PUBLISHER: Roots Analysis | PRODUCT CODE: 1869572

PUBLISHER: Roots Analysis | PRODUCT CODE: 1869572

mRNA Synthesis and Manufacturing Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Product, Scale of Operation, Synthesis and Manufacturing Activity, Indication Type, Therapeutic Area, Application Area and Geographical Regions

MRNA SYNTHESIS AND MANUFACTURING MARKET: OVERVIEW

As per Roots Analysis, the mRNA synthesis and manufacturing market is estimated to grow from USD 1.15 billion in the current year to USD 1.35 billion by 2035, at a CAGR of 20% between 2028 and 2035.

mRNA Synthesis and Manufacturing Market

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Product

- Active Pharmaceutical Ingredients

- Finished Dose Formulations

Scale of Operation

- Preclinical and Clinical Scale

- Commercial Scale

Synthesis and Manufacturing Activity

- Contract Manufacturing

- In-house Manufacturing

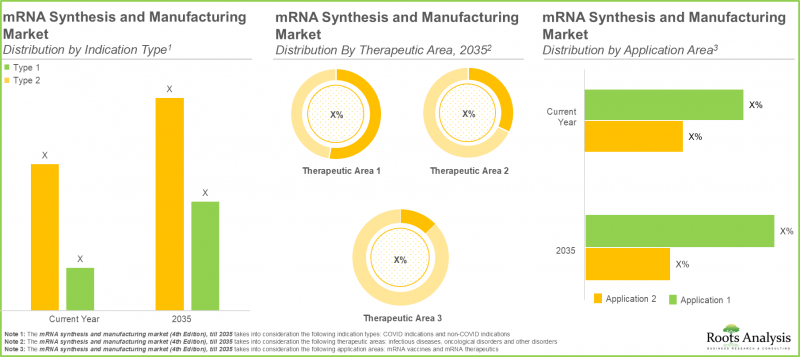

Indication Type

- COVID Indications

- Non-COVID Indications

Therapeutic Area

- Infectious Diseases

- Oncological Disorders

- Other Disorders

Application Area

- mRNA Vaccines

- mRNA Therapeutics

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and North Africa

MRNA SYNTHESIS AND MANUFACTURING MARKET: GROWTH AND TRENDS

Ribonucleic acid (RNA) is a molecule found in all living cells that translates genetic information into different proteins to carry out various cellular functions. Importantly, RNA can exist in various forms, such as messenger RNA (mRNA), transfer RNA (tRNA), and ribosomal RNA (rRNA). Amongst these, mRNA has become a crucial therapeutic approach in modern healthcare industry.

mRNA is a single-stranded RNA molecule that carries the genetic information found in DNA to synthesize proteins. The genetic information found on mRNA is translated into amino acids, which are then processed into a functional product (proteins). Significantly, following the COVID-19 pandemic, the production of mRNA vaccines and therapeutics has attracted notable focus as they have developed into a next-generation class of drugs for treating the COVID-19 infection. Additionally, mRNA therapies are being assessed for the management of different oncological, infectious, and genetic conditions. This versatility and scalability of mRNA therapeutics have further contributed to their adoption, positioning them as a cornerstone of personalized mRNA medicine production and vaccine development. Moreover, these therapies are expected to possess enhanced safety profiles for patients due to the low risk of insertional mutagenesis.

Due to this success, the need for mRNA synthesis and production has risen significantly, leading mRNA therapeutic /vaccine developers to actively investigate alternatives to meet the current demand. In this regard, outsourcing became a profitable choice for companies involved in mRNA therapeutic / vaccine development, providing effective and scalable solutions for mRNA therapeutics and vaccine development. Given the current trends and anticipated opportunities in the mRNA synthesis and manufacturing sector, we anticipate that this field is poised for single-digit market growth in the near future.

mRNA SYNTHESIS AND MANUFACTURING MARKET: KEY INSIGHTS

The report delves into the current state of the mRNA synthesis and manufacturing market and identifies potential growth opportunities within industry. Some key findings from the report include:

1. The current market landscape features the presence of close to 55 providers that claim to offer customized services for mRNA synthesis across the world; 60% of these are headquartered in North America.

2. Majority (~95%) of the mRNA custom synthesis service providers offer 5' modifications of mRNA, primarily because it enhances mRNA stability, translation efficiency and reduces chances of immunogenicity.

3. Stakeholders are actively upgrading their existing capabilities in order to enhance their respective portfolios and gain a competitive edge over other players active in the mRNA custom synthesis domain.

4. Owing to the rising demand for mRNA vaccines coupled with advancements in mRNA synthesis and manufacturing technologies, ~45 companies are actively offering mRNA contract manufacturing services.

5. Around 60% of the companies are offering mRNA contract manufacturing services for both drug substances and drug products; ~90% players offer mRNA contract manufacturing services at clinical scale.

6. mRNA contract manufacturing service providers are proactively enhancing and diversifying their mRNA manufacturing capabilities to strengthen their service portfolios and establish a competitive market foothold.

7. Presently, close to 115 kits are available in the market for mRNA synthesis; these kits are designed to cater to a wide range of applications, including molecular biology, protein production and vaccine development.

8. mRNA synthesis kits comprise of a variety of components, catering to the specific needs of clients; notably, T7 polymerase emerged as the most preferred type of enzyme being offered in more than 95% mRNA synthesis kits.

9. Presently, close to 115 kits are available in the market for mRNA synthesis; these kits are designed to cater to a wide range of applications, including molecular biology, protein production and vaccine development.

10. mRNA synthesis kits comprise of a variety of components, catering to the specific needs of clients; notably, T7 polymerase emerged as the most preferred type of enzyme being offered in more than 95% mRNA synthesis kits.

11. The rising interest in this market is reflected from the diverse partnerships established among various stakeholders in the recent past; in fact, close to 50% of the deals were inked in the last three years.

12. Various mRNA-based therapeutic / vaccine developers across the world are anticipated to forge strategic alliances with mRNA synthesis and manufacturing service providers to further augment their drug portfolio.

13. Majority (~30%) of the big pharma activities in this domain have been led by Sanofi; of these, most of the initiatives (50%) were instances of partnerships and collaborations inked with various stakeholders active in this domain.

14. Currently, majority of the mRNA synthesis and manufacturing market share is captured by North America; this can be attributed to the advanced healthcare infrastructure, enabling players to conduct extensive research.

15. The infectious diseases sub-segment is estimated to capture most of the overall market share in the current year, owing to the effectiveness of mRNA therapeutics and vaccines in the treatment of such diseases.

16. North America is expected to capture a significant market share of the overall mRNA synthesis and manufacturing market; this trend is unlikely to change in the future.

17. Driven by the rapid success of mRNA-based vaccines and therapeutics developed by prominent players in the US, the mRNA synthesis and manufacturing market is expected to grow at CAGR of 6.5%.

mRNA SYNTHESIS AND MANUFACTURING MARKET: KEY SEGMENTS

Active Pharmaceutical Ingredients Holds the Largest mRNA Synthesis and Manufacturing Market Share

Our estimates suggest that in the current year, the active pharmaceutical ingredients sub-segment is likely to capture majority (>60%) of the mRNA synthesis and manufacturing market share. This can be attributed to the fact that active pharmaceutical ingredients are a fundamental component of any therapeutic / vaccine, that impact the overall efficacy and safety of the product.

Commercial Scale Captures the Largest mRNA Synthesis and Manufacturing Market Share

In the current year, commercial scale sub-segment captures the highest market share (>85%), owing to the commercialization of a large number of mRNA-based therapeutics and vaccines. Further, the market for preclinical and clinical scale is likely to witness a moderate increase during the forecast period. Significant research and development in this field are driving growth in the preclinical and clinical areas, resulting in a rise in the development of mRNA-based products. Additionally, the firms are concentrating on expanding mRNA production facilities to enhance operations at different scales.

Contract Manufacturing is Anticipated to Dominate the mRNA Synthesis and Manufacturing Market

In the current year, the contract manufacturing sub-segment occupies the highest market share (~60%). This dominance is primarily driven by the complexity of mRNA production, which demands specialized expertise and often relies on third-party service providers. Further, the market is likely to witness a substantial increase in the share of in-house manufacturing sub-segment, growing at a CAGR of 7.5% during the forecast period.

Non-COVID-Indications is Likely to Grow at a Notable CAGR During the Forecast Period

The COVID indication sub-segment occupies the highest market share (95%) in the current year. This can be attributed to the fact that mRNA-based products can instruct cells to produce specific pathogen proteins, which in turn trigger a strong and targeted immune response without exposing the individual to the actual pathogen. Further, the market is likely to witness a substantial increase in the share of non-COVID indications, growing at a CAGR of 37.5% during the forecast period.

Focus on Infectious Disease mRNA Therapies

In the current year, the infectious diseases sub-segment occupies the highest market share (~95%), given the fact that mRNA therapeutics and vaccines demonstrated tremendous success in combating the COVID-19 pandemic. Further, the oncology segment is likely to witness significant market growth owing to the increasing prevalence of cancer and the need to develop novel therapeutic options to treat oncological disorders efficiently.

mRNA Vaccines Holds the Largest mRNA Synthesis and Manufacturing Market Share

In the current year, the market is solely driven by mRNA vaccines sub-segment as per mRNA synthesis and manufacturing market forecast, given their proven clinical success, broad preventive applications and flexible nature. Further, the market is likely to witness a substantial increase in the share of mRNA therapeutics, growing at a CAGR of 61.1% during the forecast period. This is because of their rapidly expanding therapeutic applications for therapeutic areas such as oncological, genetic, autoimmune and cardiovascular disorders, thus generating a strong clinical momentum for mRNA therapeutics.

North America to Propel in the mRNA Synthesis and Manufacturing Sector in the Coming Years

North America is likely to capture majority share (>40%) of the market. In addition, the market in North America is expected to grow at a CAGR of 6.6%, during the forecast period. This is because of the advanced healthcare infrastructure in North America, enabling several players in the industry to conduct extensive research and develop novel mRNA modalities for a wide array of therapeutic indications.

Primary Research Overview

Discussions with multiple stakeholders in this domain influenced the opinions and insights presented in this study. The market report includes detailed transcripts of interviews conducted with the following individuals:

- Chief Executive Officer, Mid-sized Organization, Belgium

- Chief Commercial Officer, Mid-sized Organization, France

- Business Development Manager, Mid-sized Organization, Spain

- Team Leader, Large Organization, South Korea

In addition, the market report includes transcripts of the following other third-party discussions:

- Scientist in Nucleic Acid Therapeutics, Very Large Organization, United States

- Senior Product Manager, Very Large Organization, United States

- NEB RNA Research Senior Scientist, Large Organization, United States

- Professor and Director of the BASE facility and, Associate Professor and Deputy Director of the BASE facility, Vert Large Organization, Australia

Example Players in the mRNA Synthesis and Manufacturing Market

- Aldevron

- APExBIO

- Aurigene Pharmaceutical Services

- BioCell

- Biomay

- BioNTech

- Biorbyt

- CELLSCRIPT

- Creative Biogene

- Curia

- Eurogentec

- GenScript

- eJena Bioscience

- Lonza

- Merck

- Porton Advanced

- Revolution Biotechnology

- Samsung Biologics

- ST Pharm

- Thermo Fisher Scientific

- TriLink BioTechnologies

- Vernal Biosciences

- WuXi Biologics

- YXgene

mRNA SYNTHESIS AND MANUFACTURING MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the mRNA synthesis and manufacturing market, focusing on key market segments, including [A] type of product, [B] scale of operation, [C] synthesis and manufacturing activity, [D] indication type, [E] therapeutic area, [F] application area and [G] geographical regions.

- Market Landscape 1: A detailed assessment of companies offering mRNA custom synthesis services, based on several relevant parameters, including [A] year of establishment, [B] company size, [C] location of the headquarters, [D] type of service offered, [E] type of starting material, [F] structural modification, [G] type of purification method, [H] scale of operation, [I] application area and [J] GMP compliance.

- Company Competitiveness Analysis: A competitiveness analysis of mRNA custom synthesis service providers, based on [A] supplier strength, and [A] service strength

- Market Landscape 2: A comprehensive assessment of the mRNA contract manufacturing service providers, based on [A] year of establishment, [B] company size, [C] location of the headquarters, [D] location of manufacturing facilities, [E] type of product, [F] type of additional services offered, [G] scale of operation, [H] GMP compliance.

- Company Competitiveness Analysis: In-depth company competitiveness analysis of mRNA contract manufacturing service providers based on [A] supplier strength and [B] service strength.

- Market Landscape 3: A detailed assessment of the current market landscape of mRNA synthesis kits based on several relevant parameters, such as [A] kit, [B] type of enzyme, [C] type of enzyme mix used, [D] type of mRNA component modified, [E] number of reactions, [F] yield per reaction, [G] reaction run-time and shelf life, [H] year of establishment, [I] company size, [J] location of the headquarters and [K] most active players.

- Product Competitive Analysis: An insightful analysis of mRNA synthesis kits, based on [A] developer strength and [B] product portfolio strength.

- Company Profiles: In-depth profiles of prominent players across North America, Europe and Asia-Pacific, focusing on [A] year of establishment, [B] location of headquarters, [C] B-mRNA synthesis service portfolio, [D] recent developments and [E] an informed future outlook.

- Partnerships and Collaborations: A detailed analysis of the partnerships inked between stakeholders engaged in this industry, based on several parameters, such as [A] year of partnership, [A] type of partnership, [B] type of product, [C] type of partner and [D] most active players.

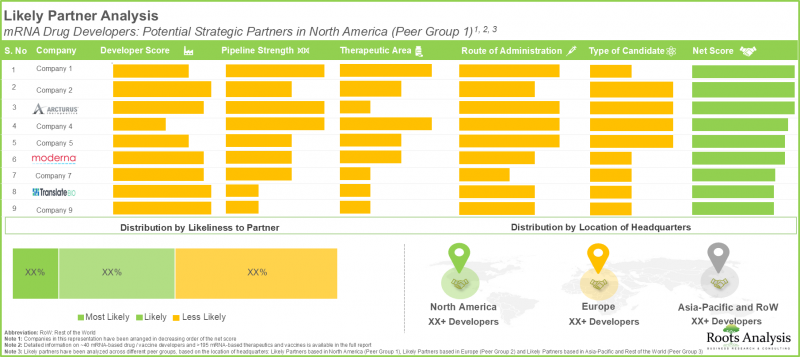

- Likely Partner Analysis: a comprehensive analysis of mRNA-based therapeutics / vaccines developers that are likely to partner with mRNA contract manufacturing service providers.

- Big Pharma Initiatives: A review of the various mRNA-focused initiatives undertaken by big players, highlighting trends across various parameters, such as [A] number of initiatives, [A] year of initiative, [A] type of partnership, [B] type of expansion, [C] region of expansion, [D] type of pharmaceutical and [E] therapeutic area.

- Market Impact Analysis: An in-depth analysis of the factors that can impact the growth of the mRNA synthesis and manufacturing market. It also features identification and market analysis of [A] key drivers, [B] potential restraints, [C] emerging opportunities, and [D] existing challenges.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What is the current global capacity of developers?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. BACKGROUND

- 1.1. Context

- 1.2. Project Objectives

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

5. EXECUTIVE SUMMARY

- 5.1. Executive Summary: Market Landscape

- 5.2. Executive Summary: Market Trends

- 5.3. Executive Summary: Market Forecast and Opportunity Analysis

6. INTRODUCTION

- 6.1. Overview of mRNA

- 6.2. Structure of mRNA

- 6.3. Evolution of mRNA Vaccines

- 6.4. Types of mRNA Synthesis Processes

- 6.4.1. Chemical Synthesis of mRNA

- 6.4.2. In vitro Synthesis of mRNA

- 6.5. Applications of mRNA

- 6.6. Challenges Associated with mRNA Synthesis

- 6.7. Commonly Outsourced mRNA Manufacturing Operations

- 6.8. Advantages of Outsourcing Manufacturing Operations

- 6.9. Conclusion

7. mRNA CUSTOM SYNTHESIS SERVICE PROVIDERS: MARKET LANDSCAPE

- 7.1. Overview of mRNA Custom Synthesis Service Providers

- 7.1.1. Analysis by Year of Establishment

- 7.1.2. Analysis by Company Size

- 7.1.3. Analysis by Location of Headquarters

- 7.1.4. Analysis by Company Size and Location of Headquarters

- 7.1.5. Analysis by Type of Service Offered

- 7.1.6. Analysis by Type of Starting Material

- 7.1.7. Analysis by Structural Modification

- 7.1.8. Analysis by Type of Purification Method

- 7.1.9. Analysis by Scale of Operation

- 7.1.10. Analysis by Application Area

- 7.1.11. Analysis by GMP Compliance

8. COMPANY COMPETITIVENESS ANALYSIS: mRNA CUSTOM SYNTHESIS SERVICE PROVIDERS

- 8.1. Methodology and Key Parameters

- 8.2. Scoring Criteria

- 8.3. Overview of Peer Groups

- 8.4. Company Competitiveness Analysis

- 8.4.1. Competitiveness Analysis of Service Providers headquartered in North America: 2D Dot Plot

- 8.4.2. Leading Service Providers headquartered in North America: Spider Web Analysis

- 8.4.3. Competitiveness Analysis of Service Providers headquartered in Europe: 2D Dot Plot

- 8.4.4. Leading Service Providers headquartered in Europe: Spider Web Analysis

- 8.4.5. Competitiveness Analysis of Service Providers headquartered in Asia-Pacific: 2D Dot Plot

- 8.4.6. Leading Service Providers headquartered in Asia-Pacific: Spider Web Analysis

9. mRNA CONTRACT MANUFACTURING SERVICE PROVIDERS: MARKET LANDSCAPE

- 9.1. Overview of mRNA Contract Manufacturing Service Providers

- 9.1.1. Analysis by Year of Establishment

- 9.1.2. Analysis by Company Size

- 9.1.3. Analysis by Location of Headquarters (Region)

- 9.1.4. Analysis by Location of Headquarters (Country)

- 9.1.5. Analysis by Location of Manufacturing Facilities

- 9.1.6. Analysis by Type of Product Manufactured

- 9.1.7. Analysis by GMP Compliance

- 9.1.8. Analysis by Scale of Operation

- 9.1.9. Analysis by Type of Additional Services Offered

10. COMPANY COMPETITIVENESS ANALYSIS: mRNA CONTRACT MANUFACTURING SERVICE PROVIDERS

- 10.1. Methodology and Key Parameters

- 10.2. Scoring Criteria

- 10.3. Overview of Peer Groups

- 10.4. Company Competitiveness Analysis

- 10.4.1. Competitiveness Analysis of Service Providers headquartered in North America: 2D Dot Plot

- 10.4.2. Leading Service Providers headquartered in North America: Spider Web Analysis

- 10.4.3. Competitiveness Analysis of Service Providers headquartered in Europe: 2D Dot Plot

- 10.4.4. Leading Service Providers headquartered in Europe: Spider Web Analysis

- 10.4.5. Competitiveness Analysis of Service Providers headquartered in Asia-Pacific: 2D Dot Plot

- 10.4.6. Leading Service Providers headquartered in Asia-Pacific: Spider Web Analysis

11. mRNA SYNTHESIS KITS: MARKET LANDSCAPE

- 11.1. Overview of mRNA Synthesis Kits

- 11.1.1. Analysis by Kit Components

- 11.1.2. Analysis by Type of Enzyme

- 11.1.3. Analysis by Type of Enzyme Mix Used

- 11.1.4. Analysis by mRNA Component Modified

- 11.1.5. Analysis by Number of Reactions

- 11.1.6. Analysis by Yield per Reaction

- 11.1.7. Analysis by Reaction Run-time

- 11.1.8. Analysis by Shelf Life

- 11.2. mRNA Synthesis Kits: Developers Landscape

- 11.2.1. Analysis by Year of Establishment

- 11.2.2. Analysis by Company Size

- 11.2.3. Analysis by Location of Headquarters

- 11.2.4. Most Active Players: Analysis by Number of Kits Developed

12. PRODUCT COMPETITIVENESS ANALYSIS: mRNA SYNTHESIS KITS

- 12.1. Methodology and Key Parameters

- 12.2. Scoring Criteria

- 12.3. Leading mRNA Synthesis Kits: 2D Dot Plot

13. COMPANY PROFILES: mRNA CUSTOM SYNTHESIS SERVICE PROVIDERS

- 13.1. Methodology

- 13.2. Aldevron

- 13.2.1. Company Details

- 13.2.2. Service Portfolio

- 13.2.3. Financial Information

- 13.2.4. Future Outlook

- 13.3. Thermo Fischer Scientific

- 13.4. Revolution Biomanufacturing

- 13.5. BioNTech

- 13.6. Eurogentec

- 13.7. Biocell

- 13.8. YXgene

- 13.9. Aurigene Pharmaceutical Services

- 13.10. Biomay

- 13.11. GenScript

- 13.12. Trilink Biotechnologies

14. COMPANY PROFILES: mRNA CONTRACT MANUFACTURING SERVICE PROVIDERS

- 14.1. Methodology

- 14.2. Curia

- 14.2.1. Company Details

- 14.2.2. Service Portfolio

- 14.2.3. Financial Information

- 14.2.4. Future Outlook

- 14.3. Lonza

- 14.4. Merck

- 14.5. Porton Advanced

- 14.6. Samsung Biologics

- 14.7. ST Pharm

- 14.8. Vernal Biosciences

- 14.9. Wuxi Biologics

15. COMPANY PROFILES: mRNA SYNTHESIS KITS

- 15.1. Methodology

- 15.2. APExBIO

- 15.2.1. Company Details

- 15.2.2. mRNA Synthesis Kits Portfolio

- 15.3. Biorbyt

- 15.4. Cell Script

- 15.5. Creative Biogene

- 15.6. Jena Bioscience

- 15.7. Thermo Fischer Scientific

16. PARTNERSHIPS AND COLLABORATIONS

- 16.1. Partnership Models

- 16.2. mRNA Synthesis and Manufacturing Market: Partnerships and Collaborations

- 16.2.1. Analysis by Year of Partnership

- 16.2.2. Analysis by Type of Partnership

- 16.2.3. Analysis by Year and Type of Partnership

- 16.2.4. Analysis by Type of Partner

- 16.2.5. Analysis by Type of Pharmaceutical

- 16.2.6. Analysis by Type of Drug Product

- 16.2.7. Most Active Players: Analysis by Number of Partnerships

- 16.2.8. Analysis by Geography

- 16.2.8.1. Local and International Deals

- 16.2.8.2. Intracontinental and Intercontinental Deals

17. LIKELY PARTNER ANALYSIS

- 17.1. mRNA Synthesis and Manufacturing Market: Likely Partner Analysis

- 17.2. Methodology and Key Parameters

- 17.3. Scoring Criteria

- 17.4. mRNA Drug Developers: Likely Partners based in North America

- 17.4.1. mRNA Drug Developers: Most Likely Partners based in North America

- 17.5. mRNA Drug Developers: Likely Partners based in Europe

- 17.5.1. mRNA Drug Developers: Most Likely Partners based in Europe

- 17.6. mRNA Drug Developers: Likely Partners based in Asia-Pacific and Rest of the World

- 17.6.1. mRNA Drug Developers: Most Likely Partners based in Asia-Pacific and Rest of the World

18. BIG PLAYER INITIATIVES

- 18.1. Methodology

- 18.2. Key Initiatives Analyzed

- 18.3. mRNA Synthesis and Manufacturing Market: Big Player Initiatives

- 18.3.1. Analysis by Year of Initiative

- 18.3.2. Analysis by Type of Initiative

- 18.3.3. Analysis by Year and Type of Initiative

- 18.3.4. Big Players: Analysis by Number of Initiatives

- 18.3.5. Big Players: Analysis by Type of Initiative

- 18.3.6. Analysis by Type of Pharmaceutical

- 18.3.7. Analysis by Therapeutic Area

- 18.3.8. Big Players: Analysis by Number of Partnerships

- 18.3.9. Analysis by Type of Partnership

- 18.3.10. Big Players: Analysis by Number of Expansions

- 18.3.11. Analysis by Type of Expansion

- 18.3.12. Big Players: Analysis by Region of Expansion

19. MARKET IMPACT ANALYSIS

- 19.1. Market Drivers

- 19.2. Market Restraints

- 19.3. Market Opportunities

- 19.4. Market Challenges

20. GLOBAL mRNA SYNTHESIS AND MANUFACTURING MARKET

- 20.1. Key Assumptions and Methodology

- 20.2. Global mRNA Synthesis and Manufacturing Market: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 20.2.1. Scenario Analysis

- 20.2.1.1. Conservative Scenario

- 20.2.1.2. Optimistic Scenario

- 20.2.1. Scenario Analysis

- 20.3. Comparison with Previous Edition

- 20.4. Key Market Segmentations

21. mRNA SYNTHESIS AND MANUFACTURING MARKET, BY TYPE OF PRODUCT

- 21.1. Methodology

- 21.2. mRNA Synthesis and Manufacturing Market: Distribution by Type of Product

- 21.2.1. mRNA Synthesis and Manufacturing Market for Active Pharmaceutical Ingredients: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 21.2.2. mRNA Synthesis and Manufacturing Market for Finished Dose Formulations: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

22. mRNA SYNTHESIS AND MANUFACTURING MARKET, BY SCALE OF OPERATION

- 22.1. Methodology

- 22.2. mRNA Synthesis and Manufacturing Market: Distribution by Scale of Operation

- 22.2.1. mRNA Synthesis and Manufacturing Market for Preclinical and Clinical Scale: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 22.2.2. mRNA Synthesis and Manufacturing Market for Commercial Scale: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

23. mRNA SYNTHESIS AND MANUFACTURING MARKET, BY SYNTHESIS AND MANUFACTURING ACTIVITY

- 23.1. Methodology

- 23.2. mRNA Synthesis and Manufacturing Market: Distribution by Synthesis and Manufacturing Activity

- 23.2.1. mRNA Synthesis and Manufacturing Market for Contract Manufacturing: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 23.2.2. mRNA Synthesis and Manufacturing Market for In-house Manufacturing: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

24. mRNA SYNTHESIS AND MANUFACTURING MARKET, BY INDICATION TYPE

- 24.1. Methodology

- 24.2. mRNA Synthesis and Manufacturing Market: Distribution by Indication Type

- 24.2.1. mRNA Synthesis and Manufacturing Market for COVID Indications: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 24.2.2. mRNA Synthesis and Manufacturing Market for Non-COVID Indications: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

25. mRNA SYNTHESIS AND MANUFACTURING MARKET, BY THERAPEUTIC AREA

- 25.1. Methodology

- 25.2. mRNA Synthesis and Manufacturing Market: Distribution by Therapeutic Area

- 25.2.1. mRNA Synthesis and Manufacturing Market for Infectious Diseases: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.2.2. mRNA Synthesis and Manufacturing Market for Oncological Disorders: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.2.3. mRNA Synthesis and Manufacturing Market for Other Disorders: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

26. mRNA SYNTHESIS AND MANUFACTURING MARKET, BY APPLICATION AREA

- 26.1. Methodology

- 26.2. mRNA Synthesis and Manufacturing Market: Distribution by Application Area

- 26.2.1. mRNA Synthesis and Manufacturing Market for mRNA Vaccines: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 26.2.2. mRNA Synthesis and Manufacturing Market for mRNA Therapeutics: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

27. mRNA SYNTHESIS AND MANUFACTURING MARKET, BY GEOGRAPHICAL REGIONS

- 27.1. Methodology

- 27.2. mRNA Synthesis and Manufacturing Market: Distribution by Geographical Regions

- 27.2.1. mRNA Synthesis and Manufacturing Market in North America: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.2.1.1. mRNA Synthesis and Manufacturing Market in the US: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.2.1.2. mRNA Synthesis and Manufacturing Market in Canada: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.3.1. mRNA Synthesis and Manufacturing Market in Europe: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.3.1.1. mRNA Synthesis and Manufacturing Market in Germany: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.3.1.2. mRNA Synthesis and Manufacturing Market in France: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.3.1.3. mRNA Synthesis and Manufacturing Market in the UK: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.3.1.4. mRNA Synthesis and Manufacturing Market in Italy: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.3.1.5. mRNA Synthesis and Manufacturing Market in Spain: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.3.1.6. mRNA Synthesis and Manufacturing Market in Rest of Europe: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.4.1. mRNA Synthesis and Manufacturing Market in Asia-Pacific: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.4.1.1. mRNA Synthesis and Manufacturing Market in China: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.4.1.2. mRNA Synthesis and Manufacturing Market in India: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.4.1.3. mRNA Synthesis and Manufacturing Market in Japan: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.4.1.4. mRNA Synthesis and Manufacturing Market in South Korea: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.4.1.5. mRNA Synthesis and Manufacturing Market in Rest of Asia-Pacific: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.5.1. mRNA Synthesis and Manufacturing Market in Latin America: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.5.1.1. mRNA Synthesis and Manufacturing Market in Brazil: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.5.1.2. mRNA Synthesis and Manufacturing Market in Argentina: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.6.1. mRNA Synthesis and Manufacturing Market in Middle East and North Africa: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.6.1.1. mRNA Synthesis and Manufacturing Market in Saudi Arabia: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.6.1.2. mRNA Synthesis and Manufacturing Market in Israel: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.6.1.3. mRNA Synthesis and Manufacturing Market in United Arab Emirates: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.6.1.4. mRNA Synthesis and Manufacturing Market in Rest of Middle East and North Africa: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 27.2.1. mRNA Synthesis and Manufacturing Market in North America: Historical Trends (since 2021) and Forecasted Estimates (till 2035)

28. MARKET OPPORTUNITY ANALYSIS: NORTH AMERICA

- 28.1. mRNA Synthesis and Manufacturing Market in North America: Distribution by Type of Product

- 28.1.1. mRNA Synthesis and Manufacturing Market in North America for Active Pharmaceutical Ingredient, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 28.1.2. mRNA Synthesis and Manufacturing Market in North America for Finished Dose Formulation, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 28.2. mRNA Synthesis and Manufacturing Market in North America: Distribution by Scale of Operation

- 28.2.1. mRNA Synthesis and Manufacturing Market in North America for Preclinical and Clinical Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 28.2.2. mRNA Synthesis and Manufacturing Market in North America for Commercial Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 28.3. mRNA Synthesis and Manufacturing Market in North America: Distribution by Synthesis and Manufacturing Activity

- 28.3.1. mRNA Synthesis and Manufacturing Market in North America for Contract Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 28.3.2. mRNA Synthesis and Manufacturing Market in North America for In-house Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 28.4. mRNA Synthesis and Manufacturing Market in North America: Distribution by Indication Type

- 28.4.1. mRNA Synthesis and Manufacturing Market in North America for COVID Indications, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 28.4.2. mRNA Synthesis and Manufacturing Market in North America for non-COVID Indications, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 28.5. mRNA Synthesis and Manufacturing Market in North America: Distribution by Therapeutic Area

- 28.5.1. mRNA Synthesis and Manufacturing Market in North America for Infectious Diseases, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 28.5.2. mRNA Synthesis and Manufacturing Market in North America for Oncological Disorders, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 28.5.3. mRNA Synthesis and Manufacturing Market in North America for Other Disorders, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 28.6. mRNA Synthesis and Manufacturing Market in North America: Distribution by Application Area

- 28.6.1. mRNA Synthesis and Manufacturing Market in North America for mRNA Vaccines, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 28.6.2. mRNA Synthesis and Manufacturing Market in North America for mRNA Therapeutics, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

29. MARKET OPPORTUNITY ANALYSIS: EUROPE

- 29.1. mRNA Synthesis and Manufacturing Market in Europe: Distribution by Type of Product

- 29.1.1. mRNA Synthesis and Manufacturing Market in Europe for Active Pharmaceutical Ingredient, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 29.1.2. mRNA Synthesis and Manufacturing Market in Europe for Finished Dose Formulation, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 29.2. mRNA Synthesis and Manufacturing Market in Europe: Distribution by Scale of Operation

- 29.2.1. mRNA Synthesis and Manufacturing Market in Europe for Preclinical and Clinical Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 29.2.2. mRNA Synthesis and Manufacturing Market in Europe for Commercial Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 29.3. mRNA Synthesis and Manufacturing Market in Europe: Distribution by Synthesis and Manufacturing Activity

- 29.3.1. mRNA Synthesis and Manufacturing Market in Europe for Contract Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 29.3.2. mRNA Synthesis and Manufacturing Market in Europe for In-house Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 29.4. mRNA Synthesis and Manufacturing Market in Europe: Distribution by Indication Type

- 29.4.1. mRNA Synthesis and Manufacturing Market in Europe for COVID Indications, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 29.4.2. mRNA Synthesis and Manufacturing Market in Europe for non-COVID Indications, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 29.5. mRNA Synthesis and Manufacturing Market in Europe: Distribution by Therapeutic Area

- 29.5.1. mRNA Synthesis and Manufacturing Market in Europe for Infectious Diseases, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 29.5.2. mRNA Synthesis and Manufacturing Market in Europe for Oncological Disorders, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 29.5.3. mRNA Synthesis and Manufacturing Market in Europe for Other Disorders, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 29.6. mRNA Synthesis and Manufacturing Market in Europe: Distribution by Application Area

- 29.6.1. mRNA Synthesis and Manufacturing Market in Europe for mRNA Vaccines, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 29.6.2. mRNA Synthesis and Manufacturing Market in Europe for mRNA Therapeutics, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

30. MARKET OPPORTUNITY ANALYSIS: ASIA-PACIFIC

- 30.1. mRNA Synthesis and Manufacturing Market in Asia-Pacific: Distribution by Type of Product

- 30.1.1. mRNA Synthesis and Manufacturing Market in Asia-Pacific for Active Pharmaceutical Ingredient, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 30.1.2. mRNA Synthesis and Manufacturing Market in Asia-Pacific for Finished Dose Formulation, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 30.2. mRNA Synthesis and Manufacturing Market in Asia-Pacific: Distribution by Scale of Operation

- 30.2.1. mRNA Synthesis and Manufacturing Market in Asia-Pacific for Preclinical and Clinical Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 30.2.2. mRNA Synthesis and Manufacturing Market in Asia-Pacific for Commercial Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 30.3. mRNA Synthesis and Manufacturing Market in Asia-Pacific: Distribution by Synthesis and Manufacturing Activity

- 30.3.1. mRNA Synthesis and Manufacturing Market in Asia-Pacific for Contract Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 30.3.2. mRNA Synthesis and Manufacturing Market in Asia-Pacific for In-house Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 30.4. mRNA Synthesis and Manufacturing Market in Asia-Pacific: Distribution by Indication Type

- 30.4.1. mRNA Synthesis and Manufacturing Market in Asia-Pacific for COVID Indications, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 30.4.2. mRNA Synthesis and Manufacturing Market in Asia-Pacific for non-COVID Indications, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 30.5. mRNA Synthesis and Manufacturing Market in Asia-Pacific: Distribution by Therapeutic Area

- 30.5.1. mRNA Synthesis and Manufacturing Market in Asia-Pacific for Infectious Diseases, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 30.5.2. mRNA Synthesis and Manufacturing Market in Asia-Pacific for Oncological Disorders, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 30.5.3. mRNA Synthesis and Manufacturing Market in Asia-Pacific for Other Disorders, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 30.6. mRNA Synthesis and Manufacturing Market in Asia-Pacific: Distribution by Application Area

- 30.6.1. mRNA Synthesis and Manufacturing Market in Asia-Pacific for mRNA Vaccines, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 30.6.2. mRNA Synthesis and Manufacturing Market in Asia-Pacific for mRNA Therapeutics, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

31. MARKET OPPORTUNITY ANALYSIS: LATIN AMERICA

- 31.1. mRNA Synthesis and Manufacturing Market in Latin America: Distribution by Type of Product

- 31.1.1. mRNA Synthesis and Manufacturing Market in Latin America for Active Pharmaceutical Ingredient, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 31.1.2. mRNA Synthesis and Manufacturing Market in Latin America for Finished Dose Formulation, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 31.2. mRNA Synthesis and Manufacturing Market in Latin America: Distribution by Scale of Operation

- 31.2.1. mRNA Synthesis and Manufacturing Market in Latin America for Preclinical and Clinical Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 31.2.2. mRNA Synthesis and Manufacturing Market in Latin America for Commercial Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 31.3. mRNA Synthesis and Manufacturing Market in Latin America: Distribution by Synthesis and Manufacturing Activity

- 31.3.1. mRNA Synthesis and Manufacturing Market in Latin America for Contract Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 31.3.2. mRNA Synthesis and Manufacturing Market in Latin America for In-house Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 31.4. mRNA Synthesis and Manufacturing Market in Latin America: Distribution by Indication Type

- 31.4.1. mRNA Synthesis and Manufacturing Market in Latin America for COVID Indications, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 31.4.2. mRNA Synthesis and Manufacturing Market in Latin America for non-COVID Indications, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 31.5. mRNA Synthesis and Manufacturing Market in Latin America: Distribution by Therapeutic Area

- 31.5.1. mRNA Synthesis and Manufacturing Market in Latin America for Infectious Diseases, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 31.5.2. mRNA Synthesis and Manufacturing Market in Latin America for Oncological Disorders, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 31.5.3. mRNA Synthesis and Manufacturing Market in Latin America for Other Disorders, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 31.6. mRNA Synthesis and Manufacturing Market in Latin America: Distribution by Application Area

- 31.6.1. mRNA Synthesis and Manufacturing Market in Latin America for mRNA Vaccines, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 31.6.2. mRNA Synthesis and Manufacturing Market in Latin America for mRNA Therapeutics, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

32. MARKET OPPORTUNITY ANALYSIS: MIDDLE EAST AND NORTH AFRICA

- 32.1. mRNA Synthesis and Manufacturing Market in Middle East and North Africa: Distribution by Type of Product

- 32.1.1. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for Active Pharmaceutical Ingredient, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 32.1.2. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for Finished Dose Formulation, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 32.2. mRNA Synthesis and Manufacturing Market in Middle East and North Africa: Distribution by Scale of Operation

- 32.2.1. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for Preclinical and Clinical Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 32.2.2. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for Commercial Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 32.3. mRNA Synthesis and Manufacturing Market in Middle East and North Africa: Distribution by Synthesis and Manufacturing Activity

- 32.3.1. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for Contract Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 32.3.2. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for In-house Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 32.4. mRNA Synthesis and Manufacturing Market in Middle East and North Africa: Distribution by Indication Type

- 32.4.1. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for COVID Indications, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 32.4.2. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for non-COVID Indications, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 32.5. mRNA Synthesis and Manufacturing Market in Middle East and North Africa: Distribution by Therapeutic Area

- 32.5.1. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for Infectious Diseases, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 32.5.2. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for Oncological Disorders, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 32.5.3. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for Other Disorders, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 32.6. mRNA Synthesis and Manufacturing Market in Middle East and North Africa: Distribution by Application Area

- 32.6.1. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for mRNA Vaccines, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 32.6.2. mRNA Synthesis and Manufacturing Market in Middle East and North Africa for mRNA Therapeutics, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- *Detailed information on Chapter 28 to 32 is available in the Excel Data Packs shared along with the report**

33. CONCLUDING INSIGHTS

34. EXECUTIVE INSIGHTS

35. APPENDIX I: TABULATED DATA

36. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 7.1 List of mRNA Custom Synthesis Service Providers

- Table 9.1 List of mRNA Contract Manufacturing Service Providers

- Table 11.1 List of mRNA Synthesis Kits

- Table 11.2 List of mRNA Synthesis Kit Developers

- Table 12.1 Aldevron: Service Portfolio

- Table 12.2 Aldevron: Recent Developments and Future Outlook

- Table 12.3 Thermo Fischer Scientific: Service Portfolio

- Table 12.4 Thermo Fischer Scientific: Recent Developments and Future Outlook

- Table 12.5 Revolution Biomanufacturing: Service Portfolio

- Table 12.6 Revolution Biomanufacturing: Recent Developments and Future Outlook

- Table 12.7 BioNTech: Service Portfolio

- Table 12.8 BioNTech: Recent Developments and Future Outlook

- Table 12.9 Eurogentec: Service Portfolio

- Table 12.10 Eurogentec: Recent Developments and Future Outlook

- Table 12.11 Biocell: Service Portfolio

- Table 12.12 Biocell: Recent Developments and Future Outlook

- Table 12.13 YXgene: Service Portfolio

- Table 12.14 YXgene: Recent Developments and Future Outlook

- Table 13.1 Curia: Service Portfolio

- Table 13.2 Curia: Recent Developments and Future Outlook

- Table 13.3 Lonza: Service Portfolio

- Table 13.4 Lonza: Recent Developments and Future Outlook

- Table 13.5 Merck: Service Portfolio

- Table 13.6 Merck: Recent Developments and Future Outlook

- Table 13.7 Porton Advanced: Service Portfolio

- Table 13.8 Porton Advanced: Recent Developments and Future Outlook

- Table 13.9 Samsung Biologics: Service Portfolio

- Table 13.10 Samsung Biologics: Recent Developments and Future Outlook

- Table 13.11 ST Pharm: Service Portfolio

- Table 13.12 ST Pharm: Recent Developments and Future Outlook

- Table 13.13 Vernal Biosciences: Service Portfolio

- Table 13.14 Vernal Biosciences: Recent Developments and Future Outlook

- Table 13.13 Wuxi Biologics: Service Portfolio

- Table 13.14 Wuxi Biologics: Recent Developments and Future Outlook

- Table 14.1 APExBIO: mRNA Synthesis Kits Portfolio

- Table 14.2 Biorbyt: mRNA Synthesis Kits Portfolio

- Table 14.3 Cell Script: mRNA Synthesis Kits Portfolio

- Table 14.4 Creative Biogene: mRNA Synthesis Kits Portfolio

- Table 14.5 Jena Bioscience: mRNA Synthesis Kits Portfolio

- Table 14.6 Thermo Fischer Scientific: mRNA Synthesis Kits Portfolio

- Table 15.1 mRNA Synthesis and Manufacturing: List of Partnerships and Collaborations, since 2019

- Table 15.2 mRNA Synthesis and Manufacturing: Information on Location of Headquarters (Country / Region) and Type of Agreement (Intercontinental / Intracontinental)

- Table 16.1 mRNA Drug Developers: Potential Strategic Partners in North America

- Table 16.2 Most Likely Partner

- Table 17.1 Big Player Initiatives: List of mRNA Synthesis and Manufacturing Focused Initiatives, since 2019

- Table 35.1 mRNA Custom Synthesis Service Providers: Distribution by Year of Establishment

- Table 35.2 mRNA Custom Synthesis Service Providers: Distribution by Company Size

- Table 35.3 mRNA Custom Synthesis Service Providers: Distribution by Location of Headquarters

- Table 35.4 mRNA Custom Synthesis Service Providers: Distribution by Company Size and Location of Headquarters

- Table 35.5 mRNA Custom Synthesis Service Providers: Distribution by Type of Service Offered

- Table 35.6 mRNA Custom Synthesis Service Providers: Distribution by Starting Material

- Table 35.7 mRNA Custom Synthesis Service Providers: Distribution by Structural Modification

- Table 35.8 mRNA Custom Synthesis Service Providers: Distribution by Type of Purification Method

- Table 35.9 mRNA Custom Synthesis Service Providers: Distribution by Scale of Operation

- Table 35.10 mRNA Custom Synthesis Service Providers: Distribution by Application Area

- Table 35.11 mRNA Custom Synthesis Service Providers: Distribution by GMP Compliance

- Table 35.12 mRNA Contract Manufacturing Service Providers: Distribution by Year of Establishment

- Table 35.13 mRNA Contract Manufacturing Service Providers: Distribution by Company Size

- Table 35.14 mRNA Contract Manufacturing Service Providers: Distribution by Location of Headquarters (Region)

- Table 35.15 mRNA Contract Manufacturing Service Providers: Distribution by Location of Headquarters (Country)

- Table 35.16 mRNA Contract Manufacturing Service Providers: Distribution by Location of Manufacturing Facilities

- Table 35.17 mRNA Contract Manufacturing Service Providers: Distribution by Type of Product Manufactured

- Table 35.18 mRNA Contract Manufacturing Service Providers: Distribution by GMP Compliance

- Table 35.19 mRNA Contract Manufacturing Service Providers: Distribution by Scale of Operation

- Table 35.20 mRNA Contract Manufacturing Service Providers: Distribution by Type of Additional Services Offered

- Table 35.21 mRNA Synthesis Kits: Distribution by Kit Components

- Table 35.22 mRNA Synthesis Kits: Distribution by Type of Enzyme

- Table 35.23 mRNA Synthesis Kits: Distribution by Type of Enzyme Mix Used

- Table 35.24 mRNA Synthesis Kits: Distribution by mRNA Component Modified

- Table 35.25 mRNA Synthesis Kits: Distribution by Number of Reactions

- Table 35.26 mRNA Synthesis Kits: Distribution by Yield Per Reaction

- Table 35.27 mRNA Synthesis Kits: Distribution by Reaction Run Time

- Table 35.28 mRNA Synthesis Kits: Distribution by Shelf Life

- Table 35.29 mRNA Synthesis Kit Providers: Distribution by Year of Establishment

- Table 35.30 mRNA Synthesis Kit Providers: Distribution by Company Size

- Table 35.31 mRNA Synthesis Kit Providers: Distribution by Location of Headquarters

- Table 35.32 Most Active Players: Distribution by Number of Kits Developed

- Table 35.33 Danaher: Annual Revenues, Since FY 2021 (USD Billion)

- Table 35.34 Thermo Fischer Scientific: Annual Revenues, Since FY 2021 (USD Billion)

- Table 35.35 BioNTech: Annual Revenues, Since FY 2021 (EUR Billion)

- Table 35.36 Kaneka: Annual Revenues, Since FY 2021 (JPY Billion)

- Table 35.37 Lonza: Annual Revenues, Since FY 2021 (CHF Billion)

- Table 35.38 Merck: Annual Revenues, Since FY 2021 (EUR Billion)

- Table 35.39 Samsung Biologics: Annual Revenues, Since FY 2021 (KRW Trillion)

- Table 35.40 ST Pharm: Annual Revenues, Since FY 2021 (KRW Billion)

- Table 35.41 Wuxi Biologics: Annual Revenues, Since FY 2020 (RMB Billion)

- Table 35.42 Partnerships and Collaborations: Distribution by Year of Partnership

- Table 35.43 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 35.44 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 35.45 Partnerships and Collaborations: Distribution by Type of Partner

- Table 35.46 Partnerships and Collaborations: Distribution by Type of Pharmaceutical

- Table 35.47 Partnerships and Collaborations: Distribution by Type of Drug Product

- Table 35.48 Most Active Players: Distribution by Number of Partnerships

- Table 35.49 Partnerships and Collaborations: Local and International Deals

- Table 35.50 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Table 35.51 Big Player Initiatives: Distribution by Year of Initiative

- Table 35.52 Big Player Initiatives: Distribution by Type of Initiative

- Table 35.53 Big Player Initiatives: Distribution by Year and Type of Initiative

- Table 35.54 Big Player Initiatives: Distribution of Player by Number of Initiatives

- Table 35.55 Big Player Initiatives: Distribution of Player by Type of Initiative

- Table 35.56 Big Player Initiatives: Distribution by Type of Pharmaceutical

- Table 35.57 Big Player Initiatives: Distribution by Therapeutic Area

- Table 35.58 Big Player Initiatives: Distribution of Player by Number of Partnerships

- Table 35.59 Big Player Initiatives: Distribution by Type of Partnership

- Table 35.60 Big Player Initiatives: Distribution of Player by Number of Expansions

- Table 35.61 Big Player Initiatives: Distribution by Type of Expansion

- Table 35.62 Big Player Initiatives: Distribution of Player by Region of Expansion

- Table 35.63 Global mRNA Synthesis and Manufacturing Market, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.64 Global mRNA Synthesis and Manufacturing Market, Forecasted Estimates (till 2035): Conservative Scenario

- Table 35.65 Global mRNA Synthesis and Manufacturing Market, Forecasted Estimates (till 2035): Optimistic Scenario

- Table 35.66 mRNA Synthesis and Manufacturing Market: Distribution by Type of Product

- Table 35.67 mRNA Synthesis and Manufacturing Market for Active Pharmaceutical Ingredients, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.68 mRNA Synthesis and Manufacturing Market for Finished Dose Formulations, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.69 mRNA Synthesis and Manufacturing Market: Distribution by Scale of Operation

- Table 35.70 mRNA Synthesis and Manufacturing Market for Preclinical and Clinical Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.71 mRNA Synthesis and Manufacturing Market for Commercial Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.72 mRNA Synthesis and Manufacturing Market: Distribution by Synthesis and Manufacturing Activity

- Table 35.73 mRNA Synthesis and Manufacturing Market for Commercial Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.74 mRNA Synthesis and Manufacturing Market for In-house Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.75 mRNA Synthesis and Manufacturing Market: Distribution by Type of Indication

- Table 35.76 mRNA Synthesis and Manufacturing Market for COVID Indication, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.77 mRNA Synthesis and Manufacturing Market for Non-COVID Indication, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.78 mRNA Synthesis and Manufacturing Market: Distribution by Therapeutic Area

- Table 35.79 mRNA Synthesis and Manufacturing Market for Infectious Diseases, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.80 mRNA Synthesis and Manufacturing Market for Oncological Diseases, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.81 mRNA Synthesis and Manufacturing Market for Other Diseases, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.82 mRNA Synthesis and Manufacturing Market: Distribution by Application Area

- Table 35.83 mRNA Synthesis and Manufacturing Market for mRNA Vaccines, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.84 mRNA Synthesis and Manufacturing Market for mRNA Therapeutics, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.85 mRNA Synthesis and Manufacturing Market: Distribution by Geographical Region

- Table 35.86 mRNA Synthesis and Manufacturing Market in North America, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.87 mRNA Synthesis and Manufacturing Market in the US, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.88 mRNA Synthesis and Manufacturing Market in Canada, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.89 mRNA Synthesis and Manufacturing Market in Europe, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.90 mRNA Synthesis and Manufacturing Market in Germany, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.91 mRNA Synthesis and Manufacturing Market in France, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.92 mRNA Synthesis and Manufacturing Market in the UK, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.93 mRNA Synthesis and Manufacturing Market in Italy, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.94 mRNA Synthesis and Manufacturing Market in Spain, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.95 mRNA Synthesis and Manufacturing Market in rest of Europe, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.96 mRNA Synthesis and Manufacturing Market in Asia-Pacific, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.97 mRNA Synthesis and Manufacturing Market in China, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.98 mRNA Synthesis and Manufacturing Market in India, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.99 mRNA Synthesis and Manufacturing Market in Japan, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.100 mRNA Synthesis and Manufacturing Market in South Korea, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.101 mRNA Synthesis and Manufacturing Market in rest of Asia-Pacific, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.102 mRNA Synthesis and Manufacturing Market in Latin America, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.103 mRNA Synthesis and Manufacturing Market in Brazil, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.104 mRNA Synthesis and Manufacturing Market in Argentina, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.105 mRNA Synthesis and Manufacturing Market in Middle East and North Africa, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.106 mRNA Synthesis and Manufacturing Market in Saudi Arabia, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.107 mRNA Synthesis and Manufacturing Market in Israel, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.108 mRNA Synthesis and Manufacturing Market in United Arab Emirates, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Table 35.109 mRNA Synthesis and Manufacturing Market in rest of Middle East and North Africa, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Data Sources for Secondary Research

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 3.1 Market Dynamics: Forecast Methodology

- Figure 3.2 Market Dynamics: Market Assessment Framework

- Figure 4.1 Lessons Learnt from Past Recessions

- Figure 5.1 Executive Summary: Market Landscape

- Figure 5.2 Executive Summary: Market Trends

- Figure 5.3 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 6.1 Structure of mRNA

- Figure 6.2 Evolution of mRNA Vaccines

- Figure 6.3 Chemical Synthesis

- Figure 6.4 In-vitro Synthesis

- Figure 6.5 Applications of mRNA

- Figure 6.6 Advantages of Outsourcing Manufacturing Operations

- Figure 7.1 mRNA Custom Synthesis Service Providers: Distribution by Year of Establishment

- Figure 7.2 mRNA Custom Synthesis Service Providers: Distribution by Company Size

- Figure 7.3 mRNA Custom Synthesis Service Providers: Distribution by Location of Headquarters

- Figure 7.4 mRNA Custom Synthesis Service Providers: Distribution by Company Size and Location of Headquarters

- Figure 7.5 mRNA Custom Synthesis Service Providers: Distribution by Type of Service Offered

- Figure 7.6 mRNA Custom Synthesis Service Providers: Distribution by Starting Material

- Figure 7.7 mRNA Custom Synthesis Service Providers: Distribution by Structural Modification

- Figure 7.8 mRNA Custom Synthesis Service Providers: Distribution by Type of Purification Method

- Figure 7.9 mRNA Custom Synthesis Service Providers: Distribution by Scale of Operation

- Figure 7.10 mRNA Custom Synthesis Service Providers: Distribution by Application Area

- Figure 7.11 mRNA Custom Synthesis Service Providers: Distribution by GMP Compliance

- Figure 8.1 Company Competitiveness Analysis: Service Providers based in North America

- Figure 8.2 Company Competitiveness Analysis: Service Providers based in Europe

- Figure 8.3 Company Competitiveness Analysis: Service Providers based in Asia-Pacific

- Figure 9.1 mRNA Contract Manufacturing Service Providers: Distribution by Year of Establishment

- Figure 9.2 mRNA Contract Manufacturing Service Providers: Distribution by Company Size

- Figure 9.3 mRNA Contract Manufacturing Service Providers: Distribution by Location of Headquarters (Region)

- Figure 9.4 mRNA Contract Manufacturing Service Providers: Distribution by Location of Headquarters (Country)

- Figure 9.5 mRNA Contract Manufacturing Service Providers: Distribution by Location of Manufacturing Facilities

- Figure 9.6 mRNA Contract Manufacturing Service Providers: Distribution by Type of Product Manufactured

- Figure 9.7 mRNA Contract Manufacturing Service Providers: Distribution by GMP Compliance

- Figure 9.8 mRNA Contract Manufacturing Service Providers: Distribution by Scale of Operation

- Figure 9.9 mRNA Contract Manufacturing Service Providers: Distribution by Type of Additional Services Offered

- Figure 10.1 Company Competitiveness Analysis: Service Providers based in North America

- Figure 10.2 Company Competitiveness Analysis: Service Providers based in Europe

- Figure 10.3 Company Competitiveness Analysis: Service Providers based in Asia-Pacific

- Figure 11.1 mRNA Synthesis Kits: Distribution by Kit Components

- Figure 11.2 mRNA Synthesis Kits: Distribution by Type of Enzyme

- Figure 11.3 mRNA Synthesis Kits: Distribution by Type of Enzyme Mix Used

- Figure 11.4 mRNA Synthesis Kits: Distribution by mRNA Component Modified

- Figure 11.5 mRNA Synthesis Kits: Distribution by Number of Reactions

- Figure 11.6 mRNA Synthesis Kits: Distribution by Yield Per Reaction

- Figure 11.7 mRNA Synthesis Kits: Distribution by Reaction Run Time

- Figure 11.8 mRNA Synthesis Kits: Distribution by Shelf Life

- Figure 11.9 mRNA Synthesis Kit Providers: Distribution by Year of Establishment

- Figure 11.10 mRNA Synthesis Kit Providers: Distribution by Company Size

- Figure 11.11 mRNA Synthesis Kit Providers: Distribution by Location of Headquarters

- Figure 11.12 Most Active Players: Distribution by Number of Kits Developed

- Figure 12.1 mRNA Synthesis Kits: 2D Dot Plot

- Figure 13.1 Danaher: Annual Revenues, Since FY 2021 (USD Billion)

- Figure 13.2 Thermo Fischer Scientific: Annual Revenues, Since FY 2021 (USD Billion)

- Figure 13.3 BioNTech: Annual Revenues, Since FY 2021 (EUR Billion)

- Figure 13.4 Eurogentec: Annual Revenues, Since FY 2021 (JPY Billion)

- Figure 14.1 Lonza: Annual Revenues, Since FY 2021 (CHF Billion)

- Figure 14.2 Merck: Annual Revenues, Since FY 2021 (EUR Billion)

- Figure 14.3 Samsung Biologics: Annual Revenues, Since FY 2021 (KRW Trillion)

- Figure 14.4 ST Pharm: Annual Revenues, Since FY 2021 (KRW Billion)

- Figure 14.5 Wuxi Biologics: Annual Revenues, Since FY 2020 (RMB Billion)

- Figure 16.1 Partnerships and Collaborations: Distribution by Year of Partnership

- Figure 16.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 16.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 16.4 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 16.5 Partnerships and Collaborations: Distribution by Type of Pharmaceutical

- Figure 16.6 Partnerships and Collaborations: Distribution by Type of Drug Product

- Figure 16.7 Most Active Players: Distribution by Number of Partnerships

- Figure 16.8 Partnerships and Collaborations: Local and International Deals

- Figure 16.9 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Figure 18.1 Big Player Initiatives: Distribution by Year of Initiative

- Figure 18.2 Big Player Initiatives: Distribution by Type of Initiative

- Figure 18.3 Big Player Initiatives: Distribution by Year and Type of Initiative

- Figure 18.4 Big Player Initiatives: Distribution of Player by Number of Initiatives

- Figure 18.5 Big Player Initiatives: Distribution of Player by Type of Initiative

- Figure 18.6 Big Player Initiatives: Distribution by Type of Pharmaceutical

- Figure 18.7 Big Player Initiatives: Distribution by Therapeutic Area

- Figure 18.8 Big Player Initiatives: Distribution of Player by Number of Partnerships

- Figure 18.9 Big Player Initiatives: Distribution by Type of Partnership

- Figure 18.10 Big Player Initiatives: Distribution of Player by Number of Expansions

- Figure 18.11 Big Player Initiatives: Distribution by Type of Expansion

- Figure 18.12 Big Player Initiatives: Distribution of Player by Region of Expansion

- Figure 19.1. Market Trends and Outlook: Market Drivers

- Figure 19.2. Market Trends and Outlook: Market Restraints

- Figure 19.3. Market Trends and Outlook: Market Opportunities

- Figure 19.4. Market Trends and Outlook: Market Challenges

- Figure 20.1 Global mRNA Synthesis and Manufacturing Market, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 20.2 Global mRNA Synthesis and Manufacturing Market, Forecasted Estimates (till 2035): Conservative Scenario

- Figure 20.3 Global mRNA Synthesis and Manufacturing Market, Forecasted Estimates (till 2035): Optimistic Scenario

- Figure 21.1 mRNA Synthesis and Manufacturing Market: Distribution by Type of Product

- Figure 21.2 mRNA Synthesis and Manufacturing Market for Active Pharmaceutical Ingredients, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 21.3 mRNA Synthesis and Manufacturing Market for Finished Dose Formulations, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 22.1 mRNA Synthesis and Manufacturing Market: Distribution by Scale of Operation

- Figure 22.2 mRNA Synthesis and Manufacturing Market for Preclinical and Clinical Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 22.3 mRNA Synthesis and Manufacturing Market for Commercial Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 23.1 mRNA Synthesis and Manufacturing Market: Distribution by Synthesis and Manufacturing Activity

- Figure 23.2 mRNA Synthesis and Manufacturing Market for Commercial Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 23.3 mRNA Synthesis and Manufacturing Market for In-house Manufacturing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 24.1 mRNA Synthesis and Manufacturing Market: Distribution by Type of Indication

- Figure 24.2 mRNA Synthesis and Manufacturing Market for COVID Indication, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 24.3 mRNA Synthesis and Manufacturing Market for Non-COVID Indication, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 25.1 mRNA Synthesis and Manufacturing Market: Distribution by Therapeutic Area

- Figure 25.2 mRNA Synthesis and Manufacturing Market for Infectious Diseases, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 25.3 mRNA Synthesis and Manufacturing Market for Oncological Diseases, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 25.4 mRNA Synthesis and Manufacturing Market for Other Diseases, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 26.1 mRNA Synthesis and Manufacturing Market: Distribution by Application Area

- Figure 26.2 mRNA Synthesis and Manufacturing Market for mRNA Vaccines, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 26.3 mRNA Synthesis and Manufacturing Market for mRNA Therapeutics, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 27.1 mRNA Synthesis and Manufacturing Market: Distribution by Geographical Region

- Figure 27.2 mRNA Synthesis and Manufacturing Market in North America, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- Figure 27.3 mRNA Synthesis and Manufacturing Market in the US, Historical Trends (since 2021) and Forecasted Estimates (till 2035)