PUBLISHER: Tariff Consultancy Ltd | PRODUCT CODE: 1103086

PUBLISHER: Tariff Consultancy Ltd | PRODUCT CODE: 1103086

H1 2022: Data Centre Developments in Europe

Datacentrepricing latest research finds that by the end of June 2022, the cumulative total of Data centre space announcement in 2022 is at 50% of the total of space announcements made in 2021.

Datacentrepricing specialists in Data Centre research worldwide, has today published a new report covering the 2022 Data Centre Developments announced in the first half of 2022 in Europe.

About the report, called “Data Centre Developments in Europe - H1 2022 ” uses information on just under sixty projects collated by datacentrepricing on key new third-party Data Centres planned across fifteen European countries.

From the research, datacentrepricing highlights the following key trends:

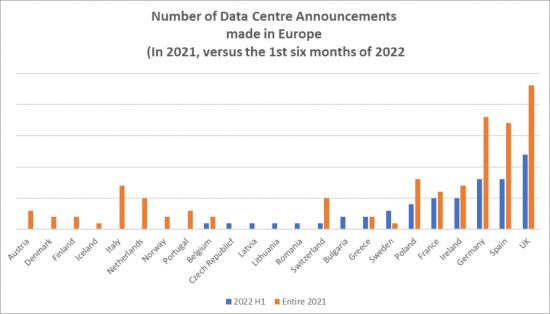

- The UK sees the highest number of new Data Centre projects with twelve followed by Germany and Spain each eight.

- The total announced Data Centre space in Europe to-date in 2022 is 467,815 m2.

- The chart below shows, in which countries Data Centre announcements have been made in 2021 and 2022, with a number of countries showing no announcements made to-date in 2022.

- Space announced vary from 325 m2 DataVita in Glasgow (announced in June 2022) up to the 50,000 m2 size development announced by Thor Digital for build in Madrid.

- A focus on new markets for Data Centres: Over the last six-month period to the end of June 2022, there has been a move in Data Centre investment away from the traditional FLAP (Frankfurt, London Amsterdam and Paris) markets - which have previously attracted the majority of Data Centre investment - to smaller Tier II/III markets including Sofia (Bulgaria), Hamburg (Germany), Birmingham (UK) and others.

- Data Centre construction in Europe continues to boom - 29% of the announced data centre space being launched in 2022, 12% in 2023, 23.5% in 2024, 26.5% in 2025 and 9% in 2026.

- The growth in new facilities in Europe reflects the spread of Data Centres to smaller metro markets in Europe who are now catching up with the larger FLAP markets with large campus developments.

It is still too early to say whether economic headwinds, notably rising energy costs, inflation and the threat of an economic slowdown will impact the Data Centre sector, but investment continues in the two largest European Data Centre markets of the UK and Germany. Otherwise, new building is occurring in so-called Tier 2 markets, where there may be further opportunities for growth where the Data Centre markets up until recently having relatively little hyperscale capacity.

Datacentrepricing will continue to track new data centre annoncements for the remainder of 2022.

Table of Contents

- About Datacentrepricing

- Methodology

- Executive Summary

- European Data Centre Development Overview: First half of 2022, covering key countries.

Belgium

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments

- Summary

Czech Republic

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments

- Summary

France

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments.

- Summary

Germany

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments

- Summary

Greece

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments.

- Summary

Ireland

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments.

- Summary

Latvia

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments.

- Summary

Lithuania

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments

- Summary

Poland

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments

- Summary

Romania

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments

- Summary

Spain

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments

- Summary

Sweden

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments

- Summary

Switzerland

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments

- Summary

UK

- Data Centre Providers Expansion Plans: Space, Power, Location, Proposed Launches

- Data Centre Provider Profiles for new developments

- Summary

Conclusions - Key Data Centre Developments during the first half of 2022