PUBLISHER: Roots Analysis | PRODUCT CODE: 1817402

PUBLISHER: Roots Analysis | PRODUCT CODE: 1817402

Electronics Batch Records Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Type of Electronic Batch Record System, Deployment Mode, Purpose of Electronic Batch Record, Geographical Regions and Leading Players

ELECTRONIC BATCH RECORDS MARKET: OVERVIEW

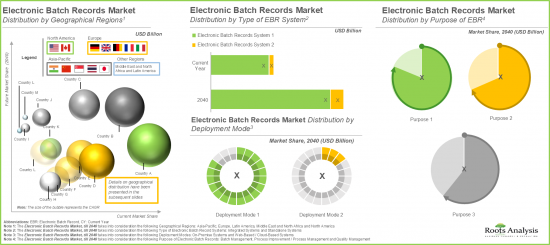

As per Roots Analysis, the global electronic batch records market size is currently valued at USD 1.28 billion and is projected to reach USD 9.62 billion by 2040, growing at a CAGR of 14.4% during the forecast period.

The opportunity for electronic batch records market has been distributed across the following segments:

Type of Electronic Batch Record System

- Integrated System

- Standalone System

Deployment Mode

- On-Premises

- Web-based / Cloud-based

Purpose of Electronic Batch Record

- Batch Management

- Process Improvement / Process Management

- Quality Management

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Market in North America

- US

- Canada

Market in Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

Market in Asia-Pacific

- China

- India

- Japan and Rest of Asia-Pacific

Market in Middle East and North Africa

- Saudi Arabia

- UAE

- Egypt

Market in Latin America

- Brazil

- Mexico

- Argentina

Electronic Batch Records Market: Growth and Trends

Electronic batch records (EBR) are digital solutions designed to track, streamline, and automate manufacturing processes. These systems capture, monitor, and store production data for every batch on the production line, ensuring transparency and adherence to quality standards across the entire manufacturing lifecycle. Currently, the electronic batch records are widely used in various sectors, such as pharmaceuticals, biotechnology, healthcare, and the food and beverage industry, where regulatory compliance and quality assurance are critical.

Moreover, the traditional manual batch records pose several challenges that can disrupt manufacturing processes, as they are more prone to human error and can lead to potential violations of regulatory standards. To overcome these challenges, many manufacturers have adopted electronic batch records in order to enhance their product quality while minimizing the operational and production costs. Further, the introduction of 21 CFR Part 11 compliance standards by the US Food and Drug Administration in 1990, aimed at reinforcing Good Manufacturing Practices (GMPs) marked a significant step toward the adoption of digital batch manufacturing solutions, underscoring the importance of EBR systems.

Growing safety concerns, stricter regulatory requirements, and the demand for scientific validation have accelerated the need for advanced EBR solutions. In addition, the increasing emphasis on quality, the shift toward multi-product manufacturing strategies, the integration of advanced technologies, and the emergence of artificial intelligence in EBR systems are expected to drive further growth in this market.

Electronic Batch Records Market: Key Insights

The report delves into the current state of the electronic batch records market and identifies potential growth opportunities within the industry. The key takeaways of the report are:

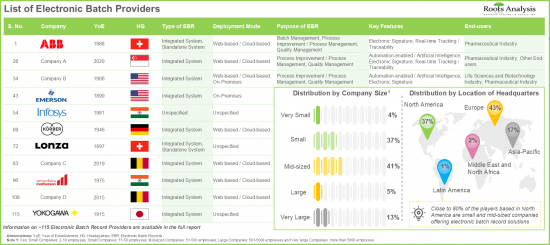

- Presently, around 115 electronic batch record solutions are offered by companies across the globe; majority of the electronic batch solution providers are headquartered in Europe.

- Close to 95% electronic batch records focus on quality management; nearly 60% of these EBRs are developed for automation in the pharmaceutical industry.

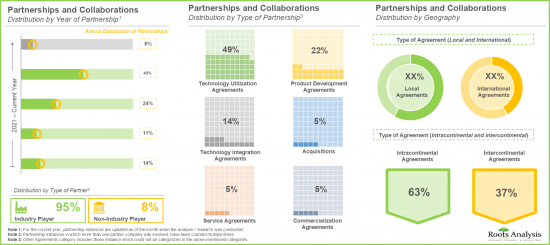

- A steady growth in the partnership activity has been observed in recent years; technology utilization agreements have emerged as the most prominent partnering model.

- More than 60% of the recent initiatives within EBR domain were focused on the launch of new solutions; notably, 83% of the solutions launched / upgraded are incorporated with real-time tracking / traceability.

- Driven by the escalating demand for automated solutions and growing regulatory compliance, the electronic batch record market is poised to rise steadily in the foreseeable future.

- The market is anticipated to grow at an annualized rate (CAGR) of 14.4% by 2040; the integrated systems segment is expected to capture the majority share (close to 80%) of the market.

Electronic Batch Records Market: Key Segments

Integrated Systems are Likely to Hold the Largest Share in the Electronic Batch Records Market During the Forecast Period

Based on the type of electronic batch record systems, the global market is segmented into integrated systems and standalone systems. Currently, the integrated systems segment leads the overall market. Further, it is important to highlight that this trend is unlikely to change in the future as well. This can be attributed to the fact that these systems have the capability to improve the efficiency and productivity of manufacturing processes, while reducing the compliance cost and manual errors.

Electronic Batch Records Market for Web-Based / Cloud-Based Deployment Mode is Likely to Grow at a Relatively Faster Pace During the Forecast Period

Based on the deployment mode, the global electronic batch records market is segmented across web-based / cloud-based segment and on-premises. Presently, the market is dominated by the revenues generated through on-premises segment. However, the revenues generated by web-based / cloud-based deployment mode are anticipated to grow at a higher CAGR during the forecast period.

Quality Management Hold the Largest Share in the Electronic Batch Records Market

Based on the purpose of electronic batch records, the global market is segmented into batch management, process improvement / process management and quality management. Presently, the quality management segment accounts for the largest market share, and this trend is unlikely to change in the future as well owing to the widespread awareness of quality control and maintaining the accuracy and reliability of manufacturing batch records.

North America Accounts for the Largest Share in the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia Pacific, Middle East and North Africa, Latin America. In the current scenario, North America is likely to capture the largest market share. Further, it is worth highlighting that the market in Asia-Pacific is expected to grow at a relatively high CAGR during the forecast period.

Example Players in the Electronic Batch Records Market

- ABB

- AmpleLogic

- Ant Solutions

- Datex

- Ecubix

- InstantGMP

- Korber

- Sapio Sciences

- Scigeniq

- Siemens

- Solulever

- Supertech Instrumentation

- Thermo Fisher Scientific

- Tulip Interfaces

- Yokogawa

Electronic Batch Records Market: Research Coverage

The report on electronic batch records market features insights into various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of current market opportunity and the future growth potential of electronic batch records market, focusing on key market segments, including [A] type of electronic batch record system, [B] deployment mode, [C] purpose of electronic batch record, [D] geographical regions, and [E] leading players.

- Market Impact Analysis: A thorough analysis of various factors, such as [A] drivers, [B] restraints, [C] opportunities, and [D] existing challenges that are likely to impact market growth.

- Market Landscape: A comprehensive evaluation of electronic batch record systems, based on several relevant parameters, such as [A] type of electronic batch record system, [B] deployment mode, [C] purpose of electronic batch record, [D] key features, and [E] end user.

- Electronic Batch Records Systems Landscape: The report features a list of system providers engaged in the electronic batch records domain, along with analyses based on [A] year of establishment, [B] company size, and [C] location of headquarters.

- Company Competitiveness Analysis: An insightful competitiveness analysis of the virtual clinical trials companies in this domain, based on various relevant parameters, such as [A] company strength, [B] portfolio strength, and [C] end user.

- Company Profiles: Comprehensive profiles of key industry players in the electronic batch records domain, featuring information on [A] company overview, [B] financial information (if available), [C] solutions portfolio, [D] recent developments, and [E] future outlook statements.

- Partnerships and Collaborations: A detailed analysis of partnerships inked between stakeholders in the electronic batch records market, since 2021, based on several relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] purpose of electronic batch record, [E] end user, [F] most active players (in terms of number of partnerships), and [G] geography.

- Recent Initiatives: A detailed analysis of the various initiatives undertaken in the electronic batch records domain, based on several relevant parameters, such as [A] year of initiative, [B] type of initiative, [C] purpose of electronic batch record, [D] key features, [E] end user, [F] most active players (in terms of number of recent initiatives), and [G] geography.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Value and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross-Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Types of Batch Records

- 6.3. Features of Electronic Batch Records

- 6.4. Applications of Electronic Batch Records

- 6.5. Advantages of Electronic Batch Records

- 6.6. Disadvantages of Electronic Batch Records

- 6.7. Key Considerations while Selecting an EBR Solution

- 6.8. Future Perspective

SECTION III: MARKET OVERVIEW

7. MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Electronic Batch Record Solution Providers: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Type of Electronic Batch Record System

- 7.2.5. Analysis by Deployment Mode

- 7.2.6. Analysis by Purpose of Electronic Batch Record

- 7.2.7. Analysis by Key Features

- 7.2.8. Analysis by End-user

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Overview of Peer Groups

- 8.5. Electronic Batch Record Solution Providers: Company Competitiveness Analysis

- 8.5.1. Electronic Batch Record Solution Providers based in North America

- 8.5.2. Electronic Batch Record Solution Providers based in Europe

- 8.5.3. Electronic Batch Record Solution Providers based in Asia-Pacific and Rest of the World

SECTION IV: COMPANY PROFILES

9. COMPANY PROFILES: ELECTRONIC BATCH RECORD SOLUTION PROVIDERS IN NORTH AMERICA

- 9.1. Chapter Overview

- 9.2 Thermo Fisher Scientific

- 9.2.1. Company Overview

- 9.2.2. Electronic Batch Record Solution Portfolio

- 9.2.3. Financial Information

- 9.2.4. Recent Developments and Future Outlook

- 9.3. Datex

- 9.4. InstantGMP

- 9.5. Sapio Sciences

- 9.6. Tulip Interfaces

10. COMPANY PROFILES: ELECTRONIC BATCH RECORD SOLUTION PROVIDERS IN EUROPE

- 10.1. Chapter Overview

- 10.2. ABB

- 10.2.1. Company Overview

- 10.2.2. Electronic Batch Record Solution Portfolio

- 10.2.3. Financial Information

- 10.2.4. Recent Developments and Future Outlook

- 10.3. Ant Solutions

- 10.4. Korber

- 10.5. Siemens

- 10.6. Solulever

11. COMPANY PROFILES: ELECTRONIC BATCH RECORD SOLUTION PROVIDERS IN ASIA-PACIFIC AND REST OF THE WORLD

- 11.1. Chapter Overview

- 11.2. Yokogawa

- 11.2.1. Company Overview

- 11.2.2. Electronic Batch Record Solution Portfolio

- 11.2.3. Financial Information

- 11.2.4. Recent Developments and Future Outlook

- 11.3. AmpleLogic

- 11.4. Ecubix

- 11.5. Scigeniq

- 11.6. Supertech Instrumentation

SECTION V: MARKET TRENDS

12. PARTNERSHIPS AND COLLABORATIONS

- 12.1. Chapter Overview

- 12.2. Partnership Models

- 12.3. Electronic Batch Records: Partnerships and Collaborations

- 12.3.1. Analysis by Year of Partnership

- 12.3.2. Analysis by Type of Partnership

- 12.3.3. Analysis by Year and Type of Partnership

- 12.3.4. Analysis by Type of Partner

- 12.3.5. Analysis by Purpose of Electronic Batch Record

- 12.3.6. Analysis by End-user

- 13.2.7. Most Active Players: Analysis by Number of Partnerships

- 12.3.8. Analysis by Geography

- 12.3.8.1. Analysis by Country

- 12.3.8.2. Analysis by Region

13. RECENT INITIATIVES

- 13.1. Chapter Overview

- 13.2. Electronic Batch Record Solutions: Recent Initiatives

- 13.2.1. Analysis by Year of Initiative

- 13.2.2. Analysis by Type of Initiative

- 13.2.3. Analysis by Year and Type of Initiative

- 13.2.4. Analysis by Purpose of Electronic Batch Record

- 13.2.5. Analysis by Key Features

- 13.2.6. Analysis by End-user

- 13.2.7. Most Active Players: Analysis by Number of Recent Initiatives

- 13.2.8. Analysis by Geography

SECTION VI: MARKET OPPORTUNITY ANALYSIS

14. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 14.1. Chapter Overview

- 14.2. Market Drivers

- 14.3. Market Restraints

- 14.4. Market Opportunities

- 14.5. Market Challenges

- 14.6. Conclusion

15. GLOBAL ELECTRONIC BATCH RECORDS MARKET

- 15.1. Chapter Overview

- 15.2. Assumptions and Methodology

- 15.3. Global Electronic Batch Records Market: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 15.3.1. Roots Analysis Perspective on Market Growth

- 15.3.2. Scenario Analysis

- 15.3.2.1. Conservative Scenario

- 15.3.2.2. Optimistic Scenario

- 15.4. Key Market Segmentations

16. ELECTRONIC BATCH RECORDS MARKET, BY TYPE OF ELECTRONIC BATCH RECORD SYSTEM

- 16.1. Chapter Overview

- 16.2. Assumptions and Methodology

- 16.3. Electronic Batch Records Market: Distribution by Type of Electronic Batch Record System

- 16.3.1. Electronic Batch Records Market for Integrated Systems: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 16.3.2. Electronic Batch Records Market for Standalone Systems: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 16.4. Data Triangulation and Validation

17. ELECTRONIC BATCH RECORDS MARKET, BY TYPE OF DEPLOYMENT MODE

- 17.1. Chapter Overview

- 17.2. Assumptions and Methodology

- 17.3. Electronic Batch Records Market: Distribution by Deployment Mode

- 17.3.1. Electronic Batch Records Market for Web-based / Cloud-based Deployment Mode: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 17.3.2. Electronic Batch Records Market for On-Premises Deployment Mode: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 17.4. Data Triangulation and Validation

18. ELECTRONIC BATCH RECORDS MARKET, BY PURPOSE OF ELECTRONIC BATCH RECORD

- 18.1. Chapter Overview

- 18.2. Assumptions and Methodology

- 18.3. Electronic Batch Records Market: Distribution by Purpose of Electronic Batch Record

- 18.3.1. Electronic Batch Records Market for Quality Management: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.3.2. Electronic Batch Records Market for Process Improvement / Process Management: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.3.3. Electronic Batch Records Market for Batch Management: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 18.4. Data Triangulation and Validation

19. ELECTRONIC BATCH RECORDS MARKET, BY GEOGRAPHICAL REGION

- 19.1. Chapter Overview

- 19.2. Assumptions and Methodology

- 19.3. Electronic Batch Records Market: Distribution by Geographical Region

- 19.3.1. Electronic Batch Records Market for North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.1.1. Electronic Batch Records Market in the US: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.1.2. Electronic Batch Records Market in Canada: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2. Electronic Batch Records Market for Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2.1. Electronic Batch Records Market in Germany: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2.2. Electronic Batch Records Market in the UK: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2.3. Electronic Batch Records Market in France: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2.4. Electronic Batch Records Market in Italy: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2.5. Electronic Batch Records Market in Spain: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.2.6. Electronic Batch Records Market for Rest of Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.3. Electronic Batch Records Market for Asia-Pacific: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.3.1. Electronic Batch Records Market in China: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.3.2. Electronic Batch Records Market in India: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.3.3. Electronic Batch Records Market for Japan and Rest of Asia-Pacific: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.4. Electronic Batch Records Market for Middle East and North Africa: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.4.1. Electronic Batch Records Market in Saudi Arabia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.4.2. Electronic Batch Records Market in UAE: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.4.3. Electronic Batch Records Market in Egypt: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.5. Electronic Batch Records Market for Latin America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.5.1. Electronic Batch Records Market in Brazil: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.5.2. Electronic Batch Records Market in Mexico: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.5.3. Electronic Batch Records Market in Argentina: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.3.1. Electronic Batch Records Market for North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040)

- 19.4. Market Movement Analysis

- 19.5 Penetration-Growth (P-G) Matrix

- 19.6. Data Triangulation and Validation

20. ELECTRONIC BATCH RECORDS SOLUTIONS MARKET, BY LEADING PLAYERS

- 20.1. Chapter Overview

- 20.2. Leading Industry Players

SECTION VII: OTHER INSIGHTS

21. CONCLUDING REMARKS

22. APPENDIX 1: TABULATED DATA

23. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 7.1 Electronic Batch Record Solution Providers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 7.2 Electronic Batch Record Solution Providers: Information on Type of EBR System, Deployment Mode and Purpose of EBR

- Table 7.3 Electronic Batch Record Solution Providers: Information on Key Features and End-user

- Table 9.1 Electronic Batch Record Solution Providers in North America: List of Companies Profiled

- Table 9.2 Datex: Company Overview

- Table 9.3 Electronic Batch Record Solutions Portfolio

- Table 9.4 Datex: Recent Developments and Future Outlook

- Table 9.5 InstantGMP: Company Overview

- Table 9.6 Electronic Batch Record Solutions Portfolio

- Table 9.7 InstantGMP: Recent Developments and Future Outlook

- Table 9.8 Sapio Sciences: Company Overview

- Table 9.9 Electronic Batch Record Solutions Portfolio

- Table 9.10 Sapio Sciences: Recent Developments and Future Outlook

- Table 9.11 Thermo Fisher Scientific: Company Overview

- Table 9.12 Electronic Batch Record Solutions Portfolio

- Table 9.13 Thermo Fisher Scientific: Recent Developments and Future Outlook

- Table 9.14 Tulip Interfaces: Company Overview

- Table 9.15 Electronic Batch Record Solutions Portfolio

- Table 9.16 Tulip Interfaces: Recent Developments and Future Outlook

- Table 10.1 Electronic Batch Record Solution Providers in Europe: List of Companies Profiled

- Table 10.2 ABB: Company Overview

- Table 10.3 Electronic Batch Record Solutions Portfolio

- Table 10.4 ABB: Recent Developments and Future Outlook

- Table 10.5 Ant Solutions: Company Overview

- Table 10.6 Electronic Batch Record Solutions Portfolio

- Table 10.7 Ant Solutions: Recent Developments and Future Outlook

- Table 10.8 Korber: Company Overview

- Table 10.9 Electronic Batch Record Solutions Portfolio

- Table 10.10 Korber: Recent Developments and Future Outlook

- Table 10.11 Siemens: Company Overview

- Table 10.12 Electronic Batch Record Solutions Portfolio

- Table 10.13 Siemens: Recent Developments and Future Outlook

- Table 10.14 Solulever: Company Overview

- Table 10.15 Electronic Batch Record Solutions Portfolio

- Table 11.1 Electronic Batch Record Solution Providers in Asia-Pacific and Rest of the World: List of Companies Profiled

- Table 11.2 AmpleLogic: Company Overview

- Table 11.3 Electronic Batch Record Solutions Portfolio

- Table 11.4 Ecubix: Company Overview

- Table 11.5 Electronic Batch Record Solutions Portfolio

- Table 11.6 Scigeniq: Company Overview

- Table 11.7 Electronic Batch Record Solutions Portfolio

- Table 11.8 Scigeniq: Recent Developments and Future Outlook

- Table 11.9 Supertech Instrumentation: Company Overview

- Table 11.10 Electronic Batch Record Solutions Portfolio

- Table 11.11 Yokogawa: Company Overview

- Table 11.12 Electronic Batch Record Solutions Portfolio

- Table 12.1 Electronic Batch Record Providers: List of Partnerships and Collaborations, Since 2021

- Table 12.2 Partnerships and Collaborations: Information on Type of Agreement

- Table 13.1 Electronic Batch Records: List of Recent Initiatives

- Table 21.1 Leading Industry Players: Based on Company Competitiveness Analysis

- Table 23.1 Electronic Batch Record Solution Providers: Distribution by Year of Establishment

- Table 23.2 Electronic Batch Record Solution Providers: Distribution by Company Size

- Table 23.3 Electronic Batch Record Solution Providers: Distribution by Location of Headquarters (Region-wise)

- Table 23.4 Electronic Batch Record Solution Providers: Distribution by Type of Electronic Batch Record System

- Table 23.5 Electronic Batch Record Solution Providers: Distribution by Deployment Mode

- Table 23.6 Electronic Batch Record Solution Providers: Distribution by Purpose of Electronic Batch Record

- Table 23.7 Electronic Batch Record Solution Providers: Distribution by Key Feature

- Table 23.8 Electronic Batch Record Solution Providers: Distribution by End-users

- Table 23.9 Thermo Fisher Scientific: Annual Revenues, Since FY 2021 (USD Billion)

- Table 23.10 ABB: Annual Revenues, Since FY 2021 (EUR Billion)

- Table 23.11 Korber: Annual Revenues, Since FY 2021 (EUR Billion)

- Table 23.12 Siemens: Annual Revenues, Since FY 2021 (EUR Billion)

- Table 23.13 Yokogawa: Annual Revenues, Since FY 2021 (YEN Billion)

- Table 23.14 Partnerships and Collaborations: Distribution by Cumulative Year-wise Trend, Since 2021

- Table 23.15 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 23.16 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2021

- Table 23.17 Partnerships and Collaborations: Distribution by Type of Partner

- Table 23.18 Partnerships and Collaborations: Distribution by Purpose of Electronic Batch Record

- Table 23.19 Partnerships and Collaborations: Distribution by End-users

- Table 23.20 Most Active Players: Distribution by Number of Partnership

- Table 23.21 Partnerships and Collaborations: Distribution by Country

- Table 23.22 Partnerships and Collaborations: Distribution by Region

- Table 23.23 Recent Initiatives: Cumulative Year-wise Trend, Since 2021

- Table 23.24 Recent Initiatives: Distribution by Type of Initiative

- Table 23.25 Recent Initiatives: Distribution by Year and Type of Initiative

- Table 23.26 Recent Initiatives: Distribution by Purpose of Electronic Batch Record

- Table 23.27 Recent Initiatives: Distribution by Key Features

- Table 23.28 Recent Initiatives: Distribution by End-user

- Table 23.29 Most Active Players: Distribution by Number of Recent Initiatives

- Table 23.30 Recent Initiatives: Distribution by Geography

- Table 23.31 Global Electronic Batch Records Market: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Table 23.32 Global Electronic Batch Records Market, Forecasted Estimates (Till 2040): Conservative Scenario (USD Billion)

- Table 23.33 Global Electronic Batch Records Market, Forecasted Estimates (Till 2040): Optimistic Scenario (USD Billion)

- Table 23.34 Electronic Batch Records Market: Distribution by Type of Electronic Batch Record System, 2020, 2025 and 2040

- Table 23.35 Electronic Batch Records Market for Integrated Systems: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.36 Electronic Batch Records Market for Standalone Systems: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.37 Electronic Batch Records Market: Distribution by Deployment Mode, 2020, 2025 and 2040

- Table 23.38 Electronic Batch Records Market for Web-Based / Cloud-Based Deployment Mode: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.39 Electronic Batch Records Market for On-Premises Deployment Mode: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.40 Electronic Batch Records Market: Distribution by Purpose of Electronic Batch Record Systems, 2020, 2025 and 2040

- Table 23.41 Electronic Batch Records Market for Quality Management: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.42 Electronic Batch Records Market for Process Improvement / Process Management: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.43 Electronic Batch Records Market for Batch Management: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.44 Electronic Batch Records Market: Distribution by Key Geographical Regions, 2020, 2025 and 2040

- Table 23.45 Electronic Batch Records Market in North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.46 Electronic Batch Records Market in the US: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.47 Electronic Batch Records Market in Canada: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.48 Electronic Batch Records Market in Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.49 Electronic Batch Records Market in Germany: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.50 Electronic Batch Records Market in the UK: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.51 Electronic Batch Records Market in France: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.52 Electronic Batch Records Market in Italy: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.53 Electronic Batch Records Market in Spain: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.54 Electronic Batch Records Market in Rest of Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.55 Electronic Batch Records Market in Asia-Pacific: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.56 Electronic Batch Records Market in China: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.57 Electronic Batch Records Market in India: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.58 Electronic Batch Records Market in Japan and Rest of Asia-Pacific: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.59 Electronic Batch Records Market in Middle East and North Africa: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.60 Electronic Batch Records Market in Saudi Arabia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.61 Electronic Batch Records Market in UAE: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.62 Electronic Batch Records Market in Egypt: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.63 Electronic Batch Records Market in Latin America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.64 Electronic Batch Records Market in Brazil: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.65 Electronic Batch Records Market in Mexico: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 23.66 Electronic Batch Records Market in Argentina: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040), Conservative, Base and Optimistic Scenarios (USD Billion)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Data Sources for Secondary Research

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 3.1 Market Dynamics: Forecast Methodology

- Figure 3.2 Market Dynamics: Market Assessment Framework

- Figure 4.1 Lessons Learnt from Past Recessions

- Figure 5.1 Executive Summary: Market Landscape

- Figure 5.2 Executive Summary: Recent Initiatives

- Figure 5.3 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 6.1 Types of Batch Records

- Figure 6.2 Features of Electronic Batch Records

- Figure 6.3 Advantages of Electronic Batch Records

- Figure 7.1 Electronic Batch Record Solution Providers: Distribution by Year of Establishment

- Figure 7.2 Electronic Batch Record Solution Providers: Distribution by Company Size

- Figure 7.3 Electronic Batch Record Solution Providers: Distribution by Location of Headquarters

- Figure 7.4 Electronic Batch Record Solution Providers: Distribution by Type of Electronic Batch Record System

- Figure 7.5 Electronic Batch Record Solution Providers: Distribution by Deployment Mode

- Figure 7.6 Electronic Batch Record Solution Providers: Distribution by Purpose of Electronic Batch Record

- Figure 7.7 Electronic Batch Record Solution Providers: Distribution by Key Features

- Figure 7.8 Electronic Batch Record Solution Providers: Distribution by End-user

- Figure 8.1 Company Competitiveness Analysis: Overview of Peer Group I

- Figure 8.2 Company Competitiveness Analysis: Overview of Peer Group II

- Figure 8.3 Company Competitiveness Analysis: Overview of Peer Group III

- Figure 8.4 Company Competitiveness Analysis: Electronic Batch Record Solution Providers based in North America

- Figure 8.5 Company Competitiveness Analysis: Electronic Batch Record Solution Providers based in Europe

- Figure 8.6 Company Competitiveness Analysis: Electronic Batch Record Solution Providers based in Asia-Pacific and Rest of the World

- Figure 9.1 Thermo Fisher Scientific: Annual Revenues, FY 2021 onwards (USD Billion)

- Figure 10.1 ABB: Annual Revenues, FY 2021 onwards (EUR Billion)

- Figure 10.2 Korber: Annual Revenues, FY 2021 onwards (EUR Billion)

- Figure 10.3 Siemens: Annual Revenues, FY 2021 onwards (EUR Billion)

- Figure 11.1 Yokogawa: Annual Revenues, FY 2021 onwards (YEN Billion)

- Figure 12.1 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2021

- Figure 12.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 12.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2021

- Figure 12.4 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 12.5 Partnerships and Collaborations: Distribution by Purpose of Electronic Batch Record

- Figure 12.6 Partnerships and Collaborations: Distribution by End-user

- Figure 12.7 Most Active Players: Distribution by Number of Partnerships

- Figure 12.8 Partnerships and Collaborations: Distribution by Country

- Figure 12.9 Partnerships and Collaborations: Distribution by Region

- Figure 13.1 Recent Initiatives: Cumulative Year-wise Trend, Since 2021

- Figure 13.2 Recent Initiatives: Distribution by Type of Initiative

- Figure 13.3 Recent Initiatives: Distribution by Year and Type of Initiative, Since 2021

- Figure 13.4 Recent Initiatives: Distribution by Purpose of Electronic Batch Record

- Figure 13.5 Recent Initiatives: Distribution by Key Features

- Figure 13.6 Recent Initiatives: Distribution by End-user

- Figure 13.7 Most Active Players: Distribution by Number of Recent Initiatives

- Figure 13.8 Recent Initiatives: Distribution by Geography

- Figure 15.1 Global Electronic Batch Records Market: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 15.2 Global Electronic Batch Records Market, Forecasted Estimate (Till 2040): Conservative Scenario (USD Billion)

- Figure 15.3 Global Electronic Batch Records Market, Forecasted Estimate (Till 2040): Optimistic Scenario (USD Billion)

- Figure 16.1 Electronic Batch Records Market: Distribution by Type of Electronic Batch Record System

- Figure 16.2 Electronic Batch Records Market for Integrated Systems: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 16.3 Electronic Batch Records Market for Standalone Systems: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 17.1 Electronic Batch Records Market: Distribution by Type of Deployment Mode

- Figure 17.2 Electronic Batch Records Market for Web-based / Cloud-based Deployment Mode: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 17.3 Electronic Batch Records Market for On-Premises Deployment Mode: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 17.4 Penetration-Growth (P-G) Matrix: Deployment Mode

- Figure 18.1 Electronic Batch Records Market: Distribution by Purpose of Electronic Batch Record

- Figure 18.2 Electronic Batch Records Market for Quality Management: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 18.3 Electronic Batch Records Market for Process Improvement / Process Management: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 18.4 Electronic Batch Records Market for Batch Management: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.1 Electronic Batch Records Market: Distribution by Geographical Region

- Figure 19.2 Electronic Batch Records Market for North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.3 Electronic Batch Records Market in the US: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.4 Electronic Batch Records Market in Canada: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.5 Electronic Batch Records Market for Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion) (USD Billion)

- Figure 19.6 Electronic Batch Records Market in Germany: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.7 Electronic Batch Records Market in the UK: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.8 Electronic Batch Records Market in France: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.9 Electronic Batch Records Market in Italy: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.1 Electronic Batch Records Market in Spain: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.11 Electronic Batch Records Market for Rest of Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.12 Electronic Batch Records Market for Asia-Pacific: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.13 Electronic Batch Records Market in China: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.14 Electronic Batch Records Market in India: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.15 Electronic Batch Records Market for Japan and Rest of Asia-Pacific: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.16 Electronic Batch Records Market for Middle East and North Africa: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.17 Electronic Batch Records Market in Saudi Arabia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.18 Electronic Batch Records Market in UAE: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.19 Electronic Batch Records Market in Egypt: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.2 Electronic Batch Records Market for Latin America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.21 Electronic Batch Records Market in Brazil: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.22 Electronic Batch Records Market in Mexico: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.23 Electronic Batch Records Market in Argentina: Historical Trends (Since 2020) and Forecasted Estimates (Till 2040) (USD Billion)

- Figure 19.24 Market Movement Analysis

- Figure 19.25 Penetration-Growth (P-G) Matrix: Geographical Region

- Figure 21.1 Concluding Remarks: Market Landscape

- Figure 21.2 Concluding Remarks: Partnerships and Collaborations

- Figure 21.3 Concluding Remarks: Recent Initiatives

- Figure 21.4 Concluding Remarks: Market Forecast and Opportunity Analysis