PUBLISHER: Roots Analysis | PRODUCT CODE: 1771411

PUBLISHER: Roots Analysis | PRODUCT CODE: 1771411

Food Safety Testing Market, Till 2035: Distribution by Type of Target Tested, Type of Food Tested, Type of Technology, Type of Application, Type of Food Test, Company Size, and Key Geographical Regions: Industry Trends and Global Forecasts

Food Safety Testing Market Overview

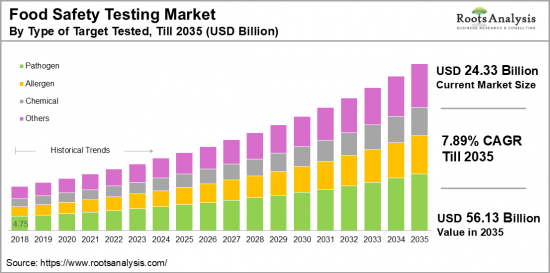

As per Roots Analysis, the global food safety testing market size is estimated to grow from USD 24.33 billion in the current year to USD 56.13 billion by 2035, at a CAGR of 7.89% during the forecast period, till 2035.

The opportunity for food safety testing market has been distributed across the following segments:

Type of Target Tested

- Allergen

- Eggs

- Fish

- Gluten

- Lactose

- Milk

- Peanuts

- Shellfish

- Soy

- Tree Nuts

- Wheat

- Chemical

- Nutritional Labeling Testing

- Pathogen

- Bacteria

- Virus

- Parasite

- Residues and Contaminants

- Chemicals

- GMOs

- Heavy Metals

- Mycotoxins

- Pesticides

- Other Contaminants

- Shelf Life

- Freshness Testing

- Spoilage Detection

- Quality Control

Type of Food Test

- Food Authenticity Testing

- Food Safety Testing

- Food Shelf Life Testing

Type of Food Tested

- Alcoholic & Non-alcoholic Beverages

- Beer

- Juice

- Soft Drink

- Spirit

- Wine

- Other Beverages

- Bakery & Confectionery

- Bread

- Cake

- Candy

- Cookie

- Pastry

- Others

- Dairy Products

- Butter

- Cheese

- Ice Cream

- Milk

- Yogurt

- Other Dairy Products

- Fresh Food

- Fruits

- Herbs

- Vegetables

- Other Fresh Produce

- Functional Food

- Minerals

- Probiotics

- Supplements

- Vitamins

- Other Functional Foods

- Infant Food

- Formula

- Baby Food

- Other Infant Food

- Meat & Poultry

- Beef

- Chicken

- Lamb

- Pork

- Turkey

- Others

- Processed & Packaged Food

- Beverages

- Canned Goods

- Dried Goods

- Frozen Foods

- Snacks

- Others

- Sea Food

- Crustaceans

- Fish

- Shellfish

- Other Seafood

Type of Technology

- Molecular Diagnostics

- DNA Sequencing

- Next Generation Sequencing

- Real Time Polymerase Chain Reaction (RT PCR)

- PCR

- Rapid

- Enzyme-Linked Immunosorbent Assay (ELISA)

- Immunoassays

- Lateral Flow Assays

- PCR

- Other Rapid Technologies

- Traditional

- Chemical Testing

- Conventional Method

- Microbiological Testing

- Other Technologies

Type of Application

- Export

- Import

- Manufacturing

- Finished Product

- Production Line

- Raw Material Testing

- Processing

- Food Safety Management

- Quality Assurance

- Quality Control

- Retail

- Food Safety Management

- Quality Assurance

- Quality Control

- Service

- Catering Testing

- Food Safety Management

- Restaurant Testing

- Other Applications

Type of Testing Type

- Consumables

- System

- Test Kits

Company Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

FOOD SAFETY TESTING MARKET: GROWTH AND TRENDS

The rising prevalence of food adulteration and outbreaks of foodborne illnesses around the globe highlights the necessity of food safety testing. An outbreak of foodborne disease refers to the occurrence of two or more cases of similar illnesses linked to the consumption of a shared food item. Therefore, food safety or hygiene testing is crucial in the food and beverage sector, as it examines food products to ensure they are safe to eat and meet regulatory standards. According to a report by WHO, approximately 600 million individuals worldwide fall ill each year due to the consumption of contaminated food.

As a result, the food safety testing market is rapidly expanding, with numerous regulatory organizations, such as the Food and Drug Administration (FDA), USDA, and EFSA, along with various regional authorities, enforcing thorough testing protocols for food products to prevent foodborne illnesses and ensure safety for individuals and communities. The importance of food safety lies in its role in verifying the cleanliness and safety of food by detecting and identifying harmful contaminants, toxins, and other substances that pose health risks.

Moreover, to combat the widespread problem of food adulteration, regulatory agencies have established several standards, leading to the food safety testing market developing specific target tests for pathogens, GMOs, allergens, chemicals, pesticides, physical contaminants, nutritional labeling, and more. These assessments assist in detecting chemical pollutants, including pesticides, heavy metals (like lead and mercury), drug residues, and potentially harmful food additives. Additionally, meat, poultry, and seafood products are particularly significant in food safety testing due to their increased risk of contamination.

Taking these aspects into account, industry players are utilizing technological innovations and data analysis to improve their processes through automation and robotics, enhancing testing methods that minimize human error and boost efficiency by effectively managing large volumes of samples. Owing to the escalating incidence of foodborne illnesses, ongoing food adulteration scandals, and advancing technologies, the food safety testing market is expected to increase during the forecast period.

FOOD SAFETY TESTING MARKET: KEY SEGMENTS

Market Share by Type of Target Tested

Based on type of target tested, the global food safety testing market is segmented into allergens (eggs, fish, gluten, lactose, milk, peanuts, shellfish, soy, tree nuts, wheat, and chemical), chemicals, nutritional labeling testing, pathogen (bacteria, virus, parasite), residues and contamination testing (chemicals, GMOs, heavy metals, mycotoxins, pesticides, other contaminants), shelf life testing (freshness testing), spoilage detection (quality control). According to our estimates, currently, pathogens segment captures the majority share of the market. This can be attributed to the increasing occurrences of flu stemming from animal bacteria and viruses that lead to foodborne illnesses.

However, the GMOs segment is expected to grow at a relatively higher CAGR during the forecast period, owing to the rising consumer awareness of GMOs, prompting a greater demand for transparent labeling and non-GMO product offerings.

Market Share by Type of Food Test

Based on type of food test, the food safety testing market is segmented into food safety testing, food authenticity testing, and food shelf life testing. According to our estimates, currently, food safety test segment captures the majority of the market. This can be attributed to the critical role of food safety testing in safeguarding public health against contaminated food that can lead to illness or outbreaks.

Additionally, the rise of globalization has made food safety testing mandatory due to stringent regulations worldwide. As a result, businesses are implementing food testing services to comply with these requirements and avoid penalties, fines, and potential damage to their reputation.

Market Share by Type of Food Tested

Based on type of food tested, the food safety testing market is segmented into alcoholic & non-alcoholic beverages (beer, juice, soft drink, spirit, wine, other beverages), bakery & confectionery (bread, cake, candy, cookie, pastry, others), dairy products (butter, cheese, ice cream, milk, yogurt, and other dairy products) fresh food (fruits, herbs, vegetables, and other fresh produce), functional food (minerals, probiotics, supplements, vitamins, and other functional foods), infant food (formula, baby food, other infant food), meat & poultry (beef, chicken, lamb, pork, turkey, and others), processed & packaged food (beverages, canned goods, dried goods, frozen foods, snacks, and others), sea food (crustaceans, fish, shellfish, and other seafood).

According to our estimates, currently, seafood segment captures the majority share of the market. This can be attributed to the rapid expansion of the construction industry globally. This growth can be attributed to the significant risk of contamination, stringent regulatory requirements, frequent outbreaks, and consumer safety apprehensions related to meat products. Moreover, the increasing demand for meat and seafood in coastal regions further propels the expansion of this segment and boosts overall market growth.

Market Share by Type of Technology

Based on type of technology, the food safety testing market is segmented into molecular diagnostics (DNA sequencing, next generation sequencing, real time polymerase chain reaction (PCR), Rapid (enzyme-linked immunosorbent assay (ELISA), immunoassays, lateral flow assays, PCR, and other rapid technologies), Traditional (Chemical testing, conventional method, microbiological testing, other technologies).

According to our estimates, currently, rapid testing segment captures the majority of the market. This can be attributed to the benefits of PCR-based assays, such as elevated sensitivity and specificity, quick results, scalability, regulatory approval, and cost-effectiveness. However, next-generation sequencing (NGS) segment is expected to grow at a relatively higher CAGR during the forecast period, owing to its extensive analysis capabilities, high throughput, and improved sensitivity and specificity.

Market Share by Type of Application

Based on type of application, the food safety testing market is segmented into export, import, manufacturing (finished product, production line, and raw material testing) processing, (food safety management, quality assurance, and quality control), retail (food safety management, quality assurance, and quality control), service (catering testing, food safety management, and restaurant testing) and other applications.

According to our estimates, currently, manufacturing segment captures the majority of the market, owing to the essential role of food safety testing in the food production industry. For instance, assessing the safety and quality of raw materials prior to their use in the manufacturing process, as well as conducting quality tests on the final product in accordance with regulatory standards before it reaches consumers, highlights the importance of food safety testing within the manufacturing field. As a result, this segment is projected to maintain its leading position in the market during the forecast period.

Market Share by Type of Testing

Based on type of testing, the food safety testing market is segmented into systems, test kits, and consumables. According to our estimates, currently, testing kits captures the majority of the market. This can be attributed to their user-friendliness, quick results, portability, and affordability. Additionally, the adaptability, compliance with regulations, technological innovations, and usefulness in monitoring the supply chain are key features that render test kits essential tools for ensuring food safety across various sectors of the food and beverage industry.

Market Share by Company Size

Based on company size, the food safety testing market is segmented into small, medium-sized enterprises (SMEs) and large enterprises. According to our estimates, currently, large multinational companies captures the majority of the market, due to their worldwide reach and wide array of food safety testing products and services. These major players hold the largest share of the market in terms of revenue. Their extensive range of products and significant research and development capabilities position them well to drive the growth of the food safety testing market.

Market Share by Geographical Regions

Based on geographical regions, the food safety testing market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market, owing to its dominant market share worldwide. The stringent regulatory standards set by global authorities like the FDA and USDA in this region greatly enhance its market position. Additionally, the significant processed food sector, increasing demand for meat products, and heightened consumer awareness are critical elements contributing to the expansion of the food safety testing market.

However, market in Asia Pacific is expected to grow at a higher CAGR during the forecast period, driven by a high prevalence of foodborne illnesses and food safety issues in countries, such as India and China.

Example Players in Food Safety Testing Market

- 3M Food Safety

- Agilent Technologies

- ALS

- AsureQuality

- Bio-Rad Laboratories

- Bureau Veritas

- Eurofins Scientific

- Intertek Group

- Merck

- Merieux Nutrisciences

- Neogen

- NSF International

- PerkinElmer

- QIAGEN

- SGS

- Thermo Fisher Scientific

- TUV SUD

- UL Solutions

FOOD SAFETY TESTING MARKET: RESEARCH COVERAGE

The report on the food safety testing market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the food safety testing market, focusing on key market segments, including [A] type of target tested, [B] type of food tested, [C] type of technology, [D] type of application, [E] type of food test, [F] company size, and [G] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the food safety testing market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the food safety testing market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] service / product portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the food safety testing market.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in food safety testing market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.2.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7 Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Food Safety Testing

- 6.2.1. Type of Target Tested

- 6.2.2. Type of Food Test

- 6.2.3. Type of Food Tested

- 6.2.4. Type of Technology

- 6.2.5. Type of Application

- 6.2.6. Type of Testing Type

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Food Safety Testing: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2.1. 3M Food Safety*

- 8.2.1.1. Company Overview

- 8.2.1.2. Company Mission

- 8.2.1.3. Company Footprint

- 8.2.1.4. Management Team

- 8.2.1.5. Contact Details

- 8.2.1.6. Financial Performance

- 8.2.1.7. Operating Business Segments

- 8.2.1.8. Service / Product Portfolio (project specific)

- 8.2.1.9. MOAT Analysis

- 8.2.1.10. Recent Developments and Future Outlook

- 8.2.2. Agilent Technologies

- 8.2.3. ALS

- 8.2.4. AsureQuality

- 8.2.5. Bureau Veritas

- 8.2.6. Eurofins Scientific

- 8.2.7. Merck

- 8.2.8. Neogen

- 8.2.9. QIAGEN

- 8.2.10. UL Solutions

- 8.2.1. 3M Food Safety*

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL FOOD SAFETY TESTING MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Food Safety Testing Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF TARGET TESTED

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Food Safety Testing Market for Allergen: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.6.1. Food Safety Testing Market for Eggs: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.6.2. Food Safety Testing Market for Fish: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.6.3. Food Safety Testing Market for Gluten: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.6.4. Food Safety Testing Market for Lactose: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.6.5. Food Safety Testing Market for Milk: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.6.6. Food Safety Testing Market for Peanuts: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.6.7. Food Safety Testing Market for Shellfish: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.6.8. Food Safety Testing Market for Soy: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.6.9. Food Safety Testing Market for Tree Nuts: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.6.10. Food Safety Testing Market for Wheat: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.7. Food Safety Testing Market for Chemical: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.8. Food Safety Testing Market for Nutritional Labeling Testing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.9. Food Safety Testing Market for Pathogen: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.9.1. Food Safety Testing Market for Bacteria: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.9.2. Food Safety Testing Market for Virus: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.9.3. Food Safety Testing Market for Parasite: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.10. Food Safety Testing Market for Residues and Contaminants: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.10.1. Food Safety Testing Market for Chemicals: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.10.2. Food Safety Testing Market for GMOs: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.10.3. Food Safety Testing Market for Heavy Metals: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.10.4. Food Safety Testing Market for Mycotoxins: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.10.5. Food Safety Testing Market for Pesticides: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.10.6. Food Safety Testing Market for Other Contaminants: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.11. Food Safety Testing Market for Shelf Life: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.11.1. Food Safety Testing Market for Freshness Testing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.11.2. Food Safety Testing Market for Spoilage Testing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.11.3. Food Safety Testing Market for Quality Control: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 12.12. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF FOOD TEST

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Food Safety Testing Market for Alcoholic & Non-alcoholic Beverages: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.6.1. Food Safety Testing Market for Beer: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.6.2. Food Safety Testing Market for Juice: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.6.3. Food Safety Testing Market for Soft Drink: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.6.4. Food Safety Testing Market for Spirit: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.6.5. Food Safety Testing Market for Wine: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.6.6. Food Safety Testing Market for Other Beverages: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.7. Food Safety Testing Market for Bakery & Confectionery: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.7.1. Food Safety Testing Market for Bread: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.7.2. Food Safety Testing Market for Cake: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.7.3. Food Safety Testing Market for Candy: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.7.4. Food Safety Testing Market for Cookie: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.7.5. Food Safety Testing Market for Pastry: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.7.6. Food Safety Testing Market for Others: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.8. Food Safety Testing Market for Dairy Products: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.8.1. Food Safety Testing Market for Butter: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035) 13.8.2.

- 13.8.2. Food Safety Testing Market for Cheese: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.8.3. Food Safety Testing Market for Ice Cream: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.8.4. Food Safety Testing Market for Milk: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.8.5. Food Safety Testing Market for Yogurt: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.8.6. Food Safety Testing Market for Other Dairy Products: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.9. Food Safety Testing Market for Fresh Food: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.9.1. Food Safety Testing Market for Fruits: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.9.2. Food Safety Testing Market for Herbs: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.9.3. Food Safety Testing Market for Vegetables: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.9.4. Food Safety Testing Market for Other Fresh Produce: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.10. Food Safety Testing Market for Functional Food: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.10.1. Food Safety Testing Market for Minerals: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.10.2. Food Safety Testing Market for Probiotics: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.10.3. Food Safety Testing Market for Supplements: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.10.4. Food Safety Testing Market for Vitamins: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.10.5. Food Safety Testing Market for Other Functional Foods: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.11. Food Safety Testing Market for Infant Food: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.11.1. Food Safety Testing Market for Formula: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.11.2. Food Safety Testing Market for Baby Food: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.11.3. Food Safety Testing Market for Other Infant Food: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.11.4. Food Safety Testing Market for Other Functional Foods: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.12. Food Safety Testing Market for Meat & Poultry: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.12.1. Food Safety Testing Market for Beef: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.12.2. Food Safety Testing Market for Chicken: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.12.3. Food Safety Testing Market for Lamb: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.12.4. Food Safety Testing Market for Pork: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.12.5. Food Safety Testing Market for Turkey: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.12.6. Food Safety Testing Market for Others: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.13. Food Safety Testing Market for Processed & Packaged Food: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.13.1. Food Safety Testing Market for Beverages: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.13.2. Food Safety Testing Market for Canned Goods: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.13.3. Food Safety Testing Market for Dried Goods: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.13.4. Food Safety Testing Market for Frozen Goods: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.13.5. Food Safety Testing Market for Snacks: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.13.6. Food Safety Testing Market for Others: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.14. Food Safety Testing Market for Sea Food: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.14.1. Food Safety Testing Market for Crustaceans: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.14.2. Food Safety Testing Market for Fish: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.14.3. Food Safety Testing Market for Shell Fish: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.14.4. Food Safety Testing Market for Other Sea Food: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.15. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF TECHNOLOGY

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Food Safety Testing Market for Molecular Diagnostics: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.6.1. Food Safety Testing Market for DNA Sequencing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.6.2. Food Safety Testing Market for Next Generation Sequencing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.6.3. Food Safety Testing Market for RT-PCR: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.6.4. Food Safety Testing Market for PCR: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.7. Food Safety Testing Market for Rapid Technology: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.7.1. Food Safety Testing Market for ELISA: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.7.2. Food Safety Testing Market for Immunoassays: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.7.3. Food Safety Testing Market for Lateral Flow Assays: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.7.4. Food Safety Testing Market for PCR: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.7.5. Food Safety Testing Market for Other Rapid Technologies: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.8. Food Safety Testing Market for Traditional Technologies: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.8.1. Food Safety Testing Market for Chemical Testing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.8.2. Food Safety Testing Market for Conventional Method: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.8.3. Food Safety Testing Market for Microbiological Testing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.9. Food Safety Testing Market for Other Technologies: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.10. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF APPLICATION

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Food Safety Testing Market for Export: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.7. Food Safety Testing Market for Import: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.8. Food Safety Testing Market for Manufacturing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.8.1. Food Safety Testing Market for Finished Product: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.8.2. Food Safety Testing Market for Production Line: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.8.3. Food Safety Testing Market for Raw Material Testing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.9. Food Safety Testing Market for Processing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.9.1. Food Safety Testing Market for Food Safety Management: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.9.2. Food Safety Testing Market for Quality Assurance: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.9.3. Food Safety Testing Market for Quality Control: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.10. Food Safety Testing Market for Retail: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.10.1. Food Safety Testing Market for Food Safety Management: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.10.2. Food Safety Testing Market for Quality Assurance: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.10.3. Food Safety Testing Market for Quality Control: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.11. Food Safety Testing Market for Service: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.11.1. Food Safety Testing Market for Catering Testing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.11.2. Food Safety Testing Market for Food Safety Management: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.11.3. Food Safety Testing Market for Restaurant Testing: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.12. Food Safety Testing Market for Other Applications: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.13. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF TESTING

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Food Safety Testing Market for Consumables: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.7. Food Safety Testing Market for System: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.8. Food Safety Testing Market for Test Kits: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.9. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Food Safety Testing Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.7. Food Safety Testing Market for Large Enterprises: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.8. Data Triangulation and Validation

18. MARKET OPPORTUNITIES FOR FOOD SAFETY TESTING IN NORTH AMERICA

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Food Safety Testing Market in North America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.6.1. Food Safety Testing Market in the US: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.6.2. Food Safety Testing Market in Canada: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.6.3. Food Safety Testing Market in Mexico: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.6.4. Food Safety Testing Market in Other North American Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.7. Data Triangulation and Validation

19. MARKET OPPORTUNITIES FOR FOOD SAFETY TESTING IN EUROPE

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Food Safety Testing Market in Europe: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.1. Food Safety Testing Market in the Austria: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.2. Food Safety Testing Market in Belgium: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.3. Food Safety Testing Market in Denmark: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.4. Food Safety Testing Market in France: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.5. Food Safety Testing Market in Germany: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.6. Food Safety Testing Market in Ireland: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.7. Food Safety Testing Market in Italy: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.8. Food Safety Testing Market in Netherlands: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.9. Food Safety Testing Market in Norway: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.10. Food Safety Testing Market in Russia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.11. Food Safety Testing Market in Spain: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.12. Food Safety Testing Market in Sweden: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.13. Food Safety Testing Market in Sweden: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.14. Food Safety Testing Market in Switzerland: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.15. Food Safety Testing Market in the UK: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.16. Food Safety Testing Market in Other European Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.7. Data Triangulation and Validation

20. MARKET OPPORTUNITIES FOR FOOD SAFETY TESTING IN ASIA

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Food Safety Testing Market in Asia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.1. Food Safety Testing Market in China: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.2. Food Safety Testing Market in India: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.3. Food Safety Testing Market in Japan: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.4. Food Safety Testing Market in Singapore: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.5. Food Safety Testing Market in South Korea: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.6. Food Safety Testing Market in Other Asian Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.7. Data Triangulation and Validation

21. MARKET OPPORTUNITIES FOR FOOD SAFETY TESTING IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Food Safety Testing Market in Middle East and North Africa (MENA): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.1. Food Safety Testing Market in Egypt: Historical Trends (Since 2018) and Forecasted Estimates (Till 205)

- 21.6.2. Food Safety Testing Market in Iran: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.3. Food Safety Testing Market in Iraq: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.4. Food Safety Testing Market in Israel: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.5. Food Safety Testing Market in Kuwait: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.6. Food Safety Testing Market in Saudi Arabia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.7. Food Safety Testing Market in United Arab Emirates (UAE): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.8. Food Safety Testing Market in Other MENA Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR FOOD SAFETY TESTING IN LATIN AMERICA

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Food Safety Testing Market in Latin America: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.1. Food Safety Testing Market in Argentina: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.2. Food Safety Testing Market in Brazil: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.3. Food Safety Testing Market in Chile: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.4. Food Safety Testing Market in Colombia Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.5. Food Safety Testing Market in Venezuela: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.6. Food Safety Testing Market in Other Latin American Countries: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR FOOD SAFETY TESTING IN REST OF THE WORLD

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Food Safety Testing Market in Rest of the World: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.1. Food Safety Testing Market in Australia: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.2. Food Safety Testing Market in New Zealand: Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.3. Food Safety Testing Market in Other Countries

- 23.7. Data Triangulation and Validation

24. TABULATED DATA

25. LIST OF COMPANIES AND ORGANIZATIONS

26. CUSTOMIZATION OPPORTUNITIES

27. ROOTS SUBSCRIPTION SERVICES

28. AUTHOR DETAILS