PUBLISHER: Roots Analysis | PRODUCT CODE: 1921898

PUBLISHER: Roots Analysis | PRODUCT CODE: 1921898

Payment Processing Solutions Market, Till 2035: Distribution by Type of Payment Method, Type of Vertical, and Geographical Regions: Industry Trends and Global Forecast

Payment Processing Solutions Market Overview

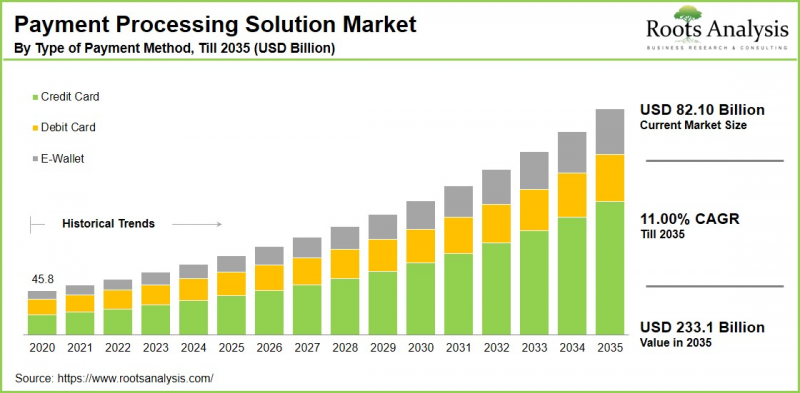

As per Roots Analysis, the global payment processing solutions market size is estimated to grow from USD 82.10 billion in the current year USD 233.1 billion by 2035, at a CAGR of 11.00% during the forecast period, till 2035.

The opportunity for payment processing solutions market has been distributed across the following segments:

Type of Payment Method

- Credit Card

- Debit Card

- E-Wallet

Type of Vertical

- BFSI

- Government

- Healthcare

- Media and Entertainment

- Other

- Real Estate

- Retail

- Telecom

- Travel and Hospitality

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

Payment Processing Solutions Market: Growth and Trends

In the modern digital landscape, the payment processing sector has become a crucial component of the global economy. A payment processing system is a set of technologies and processes that enable the transfer of money between consumers and businesses during financial transactions through various methods, including credit cards, debit cards, and bank transfers. Over time, these systems have become essential for ensuring secure, efficient, and seamless payment experiences across numerous channels, from online and in-store purchases to mobile platforms.

The key advantages of digital payment processing solutions, including convenience, security, global accessibility, and scalability, are enhancing the market outlook for payment processing solutions. The market is projected to experience significant growth driven by the increasing adoption of digital payments worldwide. This growth can be attributed to the universal acceptance of online payments, which offer a convenient and quicker method for conducting transactions. Moreover, the widespread use of these solutions in e-commerce and retail sectors is further boosting the market.

In addition to the main driving forces, emerging trends in the industry, such as the rise of mobile wallets and advancements in payment processing technologies, including AI integration, are expected to expand the market scope. However, challenges like cyberattacks and a lack of awareness regarding digital payments may hinder market growth and need to be addressed to sustain progress during the forecast period.

Payment Processing Solutions Market: Key Segments

Market Share by Type of Payment Method

Based on type of payment method, the global payment processing solutions market is segmented into credit card, debit card, and e-wallet. According to our estimates, currently, the credit card segment captures the majority of the market share. This dominance is likely due to the fact that credit cards are widely accepted not just in physical stores, but also on online platforms and mobile apps. Their familiarity and user-friendliness make them a favored option for consumers worldwide. Furthermore, the rise of near field communication (NFC) technology for tap-and-go payments has significantly increased the use of these cards.

However, the e-wallet segment is expected to grow at a higher CAGR during the forecast period. This growth is attributed to the increasing use of smartphones, especially in developing regions, which has made e-wallets accessible to millions of users.

Market Share by Type of Vertical

Based on type of vertical, the global payment processing solutions market is segmented into BFSI, government, healthcare, media and entertainment, real estate, retail, telecom, travel and hospitality, and others. According to our estimates, currently, the BFSI sector captures the majority of the market share. This can be attributed to the rapid growth of digital transactions in banking. Financial institutions and banks are quickly moving towards digital services to provide customers with convenient alternatives like online banking, mobile banking applications, and virtual wallets.

However, the retail sector is expected to grow at a higher CAGR during the forecast period. Both retail and e-commerce industries produce considerable payment volumes due to everyday transactions at brick-and-mortar establishments and online services, coupled with an emphasis on delivering a seamless customer experience.

Market Share by Geographical Regions

Based on geographical regions, the payment processing solutions market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently North America captures the majority share of the market.

In addition, Asia is transforming the market dynamics by driving the growth of payment solutions due to rising digital transformations and the widespread adoption of smartphones. The region boasts some of the highest smartphone usage rates globally, facilitating the widespread adoption of payment applications and digital wallets, which expands the market potential.

Example Players in Payment Processing Solutions Market

- ACI Worldwide

- Adyen

- AliPay

- FIS

- Fiserv

- Global Payments

- Mastercard

- Modulr

- Payment Systems

- PayPal

- Paysafe

- Paysafe

- PayU

- PhonePe

- Pineapple Payments

- Razorpay

- Secure Payment System

- SignaPay

- Stripe

- Stripe

- Visa

- Worldline

Payment Processing Solutions Market: Research Coverage

The report on the payment processing solutions market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the payment processing solutions market, focusing on key market segments, including [A] type of payment method, [B] type of vertical, and [C] geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the payment processing solutions market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the payment processing solutions market, providing details on [A] location of headquarters, [B] company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in the payment processing solutions industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the payment processing solutions domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the payment processing solutions market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the payment processing solutions market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the payment processing solutions market.

Key Questions Answered in this Report

- How many companies are currently engaged in payment processing solutions market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Payment Processing Solutions Market

- 6.2.1. Type of Payment Method

- 6.2.2. Type of Vertical

- 6.3. Future Perspective

7. REGULATORY SCENARIO

SECTION III: MARKET OVERVIEW

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Payment Processing Solutions: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Ownership Structure

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM IN THE PAYMENT PROCESSING SOLUTIONS MARKET

- 12.1. Payment Processing Solutions: Market Landscape of Startups

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Ownership Structure

- 12.2. Key Findings

SECTION IV: COMPANY PROFILES

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. ACI Worldwide*

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- 13.3. Adyen

- 13.4. AliPay

- 13.5. FIS

- 13.6. Fiserv

- 13.7. Global Payments

- 13.8. Mastercard

- 13.9. Modulr

- 13.10. PayPal

- 13.11. Paysafe

- 13.12. PayU

- 13.13. PhonePe

- 13.14. Pineapple Payments

- 13.15. Razorpay

- 13.16. Secure Payment Systems

- 13.17. SignaPay

- 13.18. Stripe

- 13.19. Visa

- 13.20. Worldline

SECTION V: MARKET TRENDS

14. MEGA TRENDS ANALYSIS

15. UNMET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

SECTION VI: MARKET OPPORTUNITY ANALYSIS

18. GLOBAL PAYMENT PROCESSING SOLUTIONS MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global Payment Processing Solutions Market, Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF PAYMENT METHOD

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. Payment Processing Solutions Market for Credit Cards: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.7. Payment Processing Solutions Market for Debit Cards: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.8. Payment Processing Solutions Market for E-Wallet: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 19.9. Data Triangulation and Validation

- 19.9.1. Secondary Sources

- 19.9.2. Primary Sources

- 19.9.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON TYPE OF VERTICAL

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. Payment Processing Solutions Market for BFSI: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.7. Payment Processing Solutions Market for Healthcare: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.8. Payment Processing Solutions Market for Media and Entertainment: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.9. Payment Processing Solutions Market for Real Estate: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.10. Payment Processing Solutions Market for Retail: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.11. Payment Processing Solutions Market for Telecom: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.12. Payment Processing Solutions Market for Travel and Hospitality: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.13. Payment Processing Solutions Market for Others: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 20.14. Data Triangulation and Validation

- 20.14.1. Secondary Sources

- 20.14.2. Primary Sources

- 20.14.3. Statistical Modeling

21. MARKET OPPORTUNITIES FOR PAYMENT PROCESSING SOLUTIONS IN NORTH AMERICA

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. Payment Processing Solutions Market in North America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.6.1. Payment Processing Solutions Market in the US: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.6.2. Payment Processing Solutions Market in Canada: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.6.3. Payment Processing Solutions Market in Mexico: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.6.4. Payment Processing Solutions Market in Other North American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 21.7. Data Triangulation and Validation

22. MARKET OPPORTUNITIES FOR PAYMENT PROCESSING SOLUTIONS IN EUROPE

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. Payment Processing Solutions Market in Europe: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.1. Payment Processing Solutions Market in Austria: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.2. Payment Processing Solutions Market in Belgium: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.3. Payment Processing Solutions Market in Denmark: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.4. Payment Processing Solutions Market in France: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.5. Payment Processing Solutions Market in Germany: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.6. Payment Processing Solutions Market in Ireland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.7. Payment Processing Solutions Market in Italy: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.8. Payment Processing Solutions Market in Netherlands: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.9. Payment Processing Solutions Market in Norway: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.10. Payment Processing Solutions Market in Russia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.11. Payment Processing Solutions Market in Spain: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.12. Payment Processing Solutions Market in Sweden: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.13. Payment Processing Solutions Market in Switzerland: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.14. Payment Processing Solutions Market in the UK: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.6.15. Payment Processing Solutions Market in Other European Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 22.7. Data Triangulation and Validation

23. MARKET OPPORTUNITIES FOR PAYMENT PROCESSING SOLUTIONS IN ASIA

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. Payment Processing Solutions Market in Asia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.1. Payment Processing Solutions Market in China: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.2. Payment Processing Solutions Market in India: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.3. Payment Processing Solutions Market in Japan: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.4. Payment Processing Solutions Market in Singapore: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.5. Payment Processing Solutions Market in South Korea: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.6.6. Payment Processing Solutions Market in Other Asian Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 23.7. Data Triangulation and Validation

24. MARKET OPPORTUNITIES FOR PAYMENT PROCESSING SOLUTIONS IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. Payment Processing Solutions Market in Middle East and North Africa (MENA): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.1. Payment Processing Solutions Market in Egypt: Historical Trends (Since 2020) and Forecasted Estimates (Till 205)

- 24.6.2. Payment Processing Solutions Market in Iran: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.3. Payment Processing Solutions Market in Iraq: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.4. Payment Processing Solutions Market in Israel: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.5. Payment Processing Solutions Market in Kuwait: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.6. Payment Processing Solutions Market in Saudi Arabia: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.7. Neuromorphic Computing Marke in United Arab Emirates (UAE): Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.6.8. Payment Processing Solutions Market in Other MENA Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 24.7. Data Triangulation and Validation

25. MARKET OPPORTUNITIES FOR PAYMENT PROCESSING SOLUTIONS IN LATIN AMERICA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. Payment Processing Solutions Market in Latin America: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.1. Payment Processing Solutions Market in Argentina: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.2. Payment Processing Solutions Market in Brazil: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.3. Payment Processing Solutions Market in Chile: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.4. Payment Processing Solutions Market in Colombia Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.5. Payment Processing Solutions Market in Venezuela: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.6.6. Payment Processing Solutions Market in Other Latin American Countries: Historical Trends (Since 2020) and Forecasted Estimates (Till 2035)

- 25.7. Data Triangulation and Validation

26. ADJACENT MARKET ANALYSIS

SECTION VII: STRATEGIC TOOLS

27. KEY WINNING STRATEGIES

28. PORTER'S FIVE FORCES ANALYSIS

29. SWOT ANALYSIS

30. VALUE CHAIN ANALYSIS

31. ROOTS STRATEGIC RECOMMENDATIONS

SECTION VIII: OTHER EXCLUSIVE INSIGHTS

32. INSIGHTS FROM PRIMARY RESEARCH

33. REPORT CONCLUSION

SECTION IX: APPENDIX

34. TABULATED DATA

35. LIST OF COMPANIES AND ORGANIZATIONS

36. CUSTOMIZATION OPPORTUNITIES

37. ROOTS SUBSCRIPTION SERVICES

38. AUTHOR DETAILS