biospecimen research primarily focused on oncological disorders; North America is likely to remain the largest shareholder till 2030.

- Presently, the use of biospecimen contract research services is largely restricted to the developed nations, and the majority of revenues generated via outsourcing are well distributed between North America (~45%) and Asia-Pacific (~30%).

Example Players in the Biospecimen Procurement Market

- BioChain Institute

- BioIVT

- Creative Bioarray

- Discovery Life Sciences

- Infinity BiologiX

- Medicover

- National BioService

- Precision for Medicine

- PrecisionMed

- REPROCELL

GLOBAL BIOSPECIMEN PROCUREMENT MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global biospecimen procurement market, focusing on key market segments, including [A] therapeutic area, [B] type of biospecimen for oncological studies, [C] type of biospecimen for non-oncological studies and [D] key geographical regions.

- Market Landscape: A comprehensive evaluation of the companies that claim to offer research services related to biospecimens, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] types of blood products offered, [E] types of human tissues offered, [F] types of biofluids offered, [G] types of other biospecimens offered, [H] types of analytical services offered, [I] types of samples offered, [J] types of accreditations received and [K] geographical reach.

- Company Competitiveness Analysis: A comprehensive company competitive analysis of biospecimen contract research service providers, examining factors, such as [A] portfolio strength, [B] service strength and [C] supplier strength.

- Company Profiles: In-depth profiles of companies offering a wide range of research services for the biospecimens, focusing on [A] company overview, [B] biospecimen related services offered, [C] types of blood products offered, [D] types of human tissues offered, [E] types of other biospecimens offered, [F] types of analytical services offered, [G] types of samples offered, [H] geographical distribution of players offering biospecimen research services and [I] recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the biospecimen procurement market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of collaborator, [D] type of service(s) offered, [E] types of biospecimen(s) handled, [F] therapeutic area, [G] most active players (in terms of the number of partnerships signed) and [H] geography.

- Market Landscape of Commercial Biobanks Case Study: A detailed analysis of the overall landscape of biospecimen procurement service providers (commercial biobanks), based on various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] types of services offered, [E] types of biospecimens handled, and [F] therapeutic area. Additionally, the section presents a competitive analysis of the commercial biobanks based on the availability of their respective biorepositories.

- Key Insights: A detailed analysis of biospecimen contract research service providers, focusing on four analysis , such as [A] a grid analysis based on the year of establishment and type of analytical services offered, [B] a comprehensive analysis based on the therapeutic area and most active players, [C] an analysis based on the company size and therapeutic area, and [D] a world map representation highlighting the regional distribution of biospecimen research service providers, based on the locations of their biorepositories.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Overview of Biospecimen

- 3.3. Importance of Biospecimen in Drug Discovery and Research

- 3.4. Factors Affecting the Quality of Biospecimen

- 3.5. Biospecimen Management

- 3.6. Regulatory Guidelines

- 3.7. Outsourcing in Biospecimen Research

- 3.7.1. Role of Contract Research Organizations in Biospecimen Procurement

- 3.7.2. Types of Services Offered by Contract Research Organizations

- 3.8. Future Perspective

4. MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Biospecimen Research Service Providers: Overall Market Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Location of Headquarters

- 4.2.4. Analysis by Type of Blood Product(s) Offered

- 4.2.5. Analysis by Type of Human Tissue(s) Offered

- 4.2.6. Analysis by Type of Biofluid(s) and Other Biospecimen(s) Offered

- 4.2.7. Analysis of Type of Analytical Service(s) Offered

- 4.2.8. Analysis by Type of Sample(s) Offered

- 4.2.9. Analysis of Accreditation(s) Received

- 4.2.10. Analysis by Geographical Reach

5. COMPANY COMPETITIVENESS ANALYSIS

- 5.1. Chapter Overview

- 5.2. Methodology

- 5.3. Key Parameters

- 5.4. Competitiveness Analysis: Biospecimen Research Service Providers with Biorepositories

- 5.4.1. Companies Offering Biospecimen Research Services in North America

- 5.4.2. Companies Offering Biospecimen Research Services in Europe and Asia-Pacific

- 5.5. Competitiveness Analysis: Biospecimen Research Service Providers without Biorepositories

- 5.5.1. Companies Offering Biospecimen Research Services in North America

- 5.5.2. Companies Offering Biospecimen Research Services in Europe

6. BIOSPECIMEN SERVICE PROVIDERS IN NORTH AMERICA: COMPANY PROFILES

- 6.1. Chapter Overview

- 6.2. BioChain Institute

- 6.2.1. Company Overview

- 6.2.2. Biospecimen Related Service Portfolio

- 6.2.3. Recent Developments and Future Outlook

- 6.3. BioIVT

- 6.3.1. Company Overview

- 6.3.2. Biospecimen Related Service Portfolio

- 6.3.3. Recent Developments and Future Outlook

- 6.4. Creative Bioarray

- 6.4.1. Company Overview

- 6.4.2. Biospecimen Related Service Portfolio

- 6.4.3. Recent Developments and Future Outlook

- 6.5. Discovery Life Sciences

- 6.5.1. Company Overview

- 6.5.2. Biospecimen Related Service Portfolio

- 6.5.3. Recent Developments and Future Outlook

- 6.6. Infinity BiologiX

- 6.6.1. Company Overview

- 6.6.2. Biospecimen Related Service Portfolio

- 6.6.3. Recent Developments and Future Outlook

- 6.7. Precision for Medicine

- 6.7.1. Company Overview

- 6.7.2. Biospecimen Related Service Portfolio

- 6.7.3. Recent Developments and Future Outlook

- 6.8. PrecisionMed

- 6.8.1. Company Overview

- 6.8.2. Biospecimen Related Service Portfolio

- 6.8.3. Recent Developments and Future Outlook

7. BIOSPECIMEN SERVICE PROVIDERS IN EUROPE AND ASIA-PACIFIC: COMPANY PROFILES

- 7.1. Chapter Overview

- 7.2. Medicover

- 7.2.1. Company Overview

- 7.2.2. Biospecimen Related Service Portfolio

- 7.2.3. Recent Developments and Future Outlook

- 7.3. National BioService

- 7.3.1. Company Overview

- 7.3.2. Biospecimen Related Service Portfolio

- 7.3.3. Recent Developments and Future Outlook

- 7.4. REPROCELL

- 7.4.1. Company Overview

- 7.4.2. Biospecimen Related Service Portfolio

- 7.4.3. Recent Developments and Future Outlook

8. PARTNERSHIPS AND COLLABORATIONS

- 8.1. Chapter Overview

- 8.2. Partnership Models

- 8.3. Biospecimen Research Services: Partnerships and Collaborations

- 8.3.1. Analysis by Year of Partnership

- 8.3.2. Analysis by Type of Partnership

- 8.3.3. Analysis by Type of Collaborator

- 8.3.4. Analysis by Type of Service(s) Offered

- 8.3.5. Analysis by Type of Biospecimen(s) Handled

- 8.3.6. Analysis by Therapeutic Area

- 8.3.7. Most Active Players: Analysis by Number of Partnerships

- 8.4. Geographical Analysis

- 8.4.1. Intercontinental and intracontinental Agreements

9. CASE STUDY: MARKET LANDSCAPE OF COMMERCIAL BIOBANKS

- 9.1. Chapter Overview

- 9.2. Commercial Biobanks: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Types of Service(s) Offered

- 9.2.5. Analysis by Types of Biospecimen(s) Handled

- 9.2.6. Analysis by Therapeutic Area

- 9.3. Company Competitiveness Analysis

- 9.3.1. Methodology and Key Parameters

- 9.3.2. Competitiveness Analysis: Commercial Biobanks with Biorepositories

- 9.3.3. Competitiveness Analysis: Commercial Biobanks without Biorepositories

10. KEY INSIGHTS

- 10.1. Chapter Overview

- 10.2. Grid Analysis: Analysis by Year of Establishment and Type of Analytical Service(s) Offered

- 10.3. Analysis by Company Size and Therapeutic Area

- 10.4. Most Active Players: Analysis by Therapeutic Area and

- 10.5. World Map Representation: Analysis by Location of In-House Biorepositories

11. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 11.1. Chapter Overview

- 11.2. Forecast Methodology and Key Assumptions

- 11.3. Overall Biospecimen Research Services Market, Till 2030

- 11.3.1. Biospecimen Research Services Market, Till 2030: Distribution by Type of Biospecimen

- 11.3.2. Biospecimen Research Services Market, Till 2030: Distribution by Therapeutic Area

- 11.3.3. Biospecimen Research Services Market, Till 2030: Distribution by Key Geographical Regions

- 11.3.3.1. Biospecimen Research Services Market in North America, Till 2030: Distribution by Countries

- 11.3.3.2. Biospecimen Research Services Market in North America, Till 2030: Distribution by Type of Biospecimen

- 11.3.3.3. Biospecimen Research Services Market in North America, Till 2030: Distribution by Therapeutic Area

- 11.3.3.4. Biospecimen Research Services Market in Europe, Till 2030: Distribution by Countries

- 11.3.3.5. Biospecimen Research Services Market in Europe, Till 2030: Distribution by Type of Biospecimen

- 11.3.3.6. Biospecimen Research Services Market in Europe, Till 2030: Distribution by Therapeutic Area

- 11.3.3.4. Biospecimen Research Services Market in Asia-Pacific, Till 2030: Distribution by Countries

- 11.3.3.5. Biospecimen Research Services Market in Asia-Pacific, Till 2030: Distribution by Type of Biospecimen

- 11.3.3.6. Biospecimen Research Services Market in Asia-Pacific, Till 2030: Distribution by Therapeutic Area

12. CONCLUSION

- 12.1. Chapter Overview

13. EXECUTIVE INSIGHTS

- 13.1. Chapter Overview

- 13.2. Company A

- 13.2.1. Overview of Company / Organization

- 13.2.2. Interview Transcript: Managing Director and Business Development Head

- 13.3. Company B

- 13.3.1. Overview of Company / Organization

- 13.3.2. Interview Transcript: Director of Business Development

14. APPENDIX 1: TABULATED DATA

15. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1 Biospecimen Research Service Providers: List of Companies

- Table 4.2 Biospecimen Contract Research Service Providers: Information on Type of Blood Product(s) Offered

- Table 4.3 Biospecimen Contract Research Service Providers: Information on Type of Human Tissue(s) Offered

- Table 4.4 Biospecimen Contract Research Service Providers: Information on Type of Biofluid(s) and Other Biospecimen offered

- Table 4.5 Biospecimen Contract Research Service Providers: Information on Type of Analytical Service(s) Offered

- Table 4.6 Biospecimen Contract Research Service Providers: Information on Type of Sample(s) Offered

- Table 4.7 Biospecimen Contract Research Service Providers: Information on Type of Accreditation(s) Received

- Table 4.8 Biospecimen Contract Research Service Providers: Information on Geographical Reach

- Table 6.1 Biospecimen Service Providers in North America: List of Profiled Companies

- Table 6.2 BioChain Institute: Company Snapshot

- Table 6.3 Biospecimen Related Service Portfolio

- Table 6.4 BioChain Institute: Recent Developments and Future Outlook

- Table 6.5 BioIVT: Company Snapshot

- Table 6.6 Biospecimen Related Service Portfolio

- Table 6.7 BioIVT: Recent Developments and Future Outlook

- Table 6.8 Creative Bioarray: Company Snapshot

- Table 6.9 Biospecimen Related Service Portfolio

- Table 6.10 Creative Bioarray: Recent Developments and Future Outlook

- Table 6.11 Discovery Life Sciences: Company Snapshot

- Table 6.12 Biospecimen Related Service Portfolio

- Table 6.13 Discovery Life Sciences: Recent Developments and Future Outlook

- Table 6.14 Infinity BiologiX: Company Snapshot

- Table 6.15 Biospecimen Related Service Portfolio

- Table 6.16 Infinity BiologiX: Recent Developments and Future Outlook

- Table 6.17 Precision for Medicine: Company Snapshot

- Table 6.18 Biospecimen Related Service Portfolio

- Table 6.19 Precision for Medicine: Recent Developments and Future Outlook

- Table 6.20 PrecisionMed: Company Snapshot

- Table 6.21 Biospecimen Related Service Portfolio

- Table 6.22 PrecisionMed: Recent Developments and Future Outlook

- Table 7.1 Medicover: Company Snapshot

- Table 7.2 Biospecimen Related Service Portfolio

- Table 7.3 Medicover: Recent Developments and Future Outlook

- Table 7.4 National BioService: Company Snapshot

- Table 7.5 Biospecimen Related Service Portfolio

- Table 7.6 National BioService: Recent Developments and Future Outlook

- Table 7.7 REPROCELL: Company Snapshot

- Table 7.8 Biospecimen Related Service Portfolio

- Table 7.9 REPROCELL: Recent Developments and Future Outlook

- Table 9.1 Biospecimen Contract Research Service Providers: Partnerships and Collaborations, Since 2015

- Table 9.2 Partnerships and Collaborations: Information on Type of Service(s) Offered, Type of Biospecimens(s) Handled and Therapeutic Area, Since 2015

- Table 10.1 Commercial Biobanks: List of Companies

- Table 10.2 Commercial Biobanks: Information on Type of Service(s) Offered

- Table 10.2 Commercial Biobanks: Information on Type of Biospecimen(s) Handled

- Table 10.3 Commercial Biobanks: Information on Therapeutic Areas

- Table 14.1 Biospecimen Contract Research Service Providers: Distribution by Year of Establishment

- Table 14.2 Biospecimen Contract Research Service Providers: Distribution by Company Size

- Table 14.3 Biospecimen Contract Research Service Providers: Distribution by Location of Headquarters

- Table 14.4 Biospecimen Contract Research Service Providers: Distribution by Type of Blood Product(s) Offered and Type of Sample(s) Offered

- Table 14.5 Biospecimen Contract Research Service Providers: Distribution by Type of Human Tissue(s) Offered

- Table 14.6 Biospecimen Contract Research Service Providers: Distribution by Type of Biofluid(s) Offered

- Table 14.7 Biospecimen Contract Research Service Providers: Distribution by Type of Analytical Service(s) Offered

- Table 14.8 Biospecimen Contract Research Service Providers: Distribution by Type of Sample(s) Offered

- Table 14.9 Biospecimen Contract Research Service Providers: Distribution by Accreditation(s) Received

- Table 14.10 Biospecimen Contract Research Service Providers: Distribution by Type of Analytical Service(s) Offered and Geographical Reach

- Table 14.11 Partnerships and Collaborations: Distribution by Year of Partnership

- Table 14.12 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 14.13 Partnerships and Collaborations: Distribution by Type of Collaborator

- Table 14.14 Partnerships and Collaborations: Distribution by Type of Service(s) Offered

- Table 14.15 Partnerships and Collaborations: Distribution by Type of Biospecimen(s) Handled

- Table 14.16 Partnerships and Collaborations: Distribution by Therapeutic Area

- Table 14.17 Partnerships and Collaborations: Distribution of Most Active Players by Number of Partnerships

- Table 14.18 Partnerships and Collaborations: Geographical Analysis

- Table 14.19 Partnerships and Collaborations: Distribution Intercontinental and Intracontinental Agreements

- Table 14.20 Commercial Biobanks: Distribution by Year of Establishment

- Table 14.21 Commercial Biobanks: Distribution by Company Size

- Table 14.22 Commercial Biobanks: Distribution by Location of Headquarters

- Table 14.23 Commercial Biobanks: Distribution by Types of Service(s) Offered

- Table 14.24 Commercial Biobanks: Distribution by Types of Biospecimen(s) Handled

- Table 14.25 Commercial Biobanks: Distribution by Therapeutic Area

- Table 14.26 Biospecimen Service Providers: Distribution by Type of Company Size and Therapeutic Area

- Table 14.27 Overall Biospecimen Research Services Market, Till 2030 (USD Million)

- Table 14.28 Biospecimen Research Services Market, Till 2030: Distribution by Type of Biospecimen (USD Million)

- Table 14.29 Biospecimen Research Services Market, Till 2030: Distribution by Therapeutic Area (USD Million)

- Table 14.30 Biospecimen Research Services Market, Till 2030: Distribution by Key Geographical Regions (USD Million)

- Table 14.31 Biospecimen Research Services Market in North America, Till 2030: Distribution by Countries (USD Million)

- Table 14.32 Biospecimen Research Services Market in North America, Till 2030: Distribution by Type of Biospecimen (USD Million)

- Table 14.33 Biospecimen Research Services Market in North America, Till 2030: Distribution by Therapeutic Area (USD Million)

- Table 14.34 Biospecimen Research Services Market in Europe, Till 2030: Distribution by Countries (USD Million)

- Table 14.35 Biospecimen Research Services Market in Europe, Till 2030: Distribution by Type of Biospecimen (USD Million)

- Table 14.36 Biospecimen Research Services Market in Europe, Till 2030: Distribution by Therapeutic Area (USD Million)

- Table 14.37 Biospecimen Research Services Market in Asia-Pacific, Till 2030: Distribution by Countries (USD Million)

- Table 14.38 Biospecimen Research Services Market in Asia-Pacific, Till 2030: Distribution by Type of Biospecimen (USD Million)

- Table 14.39 Biospecimen Research Services Market in Asia-Pacific, Till 2030: Distribution by Therapeutic Area (USD Million)

List of Figures

- Figure 2.1 Executive Summary: Current Market Landscape

- Figure 2.2 Executive Summary: Partnerships and Collaborations

- Figure 2.2 Executive Summary: Current Landscape of Commercial Biobanks

- Figure 2.3 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 3.1 Factors Affecting the Quality of Biospecimen

- Figure 3.2 Lifecycle of a Biospecimen

- Figure 3.3 Clinical Trial related Services offered by CROs

- Figure 4.1 Biospecimen Contract Research Service Providers: Distribution by Year of Establishment

- Figure 4.2 Biospecimen Contract Research Service Providers: Distribution by Company Size

- Figure 4.3 Biospecimen Contract Research Service Providers: Distribution by Location of Headquarters

- Figure 4.4 Biospecimen Contract Research Service Providers: Distribution by Type of Blood Product(s) Offered and Type of Sample(s) Offered

- Figure 4.5 Biospecimen Contract Research Service Providers: Distribution by Type of Human Tissue(s) Offered

- Figure 4.6 Biospecimen Contract Research Service Providers: Distribution by Type of Biofluid(s) Offered

- Figure 4.7 Biospecimen Contract Research Service Providers: Distribution by Type of Analytical Service(s) Offered

- Figure 4.8 Biospecimen Contract Research Service Providers: Distribution by Type of Sample(s) Offered

- Figure 4.9 Biospecimen Contract Research Service Providers: Distribution by Accreditation(s) Received

- Figure 4.10 Biospecimen Contract Research Service Providers: Distribution by Type of Analytical Service(s) Offered and Geographical Reach

- Figure 5.1 Company Competitiveness Analysis: Biospecimen Research Service Providers based in North America (With Biorepositories)

- Figure 5.2 Company Competitiveness Analysis: Biospecimen Research Service Providers based in Europe and Asia-Pacific (With Biorepositories)

- Figure 5.3 Company Competitiveness Analysis: Biospecimen Research Service Providers based in North America (Without Biorepositories)

- Figure 5.4 Company Competitiveness Analysis: Biospecimen Research Service Providers based in Europe and Asia-Pacific (Without Biorepositories)

- Figure 8.1 Partnerships and Collaborations: Distribution by Year of Partnership

- Figure 8.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 8.3 Partnerships and Collaborations: Distribution by Type of Collaborator

- Figure 8.4 Partnerships and Collaborations: Distribution by Type of Service(s) Offered

- Figure 8.5 Partnerships and Collaborations: Distribution by Type of Biospecimen(s) Handled

- Figure 8.6 Partnerships and Collaborations: Distribution by Therapeutic Area

- Figure 8.7 Partnerships and Collaborations: Distribution of Most Active Players by Number of Partnerships

- Figure 8.8 Partnerships and Collaborations: Geographical Analysis

- Figure 8.9 Partnerships and Collaborations: Distribution of Intercontinental and Intracontinental Agreements

- Figure 9.1 Commercial Biobanks: Distribution by Year of Establishment

- Figure 9.2 Commercial Biobanks: Distribution by Company Size

- Figure 9.3 Commercial Biobanks: Distribution by Location of Headquarters

- Figure 9.4 Commercial Biobanks: Distribution by Type of Service(s) Offered

- Figure 9.5 Commercial Biobanks: Distribution by Type of Biospecimen(s) Handled

- Figure 9.6 Commercial Biobanks: Distribution by Therapeutic Area

- Figure 9.7 Competitiveness Analysis: Commercial Biobanks with Biorepositories

- Figure 9.8 Competitiveness Analysis: Commercial Biobanks without Biorepositories

- Figure 10.1 Grid Analysis: Distribution by Year of Establishment and Type of Analytical Services Offered

- Figure 10.2 Biospecimen Service Providers: Distribution by Type of Company Size and Therapeutic Area

- Figure 10.3 Most Active Players: Distribution by Therapeutic Area

- Figure 10.4 World Map Representation: Distribution by Location of In-House Biorepositories

- Figure 11.1 Overall Biospecimen Research Services Market, Till 2030 (USD Million)

- Figure 11.2 Biospecimen Research Services Market, Till 2030: Distribution by Type of Biospecimen (USD Million)

- Figure 11.3 Biospecimen Research Services Market, Till 2030: Distribution by Therapeutic Area (USD Million)

- Figure 11.4 Biospecimen Research Services Market, Till 2030: Distribution by Key Geographical Regions (USD Million)

- Figure 11.5 Biospecimen Research Services Market in North America, Till 2030: Distribution by Countries (USD Million)

- Figure 11.6 Biospecimen Research Services Market in North America, Till 2030: Distribution by Type of Biospecimen (USD Million)

- Figure 11.7 Biospecimen Research Services Market in North America, Till 2030: Distribution by Therapeutic Area (USD Million)

- Figure 11.8 Biospecimen Research Services Market in Europe, Till 2030: Distribution by Countries (USD Million)

- Figure 11.9 Biospecimen Research Services Market in Europe, Till 2030: Distribution by Type of Biospecimen (USD Million)

- Figure 11.10 Biospecimen Research Services Market in Europe, Till 2030: Distribution by Therapeutic Area (USD Million)

- Figure 11.11 Biospecimen Research Services Market in Asia-Pacific, Till 2030: Distribution by Countries (USD Million)

- Figure 11.12 Biospecimen Research Services Market in Asia-Pacific, Till 2030: Distribution by Type of Biospecimen (USD Million)

- Figure 11.13 Biospecimen Research Services Market in Asia-Pacific, Till 2030: Distribution by Therapeutic Area (USD Million)

- Figure 12.1 Concluding Remarks: Current Biospecimen Contract Research Service Providers Market Landscape Summary

- Figure 12.2 Concluding Remarks: Partnerships and Collaborations

- Figure 12.3 Concluding Remarks: Market Forecast and Opportunity Analysis