PUBLISHER: Roots Analysis | PRODUCT CODE: 1771308

PUBLISHER: Roots Analysis | PRODUCT CODE: 1771308

Manufacturing Execution System Market: Industry Trends and Global Forecasts - Distribution by Type of Deployment, Type of End-User and Key Geographical Regions

GLOBAL MANUFACTURING EXECUTION SYSTEM MARKET: OVERVIEW

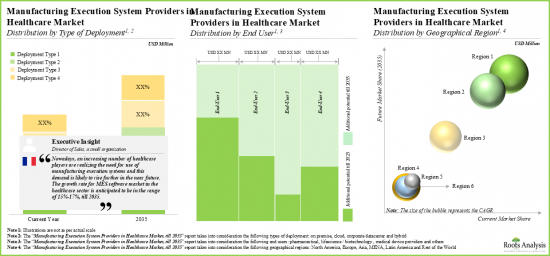

As per Roots Analysis, the global manufacturing execution system market is estimated to grow from USD 3.99 billion in the current year to USD 20.46 billion by 2035, at a CAGR of 16.02% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Deployment

- Cloud

- Corporate Data Center

- Hybrid

- On Premise

Type of End-User

- Life Science / Biotechnology Companies

- Medical Device Providers

- Pharmaceutical Companies and Others

Key Geographical Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and North Africa

GLOBAL MANUFACTURING EXECUTION SYSTEM MARKET: GROWTH AND TRENDS

Over the years, the healthcare industry has undergone substantial growth, making it essential for manufacturers to adopt new technologies and tools in order to remain relevant and competitive in the evolving market landscape. Manufacturing execution systems play a crucial role in achieving long term competitive advantages in the healthcare industry. Manufacturing execution system is a dynamic information system that connects, monitors, and synchronizes various processes of complex manufacturing processes. MES system enables enhanced plant productivity and efficiency along with increased flexibility and agility across the manufacturing processes. It also simplifies the process of complying with regulatory guidelines and facilitates healthcare companies in maintaining high quality standards during the production process.

In recent years, several healthcare stakeholders have actively undertaken initiatives to incorporate manufacturing execution systems into their production lines. In addition, players engaged in this domain are integrating advanced technologies, including internet of thing (IOT) and artificial intelligence (AI) to collect and analyze large volume of data from various sources and to produce value in the form of insights, predictions, and actions. With the healthcare industry turning towards manufacturing execution systems to make data-driven decisions about their production lines, the future of industrial processes promises greater efficiency and better opportunities for growth.

GLOBAL MANUFACTURING EXECUTION SYSTEM MARKET: KEY INSIGHTS

The report delves into the current state of the global manufacturing execution system market and identifies potential growth opportunities within industry. Some key findings from the report include:

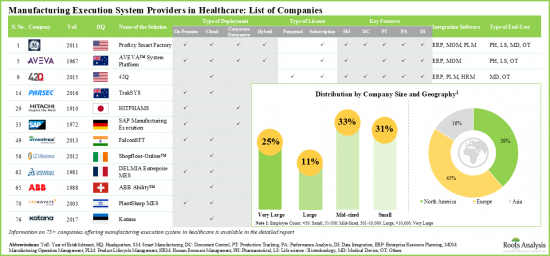

- At present, more than 75 companies across the globe claim to offer manufacturing execution systems (MES) in order to monitor, track and control the production process in the healthcare sector.

- Stakeholders are offering MES, integrated with numerous types of software, through different licensing models to serve the pharmaceutical, life science / biotechnology and medical device industries.

- Over 85% of the MES providers offer such services via subscription models; the medical device industry has emerged as a prominent end user for such services.

- ERP and PLM have emerged as the most prominent integration software; nearly 50% of stakeholders offer MES integrated with more than one type of software.

- Nearly 15% stakeholders claim to offer MES for all end users; prominent examples include Atachi Systems, Dassault Systemes, Epicor, GE Digital, Infor and Tulip.

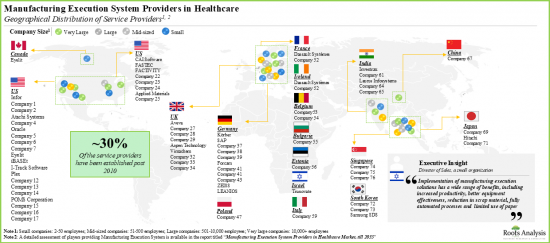

- In order to cater to the evolving needs of clients across the world, stakeholders have established a presence across different regions; Europe has emerged as the key hub, featuring the highest number of MES providers.

- The growing interest of stakeholders is also evident from the rise in partnership activity; in fact, the maximum number of collaborations were inked in the last two years.

- In pursuit of building a competitive edge, manufacturing execution system providers are actively upgrading their existing capabilities to further enhance their respective service / product offerings.

- Our proprietary value creation framework highlights the key tools and technologies that emerging players in this domain must integrate in order to augment their MES portfolio.

- The market is expected to witness a healthy growth of over 16% in the coming decade; the opportunity is likely to be well distributed across various type of deployments, end users and different regions.

GLOBAL MANUFACTURING EXECUTION SYSTEM MARKET: KEY SEGMENTS

Cloud Segment Occupies the Largest Share of the Manufacturing Execution System Market

Based on the type of deployment, the market is segmented into cloud, corporate datacenter, hybrid and on-premises. At present, the cloud segment holds the maximum (~69%) share of the global manufacturing execution system market due to the growing demand for cloud-based MES solutions. However, the hybrid segment is expected to grow at a higher CAGR during the forecast period.

By Type of End-User, Life Science / Biotechnology Companies is the Fastest Growing Segment of the Global Manufacturing Execution System Market

Based on the type of end-user, the market is segmented into life science / biotechnology companies, medical device providers, pharmaceutical companies and others. Currently, the medical device providers segment captures the highest proportion (~51%) of the manufacturing execution system market. Further, the life science / biotechnology companies' segment is likely to grow at a relatively higher CAGR as the companies highly rely on MES that aid in managing batch production, tracking, and tracing materials and products.

Europe Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa, Latin America, and the rest of the world. Currently, Europe (~41%) dominates the manufacturing execution system market and accounts for the largest revenue share. However, the market in Asia-Pacific is expected to grow at a higher CAGR of 16.8% during the forecast period.

Example Players in the Manufacturing Execution System Market

- Andea

- Critical Manufacturing

- Dassault Systemes

- GE Digital

- Infor

- Korber

- Rockwell Automation

PRIMARY RESEARCH OVERVIEW

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews conducted with the following industry stakeholders:

- Chief Executive Officer, Company A

- Chief Marketing Officer, Company B

- Director of Sales, Company C

GLOBAL MANUFACTURING EXECUTION SYSTEM MARKET

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global manufacturing execution system market, focusing on key market segments, including [A] type of deployment, [B] type of end-user and [C] key geographical regions.

- Market Landscape: A comprehensive evaluation of manufacturing execution system companies in the healthcare industry, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] type of deployment, [E] integrating MES software, [F] type of license, [G] type of end-user, [H] key features, [I] type of service(s) offered and [J] quality certifications received.

- Key Insights: An in-depth analysis of manufacturing execution system market trends using five schematic representations, including [A] a detailed analysis, based on year of establishment and region of headquarters, [B] an analysis, based on company size and type of deployment, [C] a comprehensive analysis, based on type of license and end-user, [D] an analysis, based on company size and key features, and [E] a 4D bubble chart comparing the players engaged in MES market.

- Partnerships and Collaborations: An in-depth analysis of the deals inked by stakeholders in this domain, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] key players (in terms of the number of partnerships signed) and [E] geographical distribution of partnership activity.

- Company Competitiveness Analysis: An insightful competitive analysis of manufacturing execution system providers in the healthcare industry, examining factors, such as [A] product portfolio strength, [B] competitive index and [C] partnership strength.

- Company Profiles: In-depth profiles of companies engaged in the manufacturing execution system industry, focusing on [A] company overview and [B] recent developments and an informed future outlook.

- Value Creation Framework: An insightful framework depicting the implementation of several advanced tools and technologies, such as [A] artificial intelligence, [B] cloud computing, [C] internet of things and [D] machine learning.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Overview of Manufacturing Execution Systems

- 3.2. Core Function of Manufacturing Execution Systems

- 3.3. Deployment Models of Manufacturing Execution Systems

- 3.4. Benefits Offered by Manufacturing Execution Systems

- 3.5. Challenges Associated with Manufacturing Execution Systems

- 3.6. Integration of Manufacturing Execution Systems for Different Operations

- 3.7. Concluding Remarks

4. MARKET LANDSCAPE

4.1. Manufacturing Execution System Providers in Healthcare: Market Overview

- 4.2. List of Manufacturing Execution System Providers in Healthcare

- 4.3. Analysis by Year of Establishment

- 4.4. Analysis by Company Size

- 4.5. Analysis by Location of Headquarters

- 4.6. Analysis by Type of Deployment

- 4.7. Analysis by Integrating Software

- 4.8. Analysis by Type of License

- 4.9. Analysis by Type of End User

- 4.10. Analysis by Key Features

- 4.11. Analysis by Type of Service(s) Offered

- 4.12. Analysis by Quality Certifications Received

5. KEY INSIGHTS

- 5.1. Analysis by Year of Establishment and Region of Headquarters

- 5.2. Analysis by Company Size and Type of Deployment

- 5.3. Analysis by Type of License and End User

- 5.4. Analysis by Company Size and Key Features

- 5.5. Analysis by Year of Establishment, Company Size, Type of Deployment and Quality Certifications Received (4D Bubble Chart)

6. PARTNERSHIPS AND COLLABORATIONS

- 6.1. Manufacturing Execution System Providers in Healthcare: Partnerships and Collaborations

- 6.2. Analysis by Year of Partnership

- 6.3. Analysis by Type of Partnership

- 6.4. Analysis by Year of Partnership and Type of Partnership

- 6.5. Analysis by Type of Partnership and Company Size

- 6.6. Key Players: Analysis by Number of Partnerships

- 6.7. Analysis by Type of Partner

- 6.8. Analysis by Country

- 6.9. Analysis by Region

- 6.10. Intercontinental and Intracontinental Deals

- 6.11. Analysis by Location of Headquarters of Partner

- 6.12. Analysis by Type of Partnership and Location of Headquarters of Partner

7. COMPANY COMPETITIVENESS ANALYSIS

- 7.1. Manufacturing Execution System Providers in Healthcare: Company Competitiveness Analysis

- 7.2. Assumptions and Key Parameters

- 7.3. Methodology

- 7.4. Benchmarking of Portfolio Strength

- 7.5. Benchmarking of Partnership Activity

- 7.6. Company Competitiveness Analysis: Very Large Players

- 7.7. Company Competitiveness Analysis: Large Players

- 7.8. Company Competitiveness Analysis: Mid-Sized Players

- 7.9. Company Competitiveness Analysis: Small Players

8. COMPANY PROFILES

- 8.1. Andea

- 8.1.1. Company Overview

- 8.1.2. Technology Portfolio

- 8.1.3. Recent Developments and Future Outlook

- 8.2. Critical Manufacturing

- 8.2.1. Company Overview

- 8.2.2. Technology Portfolio

- 8.2.3. Recent Developments and Future Outlook

- 8.3. Dassault Systemes

- 8.3.1. Company Overview

- 8.3.2. Technology Portfolio

- 8.3.3. Recent Developments and Future Outlook

- 8.4. GE Digital

- 8.4.1. Company Overview

- 8.4.2. Technology Portfolio

- 8.4.3. Recent Developments and Future Outlook

- 8.5. Infor

- 8.5.1. Company Overview

- 8.5.2. Technology Portfolio

- 8.5.3. Recent Developments and Future Outlook

- 8.6. Korber

- 8.6.1. Company Overview

- 8.6.2. Technology Portfolio

- 8.6.3. Recent Developments and Future Outlook

- 8.7. Rockwell Automation

- 8.7.1. Company Overview

- 8.7.2. Technology Portfolio

- 8.7.3. Recent Developments and Future Outlook

9. VALUE CREATION FRAMEWORK: A STRATEGIC GUIDE TO ADDRESS UNMET NEED FOR MANUFACTURING EXECUTION SYSTEMS

- 9.1. Unmet Need for Manufacturing Execution Systems in the Healthcare Industry

- 9.2. Key Assumptions and Methodology

- 9.3. Key Tools and Technologies

- 9.3.1. Technology 1

- 9.3.2. Technology 2

- 9.3.3. Technology 3

- 9.3.4. Technology 4

- 9.4. Extent of Innovation versus Associated Risks

- 9.5. Concluding Remarks

10. MARKET FORECAST

- 10.1. Key Assumptions and Forecast Methodology

- 10.2. Forecasted Market Segments

- 10.3. Manufacturing Execution System Providers in Healthcare Market, Till 2035

- 10.4. Manufacturing Execution System Providers in Healthcare Market: Analysis by Type of Deployment, Till 2035

- 10.4.1. Manufacturing Execution System Providers in Healthcare Market for Cloud Solutions

- 10.4.2. Manufacturing Execution System Providers in Healthcare Market for Corporate Datacenter Solutions

- 10.4.3. Manufacturing Execution System Providers in Healthcare Market for Hybrid Solutions

- 10.4.4. Manufacturing Execution System Providers in Healthcare Market for On Premise Solutions

- 10.5. Manufacturing Execution System Providers in Healthcare Market: Analysis by Type of End User, Till 2035

- 10.5.1. Manufacturing Execution System Providers in Healthcare Market for Life science / Biotechnology Companies

- 10.5.2. Manufacturing Execution System Providers in Healthcare Market for Medical Device Providers

- 10.5.3. Manufacturing Execution System Providers in Healthcare Market for Pharmaceutical Companies

- 10.5.4. Manufacturing Execution System Providers in Healthcare Market for Other End Users

- 10.6. Manufacturing Execution System Providers in Healthcare Market: Analysis by Geography, Till 2035

- 10.6.1. Manufacturing Execution System Providers in Healthcare Market in North America, Till 2035

- 10.6.2. Manufacturing Execution System Providers in Healthcare Market in Europe, Till 2035

- 10.6.3. Manufacturing Execution System Providers in Healthcare Market in Asia, Till 2035

- 10.6.4. Manufacturing Execution System Providers in Healthcare Market in Latin America, Till 2035

- 10.6.5. Manufacturing Execution System Providers in Healthcare Market in MENA, Till 2035

- 10.6.6. Manufacturing Execution System Providers in Healthcare Market in Rest of the World, Till 2035

11. EXECUTIVE INSIGHTS

- 11.1. Company A

- 11.1.1. Company Snapshot

- 11.1.2. Interview Transcript: Chief Executive Officer

- 11.2. Company B

- 11.2.1. Company Snapshot

- 11.2.2. Interview Transcript: Chief Marketing Officer

- 11.3. Company C

- 11.3.1. Company Snapshot

- 11.3.2. Interview Transcript: Director of Sales

12. APPENDICES I: OTHER FIGURES

12.1. Market Overview

- 12.2. Key Insights

- 12.3. Partnerships and Collaborations

- 12.4. List of Figures

13. APPENDICES II: TABULATED DATA

14. APPENDICES III: LIST OF COMPANIES

List of Tables

- Table 4.1. Manufacturing Execution System Providers in Healthcare: Information on Year of Establishment, Headquarters, Company Size and Name of Solution

- Table 4.2. Manufacturing Execution System Providers in Healthcare: Information on Type of Deployment, Integrating Software, Type of License, Type of End User, Key Features, Type of Service(s) Offered and Quality Certifications Received

- Table 4.3. Manufacturing Execution System Providers in Healthcare: Key Features, Type of Service(s) Offered and Quality Certifications Received

- Table 6.1. Manufacturing Execution System Providers in Healthcare: Partnerships and Collaborations

- Table 13.1. Manufacturing Execution System Providers in Healthcare Distribution by Year of Establishment

- Table 13.2. Manufacturing Execution System Providers in Healthcare: Distribution by Company Size

- Table 13.3. Manufacturing Execution System Providers in Healthcare: Distribution by Location of Headquarters

- Table 13.4. Manufacturing Execution System Providers in Healthcare: Distribution by Type of Deployment

- Table 13.5. Manufacturing Execution System Providers in Healthcare: Distribution by Integrating Software

- Table 13.6. Manufacturing Execution System Providers in Healthcare: Distribution by Type of License

- Table 13.7. Manufacturing Execution System Providers in Healthcare: Distribution by Type of End User

- Table 13.8. Manufacturing Execution System Providers in Healthcare: Distribution by Key Features

- Table 13.9. Manufacturing Execution System Providers in Healthcare: Distribution by Type of Service(s) Offered

- Table 13.10. Partnerships and Collaborations: Distribution by Year of Partnership

- Table 13.11. Partnerships and Collaborations: Distribution by Type of Partnership

- Table 13.12. Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 13.13. Partnerships and Collaborations: Distribution by Type of Partnership and Company Size

- Table 13.14. Partnerships and Collaborations: Key Players by Number of Partnerships

- Table 13.15. Partnerships and Collaborations: Distribution by Type of Partner

- Table 13.16. Partnerships and Collaborations: Distribution by Country

- Table 13.17. Partnerships and Collaborations: Distribution by Region

- Table 13.18. Intercontinental and Intracontinental Deals

- Table 13.19. Manufacturing Execution System Providers in Healthcare Market: Distribution by Type of Deployment, Till 2035

- Table 13.20. Manufacturing Execution System Providers in Healthcare Market for Cloud Solutions (USD Billion)

- Table 13.21. Manufacturing Execution System Providers in Healthcare Market for Corporate Datacenter Solutions (USD Billion)

- Table 13.22. Manufacturing Execution System Providers in Healthcare Market for Hybrid Solutions (USD Billion)

- Table 13.23. Manufacturing Execution System Providers in Healthcare Market for On Premise Solutions (USD Billion)

- Table 13.24. Manufacturing Execution System Providers in Healthcare Market: Distribution by Type of End User, Till 2035

- Table 13.25. Manufacturing Execution System Providers in Healthcare Market for Life science / Biotechnology Companies (USD Billion)

- Table 13.26. Manufacturing Execution System Providers in Healthcare Market for Medical Device Providers (USD Billion)

- Table 13.27. Manufacturing Execution System Providers in Healthcare Market for Pharmaceutical Companies (USD Billion)

- Table 13.28. Manufacturing Execution System Providers in Healthcare Market for Other End Users (USD Billion)

- Table 13.29. Manufacturing Execution System Providers in Healthcare Market: Distribution by Geography, Till 2035

- Table 13.30. Manufacturing Execution System Providers in Healthcare Market in North America, Till 2035

- Table 13.31. Manufacturing Execution System Providers in Healthcare Market in Europe, Till 2035

- Table 13.32. Manufacturing Execution System Providers in Healthcare Market in Asia, Till 2035

- Table 13.33. Manufacturing Execution System Providers in Healthcare Market in Latin America, Till 2035

- Table 13.34. Manufacturing Execution System Providers in Healthcare Market in MENA, Till 2035

- Table 13.35. Manufacturing Execution System Providers in Healthcare Market in Rest of the World, Till 2035

List of Figures

- Figure 3.4. Integration of Manufacturing Execution Systems for Different Operations

- Figure 4.1. Manufacturing Execution System Providers in Healthcare Distribution by Year of Establishment

- Figure 4.2. Manufacturing Execution System Providers in Healthcare: Distribution by Company Size

- Figure 4.3. Manufacturing Execution System Providers in Healthcare: Distribution by Location of Headquarters

- Figure 4.4. Manufacturing Execution System Providers in Healthcare: Distribution by Type of Deployment

- Figure 4.5. Manufacturing Execution System Providers in Healthcare: Distribution by Integrating Software

- Figure 4.6. Manufacturing Execution System Providers in Healthcare: Distribution by Type of License

- Figure 4.7. Manufacturing Execution System Providers in Healthcare: Distribution by Type of End User

- Figure 4.8. Manufacturing Execution System Providers in Healthcare: Distribution by Key Features

- Figure 4.9. Manufacturing Execution System Providers in Healthcare: Distribution by Type of Service(s) Offered

- Figure 5.1. Key Insights: Distribution by Year of Establishment and Region of Headquarters

- Figure 5.2. Key Insights: Distribution by Company Size and Type of Deployment

- Figure 5.3. Key Insights: Distribution by Type of License and End User

- Figure 5.4. Key Insights: Distribution by Company Size and Key Features

- Figure 5.5. Key Insights: Distribution by Year of Establishment, Company Size, Type of Deployment and Quality Certifications Received

- Figure 6.1. Partnerships and Collaborations: Distribution by Year of Partnership

- Figure 6.2. Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 6.3. Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 6.4. Partnerships and Collaborations: Distribution by Type of Partnership and Company Size

- Figure 6.5. Partnerships and Collaborations: Key Players by Number of Partnerships

- Figure 6.6. Partnerships and Collaborations: Distribution by Type of Partner

- Figure 6.7. Partnerships and Collaborations: Distribution by Country

- Figure 6.8. Partnerships and Collaborations: Distribution by Region

- Figure 6.9. Intercontinental and Intracontinental Deals

- Figure 7.1. Company Competitiveness Analysis: Benchmarking of Portfolio Strength

- Figure 7.2. Company Competitiveness Analysis: Benchmarking of Partnership Activity

- Figure 7.3. Company Competitiveness Analysis: Very Large Players

- Figure 7.4. Company Competitiveness Analysis: Large Players

- Figure 7.5. Company Competitiveness Analysis: Mid-Sized Players

- Figure 7.6. Company Competitiveness Analysis: Small Players

- Figure 9.1. Value Creation Framework: Trends in Research Activity related to Integration of Key Tools and Technologies with Manufacturing Execution System

- Figure 9.2. Value Creation Framework: Trends in Intellectual Property related to Integration of Key Tools and Technologies with Manufacturing Execution System

- Figure 9.3. Value Creation Framework: Extent of Innovation versus Associated Risk Matrix

- Figure 9.4. Value Creation Framework: Comparison of Key Tools / Technologies

- Figure 10.1. Manufacturing Execution System Providers in Healthcare Market: Distribution by Type of Deployment, Till 2035

- Figure 10.2. Manufacturing Execution System Providers in Healthcare Market for Cloud Solutions (USD Billion)

- Figure 10.3. Manufacturing Execution System Providers in Healthcare Market for Corporate Datacenter Solutions (USD Billion)

- Figure 10.4. Manufacturing Execution System Providers in Healthcare Market for Hybrid Solutions (USD Billion)

- Figure 10.5. Manufacturing Execution System Providers in Healthcare Market for On Premise Solutions (USD Billion)

- Figure 10.6. Manufacturing Execution System Providers in Healthcare Market: Distribution by Type of End User, Till 2035

- Figure 10.7. Manufacturing Execution System Providers in Healthcare Market for Life science / Biotechnology Companies (USD Billion)

- Figure 10.8. Manufacturing Execution System Providers in Healthcare Market for Medical Device Providers (USD Billion)

- Figure 10.9. Manufacturing Execution System Providers in Healthcare Market for Pharmaceutical Companies (USD Billion)

- Figure 10.10. Manufacturing Execution System Providers in Healthcare Market for Other End Users (USD Billion)

- Figure 10.11. Manufacturing Execution System Providers in Healthcare Market: Distribution by Geography, Till 2035

- Figure 10.12. Manufacturing Execution System Providers in Healthcare Market in North America, Till 2035

- Figure 10.13. Manufacturing Execution System Providers in Healthcare Market in Europe, Till 2035

- Figure 10.14. Manufacturing Execution System Providers in Healthcare Market in Asia, Till 2035

- Figure 10.15. Manufacturing Execution System Providers in Healthcare Market in Latin America, Till 2035

- Figure 10.16. Manufacturing Execution System Providers in Healthcare Market in MENA, Till 2035

- Figure 10.17. Manufacturing Execution System Providers in Healthcare Market in Rest of the World, Till 2035