PUBLISHER: Roots Analysis | PRODUCT CODE: 1771414

PUBLISHER: Roots Analysis | PRODUCT CODE: 1771414

Current Sensor Market, Till 2035: Distribution by Current Range, Current Sensing Methods, Output, Circuit, Component, Sales Channe, Application, End User, Company Size, Business Model, and Key Geographical Regions: Industry Trends and Global Forecasts

Current Sensor Market Overview

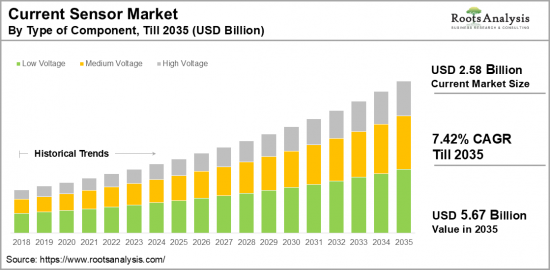

As per Roots Analysis, the global current sensor market size is estimated to grow from USD 2.58 billion in the current year to USD 5.67 billion by 2035, at a CAGR of 7.42% during the forecast period, till 2035.

The opportunity for current sensor market has been distributed across the following segments:

Type of Current Range

- Less than 100A

- 100A-1000A

- More than 1000A

Type of Current Sensing Methods

- Direct Current Sensing

- Indirect Current Sensing

Type of Output

- Analog

- Digital

Type of Circuit

- Non-Isolated

- Isolated

Type of Component

- Low Voltage

- Medium Voltage

- High Voltage

Type of Sales Channel

- Offline

- Online

Type of Technology

- Current Transformer

- Flux Gate

- Hall Effect

- Magneto-resistive

- Rogowski Coil

- Shunt

Type of Form Factor

- Closed-loop

- Module-style

- Open-loop

- PCB-mount

- Surface-mount

Mode of Application

- Automotive Power Trains

- Battery Management

- Converter & Inverter

- Fast DC Chargers (EV)

- Grid Infrastructure

- Motor Drive

- Overload Detection

- Starter & Generators

- UPS & SMPS

- Others

End User

- Aerospace & Defense

- Automotive

- Building Automation

- Consumer Electronics

- Healthcare

- Industrial Automation

- Railways

- Renewable Energy

- Telecom & Networking

- Utilities

- Others

Company Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Business Model

- B2B

- B2C

- B2B2C

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

CURRENT SENSOR MARKET: GROWTH AND TRENDS

The current sensor market is rapidly evolving, fueled by the increasing need for digital devices that manage the flow of current in electric appliances. The risk of machinery damage arises during excessive flow or high voltage conditions, leading to a heightened demand for current sensors across multiple industrial sectors.

Current sensors are devices capable of detecting and measuring the current flow through electronic devices or conductors. They employ various sensing technologies, such as Hall effect, shunt resistors, and optical sensors to monitor and regulate electrical currents. Based on specific needs, these sensors can convert current into measurable outputs, including current, voltage, and digital signals. Beyond controlling current flow, current sensors assist in monitoring voltage variations, help reduce energy consumption, improve operational efficiency, and minimize downtime. Additionally, key factors driving growth consist of industrial automation, renewable energy systems, electric vehicles, and consumer electronics.

To address the increasing demand for current sensors across a wide array of industries, numerous companies are accelerating their research and development efforts to create innovative current sensing technologies. The ongoing pursuit of technological advancements in current sensors by industry leaders has created significant opportunities for growth. Nevertheless, the primary focus will stay on incorporating AI-based technologies and IoT sensors for improved precision in current flow monitoring. With continuous innovation and adoption, the current sensors market is projected to experience significant growth during the forecast period.

CURRENT SENSOR MARKET: KEY SEGMENTS

Market Share by Type of Current Range

Based on type of current range, the global current sensor market is segmented into less than 100A, 100A-1,000A, and more than 1,000A. According to our estimates, currently, optimal range 100A-1,000A segment captures the majority share of the market. This is attributed to the increasing need for precise monitoring current sensors in industrial applications, renewable energy systems, and electric vehicles.

Additionally, current sensors in this range are known for their high performance and versatility, making them ideal for various applications that require effective energy management and monitoring. As industries place greater emphasis on energy efficiency and sustainability, the 100A-1,000A segment continues to see notable growth and demand.

Market Share by Type of Current Sensing Methods

Based on type of current sensing methods, the current sensor market is segmented into direct current sensing and indirect current sensing. According to our estimates, currently, direct current sensing segment captures the majority of the market. This can be attributed to its superior accuracy and capability for real-time monitoring, which is crucial for applications that demand precise data collection.

This approach is particularly preferred in sectors like industrial automation, electric vehicles, and renewable energy systems, where dependable performance and efficiency are vital. The increasing focus on precise energy management further strengthens the leadership of direct current sensing.

Although direct current sensing commands the largest share and is expected to experience a higher compound annual growth rate (CAGR), indirect current sensing also maintains a notable market share. This can be attributed to its importance in several industrial fields, including the automotive and energy sectors.

Market Share by Type of Output

Based on type of output, the current sensor market is segmented into analog and digital outputs. According to our estimates, currently, the digital output segment captures the majority share of the market. This growth is primarily due to its benefits in precision, resistance to noise, and alignment with contemporary digital systems. Digital sensors enable seamless integration with sophisticated data processing and IoT applications, allowing for monitoring and analysis in real time.

Market Share by Type of Circuit

Based on type of circuit, the current sensor market is segmented into isolated and non-isolated circuits. According to our estimates, currently, isolated circuit segment captures the majority share of the market. This can be attributed to its capability to provide improved safety and protection against electrical noise and surges, making it suitable for sensitive applications in sectors like industrial automation, renewable energy, and electric vehicles. Isolated circuits avoid ground loops and guarantee precise current measurements, which are essential for ensuring system reliability.

As safety standards become more stringent and the need for accurate monitoring rises, we anticipate that the isolated circuit segment will continue to gain momentum in the market and is expected to experience a higher CAGR during the forecast period.

Market Share by Type of Sales Channel

Based on type of sales channel, the current sensor market is segmented into online and offline. According to our estimates, currently, online segment captures the majority share of the market. This can be attributed to the increasing popularity of e-commerce and the convenience it provides to consumers.

Moreover, these online platforms offer easy access to a diverse range of products, competitive pricing, and customer reviews, which enhance the overall purchasing experience. Additionally, the rising adoption of digital technologies in industrial sectors and the presence of comprehensive product information online further stimulate the growth of online sales.

Market Share by Type of Technology

Based on type of technology, the current sensor market is segmented into Hall Effect, shunt, flux gate, magneto-resistive, current transformer, and Rogowski coil. According to our estimates, currently, Hall Effect segment captures the majority share of the market. This can be attributed to its versatility, accuracy, and capability to measure both AC and DC currents.

Additionally, Hall Effect sensors are compact and highly dependable, making them suitable for a variety of applications, including electric vehicles, renewable energy systems, and industrial automation, thanks to their size and reliability.

Market Share by Type of Form Factor

Based on type of form factor, the current sensor market is segmented into PCB-mount, module-style, open-loop, closed-loop, and surface-mount configurations. According to our estimates, currently, PCB-mount segment captures the majority share of the market. This can be attributed to its compact design and the ease with which it can be integrated into various electronic systems. Additionally, PCB-mounted sensors are preferred in applications such as consumer electronics, automotive, and industrial automation due to their limited space requirements and high reliability

Market Share by Mode of Application

Based on mode of application, the current sensor market is segmented into automotive power trains, battery management, converters & inverters, fast DC chargers (EV), grid infrastructure, motor drives, overload detection, starters & generators, UPS & SMPS, and others. According to our estimates, currently, battery management segment captures the majority share of the market. This can be attributed to the increasing adoption of electric vehicles (EVs) and the rising demand for effective energy storage solutions.

Market Share by End User

Based on end user, the current sensor market is segmented into aerospace & defense, automotive, building automation, consumer electronics, healthcare, industrial automation, railways, renewable energy, telecom & networking, utilities, and others based on the end users. According to our estimates, currently, automotive segment captures the majority share of the market.

This can be attributed to the swift rise of electric vehicles (EVs) and advancements in automotive electronics. It is worth noting that current sensors play a vital role in EVs for battery management, motor control, and safety. With the increasing emphasis on electrification and automation, we anticipate that this segment will continue to hold its prominent position in the market.

Market Share by Company Size

Based on company size, the current sensor market is segmented into large size companies and small and mid-size companies. According to our estimates, currently, large companies capture the majority share of the market. This can be attributed to the fact that large enterprises possess the resources and capabilities to make substantial investments in research and development, manufacturing capabilities, and marketing, which allows them to create current sensors at a lower cost per unit than their smaller counterparts.

Additionally, the current sensors offered by medium and small-sized companies are cost-effective options that maintain good quality. This segment is projected to grow at a higher CAGR, due to the rising demand and improved availability of better current sensors in the market.

Market Share by Business Model

Based on business model, the current sensor market is segmented into B2B, B2C and B2B2C. According to our estimates, currently, B2B captures the majority share of the market. This can be attributed to the growing implementation of current sensor technology across various industries, including aerospace, manufacturing, healthcare and finance.

Additionally, the B2C model is likely to experience a higher CAGR, during the forecast period, as current sensor technologies become increasingly user-friendly, leading to more consumers integrating them for personalized uses, smartphone compatibility, and enhanced user experiences.

Market Share by Geographical Regions

Based on geographical regions, the current sensor market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market. This can be attributed to the technological infrastructure and high concentration of innovative firms that are actively engaged in the development and implementation of advanced current sensing technologies.

Additionally, North America serves as the home for numerous leading current sensor manufacturers, who utilize state-of-the-art research and development to maintain their competitive edge. The increasing demand for electric vehicles, renewable energy systems, and industrial automation in North America generates a considerable customer base for current sensors, as these systems and vehicles depend on direct current.

Example Players in Current Sensor Market

- Aceinna

- Allegro MicroSystems

- American Aerospace Controls

- Asahi Kasei

- DARE

- Eaton

- ELECTROHMS

- Honeywell

- ICE

- Infineon

- KOHSHIN

- LEM Holding

- Magnesensor

- Melexis

- Ningbo Xici Electronic Technology

- NK Technologies

- Omron

- Pulse Electronics

- Sensitec

- Sensor Electronic Technology (SET)

- Silicon Laboratories

- STMicroelectronics

- TAMURA

- Texas Instruments

- TDK

- VACUUMSCHMELZE

- Yageo

- YUANXING

CURRENT SENSOR MARKET: RESEARCH COVERAGE

The report on the current sensor market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the current sensor market, focusing on key market segments, including [A] type of current range, [B] type of current sensing methods, [C] type of output, [D] type of circuit, [E] type of component, [F] type of sales channel, [G] type of technology, [H] type of form factor, [I] mode of application, [J] end user, [K] company size, [L] type of business model, and [M] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the current sensor market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the current sensor market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] service / product portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in current sensor market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.1. Time Period

4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Current Sensor Market

- 6.2.1. Type of Current Range

- 6.2.2. Type of Current Sensing Methods

- 6.2.3. Advantages of Current Sensors

- 6.2.4. Challenges with Current Sensors

- 6.3. Future Perspective

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Current Sensor: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Ownership Structure

8. COMPANY PROFILES

- 8.1. Chapter Overview

- 8.2. Aceinna

- 8.2.1. Company Overview

- 8.2.2. Company Mission

- 8.2.3. Company Footprint

- 8.2.4. Management Team

- 8.2.5. Contact Details

- 8.2.6. Financial Performance

- 8.2.7. Operating Business Segments

- 8.2.8. Service / Product Portfolio (project specific)

- 8.2.9. MOAT Analysis

- 8.2.10. Recent Developments and Future Outlook

- Similar detail is presented for other below mentioned companies based on information in the public domain

- 8.3. Allegro MicroSystems

- 8.4. American Aerospace Controls

- 8.5. Asahi Kasei

- 8.6. DARE

- 8.7. Eaton

- 8.8. Honeywell

- 8.9. ICE

- 8.10. Infenion

- 8.11. KOHSHIN

- 8.12. STMicroelectronics

- 8.13. TAMURA

- 8.14. Texas Instruments

- 8.15. TDK

- 8.16. VACUUMSCHMELZE

- 8.17. Yageo

- 8.18. YUANXING

9. VALUE CHAIN ANALYSIS

10. SWOT ANALYSIS

11. GLOBAL CURRENT SENSOR MARKET

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.3. Trends Disruption Impacting Market

- 11.4. Global Current Sensor Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 11.5. Multivariate Scenario Analysis

- 11.5.1. Conservative Scenario

- 11.5.2. Optimistic Scenario

- 11.6. Key Market Segmentations

12. MARKET OPPORTUNITIES BASED ON TYPE OF CURRENT RANGE

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. Revenue Shift Analysis

- 12.4. Market Movement Analysis

- 12.5. Penetration-Growth (P-G) Matrix

- 12.6. Current Sensor Market for Less than 100A: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.7. Current Sensor Market for 100A-1000A: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.8. Current Sensor Market for More than 1000A: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 12.9. Data Triangulation and Validation

13. MARKET OPPORTUNITIES BASED ON TYPE OF CURRENT SENSING METHOD

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Revenue Shift Analysis

- 13.4. Market Movement Analysis

- 13.5. Penetration-Growth (P-G) Matrix

- 13.6. Current Sensor Market for Direct Current Sensing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.7. Current Sensor Market for Indirect Current Sensing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.8. Current Sensor Market for Underground: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.9. Data Triangulation and Validation

14. MARKET OPPORTUNITIES BASED ON TYPE OF OUTPUT

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Revenue Shift Analysis

- 14.4. Market Movement Analysis

- 14.5. Penetration-Growth (P-G) Matrix

- 14.6. Current Sensor Market for Analog: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.7. Current Sensor Market for Digital: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.8. Data Triangulation and Validation

15. MARKET OPPORTUNITIES BASED ON TYPE OF CIRCUIT

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Revenue Shift Analysis

- 15.4. Market Movement Analysis

- 15.5. Penetration-Growth (P-G) Matrix

- 15.6. Current Sensor Market for Non-Isolated: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.7. Current Sensor Market for Isolated: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.8. Data Triangulation and Validation

16. MARKET OPPORTUNITIES BASED ON TYPE OF COMPONENT

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Revenue Shift Analysis

- 16.4. Market Movement Analysis

- 16.5. Penetration-Growth (P-G) Matrix

- 16.6. Current Sensor Market for Low Voltage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.7. Current Sensor Market for Medium Voltage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.8. Current Sensor Market for High Voltage: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.9. Data Triangulation and Validation

17. MARKET OPPORTUNITIES BASED ON TYPE OF SALES CHANNEL

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Revenue Shift Analysis

- 17.4. Market Movement Analysis

- 17.5. Penetration-Growth (P-G) Matrix

- 17.6. Current Sensor Market for Offline: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.7. Current Sensor Market for Online: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.8. Data Triangulation and Validation

18. MARKET OPPORTUNITIES BASED ON TYPE OF TECHNOLOGY

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Revenue Shift Analysis

- 18.4. Market Movement Analysis

- 18.5. Penetration-Growth (P-G) Matrix

- 18.6. Current Sensor Market for Current Transformer: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Current Sensor Market for Flux Gate: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.8. Current Sensor Market for Hall Effect: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.9. Current Sensor Market for Magneto-resistive: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.10. Current Sensor Market for Rogowski Coil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.11. Current Sensor Market for Shunt: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.12. Data Triangulation and Validation

19. MARKET OPPORTUNITIES BASED ON FORM FACTOR

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Current Sensor Market for Closed-loop: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. Current Sensor Market for Module-style: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Current Sensor Market for Open-loop: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.9. Current Sensor Market for PCB-mount: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.10. Current Sensor Market for Surface-mount: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.11. Data Triangulation and Validation

20. MARKET OPPORTUNITIES BASED ON MODE OF APPLICATION

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Current Sensor Market for Automotive Power Trains: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. Current Sensor Market for Battery Management: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Current Sensor Market for Converter & Inverter: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.9. Current Sensor Market for Fast DC Charges (EV): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.10. Current Sensor Market for Grid Infrastructure: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.11. Current Sensor Market for Motor Drive: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.12. Current Sensor Market for Overload Detection: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.13. Current Sensor Market for Starter & Generators: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.14. Current Sensor Market for UPS & SMPS: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.15. Current Sensor Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.16. Data Triangulation and Validation

21. MARKET OPPORTUNITIES BASED ON END USER

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Current Sensor Market for Residential: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. Current Sensor Market for Aerospace & Defense: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Current Sensor Market for Automotive: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.9. Current Sensor Market for Building Automation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.10. Current Sensor Market for Consumer Electronics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.11. Current Sensor Market for Healthcare: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.12. Current Sensor Market for Industrial Automation: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.13. Current Sensor Market for Railways: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.14. Current Sensor Market for Renewable Energy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.15. Current Sensor Market for Telecom & Networking: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.16. Current Sensor Market for Utilities: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.17. Current Sensor Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.18. Data Triangulation and Validation

22. MARKET OPPORTUNITIES BASED ON COMPANY SIZE

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Current Sensor Market for Large Enterprises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. Current Sensor Market for Small and Medium-sized Enterprises (SMEs): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.8. Data Triangulation and Validation

23. MARKET OPPORTUNITIES BASED ON BUSINESS MODEL

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Current Sensor Market for B2B: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. Current Sensor Market for B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.8. Current Sensor Market for B2B2C: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.9. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR CURRENT SENSOR IN NORTH AMERICA

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Current Sensor Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.1. Current Sensor Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.2. Current Sensor Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.3. Current Sensor Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.6.4. Current Sensor Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR CURRENT SENSOR IN EUROPE

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Current Sensor Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.1. Current Sensor Market in the Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.2. Current Sensor Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.3. Current Sensor Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.4. Current Sensor Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.5. Current Sensor Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.6. Current Sensor Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.7. Current Sensor Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.8. Current Sensor Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.9. Current Sensor Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.10. Current Sensor Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.11. Current Sensor Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.12. Current Sensor Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.13. Current Sensor Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.14. Current Sensor Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.6.15. Current Sensor Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. MARKET OPPORTUNITIES FOR CURRENT SENSOR IN ASIA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. Current Sensor Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. Current Sensor Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. Current Sensor Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. Current Sensor Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. Current Sensor Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.5. Current Sensor Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.6. Current Sensor Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR CURRENT SENSOR IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. Current Sensor Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. Current Sensor Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 27.6.2. Current Sensor Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. Current Sensor Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.4. Current Sensor Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.5. Current Sensor Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.6. Current Sensor Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.7. Current Sensor Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.8. Current Sensor Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR CURRENT SENSOR IN LATIN AMERICA

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. Current Sensor Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.1. Current Sensor Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.2. Current Sensor Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.3. Current Sensor Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.4. Current Sensor Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.5. Current Sensor Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.6. Current Sensor Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.7. Data Triangulation and Validation

29. MARKET OPPORTUNITIES FOR CURRENT SENSOR IN REST OF THE WORLD

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Revenue Shift Analysis

- 29.4. Market Movement Analysis

- 29.5. Penetration-Growth (P-G) Matrix

- 29.6. Current Sensor Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.1. Current Sensor Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.2. Current Sensor Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.3. Current Sensor Market in Other Countries

- 29.7. Data Triangulation and Validation

30. TABULATED DATA

31. LIST OF COMPANIES AND ORGANIZATIONS

32. CUSTOMIZATION OPPORTUNITIES

33. ROOTS SUBSCRIPTION SERVICES

34. AUTHOR DETAIL