PUBLISHER: Roots Analysis | PRODUCT CODE: 1817405

PUBLISHER: Roots Analysis | PRODUCT CODE: 1817405

Generative AI in Healthcare Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Purpose, Type of Offering, Application Area, End-User, Key Geographical Regions and Leading Players:

GENERATIVE AI in HEALTHCARE MARKET: OVERVIEW

As per Roots Analysis, the global generative AI in healthcare market is currently valued at USD 3.3 billion and is projected to reach USD 39.8 billion by 2035, growing at a CAGR of 28% during the forecast period.

The opportunity for generative AI in healthcare market has been distributed across the following segments:

Purpose

- Clinical-based Purpose

- System-based Purpose

Type of Offering

- Technology / Platform

- Service

Application Area

- Drug Discovery and Development

- Diagnosis

- Treatment

- Administrative Tasks

- Other Application Areas

End-User

- Pharmaceutical and Life Science Companies

- Healthcare Providers

- Other End-Users

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Market in North America

- US

- Canada

Market in Europe

- Germany

- UK

- France

- Spain

- Switzerland

- The Netherlands

- Rest of Europe

Market in Asia-Pacific

- China

- Japan

- South Korea

- Singapore

- India

- Rest of Asia-Pacific

Market in Middle East and North Africa

- Israel

- UAE

- Rest of Middle East and North Africa

Market in Latin America

- Brazil

- Rest of Latin America

Generative AI in Healthcare Market: Growth and Trends

Generative AI is a part of artificial intelligence that utilizes generative models to create data-driven outputs, such as insights, images, videos, and other formats. In the healthcare sector, this technology is evolving rapidly, with the potential to transform patient care, research and treatment.

The healthcare industry is currently navigating a complex landscape marked by a number of challenges, including inefficiencies in clinical workflows, escalating treatment costs, staff shortages, and burnout of the healthcare workers. According to Medscape's 2024 Physician Burnout and Depression Report, nearly 49% of physicians reported feeling burnt out, with administrative burdens (62%) and long working hours (41%). In addition, the conventional drug discovery methods remain time-intensive with no focus on the personalized treatment approaches. Moreover, about 90% of drug candidates fail to progress to advanced clinical trial phases, despite significant time and financial investments. This high failure rate not only impedes innovation but also intensifies the financial strains on the global healthcare systems.

To address these challenges, several pharmaceutical and life sciences companies have increasingly shown interest in exploring the adoption of generative AI. Further, it is important to highlight that generative AI in healthcare industry holds great potential in automating administrative processes for improving the overall operational efficiency, enhancing diagnostic accuracy through advanced imaging, personalizing patient engagement, and accelerating drug discovery and development. Notably, the implementation of generative AI in administrative tasks alone could generate annual savings of approximately USD 150 billion across the healthcare sector. Additionally, studies suggest generative AI could reduce diagnostic errors by up to 85% and reduce nursing overtime by 21%, resulting in potential cost savings of nearly USD 469,000 over the span of three years per hospital. However, as healthcare organizations integrate generative AI into their systems, it is essential to establish robust governance frameworks that ensure ethical AI use and address key concerns, such as data privacy, algorithmic bias, and transparency.

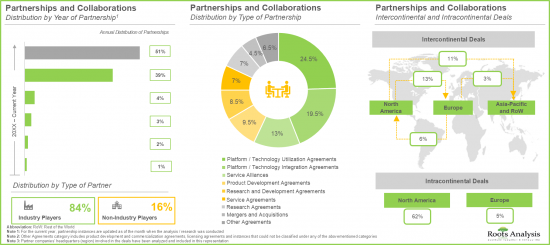

In recent years, several pharmaceutical and healthcare companies have entered into strategic partnerships with various AI firms to explore applications of generative AI in healthcare. Simultaneously, several generative AI developers are securing significant funding in order to enhance their model capabilities for diverse medical applications. Given the growing interest of the investors and the expanding collaborative landscape, generative AI in healthcare market is poised for sustained growth in the coming years.

Generative AI in Healthcare Market: Key Insights

The report delves into the current state of the generative AI in healthcare market and identifies potential growth opportunities within industry. The key takeaways of the report are:

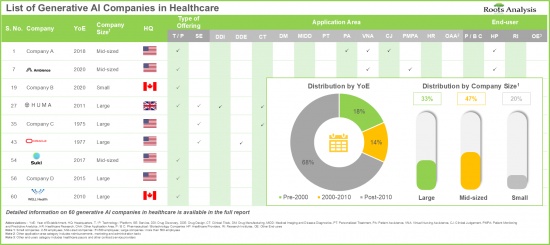

- More than 45% of the companies engaged in offering generative AI solutions in the healthcare industry are mid-sized firms; of these, 79% of the firms are headquartered in North America.

- >85% of the companies offer gen AI technology / platforms to streamline various healthcare processes; of these, 27% of the gen AI companies cater to the evolving needs of both, healthcare providers and P / B companies.

- The rising interest in this domain is reflected by the rise in partnership activity; notably, close to 90% of the deals were inked in the last two years.

- Based on our analysis, in the generative AI in healthcare market, we expect the buyers to have a very high bargaining power; any initiative taken must be carefully evaluated, considering the likely future market dynamics.

- The increasing administrative burden in healthcare, rising funding and investments, and advancements in AI and ML are likely to drive the market for gen AI in healthcare, leading to steady growth in the foreseeable future.

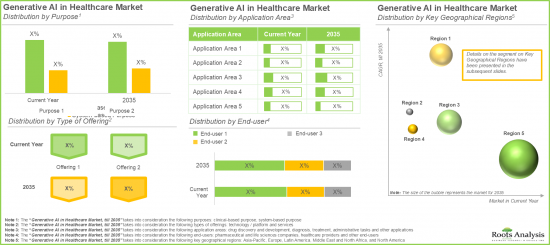

- The technology / platform segment dominates the current market with close to 75% of the market share; notably, generative AI in healthcare market is anticipated to grow at a lucrative growth rate (CAGR of 28%) till 2035.

Generative AI in Healthcare Market: Key Segments

Generative AI used for Clinical-based Purposes is Likely to Hold the Largest Share of the Current Market During the Forecast Period

Based on purpose, the global market is segmented into clinical-based and system-based purposes. Amongst these types, the clinical-based purpose segment occupies the largest share of the current overall market. This can be attributed to their direct impact on patient care, as these would help the clinicians make informed decisions, increasing their adoption in the hospitals and clinics.

Based on the Type of Offering, Platform / Technology Segment Captures the Majority of the Current Market Share

Based on the type of offerings, the global generative AI in healthcare market is segmented into platform / technology and service. Presently, the platform / technology segment occupies the highest share in the overall market. However, it is important to note that the services segment is anticipated to grow at a relatively higher CAGR during the forecast period.

Treatment Segment is Likely to Hold the Largest Share in the Generative AI in Healthcare Market During the Forecast Period

Based on the application area, the global generative AI in healthcare market is segmented into drug discovery and development, diagnosis, treatment, administrative tasks and other application areas. Currently, the treatment segment leads generative AI in healthcare market. It is important to highlight that this trend is unlikely to change in the future as well. This can be attributed to the fact that generative AI boosts treatment efficacy and patient care, reducing administrative burdens, driving sustained growth in clinical applications.

Generative AI in Healthcare Market for Healthcare Providers is Likely to Grow at a Relatively Faster Pace During the Forecast Period

Based on the end-user, the global generative AI in healthcare market is segmented across pharmaceutical and life science companies, healthcare providers and other end-users. Presently, the market is dominated by the revenues generated through the systems intended for use by healthcare providers. Further, this market trend is unlikely to change in the future as well owing to the wider applicability of the gen AI solutions, such as enhanced patient care, improved operational efficiency, data driven insights and cost saving potential.

North America Accounts for the Largest Share in the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Middle East and North Africa and Latin America. In the current scenario, North America is likely to capture the largest market share. Further, it is worth highlighting that Asia-Pacific is expected to grow at a relatively high CAGR during the forecast period.

Example Players in the Generative AI in Healthcare Market

- Amazon Web Services

- C3 AI

- Exscientia

- Huma

- IBM

- Iktos

- LeewayHertz

- Medical IP

- Microsoft

- NVIDIA

- OpenAI

- Oracle

- PhamaX

- Syntegra

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Vice President, Finance and Head of Investor Relations, Mid-sized Company in the US

- Marketing Director, Mid-sized Company in Israel

- Application Scientist of Asia, Mid-sized Company in France

Generative AI in Healthcare Market: Research Coverage

The report on generative AI in healthcare market features insights into various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of current market opportunity and the future growth potential of generative AI in healthcare market, focusing on key market segments, including [A] purpose, [B] type of offering, [C] application area, [D] end-user, [E] key geographical regions, and [G] leading players.

- Market Impact Analysis: A thorough analysis of various factors, such as [A] drivers, [B] restraints, [C] opportunities, and [D] existing challenges that are likely to impact market growth.

- Market Landscape: A comprehensive evaluation of generative AI in healthcare providers, based on several relevant parameters, such as [A] type of offering, [B] application area, and [C] end-user.

- Generative AI in Healthcare Providers Landscape: The report features a list of generative AI in healthcare providers engaged in this domain, along with analyses based on [A] year of establishment, [B] company size [C] location of headquarters, and [D] type of generative AI company.

- Company Competitiveness Analysis: An insightful competitiveness analysis of the generative AI in healthcare providers, based on various relevant parameters, such as [A] company strength, and [B] service portfolio strength.

- Company Profiles: Comprehensive profiles of key industry players in the generative AI in the healthcare domain, featuring information on [A] company overview, [B] financial information (if available), [C] generative AI in healthcare portfolio, [D] recent developments, and [E] future outlook statements.

- Partnerships and Collaborations: A detailed analysis of partnerships inked between stakeholders in the generative AI in healthcare market, based on several relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner company, [D] purpose of partnership, [E] geography, and [G] most active players (in terms of number of partnerships).

- Generative AI in Healthcare Use Cases: A detailed case study of the use cases of generative AI in healthcare, presenting information on collaborations inked between various generative AI companies in healthcare. Each use case provides information on various parameters, such as [A] a brief overview of the companies involved, [B] business needs [C] details on the objectives achieved, and [D] solutions provided.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Introduction to Generative AI

- 6.3. Evolution of AI

- 6.4. Applications of Generative AI in Healthcare

- 6.4.1. Healthcare Research

- 6.4.1.1. Drug Discovery and Development

- 6.4.2. Disease Diagnosis and Prognosis

- 6.4.3. Treatment and Medical Care

- 6.4.4. Marketing and Administrative Tasks

- 6.4.1. Healthcare Research

- 6.5. Challenges Associated with the Adoption of Generative AI

- 6.6. Future Perspectives

SECTION III: MARKET OVERVIEW

7. COMPETITIVE LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Generative AI Companies in Healthcare: Overall Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Company Size and Location of Headquarters (Region)

- 7.2.5. Analysis by Type of Generative AI Company

- 7.2.6. Analysis by Type of Offering

- 7.2.7. Analysis by Application Area

- 7.2.8. Analysis by End-user

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Generative AI Companies in Healthcare: Company Competitiveness Analysis

- 8.4.1. Generative AI Companies based in North America

- 8.4.2. Generative AI Companies based in Europe and Asia-Pacific

SECTION IV: COMPANY PROFILES

9. NORTH AMERICA BASED GENERATIVE AI COMPANIES IN HEALTHCARE

- 9.1. Chapter Overview

- 9.2. Detailed Profiles of Generative AI Companies Based in North America

- 9.2.1. IBM

- 9.2.1.1. Company Overview

- 9.2.1.2. Management Team

- 9.2.1.3. Contact Details

- 9.2.1.4. Financial Performance

- 9.2.1.5. Operating Business Segments

- 9.2.1.6. Generative AI in Healthcare Portfolio

- 9.2.1.7. Recent Developments and Future Outlook

- 9.2.2. Microsoft

- 9.2.3. NVIDIA

- 9.2.4. OpenAI

- 9.2.1. IBM

- 9.3. Short Profiles of Generative AI Companies Based in North America

- 9.3.1. Amazon Web Services

- 9.3.2. C3 AI

- 9.3.3. Google

- 9.3.4. Oracle

- 9.3.5. Syntegra

10. EUROPE AND ASIA-PACIFIC BASED GENERATIVE AI COMPANIES IN HEALTHCARE

- 10.1. Chapter Overview

- 10.2. Detailed Profiles of Generative AI Companies Based in Europe and Asia-Pacific

- 10.2.1. Huma

- 10.2.1.1. Company Overview

- 10.2.1.2. Management Team

- 10.2.1.3. Contact Details

- 10.2.1.4. Generative AI in Healthcare Portfolio

- 10.2.1.5. Recent Developments and Future Outlook

- 10.2.2. LeewayHertz

- 10.2.1. Huma

- 10.3. Short Profiles of Generative AI Companies Based in Europe and Asia-Pacific

- 10.3.1. Exscientia

- 10.3.2. Iktos

- 10.3.3. Medical IP

- 10.3.4. PhamaX

SECTION V: MARKET TRENDS

11. PARTNERSHIPS AND COLLABORATIONS

- 11.1. Chapter Overview

- 11.2. Partnership Models

- 11.3. Generative AI in Healthcare Providers: Partnerships and Collaborations

- 11.3.1. Analysis by Year of Partnership

- 11.3.2. Analysis by Type of Partnership

- 11.3.3. Analysis by Year and Type of Partnership

- 11.3.4. Analysis by Type of Partner Company

- 11.3.5. Analysis by Purpose of Partnership

- 11.3.6. Analysis by Geography

- 11.3.6.1. Local and International Agreements

- 11.3.6.2. Intracontinental and Intercontinental Agreements

- 11.3.7. Most Active Players: Analysis by Number of Partnerships

12. GENERATIVE AI IN HEALTHCARE: USE CASES

- 12.1. Chapter Overview

- 12.2. Use Case 1: Collaboration between NVIDIA and Genentech

- 12.2.1. NVIDIA

- 12.2.2. Genentech

- 12.2.3. Business Needs

- 12.2.4. Objectives Achieved and Solutions Provided

- 12.3. Use Case 2: Collaboration between Insilico Medicine and Inimmune

- 12.3.1. Insilico Medicine

- 12.3.2. Inimmune

- 12.3.3. Business Needs

- 12.3.4. Objectives Achieved and Solutions Provided

- 12.4. Use Case 3: Collaboration between OpenAI and Moderna

- 12.4.1. OpenAI

- 12.4.2. Moderna

- 12.4.3. Business Needs

- 12.4.4. Objectives Achieved and Solutions Provided

- 12.5. Use Case 4: Collaboration between Amazon Web Services and Pfizer

- 12.5.1. Amazon Web Services

- 12.5.2. Pfizer

- 12.5.3. Business Needs

- 12.5.4. Objectives Achieved and Solutions Provided

- 12.6. Use Case 5: Collaboration between Suki and Ascension Saint Thomas

- 12.6.1. Suki

- 12.6.2. Ascension Saint Thomas

- 12.6.3. Business Needs

- 12.6.4. Objectives Achieved and Solutions Offered

- 12.7. Use Case 6: Collaboration between Abridge and Emory Healthcare

- 12.7.1. Abridge

- 12.7.2. Emory Healthcare

- 12.7.3. Business Needs

- 12.7.4. Objectives Achieved and Solutions Offered

- 12.8. Use Case 7: Collaboration between Google and China Medical University Hospital

- 12.8.1. Google

- 12.8.2. China Medical University Hospital

- 12.8.3. Business Needs

- 12.8.4. Objectives Achieved and Solutions Provided

SECTION VI: MARKET OPPORTUNITY ANALYSIS

13. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 13.1. Chapter Overview

- 13.2. Market Drivers

- 13.3. Market Restraints

- 13.4. Market Opportunities

- 13.5. Market Challenges

- 13.6. Conclusion

14. GLOBAL GENERATIVE AI IN HEALTHCARE MARKET

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Global Generative AI in Healthcare Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 14.4. Multivariate Scenario Analysis

- 14.4.1. Conservative Scenario

- 14.4.2. Optimistic Scenario

- 14.5. Key Market Segmentations

15. GENERATIVE AI IN HEALTHCARE MARKET, BY PURPOSE

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Generative AI in Healthcare Market: Distribution by Purpose

- 15.3.1. Generative AI in Healthcare Market for Clinical-based Purpose, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.3.2. Generative AI in Healthcare Market for System-based Purpose, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 15.4. Data Triangulation and Validation

- 15.4.1. Secondary Sources

- 15.4.2. Primary Sources

16. GENERATIVE AI IN HEALTHCARE MARKET, BY TYPE OF OFFERING

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. Generative AI in Healthcare Market: Distribution by Type of Offering

- 16.3.1. Generative AI in Healthcare Market for Technology / Platform, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.3.2. Generative AI in Healthcare Market for Services, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 16.4. Data Triangulation and Validation

- 16.4.1. Secondary Sources

- 16.4.2. Primary Sources

17. GENERATIVE AI IN HEALTHCARE MARKET, BY APPLICATION AREA

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Generative AI in Healthcare Market: Distribution by Application Area

- 17.3.1. Generative AI in Healthcare Market for Drug Discovery and Development, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.3.2. Generative AI in Healthcare Market for Diagnosis, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.3.3. Generative AI in Healthcare Market for Treatment, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.3.4. Generative AI in Healthcare Market for Administrative Tasks, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.3.5. Generative AI in Healthcare Market for Other Applications, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 17.4. Data Triangulation and Validation

- 17.4.1. Secondary Sources

- 17.4.2. Primary Sources

18. GENERATIVE AI IN HEALTHCARE MARKET, BY END-USER

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Generative AI in Healthcare Market: Distribution by End-user

- 18.3.1. Generative AI in Healthcare Market for Pharmaceutical and Life Science Companies, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.3.2. Generative AI in Healthcare Market for Healthcare Providers, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.3.3. Generative AI in Healthcare Market for Other End-users, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.4. Data Triangulation and Validation

- 18.4.1. Secondary Sources

- 18.4.2. Primary Sources

19. GENERATIVE AI IN HEALTHCARE MARKET, BY GEOGRAPHICAL REGIONS

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Generative AI in Healthcare Market: Distribution by Geographical Regions

- 19.3.1. Generative AI in Healthcare Market in North America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.1.1. Generative AI in Healthcare Market in the US, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.1.2. Generative AI in Healthcare Market in Canada, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.2. Generative AI in Healthcare Market in Europe, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.2.1. Generative AI in Healthcare Market in Germany, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.2.2. Generative AI in Healthcare Market in the UK, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.2.3. Generative AI in Healthcare Market in France, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.2.4. Generative AI in Healthcare Market in Spain, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.2.5. Generative AI in Healthcare Market in Switzerland, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.2.6. Generative AI in Healthcare Market in the Netherlands, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.2.7. Generative AI in Healthcare Market in Rest of Europe, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.3. Generative AI in Healthcare Market in Asia-Pacific, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.3.1. Generative AI in Healthcare Market in China, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.3.2. Generative AI in Healthcare Market in Japan, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.3.3. Generative AI in Healthcare Market in South Korea, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.3.4. Generative AI in Healthcare Market in Singapore, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.3.5. Generative AI in Healthcare Market in India, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.3.6. Generative AI in Healthcare Market in Rest of Asia-Pacific, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.4. Generative AI in Healthcare Market in Middle East and North Africa, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.4.1. Generative AI in Healthcare Market in Israel, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.4.2. Generative AI in Healthcare Market in UAE, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.4.3. Generative AI in Healthcare Market in Rest of Middle East and North Africa, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.5. Generative AI in Healthcare Market in Latin America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.5.1. Generative AI in Healthcare Market in Brazil, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.5.2. Generative AI in Healthcare Market in Rest of Latin America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.3.1. Generative AI in Healthcare Market in North America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.4. Generative AI in Healthcare Market, By Geographical Regions: Market Dynamics Assessment

- 19.4.1. Penetration-Growth (P-G) Matrix

- 19.4.2. Market Movement Analysis

- 19.5. Data Triangulation and Validation

- 19.5.1. Secondary Sources

- 19.5.2. Primary Sources

20. GENERATIVE AI IN HEALTHCARE MARKET, BY LEADING PLAYERS

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Generative AI in Healthcare Market: Distribution by Leading Generative AI Companies

- 20.4. Data Triangulation and Validation

21. ADJACENT MARKET ANALYSIS

SECTION VII: STRATEGIC TOOLS

22. PORTER'S FIVE FORCES ANALYSIS

- 22.1. Chapter Overview

- 22.2. Significance of Porter's Five Forces Analysis

- 22.3. Methodology and Assumptions

- 22.4. Porter's Five Forces

- 22.4.1. Threats of New Entrants

- 22.4.2. Bargaining Power of Buyers

- 22.4.3. Bargaining Power of Generative AI Companies

- 22.4.4. Threats of Substitute Products

- 22.4.5. Rivalry Among Existing Competitors

- 22.5. Concluding Remarks

SECTION VIII: OTHER EXCLUSIVE INSIGHTS

23. INSIGHTS FROM PRIMARY RESEARCH

24. CONCLUDING REMARKS

SECTION IX: APPENDIX

25. TABULATED DATA

26. LIST OF COMPANIES AND ORGANIZATIONS

27. CUSTOMIZATION OPPORTUNITIES

28. ROOTS SUBSCRIPTION SERVICES

29. AUTHOR DETAILS

List of Tables

- Table 7.1 Generative AI Companies in Healthcare: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 7.2 Generative AI Companies in Healthcare: Information on Type of Generative AI Company and Type of Offering

- Table 7.3 Generative AI Companies in Healthcare: Information on Application Area

- Table 7.4 Generative AI Companies in Healthcare: Information on End-user

- Table 9.1 Generative AI Companies based in North America: List of Companies Profiled

- Table 9.2 IBM: Company Overview

- Table 9.3 IBM: Generative AI in Healthcare Portfolio

- Table 9.4 IBM: Recent Developments and Future Outlook

- Table 9.5 Microsoft: Company Overview

- Table 9.6 Microsoft: Generative AI in Healthcare Portfolio

- Table 9.7 Microsoft: Recent Developments and Future Outlook

- Table 9.8 NVIDIA: Company Overview

- Table 9.9 NVIDIA: Generative AI in Healthcare Portfolio

- Table 9.10 NVIDIA: Recent Developments and Future Outlook

- Table 9.11 OpenAI: Company Overview

- Table 9.12 OpenAI: Generative AI in Healthcare Portfolio

- Table 9.13 OpenAI: Recent Developments and Future Outlook

- Table 9.14 Amazon Web Services: Company Overview

- Table 9.15 Amazon Web Services: Generative AI in Healthcare Portfolio

- Table 9.16 C3 AI: Company Overview

- Table 9.17 C3 AI: Generative AI in Healthcare Portfolio

- Table 9.18 Google: Company Overview

- Table 9.19 Google: Generative AI in Healthcare Portfolio

- Table 9.20 Oracle: Company Overview

- Table 9.21 Oracle: Generative AI in Healthcare Portfolio

- Table 9.22 Syntegra: Company Overview

- Table 9.23 Syntegra: Generative AI in Healthcare Portfolio

- Table 10.1 Generative AI Companies based in Europe and Asia-Pacific: List of Companies Profiled

- Table 10.2 Huma: Company Overview

- Table 10.3 Huma: Generative AI in Healthcare Portfolio

- Table 10.4 Huma: Recent Developments and Future Outlook

- Table 10.5 LeewayHertz: Company Overview

- Table 10.6 LeewayHertz: Generative AI in Healthcare Portfolio

- Table 10.7 LeewayHertz: Recent Developments and Future Outlook

- Table 10.8 Exscientia: Company Overview

- Table 10.9 Exscientia: Generative AI in Healthcare Portfolio

- Table 10.10 Iktos: Company Overview

- Table 10.11 Iktos: Generative AI in Healthcare Portfolio

- Table 10.12 Medical IP: Company Overview

- Table 10.13 Medical IP: Generative AI in Healthcare Portfolio

- Table 10.14 PhamaX: Company Overview

- Table 10.15 PhamaX: Generative AI in Healthcare Portfolio

- Table 11.1 Generative AI Companies in Healthcare: List of Partnerships and Collaborations, Since 2019

- Table 11.2 Generative AI Companies in Healthcare: Information on Type of Partner Company and Purpose of Partnership

- Table 11.3 Generative AI Companies in Healthcare: Information on Type of Agreement (Country-wise and Region-wise)

- Table 23.1 Absci: Company Overview

- Table 23.2 aiOla: Company Overview

- Table 23.3 Iktos: Company Overview

- Table 25.1 Generative AI Companies in Healthcare: Distribution by Year of Establishment

- Table 25.2 Generative AI Companies in Healthcare: Distribution by Company Size

- Table 25.3 Generative AI Companies in Healthcare: Distribution by Location of Headquarters

- Table 25.4 Generative AI Companies in Healthcare: Distribution by Company Size and Location of Headquarters (Region)

- Table 25.5 Generative AI Companies in Healthcare: Distribution by Type of Generative AI Company

- Table 25.6 Generative AI Companies in Healthcare: Distribution by Type of Offering

- Table 25.7 Generative AI Companies in Healthcare: Distribution by Application Area

- Table 25.8 Generative AI Companies in Healthcare: Distribution by End-user

- Table 25.9 IBM: Annual Revenues, FY 2021 onwards (USD Million)

- Table 25.10 Microsoft: Annual Revenues, FY 2021 onwards (USD Million)

- Table 25.11 NVIDIA: Annual Revenues, FY 2021 onwards (USD Million)

- Table 25.12 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2019

- Table 25.13 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 25.14 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 25.15 Partnerships and Collaborations: Distribution by Type of Partner Company

- Table 25.16 Partnerships and Collaborations: Distribution by Purpose of Partnership

- Table 25.17 Partnerships and Collaborations: Distribution by Local and International Agreements

- Table 25.18 Partnerships and Collaborations: Distribution by Intracontinental and Intercontinental Agreements

- Table 25.19 Most Active Players: Distribution by Number of Partnerships

- Table 25.20 Global Generative AI in Healthcare Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Table 25.21 Global Generative AI in Healthcare Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Table 25.22 Global Generative AI in Healthcare Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Table 25.23 Generative AI in Healthcare Market: Distribution by Type of Purpose

- Table 25.24 Generative AI in Healthcare Market for Clinical-based Purpose, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.25 Generative AI in Healthcare Market for System-based Purpose, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.26 Generative AI in Healthcare Market: Distribution by Type of Offering

- Table 25.27 Generative AI in Healthcare Market for Technology / Platform, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.28 Generative AI in Healthcare Market for Services, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.29 Generative AI in Healthcare Market: Distribution by Application Area

- Table 25.30 Generative AI in Healthcare Market for Drug Discovery and Development, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.31 Generative AI in Healthcare Market for Diagnosis, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.32 Generative AI in Healthcare Market for Treatment, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.33 Generative AI in Healthcare Market for Administrative Tasks, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.34 Generative AI in Healthcare Market for Other Applications, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.35 Generative AI in Healthcare Market: Distribution by End-user

- Table 25.36 Generative AI in Healthcare Market for Pharmaceutical and Life Science Companies, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.37 Generative AI in Healthcare Market for Healthcare Providers, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.38 Generative AI in Healthcare Market for Other End-users, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.39 Generative AI in Healthcare Market: Distribution by Key Geographical Regions

- Table 25.40 Generative AI in Healthcare Market in North America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.41 Generative AI in Healthcare Market in the US, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.42 Generative AI in Healthcare Market in Canada, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.43 Generative AI in Healthcare Market in Europe, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.44 Generative AI in Healthcare Market in Germany, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.45 Generative AI in Healthcare Market in the UK, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.46 Generative AI in Healthcare Market in France, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.47 Generative AI in Healthcare Market in Spain, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.48 Generative AI in Healthcare Market in Switzerland, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.49 Generative AI in Healthcare Market in the Netherlands, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.50 Generative AI in Healthcare Market in Rest of Europe, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.51 Generative AI in Healthcare Market in Asia-Pacific, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.52 Generative AI in Healthcare Market in China, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.53 Generative AI in Healthcare Market in Japan, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.54 Generative AI in Healthcare Market in South Korea, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.55 Generative AI in Healthcare Market in Singapore, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.56 Generative AI in Healthcare Market in India, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.57 Generative AI in Healthcare Market in Middle East and North Africa, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.58 Generative AI in Healthcare Market in Israel, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.59 Generative AI in Healthcare Market in UAE, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.60 Generative AI in Healthcare Market in Rest of Middle East and North Africa, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.61 Generative AI in Healthcare Market in Latin America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.62 Generative AI in Healthcare Market in Brazil, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.63 Generative AI in Healthcare Market in Rest of Latin America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035), Conservative, Base and Optimistic Scenarios (USD Billion)

- Table 25.64 Generative AI in Healthcare Market: Distribution by Leading Generative AI Companies

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Data Sources for Secondary Research

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 3.1 Market Dynamics: Forecast Methodology

- Figure 3.2 Market Dynamics: Market Assessment Framework

- Figure 4.1 Lesson Learnt from Past Recessions

- Figure 5.1 Executive Summary: Market Landscape

- Figure 5.2 Executive Summary: Partnerships and Collaborations

- Figure 5.3 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 6.1 Workflow of Generative AI

- Figure 6.2 Evolution of AI

- Figure 6.3 Applications of Generative AI in Healthcare

- Figure 6.4 Challenges Associated with the Adoption of Generative AI

- Figure 7.1 Generative AI Companies in Healthcare: Distribution by Year of Establishment

- Figure 7.2 Generative AI Companies in Healthcare: Distribution by Company Size

- Figure 7.3 Generative AI Companies in Healthcare: Distribution by Location of Headquarters

- Figure 7.4 Generative AI Companies in Healthcare: Distribution by Company Size and Location of Headquarters (Region)

- Figure 7.5 Generative AI Companies in Healthcare: Distribution by Type of Generative AI Company

- Figure 7.6 Generative AI Companies in Healthcare: Distribution by Type of Offering

- Figure 7.7 Generative AI Companies in Healthcare: Distribution by Application Area

- Figure 7.8 Generative AI Companies in Healthcare: Distribution by End-user

- Figure 8.1 Company Competitiveness Analysis: Generative AI Companies based in North America

- Figure 8.2 Company Competitiveness Analysis: Generative AI Companies based in Europe and Asia-Pacific

- Figure 9.1 IBM: Annual Revenues, FY 2021 onwards (USD Million)

- Figure 9.2 Microsoft: Annual Revenues, FY 2021 onwards (USD Million)

- Figure 9.3 NVIDIA: Annual Revenues, FY 2021 onwards (USD Million)

- Figure 11.1 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2019

- Figure 11.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 11.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 11.4 Partnerships and Collaborations: Distribution by Type of Partner Company

- Figure 11.5 Partnerships and Collaborations: Distribution by Purpose of Partnership

- Figure 11.6 Partnerships and Collaborations: Distribution by Local and International Agreements

- Figure 11.7 Partnerships and Collaborations: Distribution by Intracontinental and Intercontinental Agreements

- Figure 11.8 Most Active Players: Distribution by Number of Partnerships

- Figure 13.1 Global Generative AI in Healthcare Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 13.2 Global Generative AI in Healthcare Market, Forecasted Estimates (Till 2035): Conservative Scenario (USD Billion)

- Figure 13.3 Global Generative AI in Healthcare Market, Forecasted Estimates (Till 2035): Optimistic Scenario (USD Billion)

- Figure 15.1 Generative AI in Healthcare Market: Distribution by Type of Purpose

- Figure 15.2 Generative AI in Healthcare Market for Clinical-based Purpose, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 15.3 Generative AI in Healthcare Market for System-based Purpose, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.1 Generative AI in Healthcare Market: Distribution by Type of Offering

- Figure 16.2 Generative AI in Healthcare Market for Technology / Platform, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 16.3 Generative AI in Healthcare Market for Services, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.1 Generative AI in Healthcare Market: Distribution by Application Area

- Figure 17.2 Generative AI in Healthcare Market for Drug Discovery and Development, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.3 Generative AI in Healthcare Market for Diagnosis, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.4 Generative AI in Healthcare Market for Treatment, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.5 Generative AI in Healthcare Market for Administrative Tasks, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 17.6 Generative AI in Healthcare Market for Other Applications, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.1 Generative AI in Healthcare Market: Distribution by End-user

- Figure 18.2 Generative AI in Healthcare Market for Pharmaceutical and Life Science Companies, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.3 Generative AI in Healthcare Market for Healthcare Providers, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 18.4 Generative AI in Healthcare Market for Other End-users, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.1 Generative AI in Healthcare Market: Distribution by Key Geographical Regions

- Figure 19.2 Generative AI in Healthcare Market in North America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.3 Generative AI in Healthcare Market in the US, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.4 Generative AI in Healthcare Market in Canada, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.5 Generative AI in Healthcare Market in Europe, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion) (USD Billion)

- Figure 19.6 Generative AI in Healthcare Market in Germany, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.7 Generative AI in Healthcare Market in the UK, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.8 Generative AI in Healthcare Market in France, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.9 Generative AI in Healthcare Market in Spain, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.10 Generative AI in Healthcare Market in Switzerland, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.11 Generative AI in Healthcare Market in the Netherlands, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.12 Generative AI in Healthcare Market in Rest of Europe, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.13 Generative AI in Healthcare Market in Asia-Pacific, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.14 Generative AI in Healthcare Market in China, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.15 Generative AI in Healthcare Market in Japan, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.16 Generative AI in Healthcare Market in South Korea, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.17 Generative AI in Healthcare Market in Singapore, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.18 Generative AI in Healthcare Market in India, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.19 Generative AI in Healthcare Market in Rest of Asia-Pacific, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.20 Generative AI in Healthcare Market in Middle East and North Africa, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.21 Generative AI in Healthcare Market in Israel, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.22 Generative AI in Healthcare Market in UAE, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.23 Generative AI in Healthcare Market in Rest of Middle East and North Africa, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.24 Generative AI in Healthcare Market in Latin America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.25 Generative AI in Healthcare Market in Brazil, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.26 Generative AI in Healthcare Market in Rest of Latin America, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035) (USD Billion)

- Figure 19.27 Penetration-Growth (P-G) Matrix

- Figure 19.28 Market Movement Analysis

- Figure 20.1 Generative AI in Healthcare Market: Distribution by Leading Generative AI Companies

- Figure 22.1 Porter's Five Forces

- Figure 22.2 Threats of New Entrants: Key Factors

- Figure 22.3 Bargaining Power of Buyers: Key Factors

- Figure 22.4 Bargaining Power of Generative AI Companies: Key Factors

- Figure 22.5 Threats of Substitute Products: Key Factors

- Figure 22.6 Rivalry Among Existing Competitors: Key Factors

- Figure 22.7 Porter's Five Forces Analysis: Concluding Remarks

- Figure 23.1 Concluding Remarks: Market Landscape

- Figure 23.2 Concluding Remarks: Partnerships and Collaborations

- Figure 23.3 Concluding Remarks: Market Forecast and Opportunity Analysis