PUBLISHER: Roots Analysis | PRODUCT CODE: 1821509

PUBLISHER: Roots Analysis | PRODUCT CODE: 1821509

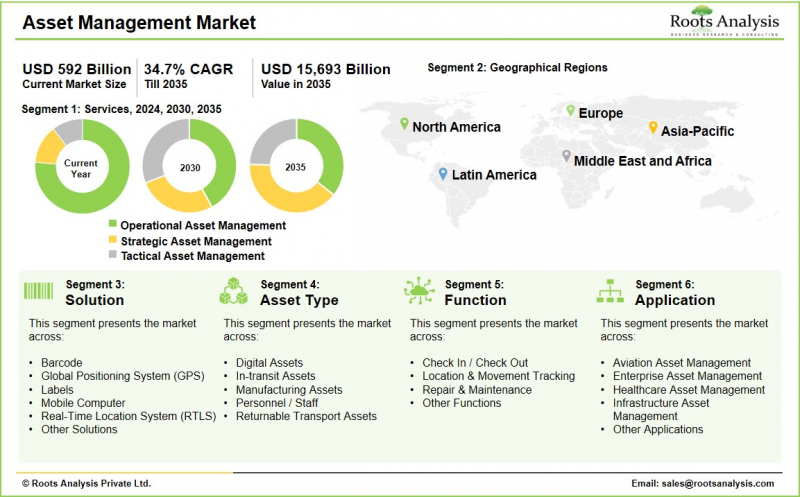

Asset Management Market, Till 2035: Distribution by Solution, Services, Asset Type, Function, Application, and Geography, Industry Trends and Global Forecasts

Asset Management Market Overview

As per Roots Analysis, the global asset management market size is estimated to grow from USD 592 billion in the current year to USD 15,693 billion by 2035, at a CAGR of 34.7% during the forecast period, till 2035.

The opportunity for asset management market has been distributed across the following segments:

Solution

- Barcode

- Global Positioning System (GPS)

- Labels

- Mobile Computer

- Real-Time Location System (RTLS)

- Other Solutions

Services

- Operational Asset Management

- Strategic Asset Management

- Tactical Asset Management

Asset Type

- Digital Assets

- In-transit Assets

- Manufacturing Assets

- Personnel / Staff

- Returnable Transport Assets

Function

- Check In / Check Out

- Location & Movement Tracking

- Repair & Maintenance

- Other Functions

Application

- Aviation Asset Management

- Enterprise Asset Management

- Healthcare Asset Management

- Infrastructure Asset Management

- Other Applications

Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Asset Management Market: Growth and Trends

Asset management is crucial within the financial services sector. It encompasses the acquisition, monitoring, and enhancement of investments to increase the value of a client's assets over time. Additionally, asset management firms are often referred to as money managers or investment firms that manage assets for various types of clients. These clients can include affluent individuals, pension funds, insurance companies, and other large-scale investors.

Further, the objective of asset management is to grow client assets while keeping risk at an acceptable level. To achieve this, asset managers employ a variety of strategies, including both active and passive management. Active management entails a thorough research and analysis process aimed at creating a portfolio featuring undervalued or promising investments. Conversely, passive management seeks to closely replicate the performance of a specific market index instead of trying to surpass it.

In conjunction with this framework, asset management firms generate income through management fees, typically calculated as a percentage of total assets under management (AUM). The scale and complexity of an asset manager's operations can range from small independent firms managing individual client accounts to large global entities overseeing trillions in AUM across various investment products, such as mutual funds, exchange-traded funds (ETFs), and hedge funds. As a result, owing to the above mentioned factors, the global asset management market is expected to grow significantly during the forecast period.

Asset Management Market: Key Segments

Market Share by Solution

Based on solution, the global asset management market is segmented into barcode, global positioning system (GPS), labels, mobile computer, real-time location system (RTLS) and other solutions. According to our estimates, currently, the barcodes segment captures the majority of the market share. This growth can be attributed to the extensive usability of barcode systems for asset tracking via scanning, providing an economical and easy-to-use solution.

Market Share by Services

Based on services, the global asset management market is segmented into operational asset management, strategic asset management and tactical asset management. According to our estimates, currently, the strategic asset management segment captures the majority of the market share. This trend can be linked to the growing need for effective and data-informed methods to oversee and enhance the performance of physical assets in a range of industries.

Market Share by Asset Type

Based on asset type, the global asset management market is segmented into digital assets, in-transit assets, manufacturing assets, personnel / staff and returnable transport assets. According to our estimates, currently, the digital asset segment captures the majority of the market share. However, the in-transit assets are expected to grow at a relatively higher CAGR during the forecast period. This growth can be attributed to the rising need for real-time tracking and monitoring of assets while in transit.

Market Share by Function

Based on function, the global asset management market is segmented into check in / check out, location and movement tracking, repair and maintenance, and other functions. According to our estimates, currently, the location and movement tracking segment captures the majority of the market share. However, the repair and maintenance segment is expected to grow at a relatively higher CAGR during the forecast period. This growth can be attributed to the rising demand for effective asset management and an increasing emphasis on prolonging the life of current assets.

Market Share by Application

Based on application, the global asset management market is segmented into aviation asset management, enterprise asset management, healthcare asset management, infrastructure asset management and other applications. According to our estimates, currently, the digital asset segment captures the majority of the market share. However, the aviation asset management segment is expected to grow at a relatively higher CAGR during the forecast period.

Market Share by Geographical Regions

Based on geographical regions, the asset management market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, North America captures the majority share of the market. However, the market in Asia-Pacific is expected to grow at a higher CAGR during the forecast period.

Example Players in Asset Management Market

- ABB

- Adobe

- Amundi Asset Management

- BlackRock

- Brookfield Asset Management

- Cisco

- General Electric

- Hitachi

- Honeywell International

- IBM

- J.P. Morgan

- Johnson Controls International

- Oracle Corporation

- Rockwell Automation

- SAP

- Schneider Electric

- Siemens

- Wipro

- WSP

- Zebra Technologies

Asset Management Market: Research Coverage

The report on the asset management market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the asset management market, focusing on key market segments, including [A] solution, [B] services, [C] asset type, [D] function, [E] application, and [F] geography.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the asset management market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the asset management market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] asset management portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the asset management industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the asset management domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the asset management market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the asset management market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the asset management market.

Key Questions Answered in this Report

- How many companies are currently engaged in asset management market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.1. Time Period

4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

5. EXECUTIVE SUMMARY

- 5.1. Insights on Leading Players

- 5.2. Insights on Startups Ecosystem

- 5.3. Insights on Global Asset Management Market Opportunity

- 5.4. Insights on Global Asset Management Market Opportunity by Solution

- 5.5. Insights on Global Asset Management Market Opportunity by Services

- 5.6. Insights on Global Asset Management Market Opportunity by Asset Type

- 5.7. Insights on Global Asset Management Market Opportunity by Function

- 5.8. Insights on Global Asset Management Market Opportunity by Application

- 5.9. Insights on Global Asset Management Market Opportunity by Geography

6. ASSET MANAGEMENT MARKET: MEGATRENDS

7. INTRODUCTION

- 7.1. Overview of the Asset Management Industry

- 7.1.1. Technological Trends

- 7.2. Challenges Prevailing in the Asset Management Industry

- 7.3. Recent Developments in the Asset Management Industry

- 7.4. Future Perspectives

8. ASSET MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

- 8.1 Brief Overview on Asset Management Process and Stakeholders Involved

- 8.2. The Evolving Requirements of Stakeholders and Conclusion

9. COMPETITIVE LANDSCAPE: LEADING PLAYERS IN THE ASSET MANAGEMENT MARKET

- 9.1. Asset Management Market: Market Landscape of Leading Players

- 9.1.1. Analysis by Year of Establishment

- 9.1.2. Analysis by Company Size

- 9.1.3. Analysis by Company Size and Year of Establishment

- 9.1.4. Analysis by Location of Headquarters

- 9.1.5. Analysis by Company Size and Location of Headquarters

- 9.1.6. Analysis by Type of Asset

- 9.1.7. Analysis by Solution

- 9.1.8. Analysis by Service

- 9.1.9. Analysis by Function

- 9.1.10. Analysis by Application

10. MARKET CONCENTRATION ANALYSIS

- 10.1. Chapter Overview

- 10.2. Assumptions and Key Parameters

- 10.3. Methodology

- 10.4. Market Concertation Analysis: Top Asset Management Companies

11. PATENT ANALYSIS

- 11.1. Chapter Overview

- 11.2. Scope and Methodology

- 11.3. Asset Management Market: Patent Analysis

- 11.3.1. Analysis by Patent Publication Year

- 11.3.2. Analysis by Patent Application Year

- 11.3.3. Analysis of Granted Patents and Patent Applications by Publication Year

- 11.3.4. Analysis by Patent Jurisdiction

- 11.3.5. Analysis by CPC Symbols

- 11.3.6. Analysis by Type of Applicant

- 11.3.7. Leading Industry Players: Analysis by Number of Patents

- 11.3.8. Leading Non-Industry Players: Analysis by Number of Patents

- 11.3.9. Leading Individual Assignees: Analysis by Number of Patents

- 11.4. Asset Management Market: Patent Benchmarking Analysis

- 11.4.1. Analysis by Patent Characteristics

- 11.5. Asset Management Market: Patent Valuation

- 11.6. Leading Patents by Number of Citations

12. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 12.1. Chapter Overview

- 12.2. Market Drivers

- 12.3. Market Restraints

- 12.4. Market Opportunities

- 12.5. Market Challenges

- 12.6. Conclusion

13. GLOBAL ASSET MANAGEMENT MARKET

- 13.1. Assumptions and Methodology

- 13.2. Global Asset Management Market, Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 13.2.1. Scenario Analysis

- 13.2.1.1. Conservative Scenario

- 13.2.1.2. Optimistic Scenario

- 13.2.1. Scenario Analysis

- 13.3. Global Asset Management Market: Distribution by Geography

- 13.4. Key Market Segmentations

14. ASSET MANAGEMENT MARKET, BY SOLUTION

- 14.1. Assumptions and Methodology

- 14.2. Asset Management Market: Distribution by Solution

- 14.2.1. Asset Management Market for Barcode (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.2.2. Asset Management Market for Global Positioning System (GPS) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.2.3. Asset Management Market for Labels (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.2.4. Asset Management Market for Mobile Computer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.2.5. Asset Management Market for Real-Time Location System (RTLS) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.2.6. Asset Management Market for Other Solutions (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 14.3. Data Triangulation and Validation

15. ASSET MANAGEMENT MARKET, BY SERVICES

- 15.1. Assumptions and Methodology

- 15.2. Asset Management Market: Distribution by Services

- 15.2.1. Asset Management Market for Operational Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.2.2. Asset Management Market for Strategic Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.2.3. Asset Management Market for Tactical Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 15.3. Data Triangulation and Validation

16. ASSET MANAGEMENT MARKET, BY ASSET TYPE

- 16.1. Assumptions and Methodology

- 16.2. Asset Management Market: Distribution by Asset Type

- 16.2.1. Asset Management Market for Digital Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.2.2. Asset Management Market for In-transit Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.2.3. Asset Management Market for Manufacturing Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.2.4. Asset Management Market for Personnel / Staff (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.2.5. Asset Management Market for Returnable Transport Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 16.3. Data Triangulation and Validation

17. ASSET MANAGEMENT MARKET, BY FUNCTION

- 17.1. Assumptions and Methodology

- 17.2. Asset Management Market: Distribution by Function

- 17.2.1. Asset Management Market for Check In / Check Out (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.2.2. Asset Management Market for Location and Movement Tracking (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.2.3. Asset Management Market for Repair and Maintenance (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.2.4. Asset Management Market for Other Functions (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 17.3. Data Triangulation and Validation

18. ASSET MANAGEMENT MARKET, BY APPLICATION

- 18.1. Assumptions and Methodology

- 18.2. Asset Management Market: Distribution by Application

- 18.2.1. Asset Management Market for Aviation Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.2.2. Asset Management Market for Enterprise Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.2.3. Asset Management Market for Healthcare Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.2.4. Asset Management Market for Infrastructure Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.2.5. Asset Management Market for Other Applications (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 18.3. Data Triangulation and Validation

19. NORTH AMERICA ASSET MANAGEMENT MARKET

- 19.1. Assumptions and Methodology

- 19.2. North America Asset Management Market: Distribution by Solution

- 19.2.1. North America Asset Management Market for Barcode (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.2.2. North America Asset Management Market for Global Positioning System (GPS) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.2.3. North America Asset Management Market for Labels (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.2.4. North America Asset Management Market for Mobile Computer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.2.5. North America Asset Management Market for Real-Time Location System (RTLS) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.2.6. North America Asset Management Market for Other Solutions (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.3. North America Asset Management Market: Distribution by Services

- 19.3.1. North America Asset Management Market for Operational Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.3.2. North America Asset Management Market for Strategic Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.3.3. North America Asset Management Market for Tactical Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.4. North America Asset Management Market: Distribution by Asset Type

- 19.4.1. North America Asset Management Market for Digital Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.4.2. North America Asset Management Market for In-transit Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.4.3. North America Asset Management Market for Manufacturing Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.4.4. North America Asset Management Market for Personnel / Staff (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.4.5. North America Asset Management Market for Returnable Transport Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.5. North America Asset Management Market: Distribution by Function

- 19.5.1. North America Asset Management Market for Check In / Check Out (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.5.2. North America Asset Management Market for Location and Movement Tracking (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.5.3. North America Asset Management Market for Repair and Maintenance (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.5.4. North America Asset Management Market for Other Functions (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6. North America Asset Management Market: Distribution by Application

- 19.6.1. North America Asset Management Market for Aviation Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.2. North America Asset Management Market for Enterprise Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.3. North America Asset Management Market for Healthcare Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.4. North America Asset Management Market for Infrastructure Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.6.5. North America Asset Management Market for Other Applications (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.7. Asset Management Market in the US (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.8. Asset Management Market in Canada (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 19.9. Data Triangulation and Validation

20. EUROPE ASSET MANAGEMENT MARKET

- 20.1. Assumptions and Methodology

- 20.2. Europe Asset Management Market: Distribution by Solution

- 20.2.1. Europe Asset Management Market for Barcode (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.2.2. Europe Asset Management Market for Global Positioning System (GPS) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.2.3. Europe Asset Management Market for Labels (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.2.4. Europe Asset Management Market for Mobile Computer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.2.5. Europe Asset Management Market for Real-Time Location System (RTLS) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.2.6. Europe Asset Management Market for Other Solutions (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3. Europe Asset Management Market: Distribution by Services

- 20.3.1. Europe Asset Management Market for Operational Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3.2. Europe Asset Management Market for Strategic Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.3.3. Europe Asset Management Market for Tactical Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4. Europe Asset Management Market: Distribution by Asset Type

- 20.4.1. Europe Asset Management Market for Digital Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.2. Europe Asset Management Market for In-transit Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.3. Europe Asset Management Market for Manufacturing Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.4. Europe Asset Management Market for Personnel / Staff (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.4.5. Europe Asset Management Market for Returnable Transport Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5. Europe Asset Management Market: Distribution by Function

- 20.5.1. Europe Asset Management Market for Check In / Check Out (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.2. Europe Asset Management Market for Location and Movement Tracking (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.3. Europe Asset Management Market for Repair and Maintenance (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.5.4. Europe Asset Management Market for Other Functions (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6. Europe Asset Management Market: Distribution by Application

- 20.6.1. Europe Asset Management Market for Aviation Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.2. Europe Asset Management Market for Enterprise Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.3. Europe Asset Management Market for Healthcare Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.4. Europe Asset Management Market for Infrastructure Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.6.5. Europe Asset Management Market for Other Applications (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.7. Asset Management Market in Germany (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.8. Asset Management Market in France (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.9. Asset Management Market in Italy (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.10. Asset Management Market in the UK (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.11. Asset Management Market in Spain (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.12. Asset Management Market in Rest of Europe (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 20.13. Data Triangulation and Validation

21. ASIA-PACIFIC ASSET MANAGEMENT MARKET

- 21.1. Assumptions and Methodology

- 21.2. Asia-Pacific Asset Management Market: Distribution by Solution

- 21.2.1. Asia-Pacific Asset Management Market for Barcode (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.2.2. Asia-Pacific Asset Management Market for Global Positioning System (GPS) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.2.3. Asia-Pacific Asset Management Market for Labels (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.2.4. Asia-Pacific Asset Management Market for Mobile Computer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.2.5. Asia-Pacific Asset Management Market for Real-Time Location System (RTLS) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.2.6. Asia-Pacific Asset Management Market for Other Solutions (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.3. Asia-Pacific Asset Management Market: Distribution by Services

- 21.3.1. Asia-Pacific Asset Management Market for Operational Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.3.2. Asia-Pacific Asset Management Market for Strategic Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.3.3. Asia-Pacific Asset Management Market for Tactical Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.4. Asia-Pacific Asset Management Market: Distribution by Asset Type

- 21.4.1. Asia-Pacific Asset Management Market for Digital Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.4.2. Asia-Pacific Asset Management Market for In-transit Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.4.3. Asia-Pacific Asset Management Market for Manufacturing Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.4.4. Asia-Pacific Asset Management Market for Personnel / Staff (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.4.5. Asia-Pacific Asset Management Market for Returnable Transport Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.5. Asia-Pacific Asset Management Market: Distribution by Function

- 21.5.1. Asia-Pacific Asset Management Market for Check In / Check Out (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.5.2. Asia-Pacific Asset Management Market for Location and Movement Tracking (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.5.3. Asia-Pacific Asset Management Market for Repair and Maintenance (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.5.4. Asia-Pacific Asset Management Market for Other Functions (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6. Asia-Pacific Asset Management Market: Distribution by Application

- 21.6.1. Asia-Pacific Asset Management Market for Aviation Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.2. Asia-Pacific Asset Management Market for Enterprise Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.3. Asia-Pacific Asset Management Market for Healthcare Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.4. Asia-Pacific Asset Management Market for Infrastructure Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.6.5. Asia-Pacific Asset Management Market for Other Applications (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.7. Asset Management Market in China (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.8. Asset Management Market in Japan (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.9. Asset Management Market in South Korea (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.10. Asset Management Market in India (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.11. Asset Management Market in Australia (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.12. Asset Management Market in Rest of Asia-Pacific (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 21.13. Data Triangulation and Validation

22. LATIN AMERICA ASSET MANAGEMENT MARKET

- 22.1. Assumptions and Methodology

- 22.2. Latin America Asset Management Market: Distribution by Solution

- 22.2.1. Latin America Asset Management Market for Barcode (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.2.2. Latin America Asset Management Market for Global Positioning System (GPS) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.2.3. Latin America Asset Management Market for Labels (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.2.4. Latin America Asset Management Market for Mobile Computer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.2.5. Latin America Asset Management Market for Real-Time Location System (RTLS) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.2.6. Latin America Asset Management Market for Other Solutions (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3. Latin America Asset Management Market: Distribution by Services

- 22.3.1. Latin America Asset Management Market for Operational Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.2. Latin America Asset Management Market for Strategic Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.3.3. Latin America Asset Management Market for Tactical Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.4. Latin America Asset Management Market: Distribution by Asset Type

- 22.4.1. Latin America Asset Management Market for Digital Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.4.2. Latin America Asset Management Market for In-transit Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.4.3. Latin America Asset Management Market for Manufacturing Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.4.4. Latin America Asset Management Market for Personnel / Staff (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.4.5. Latin America Asset Management Market for Returnable Transport Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.5. Latin America Asset Management Market: Distribution by Function

- 22.5.1. Latin America Asset Management Market for Check In / Check Out (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.5.2. Latin America Asset Management Market for Location and Movement Tracking (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.5.3. Latin America Asset Management Market for Repair and Maintenance (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.5.4. Latin America Asset Management Market for Other Functions (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6. Latin America Asset Management Market: Distribution by Application

- 22.6.1. Latin America Asset Management Market for Aviation Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.2. Latin America Asset Management Market for Enterprise Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.3. Latin America Asset Management Market for Healthcare Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.4. Latin America Asset Management Market for Infrastructure Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.6.5. Latin America Asset Management Market for Other Applications (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.7. Asset Management Market in Brazil (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.8. Asset Management Market in Argentina (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.9. Asset Management Market in Rest of Latin America (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 22.10. Data Triangulation and Validation

23. MIDDLE EAST AND AFRICA ASSET MANAGEMENT MARKET

- 23.1. Assumptions and Methodology

- 23.2. Middle East and Africa Asset Management Market: Distribution by Solution

- 23.2.1. Middle East and Africa Asset Management Market for Barcode (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.2.2. Middle East and Africa Asset Management Market for Global Positioning System (GPS) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.2.3. Middle East and Africa Asset Management Market for Labels (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.2.4. Middle East and Africa Asset Management Market for Mobile Computer (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.2.5. Middle East and Africa Asset Management Market for Real-Time Location System (RTLS) (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.2.6. Middle East and Africa Asset Management Market for Other Solutions (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.3. Middle East and Africa Asset Management Market: Distribution by Services

- 23.3.1. Middle East and Africa Asset Management Market for Operational Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.3.2. Middle East and Africa Asset Management Market for Strategic Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.3.3. Middle East and Africa Asset Management Market for Tactical Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.4. Middle East and Africa Asset Management Market: Distribution by Asset Type

- 23.4.1. Middle East and Africa Asset Management Market for Digital Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.4.2. Middle East and Africa Asset Management Market for In-transit Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.4.3. Middle East and Africa Asset Management Market for Manufacturing Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.4.4. Middle East and Africa Asset Management Market for Personnel / Staff (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.4.5. Middle East and Africa Asset Management Market for Returnable Transport Assets (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.5. Middle East and Africa Asset Management Market: Distribution by Function

- 23.5.1. Middle East and Africa Asset Management Market for Check In / Check Out (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.5.2. Middle East and Africa Asset Management Market for Location and Movement Tracking (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.5.3. Middle East and Africa Asset Management Market for Repair and Maintenance (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.5.4. Middle East and Africa Asset Management Market for Other Functions (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6. Middle East and Africa Asset Management Market: Distribution by Application

- 23.6.1. Middle East and Africa Asset Management Market for Aviation Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.2. Middle East and Africa Asset Management Market for Enterprise Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.3. Middle East and Africa Asset Management Market for Healthcare Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.4. Middle East and Africa Asset Management Market for Infrastructure Asset Management (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.6.5. Middle East and Africa Asset Management Market for Other Applications (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.7. Asset Management Market in Africa (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.8. Asset Management Market in UAE (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.9. Asset Management Market in Rest of Middle East and Africa (Value, YoY Growth): Historical Trends (Since 2018) and Forecasted Estimates (Till 2035)

- 23.10. Data Triangulation and Validation

24. COMPANY PROFILES

- 24.1. Chapter Overview

- 24.2. Leading Players in the Asset Management Market

- 24.2.1. ABB

- 24.2.1.1. Company Overview

- 24.2.1.2. Product Portfolio

- 24.2.1.3. Financial Details

- 24.2.1.4. Recent Developments and Future Outlook

- 24.2.2. BlackRock

- 24.2.2.1. Company Overview

- 24.2.2.2. Product Portfolio

- 24.2.2.3. Financial Details

- 24.2.2.4. Recent Developments and Future Outlook

- 24.2.3. Brookfield Asset Management

- 24.2.3.1. Company Overview

- 24.2.3.2. Product Portfolio

- 24.2.3.3. Financial Details

- 24.2.3.4. Recent Developments and Future Outlook

- 24.2.4. Hitachi

- 24.2.4.1. Company Overview

- 24.2.4.2. Product Portfolio

- 24.2.4.3. Financial Details

- 24.2.4.4. Recent Developments and Future Outlook

- 24.2.5. Honeywell International

- 24.2.5.1. Company Overview

- 24.2.5.2. Product Portfolio

- 24.2.5.3. Financial Details

- 24.2.5.4. Recent Developments and Future Outlook

- 24.2.6. IBM

- 24.2.6.1. Company Overview

- 24.2.6.2. Product Portfolio

- 24.2.6.3. Financial Details

- 24.2.6.4. Recent Developments and Future Outlook

- 24.2.7. J.P. Morgan

- 24.2.7.1. Company Overview

- 24.2.7.2. Product Portfolio

- 24.2.7.3. Financial Details

- 24.2.7.4. Recent Developments and Future Outlook

- 24.2.8. Oracle Corporation

- 24.2.8.1. Company Overview

- 24.2.8.2. Product Portfolio

- 24.2.8.3. Financial Details

- 24.2.8.4. Recent Developments and Future Outlook

- 24.2.9. Rockwell Automation

- 24.2.9.1. Company Overview

- 24.2.9.2. Product Portfolio

- 24.2.9.3. Financial Details

- 24.2.9.4. Recent Developments and Future Outlook

- 24.2.10. Zebra Technologies

- 24.2.10.1. Company Overview

- 24.2.10.2. Product Portfolio

- 24.2.10.3. Financial Details

- 24.2.10.4. Recent Developments and Future Outlook

- 24.2.1. ABB

- 24.3. Other Prominent Players in the Asset Management Market

- 24.3.1. Adobe

- 24.3.1.1. Company Overview

- 24.3.1.2. Product Portfolio

- 24.3.2. Amundi Asset Management

- 24.3.2.1. Company Overview

- 24.3.2.2. Product Portfolio

- 24.3.3. Cisco

- 24.3.3.1. Company Overview

- 24.3.3.2. Product Portfolio

- 24.3.4. General Electric

- 24.3.4.1. Company Overview

- 24.3.4.2. Product Portfolio

- 24.3.5. Johnson Controls International

- 24.3.5.1. Company Overview

- 24.3.5.2. Product Portfolio

- 24.3.6. SAP

- 24.3.6.1. Company Overview

- 24.3.6.2. Product Portfolio

- 24.3.7. Schneider Electric

- 24.3.7.1. Company Overview

- 24.3.7.2. Product Portfolio

- 24.3.8. Siemens

- 24.3.8.1. Company Overview

- 24.3.8.2. Product Portfolio

- 24.3.9. Wipro

- 24.3.9.1. Company Overview

- 24.3.9.2. Product Portfolio

- 24.3.10. WSP

- 24.3.10.1. Company Overview

- 24.3.10.2. Product Portfolio

- 24.3.1. Adobe

25. PORTER'S FIVE FORCES ANALYSIS

- 25.1. Chapter Overview

- 25.2. Research Methodology

- 25.3. Key Parameters

- 25.3.1. Threats to New Entrants

- 25.3.2. Bargaining Power of Buyers

- 25.3.3. Bargaining Power of Product Providers

- 25.3.4. Threats of Substitute Products

- 25.3.5. Rivalry among Existing Competitors

- 25.4. Harvey Ball Analysis

- 25.5. Concluding Remarks

26. EXECUTIVE INSIGHTS

27. APPENDIX 1: TABULATED DATA

28. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS