PUBLISHER: Roots Analysis | PRODUCT CODE: 1932845

PUBLISHER: Roots Analysis | PRODUCT CODE: 1932845

India Biosimilars Market: Industry Trends and Global Forecasts - Distribution by Drug Class, Therapeutic Area, Type of Manufacturer, Distribution Channel, Geographical Regions and Leading Players

India Biosimilars Market: Overview

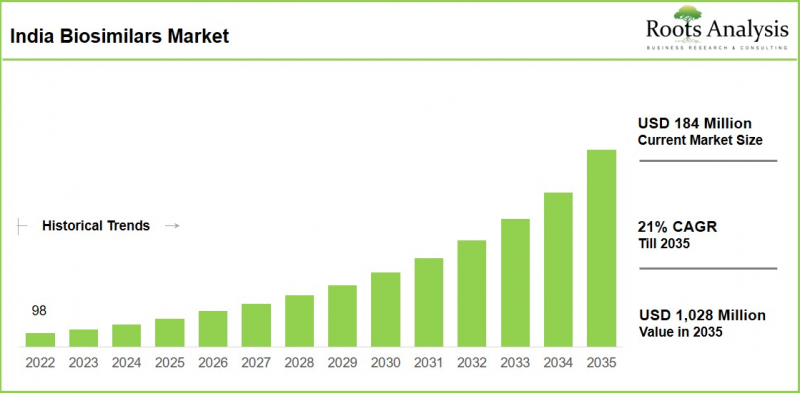

As per Roots Analysis, the India biosimilars market is estimated to grow from USD 184 million in the current year to USD 1,028 million by 2035 at a CAGR of 21% during the forecast period, 2026-2035.

India Biosimilars Market: Growth and Trends

The growth of the biosimilars market in the coming decade is projected to be fueled by the expiration of biologics patents, resulting in the development of alternative biosimilars that closely resemble their reference biologics.

In recent times, the biologics sector has experienced significant growth, largely attributed to its improved efficacy in managing chronic illnesses. Nonetheless, the elevated expenses linked to biologics present considerable financial and healthcare challenges. With the increasing demand for biologics, developers are exploring innovative approaches to create more cost-effective biologic products that maintain comparable safety and efficacy profiles to optimize their investment returns.

Over the past few years, the field has seen a rise in investments and cooperative initiatives from the biosimilar developers. Additionally, regulatory progress, more efficient approval processes, and increased research have bolstered the development of biosimilars, including those for oncology.

In 2026, India's biosimilars market demonstrates strong activity characterized by strategic acquisitions, pipeline growth, regulatory changes, and international partnerships, with expected double-digit growth

With the expanding market for biosimilars as a cost-effective option, the operations for in-house development and outsourcing services are anticipated to rise in India. This trend is set to offer appealing growth prospects for developers of biosimilars.

Growth Drivers: Strategic Enablers of Market Expansion

The India biosimilars market experiences robust growth driven by several key factors, including rising prevalence of chronic diseases like cancer, diabetes, and autoimmune disorders and increased demand for affordable biologic alternatives. In addition, government initiatives such as streamlined regulatory pathways via the Central Drugs Standard Control Organization (CDSCO) and incentives under the PLI (Production Linked Incentive) Scheme for biologics also propel market growth. Further, patent expiries of major drugs like Herceptin and Rituxan, enable local manufacturers to expand portfolios rapidly. Strategic partnerships with global firms, low-cost manufacturing capabilities, and a skilled workforce further position India as a leading exporter.

Market Challenges: Critical Barriers Impeding Progress

Challenges persist in the India biosimilars market despite the ongoing market growth, hindering faster adoption. High development costs, complex manufacturing processes requiring stringent quality controls, and risks of immunogenicity or structural variability raise entry barriers for smaller players in this market space. Further, regulatory hurdles, including evolving guidelines and the need for comparative clinical trials, result in delayed approvals. Market access issues, such as competition from branded generics, pricing pressures, and patent litigations from originator companies, also constrain growth.

Monoclonal Antibodies: Leading Market Segment

Currently, monoclonal antibodies segment captures nearly 55% of the overall market share in India. This dominance can be primarily attributed to their extensive use in treating chronic conditions like cancer, rheumatoid arthritis, and other autoimmune disorders. However, the peptide segment is likely to grow at a higher CAGR during the forecast period.

Oncological Disorders: Dominating Market Segment

At present, majority (~40%) of the market share of biosimilars in India is held by oncological disorders, due to the increasing cancer burden. This is further fueled by rising aging population, lifestyle changes, and enhanced diagnostic methods, which need cost-effective treatments, especially for expensive monoclonal antibody therapies. This is likely to offer appealing growth prospects for developers of biosimilars. Further, the hematological disorders segment is likely to grow at a higher CAGR during the forecast period.

India Biosimilars Market: Key Segments

By Drug Class

- Monoclonal Antibodies

- Proteins

- Peptides

- Others

By Therapeutic Area

- Oncological Disorders

- Autoimmune and Inflammatory Disorders

- Hematological Disorders

- Metabolic Disorders

- Other Disorders

By Type of Manufacturer

- Contract Manufacturers

- In-house Developers

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Example Players in India Biosimilars Market

- Avesthagen

- Biocon Biologics

- Biosimilar Sciences India

- Cipla

- Clonz Biotech

- CuraTeQ Biologics (Subsidiary of Aurobindo Pharma)

- Enzene Biosciences

- GeneSys

- Glenmark Pharmaceuticals

- Intas Pharmaceuticals

- Jodas Expoim

- Levim Lifetech

- Lupin

- Sayre Therapeutics

- Shilpa Biologicals

- Stelis Biopharma

- VITANE Biologics

- Zydus Cadila

Key Questions Answered in this Report

- How many India biosimilars providers are currently engaged in this market?

- Which are the leading companies in this market?

- Which country dominates the India biosimilars market?

- What are the key trends observed in the India biosimilars market?

- What factors are likely to influence the evolution of this market?

- What are the primary challenges faced by biosimilars providers in India?

- What is the current and future India biosimilars market size?

- What is the CAGR of India biosimilars market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

- The report can aid businesses in identifying future opportunities in any sector. It also helps in understanding if those opportunities are worth pursuing.

- The report helps in identifying customer demand by understanding the needs, preferences, and behavior of the target audience in order to tailor products or services effectively.

- The report equips new entrants with requisite information regarding a particular market to help them build successful business strategies.

- The report allows for more effective communication with the audience and in building strong business relations.

Complementary Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Value and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross-Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Biologics

- 6.3. Overview of Biosimilars and Biobetters

- 6.4. Difference between Innovator Biologics, Biosimilars and Generics

- 6.5. Advantages of Biosimilars

- 6.6. Manufacturing of Biosimilars

- 6.7. Development Timeline of Biosimilars

- 6.8. Future Perspectives

7. MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Biosimilars: Developers Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters (Region)

- 7.2.4. Analysis by Location of Headquarters (Country)

- 7.3. Biosimilars: Overall Market Landscape

- 7.3.1. Analysis by Stage of Development

- 7.3.2. Analysis by Therapeutic Area

- 7.3.3. Analysis by Drug Class

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Biosimilars Providers in Japan: Company Competitiveness Analysis

- 8.4.1. Small Biosimilar Developers (Peer Group I)

- 8.4.2. Mid-sized Biosimilar Developers (Peer Group II)

- 8.4.3. Large Biosimilar Developers (Peer Group III)

- 8.5. Capability Benchmarking of top Biosimilar Developers

9. COMPANY PROFILES: INDIA BIOSIMILARS MARKET

- 9.1. Chapter Overview

- 9.2. Avesthagen

- 9.2.1. Company Overview

- 9.2.2. Product Portfolio

- 9.2.3. Financial Information

- 9.2.4. Recent Developments and Future Outlook

- 9.3. Biocon Biologics

- 9.4. Biosimilar Sciences India

- 9.5. Cipla

- 9.6. Clonz Biotech

- 9.7. CuraTeQ Biologics

- 9.8. Enzene Biosciences

- 9.9. GeneSys

- 9.10. Glenmark Pharmaceuticals

- 9.11. Intas Pharmaceuticals

10. COST PRICE ANALYSIS

- 10.1. Chapter Overview

- 10.2. Factors Contributing to High Price of Novel Biologics

- 10.3. Pricing of Biosimilars

- 10.3.1. Price Comparison of Different Biosimilars with its Reference Biologic

- 10.4. Concluding Remarks

11. DEMAND ANALYSIS

- 11.1. Chapter Overview

- 11.2. Key Assumptions and Methodology

- 11.2.1. Global Annual Demand for Biosimilars

- 11.2.1.1. Analysis by Drug Class

- 11.2.1.2. Analysis by Therapeutic Area

- 11.2.1.3. Analysis by Type of Manufacturer

- 11.2.1.4. Analysis by Distribution Channel

- 11.2.1.5. Analysis by Geographical Regions

- 11.2.1. Global Annual Demand for Biosimilars

12. MARKET IMPACT ANALYSIS

- 12.1. Chapter Overview

- 12.2. Market Drivers

- 12.3. Market Restraints

- 12.4. Market Opportunities

- 12.5. Market Challenges

- 12.6. Conclusion

13. INDIA BIOSIMILARS MARKET

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. Global Biosimilars Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 13.4. Roots Analysis Perspective on Market Growth

- 13.5 Scenario Analysis

- 13.5.1. Conservative Scenario

- 13.5.2. Optimistic Scenario

- 13.6. Key Market Segmentations

14. INDIA BIOSIMILARS MARKET, BY DRUG CLASS

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Biosimilars Market: Distribution by Drug Class

- 14.3.1. Biosimilars Market for Monoclonal Antibodies, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.3.2. Biosimilars Market for Proteins, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.3.3. Biosimilars Market for Peptides, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.3.4. Biosimilars Market for Others, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 14.4. Data Triangulation and Validation

15. INDIA BIOSIMILARS MARKET, BY THERAPEUTIC AREA

- 15.1. Chapter Overview

- 15.2. Assumptions and Methodology

- 15.3. Biosimilars Market: Distribution by Therapeutic Area

- 15.3.1. Biosimilars Market for Oncological Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.3.2. Biosimilars Market for Autoimmune and Inflammatory Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.3.3. Biosimilars Market for Hematological Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.3.4. Biosimilars Market for Metabolic Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.3.5. Biosimilars Market for Other Disorders, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 15.4. Data Triangulation and Validation

16. INDIA BIOSIMILARS MARKET, BY TYPE OF MANUFACTURER

- 16.1. Chapter Overview

- 16.2. Assumptions and Methodology

- 16.3. Biosimilars Market: Distribution by Type of Manufacturer

- 16.3.1. Biosimilars Market for Contract Manufacturers, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.3.2. Biosimilars Market for In-house Developers, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 16.4. Data Triangulation and Validation

17. INDIA BIOSIMILARS MARKET, BY DISTRIBUTION CHANNEL

- 17.1. Chapter Overview

- 17.2. Assumptions and Methodology

- 17.3. Biosimilars Market: Distribution by Distribution Channel

- 17.3.1. Biosimilars Market for Hospital Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.3.2. Biosimilars Market for Retail Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.3.3. Biosimilars Market for Online Pharmacies, Historical Trends (since 2019) and Forecasted Estimates (till 2035)

- 17.4. Data Triangulation and Validation

18. CONCLUDING REMARKS

19. APPENDIX I: TABULATED DATA

20. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS