PUBLISHER: Roots Analysis | PRODUCT CODE: 1891251

PUBLISHER: Roots Analysis | PRODUCT CODE: 1891251

Single Use Bioprocessing Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Type of Product, Scale of Operation and Key Geographical Regions

Single Use Bioprocessing Market: Overview

As per Roots Analysis, the single use bioprocessing market is estimated to grow from USD 5.1 billion in the current year to USD 15.5 billion by 2035, at a CAGR of 11.7% during the forecast period, till 2035.

Single Use Bioprocessing Market

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Product

- Single Use Bioreactors

- Single Use Mixers

- Single Use Media Bags

- Single Use Filters

- Single Use Sampling Systems

- Single Use Connectors

- Others

Scale of Operation

- Preclinical / Clinical

- Commercial

Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Single Use Bioprocessing Market: Growth and Trends

Biologics has become increasingly popular due to their therapeutic effectiveness, positive safety profiles, and capacity to address a range of disease indications that are otherwise difficult to manage. The effectiveness of these interventions encouraged the stakeholders to enhance the conventional biologics contract manufacturing technology. The need for enhanced productivity and flexibility, improved profitability, and quicker market delivery is further accelerating the shift from conventional stainless-steel equipment to single-use technologies, such as single-use mixers and single-use bioreactors. These disposable technologies have gained acceptance in a relatively brief time frame and have emerged as a crucial resource in the advancement of numerous biotechnological processes.

Additionally, the COVID-19 pandemic has driven the biopharmaceutical sector to adopt single-use technology. These single-use bioprocessing technologies reduce the footprint requirement and remove cleaning expenses during the development phase. Moreover, single-use bioprocessing technologies can tackle several issues linked to conventional bioprocessing systems and provide numerous extra advantages, including reduced water and energy use (by approximately 45%), lower capital investment (by 40%), shorter processing time for biologics (by 33%), diminished cross-contamination risk (by 8%), and greater potential for cost savings (by 30-40%).

Currently, numerous single-use bioprocessing firms are involved in developing and producing single-use upstream bioprocessing technologies and tools, including single-use bioreactors, single-use mixers, single-use filters, single-use media bags and containers, single-use sampling systems, and single-use connectors. Additionally, several of these bioprocessing firms are concentrating on adding extra functionalities, such as alert / notification systems, integrated process control sensors, digital process logs, remote supervision capabilities, touchscreen interfaces, and enhanced safety measures, to their proprietary products. The utilization of this single-use technology comes with various challenges, including the risks associated with extractables and leachable, disposal of single-use technology, sterilization / irradiation complications, and possible inconsistencies in the resins. However, due to ongoing sustainability research and other technical developments, we believe that the potential for technology providers in the single-use bioprocessing market is expected to see significant growth throughout the forecast period.

Single Use Bioprocessing Market: Key Insights

The report delves into the current state of the single use bioprocessing market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Over 500 single-use upstream bioprocessing equipment are currently commercially available / being developed; single-use bioreactors, single-use sensors and single-use mixers are steadily gaining traction.

- In addition, companies have developed a variety of single-use media bags, single-use filters, single-use connectors and single-use sampling systems; these systems are inbuilt with various key features.

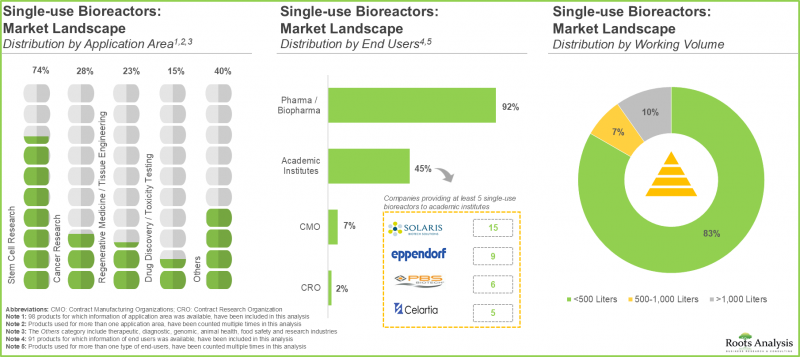

- Majority of the single-use bioreactors are being used by the pharmaceutical / biopharmaceutical industry; of these, several have been deployed across different application areas.

- Over 90% of the single-use mixers use liquid / liquid mixing system to obtain uniform composition of the components; a significant proportion of these mixers can be used across all scales of operations.

- In pursuit of gaining a competitive edge, developers are focusing on introducing advanced features in their respective products.

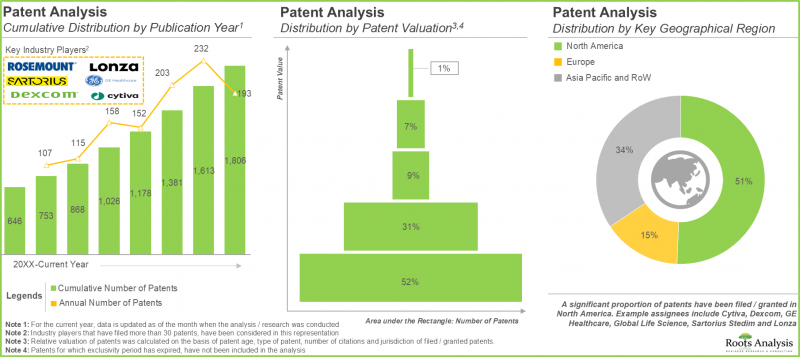

- More than 1,800 patents related to single-use bioprocessing technology have been filed by various industry and non-industry players; this is indicative of the heightened pace of research and innovation in this field.

- Owing to the cost saving potential and other benefits of single-use technology, the adoption of this technology is expected to ration.

- 57% of the pre-calibrated sensors are flow sensors; all the single-use sensors use gamma-irradiation sterilization technique.

- The current market landscape features the presence of both well-established firms and new entrants; most of the companies are headquartered in developed regions.

- Over time, stakeholders have established strong brand positions in order to cater to the increasing demand for single-use technology and to enhance their respective product portfolio.

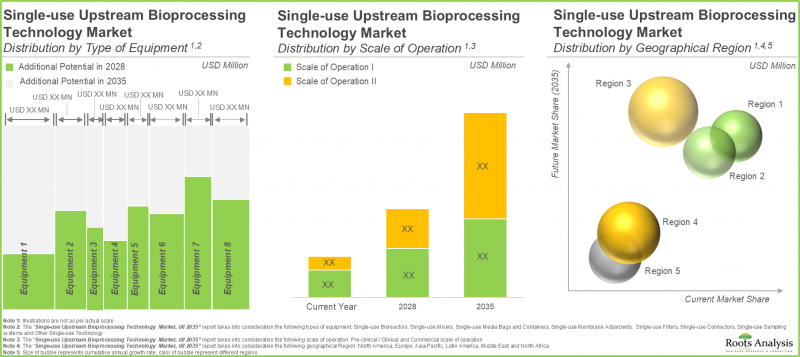

- The market is anticipated to grow at a CAGR of 11.7% in the coming decade; the opportunity is likely to be well distributed across different scales of operation, type of equipment and geographical regions.

Single Use Bioprocessing Market: Market Segments

Preclinical and Clinical Scale is the Fastest Growing Segment of the Probiotics Market

In terms of scale of operation, the global market for single-use bioprocessing technology market is segmented into preclinical and clinical scale, and commercial scale. Currently, majority share (87%) of the market is captured by preclinical and clinical scale. Further, the clinical scale segment is likely to grow at a higher CAGR (10%) in the coming years.

Disposable Filter Cartridges are Likely to Grow at a Higher CAGR During the Forecast

Period

Based on the type of product, the global market is segmented into single-use bioreactors, single-use mixing systems, single-use media-bags, single-use filters, single-use sampling system, single-use connectors, single-use membrane adsorbents, and single-use membrane adsorbents. amongst these types, the disposable filter cartridges are likely to witness highest growth during the forecast period, followed by media bags and single-use sampling system.

Disposable Filter Cartridges are Likely to Grow at a Higher CAGR During the Forecast

Period

In terms of the type of product, the global market is segmented into single-use bioreactors, single-use mixing systems, single-use media-bags, single-use filters, single-use sampling system, single-use connectors, single-use membrane adsorbents, and single-use membrane adsorbents. amongst these types, the disposable filter cartridges are likely to witness highest growth during the forecast period, followed by media bags and single-use sampling system.

Asia-Pacific is Likely to Propel the Market Growth During the Forecast Period

In terms of the geographical regions, the global market is segmented into North America, Europe, Asia-Pacific, Latin America and Middel East and North Africa. Amongst these, Asia-Pacific is likely to capture most of the market share (35%), followed by North America (30%) and Europe (25%).

Example Players in the Single-use Bioprocessing Technology Market

- Avantor

- Cytiva

- Eppendorf

- Merck KGaA

- Pall

- Premas Biotech

- REPROCELL

- Saint-Gobain

- Sartorius

- Satake Multimix

- Thermo Fisher Scientific

Single Use Bioprocessing Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the single use bioprocessing market, focusing on key market segments, including [A] type of product, [B] scale of operation, and [C] geographical regions.

- Market Landscape 1: A detailed assessment of overall market landscape of single-use bioreactors based on several relevant parameters, such as [A] scale of operation, [B] type of cell culture system, [C] type of cell culture, [D] type of molecule, [E] key features, [F] application and [G] end users.

- Market Landscape 2: A detailed assessment of the overall market landscape of single-use mixers based on a number of relevant parameters, such as [A] scale of operation, [B] type of mixing system, [C] type of molecule, [D] key features [E] application area, [F] year of establishment, [G] company size, and [H] geographical presence.

- Market Landscape 3: A detailed assessment of the overall market landscape of single-use sensors, based on several relevant parameters, such as [A] type of sensor, [B] type of bioprocessing, [C] measurement range, [D] operating temperature, [E] sterilization technique, [F] material used [G] application area, [H] year of establishment, [I] company size, and [J] geographical presence.

- Company Competitiveness Analysis: A comprehensive competitive analysis of single use bioreactors, examining factors, such as [A] product applicability and [B] product strength.

- Company Profiles: In-depth profiles of prominent players engaged in this domain, that are currently involved key bioprocessing companies providing single-use upstream bioprocessing technologies, which are headquartered in North America, Europe and Asia-Pacific, focusing on [A] year of establishment, [B] location of headquarters, [C] drug portfolio, [D] recent developments and [E] an informed future outlook.

- Patent Analysis: An in-depth analysis of various patents that have been filed / granted for single-use upstream bioprocessing technology, based on relevant parameters, including [A] type of patents, [B] publication year, [C] application year, [D] issuing authorities involved, [E] type of organizations, [F] emerging focus area, [G] patent age, [H] CPC symbols, [I] leading patent assignees, [J] patent characteristics and [K] geography.

- Brand Positioning Analysis: A detailed brand positioning analysis of the key industry players, highlighting the current perceptions regarding their proprietary products by taking into consideration several relevant aspects, such as [A] experience of the manufacturer, [B] number of products offered, [C] product diversity, and [D] number of patents published.

- Cost and Time Saving Potential: An in-depth analysis of the cost and time saving potential of single-use upstream bioprocessing technology.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What is the current global capacity of developers?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Overview

- 1.2. Scope of the Report

- 1.3. Research Methodology

- 1.4. Key Questions Answered

- 1.5. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Overview of Single-use Upstream Bioprocessing Technology

- 3.3. Historical Evolution of Single-use Upstream Bioprocessing Technology

- 3.4. Types of Single-use Upstream Bioprocessing Technology

- 3.5. Applications of Single-use Upstream Bioprocessing Technology

- 3.6. Key Challenges Associated with Single-use Upstream Bioprocessing Technology

- 3.7. Future Perspective

4. MARKET LANDSCAPE: SINGLE-USE BIOREACTORS

- 4.1. Chapter Overview

- 4.2. Single-use Bioreactors: List of Products

- 4.2.1. Analysis by Type of Bioreactor

- 4.2.2. Analysis by Scale of Operation

- 4.2.3. Analysis by Type of Cell Culture System

- 4.2.4. Analysis by Type of Cell Culture

- 4.2.5. Analysis by Type of Molecule Processed

- 4.2.6. Analysis by Key Features

- 4.2.7. Analysis by Application Area

- 4.2.8. Analysis by End Users

- 4.3. Single-use Bioreactors: Developer Landscape

- 4.3.1. Analysis by Year of Establishment

- 4.3.2. Analysis by Company Size

- 4.3.2. Analysis by Year of Establishment and Company Size

- 4.3.3. Analysis by Location of Headquarters

- 4.3.4. Leading Developers: Analysis by Number of Single-use Bioreactors

5. MARKET LANDSCAPE: SINGLE-USE MIXERS

- 5.1. Chapter Overview

- 5.2. Single-use Mixers: List of Products

- 5.2.1. Analysis by Scale of Operation

- 5.2.2. Analysis by Type of Mixing System

- 5.2.3. Analysis by Stage of Bioprocessing

- 5.2.4. Analysis by Type of Molecule Processed

- 5.2.5. Analysis by Key Features

- 5.2.6. Analysis by Application Area

- 5.3. Single-use Mixers: Developer Landscape

- 5.3.1. Analysis by Year of Establishment

- 5.3.2. Analysis by Company Size

- 5.3.3. Analysis by Location of Headquarters

- 5.3.4. Analysis by Year of Establishment and Location of Headquarters

- 5.3.5. Leading Developers: Analysis by Number of Single-use Mixers

6. MARKET LANDSCAPE: SINGLE-USE SENSORS

- 6.1. Chapter Overview

- 6.2. Single-use Sensors: List of Products

- 6.2.1 Analysis by Type of Sensor

- 6.2.2. Analysis by Stage of Bioprocessing

- 6.2.3. Analysis by Operating Temperature

- 6.2.4. Analysis by Sterilization Technique

- 6.2.5. Analysis by Sensor Calibration

- 6.2.6. Analysis by Type of Material Used

- 6.2.7. Analysis by Application Area

- 6.3. Single-use Sensors: Developer Landscape

- 6.3.1. Analysis by Year of Establishment

- 6.3.2. Analysis by Company Size

- 6.3.3. Analysis by Location of Headquarters

- 6.3.4. Leading Developers: Analysis by Number of Single-use Sensors

7. MARKET LANDSCAPE: OTHER SINGLE-USE UPSTREAM BIOPROCESSING TECHNOLOGIES

- 7.1. Chapter Overview

- 7.2. Single-use Media Bags and Containers

- 7.3. Single-use Filters

- 7.4. Single-use Sampling Systems

- 7.5. Single-use Connectors

8. PRODUCT COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Methodology

- 8.3. Assumptions / Key Parameters

- 8.4. Product Competitiveness Analysis: Single-use Bioreactors

- 8.4.1. Companies Headquartered in North America

- 8.4.2. Companies Headquartered in Europe

- 8.4.3. Companies Headquartered in Asia-Pacific and Rest of the World

- 8.5. Product Competitiveness Analysis: Single-use Mixers

- 8.5.1. Companies Headquartered in North America

- 8.5.2. Companies Headquartered in Europe

- 8.5.3. Companies Headquartered in Asia-Pacific and Rest of the World

- 8.6. Product Competitiveness Analysis: Single-use Sensors

- 8.6.1. Companies Headquartered in North America

- 8.6.2. Companies Headquartered in Europe

- 8.6.3. Companies Headquartered in Asia-Pacific and Rest of the World

9. SINGLE-USE UPSTREAM BIOPROCESSING TECHNOLOGY PROVIDERS IN NORTH AMERICA: COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. Avantor

- 9.2.1. Company Overview

- 9.2.2. Financial Information

- 9.2.3. Service Portfolio

- 9.2.4. Product Portfolio

- 9.2.5. Recent Developments and Future Outlook

- 9.3. Cytiva

- 9.3.1. Company Overview

- 9.3.2. Financial Information

- 9.3.3. Service Portfolio

- 9.3.4. Product Portfolio

- 9.3.5. Recent Developments and Future Outlook

- 9.4. Merck KGaA

- 9.4.1. Company Overview

- 9.4.2. Financial Information

- 9.4.3. Service Portfolio

- 9.4.4. Product Portfolio

- 9.4.5. Recent Developments and Future Outlook

- 9.5. Pall

- 9.5.1. Company Overview

- 9.5.2. Financial Information

- 9.5.3. Service Portfolio

- 9.5.4. Product Portfolio

- 9.5.5. Recent Developments and Future Outlook

- 9.6. Thermo Fisher Scientific

- 9.6.1. Company Overview

- 9.6.2. Financial Information

- 9.6.3. Service Portfolio

- 9.6.4. Product Portfolio

- 9.6.5. Recent Developments and Future Outlook

10. SINGLE-USE UPSTREAM BIOPROCESSING TECHNOLOGY PROVIDERS IN EUROPE: COMPANY PROFILES

- 10.1. Chapter Overview

- 10.2. Eppendorf

- 10.2.1. Company Overview

- 10.2.2. Financial Information

- 10.2.3. Service Portfolio

- 10.2.4. Product Portfolio

- 10.2.5. Recent Developments and Future Outlook

- 10.3. Saint-Gobain

- 10.3.1. Company Overview

- 10.3.2. Financial Information

- 10.3.3. Service Portfolio

- 10.3.4. Product Portfolio

- 10.3.5. Recent Developments and Future Outlook

- 10.4. Sartorius

- 10.4.1. Company Overview

- 10.4.2. Financial Information

- 10.4.3. Service Portfolio

- 10.4.4. Product Portfolio

- 10.4.5. Recent Developments and Future Outlook

11. SINGLE-USE UPSTREAM BIOPROCESSING TECHNOLOGY PROVIDERS IN ASIA-PACIFIC: COMPANY PROFILES

- 11.1. Chapter Overview

- 11.2. Satake Multimix

- 11.2.1. Company Overview

- 11.2.2. Financial Information

- 11.2.3. Service Portfolio

- 11.2.4. Product Portfolio

- 11.2.5. Recent Developments and Future Outlook

- 11.3. REPROCELL

- 11.3.1. Company Overview

- 11.3.2. Financial Information

- 11.3.3. Service Portfolio

- 11.3.4. Product Portfolio

- 11.3.5. Recent Developments and Future Outlook

- 11.4. Premas Biotech

- 11.4.1. Company Overview

- 11.4.2. Financial Information

- 11.4.3. Service Portfolio

- 11.4.4. Product Portfolio

- 11.4.5. Recent Developments and Future Outlook

12. PATENT ANALYSIS

- 12.1. Chapter Overview

- 12.2. Scope and Methodology

- 12.3. Single-use Upstream Bioprocessing Technology: Patent Analysis

- 12.3.1. Analysis by Publication Year

- 12.3.2. Analysis by Application Year

- 12.3.3. Analysis by Patent Office

- 12.3.4. Analysis by Geographical Location

- 12.3.5. Analysis by CPC Symbols

- 12.3.6. Emerging Focus Area

- 12.3.7. Analysis by Type of Organization

- 12.3.8. Leading Players: Analysis by Number of Patents

- 12.4. Patent Benchmarking Analysis

- 12.4.1. Analysis by Patent Characteristics

- 12.5. Analysis by Patent Valuation

13. BRAND POSITIONING MATRIX

- 13.1. Chapter Overview

- 13.2 Methodology

- 13.3. Key Parameters

- 13.4. Brand Positioning Matrix of Single-use Bioreactor Developers

- 13.4.1. Brand Positioning Matrix: Pall Corporation

- 13.4.2. Brand Positioning Matrix: Eppendorf

- 13.4.3. Brand Positioning Matrix: Solaris Biotech

- 13.4.4. Brand Positioning Matrix: Sartorius Stedim Biotech

- 13.4.5. Brand Positioning Matrix: Applikon Biotechnology

- 13.4.6. Brand Positioning Matrix: CerCell

- 13.4.7. Brand Positioning Matrix: Synthecon

- 13.5. Brand Positioning Matrix of Single-use Mixer Developers

- 13.5.1. Brand Positioning Matrix: Thermo Fisher Scientific

- 13.5.2. Brand Positioning Matrix: Merck Millipore

- 13.5.3. Brand Positioning Matrix: Cytiva Lifesciences

- 13.5.4. Brand Positioning Matrix: Pall Corporation

- 13.6. Brand Positioning Matrix of Single-use Sensors Developers

- 13.6.1. Brand Positioning Matrix: Masterflex

- 13.6.2. Brand Positioning Matrix: Levitronix

- 13.6.3. Brand Positioning Matrix: Malema Engineering

- 13.6.4. Brand Positioning Matrix: Parken Hannifin

- 13.6.5. Brand Positioning Matrix: Pendo TECH

14. CASE STUDY: COST AND TIME SAVING POTENTIAL OF SINGLE-USE UPSTREAM BIOPROCESSING TECHNOLOGY

- 14.1. Chapter Overview

- 14.2. Overall Cost Saving Potential of Single-Use Upstream Bioprocessing Technology, Till 2035

- 14.2.1. Scenario 1

- 14.2.1.1. Key Assumptions and Methodology

- 14.2.1.2. Cost Saving Potential with Acquisition of Single-Use Upstream Technology, Till 2035

- 14.2.2. Scenario 2

- 14.2.2.1. Key Assumptions and Methodology

- 14.2.2.2. Cost Saving Potential with Implementation of Single-Use Upstream Bioprocessing Technology, Till 2035

- 14.2.1. Scenario 1

- 14.3. Overall Time Saving Potential of Single-Use Upstream Bioprocessing Technology, Till 2035

- 14.4. Concluding Remarks

15. DEMAND AND SUPPLY ANALYSIS

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. Global Demand for Biologics, Till 2035

- 15.3.1. Demand Vs Supply Scenario 1

- 15.3.2. Demand Vs Supply Scenario 2

- 15.3.3. Demand Vs Supply Scenario 3

- 15.3.4. Demand Vs Supply Scenario 4

- 15.4. Concluding Remarks

16. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 16.1. Chapter Overview

- 16.2. Forecast Methodology and Key Assumptions

- 16.3. Global Single-use Upstream Bioprocessing Technology Market, Till 2035

- 16.3.1. Global Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Scale of Operation

- 16.3.1.1. Global Single-use Upstream Bioprocessing Technology Market for Preclinical / Clinical Operations, Till 2035

- 16.3.1.2. Global Single-use Upstream Bioprocessing Technology Market for Commercial Operations, Till 2035

- 16.3.2. Global Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Type of Equipment

- 16.3.2.1. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Bioreactors, Till 2035

- 16.3.2.2. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Mixers, Till 2035

- 16.3.2.3. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Media Bags, Till 2035

- 16.3.2.4. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Filters, Till 2035

- 16.3.2.5. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Sampling Systems, Till 2035

- 16.3.2.6. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Connectors, Till 2035

- 16.3.2.7. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Membrane Adsorbers, Till 2035

- 16.3.2.8. Global Single-use Upstream Bioprocessing Technology Market for Other Single-Use Technologies, Till 2035

- 16.3.3. Global Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Geographical Region

- 16.3.3.1. Global Single-use Upstream Bioprocessing Technology Market in North America, Till 2035

- 16.3.2.1.1. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Bioreactors in North America, Till 2035

- 16.3.2.1.2. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Mixers in North America, Till 2035

- 16.3.2.1.3. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Media Bags in North America, Till 2035

- 16.3.2.1.4. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Filters in North America, Till 2035

- 16.3.2.1.5. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Sampling Systems in North America, Till 2035

- 16.3.2.1.6. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Connectors in North America, Till 2035

- 16.3.2.1.7. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Membrane Adsorbers in North America, Till 2035

- 16.3.2.1.8. Global Single-use Upstream Bioprocessing Technology Market for Other Single-Use Technologies in North America, Till 2035

- 16.3.3.2. Global Single-use Upstream Bioprocessing Technology Market in Europe, Till 2035

- 16.3.2.2.1. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Bioreactors in Europe, Till 2035

- 16.3.2.2.2. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Mixers in Europe, Till 2035

- 16.3.2.2.3. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Media Bags in Europe, Till 2035

- 16.3.2.2.4. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Filters in Europe, Till 2035

- 16.3.2.2.5. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Sampling Systems in Europe, Till 2035

- 16.3.2.2.6. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Connectors in Europe, Till 2035

- 16.3.2.2.7. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Membrane Adsorbers in Europe, Till 2035

- 16.3.2.2.8. Global Single-use Upstream Bioprocessing Technology Market for Other Single-Use Technologies in Europe, Till 2035

- 16.3.3.3. Global Single-use Upstream Bioprocessing Technology Market in Asia-Pacific, Till 2035

- 16.3.2.3.1. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Bioreactors in Asia-Pacific, Till 2035

- 16.3.2.3.2. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Mixers in Asia-Pacific, Till 2035

- 16.3.2.3.3. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Media Bags in Asia-Pacific, Till 2035

- 16.3.2.3.4. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Filters in Asia-Pacific, Till 2035

- 16.3.2.3.5. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Sampling Systems in Asia-Pacific, Till 2035

- 16.3.2.3.6. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Connectors in Asia-Pacific, Till 2035

- 16.3.2.3.7. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Membrane Adsorbers in Asia-Pacific, Till 2035

- 16.3.2.3.8. Global Single-use Upstream Bioprocessing Technology Market for Other Single-Use Technologies in Asia-Pacific, Till 2035

- 16.3.3.4. Global Single-use Upstream Bioprocessing Technology Market in Latin America, Till 2035

- 16.3.2.4.1. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Bioreactors in Latin America, Till 2035

- 16.3.2.4.2. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Mixers in Latin America, Till 2035

- 16.3.2.4.3. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Media Bags in Latin America, Till 2035

- 16.3.2.4.4. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Filters in Latin America, Till 2035

- 16.3.2.4.5. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Sampling Systems in Latin America, Till 2035

- 16.3.2.4.6. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Connectors in Latin America, Till 2035

- 16.3.2.4.7. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Membrane Adsorbers in Latin America, Till 2035

- 16.3.2.4.8. Global Single-use Upstream Bioprocessing Technology Market for Other Single-Use Technologies in Latin America, Till 2035

- 16.3.3.5. Global Single-Use Upstream Bioprocessing Technology Market in Middle East and North Africa, Till 2035

- 16.3.2.5.1. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Bioreactors in Middle East and North Africa, Till 2035

- 16.3.2.5.2. Global Single-use Upstream Bioprocessing Technology Market for Single- Use Mixers in Middle East and North Africa, Till 2035

- 16.3.2.5.3. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Media Bags in Middle East and North Africa, Till 2035

- 16.3.2.5.4. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Filters in Middle East and North Africa, Till 2035

- 16.3.2.5.5. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Sampling Systems in Middle East and North Africa, Till 2035

- 16.3.2.5.6. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Connectors in Middle East and North Africa, Till 2035

- 16.3.2.5.7. Global Single-use Upstream Bioprocessing Technology Market for Single-Use Membrane Adsorbers in Middle East and North Africa, Till 2035

- 16.3.2.5.8. Global Single-use Upstream Bioprocessing Technology Market for Other Single-Use Technologies in Middle East and North Africa, Till 2035

- 16.3.3.1. Global Single-use Upstream Bioprocessing Technology Market in North America, Till 2035

- 16.3.1. Global Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Scale of Operation

17. CONCLUSION

- 17.1. Chapter Overview

18. EXECUTIVE INSIGHTS

19. APPENDIX 1: TABULATED DATA

20. APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 4.1. Single-use Bioreactors: Information on Developers, Scale of Operation, Key Features, Type of Cell Culture System, Type of Cell Culture, Type of Molecule and Application Areas

- Table 5.1. Single-use Mixers: Information on Developers, Scale of Operation, Type of Mixing System, Type of Molecule used, Key Features and Application Areas

- Table 6.1. Single-use Sensors: Information on Developers, Product Specific Details, Type of Bioprocessing, Sterilization Techniques used and Application Areas

- Table 7.1. Single-use Media Bags and Containers: Information on Developers, Purpose of Product, Type of Material / Tubing used, Key Features and Application Areas

- Table 7.2. Single-use Filters: Information on Developers, Material of Construction, Key Features and Application Areas

- Table 7.3. Single-use Connectors: Information on Developers, Material of Construction, Gender / Valve, Sterilizability, Key Features and Application Areas

- Table 7.4. Single-use Sampling Systems: Information on Developers, Tubing Material, Sampling Unit, Sterilizability, Key Features and Application Areas

- Table 9.1. Avantor: Product Portfolio (Single-use Bags and Containers)

- Table 9.2. Avantor: Product Portfolio (Single-use Mixers)

- Table 9.3. Cytiva: Product Portfolio (Single-use Bioreactors)

- Table 9.4. Cytiva: Product Portfolio (Single-use Mixers)

- Table 9.5. Merck KGaA: Product Portfolio (Single-use Bioreactors)

- Table 9.6. Merck KGaA: Product Portfolio (Single-use Mixers)

- Table 9.7. Merck KGaA: Product Portfolio (Single-use Filters)

- Table 9.8. Pall: Product Portfolio (Single-use Bioreactors)

- Table 9.9. Pall: Product Portfolio (Single-use Media Bags and Containers)

- Table 9.10. Pall: Product Portfolio (Single-use Mixers)

- Table 9.11. Thermo Fisher Scientific: Product Portfolio (Single-use Media Bags and Containers)

- Table 9.12. Thermo Fisher Scientific: Product Portfolio (Single-use Mixers)

- Table 10.1. Eppendorf: Product Portfolio (Single-use Bioreactors)

- Table 10.2. Saint Gobain: Product Portfolio (Single-use Media Bags and Containers)

- Table 10.3. Sartorius: Product Portfolio (Single-use Media Bags and Containers)

- Table 11.1. Satake Multimix: Product Portfolio (Single-use Bioreactors)

- Table 11.2. Reprocell: Product Portfolio (Single-use Bioreactors)

- Table 11.3. Premas Biotech: Product Portfolio (Single-use Bioreactors)

List of Figures

- Figure 4.1. Single-use Bioreactors: Distribution by Type of Bioreactor

- Figure 4.2. Single-use Bioreactors: Distribution by Scale of Operation

- Figure 4.3. Single-use Bioreactors: Distribution by Type of Cell Culture System

- Figure 4.4. Single-use Bioreactors: Distribution by Type of Cell Culture

- Figure 4.5. Single-use Bioreactors: Distribution by Type of Molecule Processed

- Figure 4.6. Single-use Bioreactors: Distribution by Key Features

- Figure 4.7. Single-use Bioreactors: Distribution by Application Area

- Figure 4.8. Single-use Bioreactors: Distribution by End Users

- Figure 4.9. Single-use Bioreactors: Distribution of Developers by Year of Establishment

- Figure 4.10. Single-use Bioreactors: Distribution of Developers by Company Size

- Figure 4.11. Single-use Bioreactors: Distribution of Developers by Leading Players

- Figure 4.12. Single-use Bioreactors: Distribution of Developers by Location of Headquarters

- Figure 5.1. Single-use Mixers: Distribution by Scale of Operation

- Figure 5.2. Single-use Mixers: Distribution by Type of Mixing System

- Figure 5.3. Single-use Mixers: Distribution by Type of Molecule Processed

- Figure 5.4. Single-use Mixers: Distribution by Key Features

- Figure 5.5. Single-use Mixers: Distribution by Application Area

- Figure 5.6. Single-use Mixers: Distribution of Developers by Year of Establishment

- Figure 5.7. Single-use Mixers: Distribution of Developers by Company Size

- Figure 5.8. Single-use Mixers: Distribution of Developers by Geographical Region

- Figure 5.9. Single-use Mixers: Distribution of Developers by Year of Establishment and Company Size

- Figure 5.10. Single-use Mixers: Distribution of Developers by Leading Players

- Figure 6.1. Single-use Sensors: Distribution by Type of Sensor

- Figure 6.2. Single-use Sensors: Distribution by Type of Sensor Calibration

- Figure 6.3. Single-use Sensors: Distribution by Sterilization Techniques

- Figure 6.4. Single-use Sensors: Distribution by Application Area

- Figure 6.5. Single-use Sensors: Distribution by Material of Construction

- Figure 6.6. Single-use Sensors: Distribution of Developers by Year of Establishment

- Figure 6.7. Single-use Sensors: Distribution of Developers by Company Size

- Figure 6.8. Single-use Sensors: Distribution of Developers by Geographical Region

- Figure 8.1. Product Competitiveness Analysis: Single-use Bioreactor developers based in North America

- Figure 8.2. Product Competitiveness Analysis: Single-use Bioreactor developers based in Europe

- Figure 8.3. Product Competitiveness Analysis: Single-use Bioreactor developers based in Asia-Pacific

- Figure 8.4. Product Competitiveness Analysis: Single-use Mixer developers based in North America

- Figure 8.5. Product Competitiveness Analysis: Single-use Mixer developers based in Europe

- Figure 8.6. Product Competitiveness Analysis: Single-use Sensor developers based in North America

- Figure 8.7. Product Competitiveness Analysis: Single-use Sensor developers based in Europe

- Figure 9.1. Avantor: Annual Revenues, 2016- 9M 2021 (USD Billion)

- Figure 9.2. Cytiva: Annual Revenues, 2016- 9M 2021 (USD Billion)

- Figure 9.3. Merck KGaA: Annual Revenues, 2017- 9M 2021 (USD Billion)

- Figure 9.4. Thermo Fisher Scientific: Annual Revenues, 2016- 9M 2021 (USD Billion)

- Figure 10.1. Eppendorf: Annual Revenues, 2016- 2020 (EUR Billion)

- Figure 10.2. Saint-Gobain: Annual Revenues, 2016- 9M 2021 (EUR Billion)

- Figure 10.3. Sartorius: Annual Revenues, 2016- 9M 2021 (EUR Billion)

- Figure 12.1. Patent Analysis: Cumulative Distribution by Publication Year

- Figure 12.2. Patent Analysis: Distribution by Type of Patents

- Figure 12.3. Patent Analysis: Geographical Distribution by Issuing Authority

- Figure 12.4. Patent Analysis: Cumulative Year wise trend of Patents

- Figure 12.5. Patent Analysis: Distribution by Type of Organization

- Figure 12.6. Patent Analysis: Distribution by Patent Age

- Figure 12.7. Patent Analysis: Distribution by Patent Valuation

- Figure 12.8. Patent Analysis: Distribution by Most Popular CPC Symbol

- Figure 12.9. Patent Analysis: Leading Industry Players

- Figure 12.10. Patent Analysis: Leading Academic Players

- Figure 12.11. Patent Analysis: Leading Patent Assignees

- Figure 13.1. Brand Positioning Matrix of Single-use Bioreactors: Pall

- Figure 13.2. Brand Positioning Matrix of Single-use Bioreactors: Eppendorf

- Figure 13.3. Brand Positioning Matrix of Single-use Bioreactors: Solaris Biotech

- Figure 13.4. Brand Positioning Matrix of Single-use Bioreactors: Sartorius Stedim Biotech

- Figure 13.5. Brand Positioning Matrix of Single-use Bioreactors: Applikon Biotechnology

- Figure 13.6. Brand Positioning Matrix of Single-use Bioreactors: CerCell

- Figure 13.7. Brand Positioning Matrix of Single-use Bioreactors: Sythecon

- Figure 13.8. Brand Positioning Matrix of Single-use Mixers: Thermo Fisher Scientific

- Figure 13.9. Brand Positioning Matrix of Single-use Mixers: Merck Millipore

- Figure 13.10. Brand Positioning Matrix of Single-use Mixers: Cytiva

- Figure 13.11. Brand Positioning Matrix of Single-use Mixers: Pall

- Figure 13.12. Brand Positioning Matrix of Single-use Sensors: Masterflex

- Figure 13.13. Brand Positioning Matrix of Single-use Sensors: Levitronix

- Figure 13.14. Brand Positioning Matrix of Single-use Sensors: Malema Engineering

- Figure 13.15. Brand Positioning Matrix of Single-use Sensors: Parken Hannif

- Figure 13.16. Brand Positioning Matrix of Single-use Sensors: Pendo TECH

- Figure 14.1. Cost Saving Analysis (Equipment Cost)

- Figure 14.2. Cost Saving Analysis (Manufacturing Cost)

- Figure 15.1. Demand and Supply Analysis: Demand for Biologics, Till 2035

- Figure 15.2. Demand and Supply Analysis: Demand and Supply, Till 2035

- Figure 16.1. Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Scale of Operation

- Figure 16.2. Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Type of Equipment

- Figure 16.3. Single-use Upstream Bioprocessing Technology Market for Single-use Filters, Till 2035

- Figure 16.4. Single-use Upstream Bioprocessing Technology Market for Single-use Media Bags, Till 2035

- Figure 16.5. Single-use Upstream Bioprocessing Technology Market for Single-use Bioreactors, Till 2035

- Figure 16.6. Single-use Upstream Bioprocessing Technology Market for Single-use Mixers, Till 2035

- Figure 16.7. Single-use Upstream Bioprocessing Technology Market for Single-use Connectors, Till 2035

- Figure 16.8. Single-use Upstream Bioprocessing Technology Market for Single-use Sampling Systems, Till 2035

- Figure 16.9. Single-use Upstream Bioprocessing Technology Market for Single-use Membrane Adsorbents, Till 2035

- Figure 16.10. Single-use Upstream Bioprocessing Technology Market for Other Single-use Technology, Till 2035

- Figure 16.11. Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Geography

- Figure 16.12. Single-use Upstream Bioprocessing Technology Market, Till 2035: Distribution by Geography

- Figure 16.13. Single-use Upstream Bioprocessing Technology Market in North America, Till 2035

- Figure 16.14. Single-use Upstream Bioprocessing Technology Market in North America, Till 2035: Distribution by Type of Equipment

- Figure 16.15. Single-use Upstream Bioprocessing Technology Market in Europe, Till 2035

- Figure 16.16. Single-use Upstream Bioprocessing Technology Market in Europe, Till 2035: Distribution by Type of Equipment

- Figure 16.17. Single-use Upstream Bioprocessing Technology Market in Asia-Pacific, Till 2035

- Figure 16.18. Single-use Upstream Bioprocessing Technology Market, Till 2035 in Asia-Pacific: Distribution by Type of Equipment

- Figure 16.19. Single-use Upstream Bioprocessing Technology Market in Latin America, Till 2035

- Figure 16.20. Single-use Upstream Bioprocessing Technology Market in Latin America, Till 2035: Distribution by Type of Equipment

- Figure 16.21. Single-use Upstream Bioprocessing Technology Market in Middle East and North Africa, Till 2035

- Figure 16.22. Single-use Upstream Bioprocessing Technology Market in Middle East and North Africa, Till 2035: Distribution by Type of Equipment