Need help finding what you are looking for?

Contact Us

PUBLISHER: TECHCET | PRODUCT CODE: 1498830

PUBLISHER: TECHCET | PRODUCT CODE: 1498830

Electronic Gases including Ne & Xe Market Report 2024-2025 (Critical Materials Report)

PUBLISHED:

PAGES: 311 Pages

DELIVERY TIME: 1-2 business days

SELECT AN OPTION

This report covers the market landscape and supply-chain for Electronic Gases used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

SAMPLE VIEW

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 ELECTRONIC GASES BUSINESS - MARKET OVERVIEW

- 1.2 MARKET TRENDS IMPACTING 2024 OUTLOOK

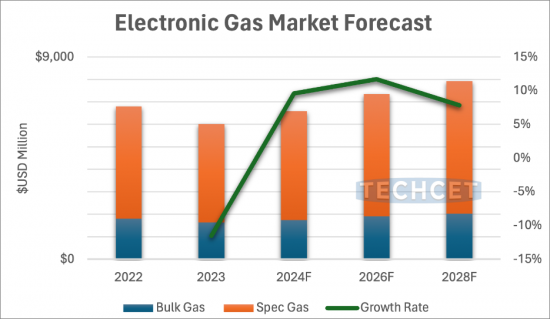

- 1.3 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT

- 1.4 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT-HIGHLIGHT KEY MATERIALS

- 1.5 ELECTRONIC GASES SEGMENT TRENDS

- 1.6 TECHNOLOGY TRENDS

- 1.7 COMPETITIVE LANDSCAPE - ELECTRONIC GASES

- 1.7.1 COMPETITIVE LANDSCAPE - INDUSTRIAL GASES

- 1.8 CURRENT QUARTER TOP-5 GLOBAL ELECTRONIC GASES SUPPLIERS' ACTIVITIES & REPORTED REVENUES

- 1.9 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

- 1.10 ANALYST ASSESSMENT OF ELECTRONIC GASES

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 ELECTRONIC GASES MARKET TRENDS

- 4.1 ELECTRONIC GASES MARKET TRENDS - OUTLINE

- 4.1.1 2023 ELECTRONIC GASES MARKET LEADING INTO 2024

- 4.1.2 ELECTRONIC GASES MARKET OUTLOOK

- 4.1.3 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.1.4 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT-HIGHLIGHT KEY MATERIALS

- 4.2 ELECTRONIC GASES SUPPLY CAPACITY AND DEMAND, OVERVIEW

- 4.2.1 ELECTRONIC GASES SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.2.2 ELECTRONIC GASES PRODUCTION BY REGION

- 4.2.3 ELECTRONIC GASES PRODUCTION CAPACITY EXPANSIONS

- 4.2.4 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.2.4.1 REGIONAL ACTIVITY SPECIALTY GAS INVESTMENTS

- 4.2.5 INVESTMENT ACTIVITY ADDITIONAL COMMENTS

- 4.2.6 RARE GASES - XE, KR, NE - SUPPLY VS. DEMAND BALANCE - OVERVIEW

- 4.2.6.1 SPECIALTY GAS MARKET: 5-YEAR SUPPLY & DEMAND, SELECT GASES

- 4.2.6.2 SUPPLY VS. DEMAND BALANCE - NEON

- 4.2.6.3 SUPPLY VS. DEMAND BALANCE - NEON (CONTINUED)

- 4.2.6.4 SUPPLY VS. DEMAND BALANCE - XENON

- 4.2.6.5 SUPPLY VS. DEMAND BALANCE - KRYPTON

- 4.2.7 HELIUM SUPPLY V. DEMAND

- 4.2.7.1 SUPPLY VS. DEMAND BALANCE - HELIUM

- 4.2.7.2 SUPPLY VS. DEMAND BALANCE - REGIONAL HELIUM SUPPLY

- 4.2.7.3 HELIUM SUPPLY RISK BY COUNTRY 2030

- 4.2.7.4 KEY PLAYERS IN THE HELIUM SUPPLY CHAIN

- 4.2.8 SUPPLY VS. DEMAND BALANCE - NF3, NITROGEN TRIFLUORIDE

- 4.2.8.1 ELECTRONIC GASES MARKET OUTLOOK - NF3

- 4.2.9 SUPPLY VS. DEMAND BALANCE - WF6, TUNGSTEN HEXAFLUORIDE

- 4.3 PRICING TRENDS

- 4.3.1 PRICING TRENDS - NEON

- 4.3.2 PRICING TRENDS - XENON

- 4.3.3 PRICING TRENDS - KRYPTON

- 4.3.4 HELIUM PRICE TREND & FORECAST

- 4.4 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 4.4.1 ELECTRONIC GASES GENERAL TECHNOLOGY OVERVIEW

- 4.4.2 ELECTRONIC GASES TECHNOLOGY TRENDS

- 4.4.3 SPECIALTY/EMERGING MATERIAL AND APPLICATIONS

- 4.4.4 WF6 MARKET DEMAND, POTENTIAL DISPLACEMENT BY MOLYBDENUM

- 4.4.5 ALE ETCH GAS LISTING

- 4.4.6 SUMMARY OF TECHNICAL TRENDS AND OPPORTUNITIES

- 4.5 REGIONAL CONSIDERATIONS

- 4.6 EHS AND TRADE/LOGISTIC ISSUES

- 4.6.1 RUSSIA INVASION OF UKRAINE

- 4.6.2 YEMEN'S HOUTHI ATTACKS IN THE RED SEA AND GULF OF ADEN DISRUPT GLOBAL SHIPPING

- 4.6.3 NEW MIDDLE EAST CONFLICT COULD DISRUPT GLOBAL TECH SUPPLY CHAIN AND INTEL'S EXPANSION PLANS

- 4.6.4 PANAMA CANAL HISTORIC DROUGHT

- 4.6.5 EHS ISSUES

- 4.6.6 EHS ISSUES

- 4.6.7 TRADE/LOGISTICS ISSUES

- 4.7 ANALYST ASSESSMENT OF ELECTRONIC GASES MARKET TRENDS

5 SUPPLY-SIDE MARKET LANDSCAPE

- 5.1 ELECTRONIC GASES MARKET SHARE

- 5.1.1 INDUSTRIAL GASES MARKET SHARE

- 5.2 CURRENT QUARTER TOP-5 GLOBAL ELECTRONIC GASES SUPPLIERS' ACTIVITIES & REPORTED REVENUES

- 5.2.1 US SUPPLIER RANKING

- 5.3 LINDE PLC FULL YEAR 2023 AND Q4 - ROBUST EARNINGS GROWTH DESPITE SALES DECLINE, FORECASTS CONTINUED STRONG PERFORMANCE

- 5.3.1 AIR LIQUIDE'S Q4 AND 2023 REVENUES WEIGHED BY DECLINING ENERGY PRICES, BUT SHOWING POSITIVE METRICS

- 5.3.2 MERCK'S ELECTRONICS SECTOR FACES 4% ORGANIC SALES DECLINE IN Q3 2023, IMPACTED BY SEMICONDUCTOR SLOWDOWN AND MARKET PRESSURES

- 5.3.3 TAIYO NIPPON SANSO REVENUES Q3 RESULTS

- 5.4 REGIONAL TRENDS- KOREA

- 5.4.1 REGIONAL TRENDS- JAPAN

- 5.4.2 REGIONAL TRENDS- CHINA

- 5.4.3 REGIONAL TRENDS - RUSSIA

- 5.4.4 REGIONAL TRENDS- USA

- 5.4.5 REGIONAL TRENDS- EU

- 5.5 M&A ACTIVITY AND PARTNERSHIPS

- 5.5.1 M&A ACTIVITY AND PARTNERSHIPS

- 5.6 PLANT CLOSURES / DIVESTITURES

- 5.7 NEW ENTRANTS

- 5.8 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.9 TECHCET ANALYST ASSESSMENT OF ELECTRONIC GAS SUPPLIERS

6 SUB-TIER SUPPLY CHAIN, ELECTRONIC GASES

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 BULK GASES AND THEIR SOURCES

- 6.1.2 FLUORSPAR SUPPLY

- 6.1.2.1 FLUORSPAR WORLD RESERVES

- 6.1.2.2 FLUORSPAR SUPPLY, DEMAND AND PRICING IMPACTS

- 6.1.3 BROMINE SUPPLY

- 6.2 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES

- 6.3 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 SUPPLIER PROFILES

- Air Liquide

- Air Products

- Air Water

- Cryoin Engineering

- DuPont

- ...AND 20+ MORE

8 APPENDIX

- 8.1 GASES USED BY MULTIPLE INDUSTRIES

- 8.1.1 SPECIALTY GAS INDUSTRY MATRIX

- 8.1.2 GASES USED FOR SEMICONDUCTOR DEVICE MANUFACTURING

- 8.1.3 GASES USED IN THE DISPLAY INDUSTRY

- 8.2 SUPPLIER LISTING BY GAS TYPE

- 8.2.1 HYDRIDES

- 8.2.2 SILICON PRECURSORS (SILANES)

- 8.2.3 ETCHANTS/CHAMBER CLEAN

- 8.2.4 DEPOSITION/MISC

- 8.2.5 BULK GASES

- 8.3 ETCH GAS ROADMAPS

- 8.3.1 ETCH ROADMAPS 1 OF 3

- 8.3.2 ETCH ROADMAPS 2 OF 3

- 8.3.3 ETCH ROADMAPS 3 OF 3

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 ELECTRONIC GASES BUSINESS - MARKET OVERVIEW

- 1.2 MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT

- 1.4 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT-HIGHLIGHT KEY MATERIALS

- 1.5 ELECTRONIC GASES SEGMENT TRENDS

- 1.6 TECHNOLOGY TRENDS

- 1.7 COMPETITIVE LANDSCAPE - ELECTRONIC GASES

- 1.7.1 COMPETITIVE LANDSCAPE - INDUSTRIAL GASES

- 1.8 CURRENT QUARTER TOP-5 GLOBAL ELECTRONIC GASES SUPPLIERS' ACTIVITIES & REPORTED REVENUES

- 1.9 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

- 1.10 ANALYST ASSESSMENT OF ELECTRONIC GASES

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 ELECTRONIC GASES MARKET TRENDS

- 4.1 ELECTRONIC GASES MARKET TRENDS - OUTLINE

- 4.1.1 2023 ELECTRONIC GASES MARKET LEADING INTO 2024

- 4.1.2 ELECTRONIC GASES MARKET OUTLOOK

- 4.1.3 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.1.4 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT-HIGHLIGHT KEY MATERIALS

- 4.2 ELECTRONIC GASES SUPPLY CAPACITY AND DEMAND, OVERVIEW

- 4.2.1 ELECTRONIC GASES SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.2.2 ELECTRONIC GASES PRODUCTION BY REGION

- 4.2.3 ELECTRONIC GASES PRODUCTION CAPACITY EXPANSIONS

- 4.2.4 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.2.4.1 REGIONAL ACTIVITY SPECIALTY GAS INVESTMENTS

- 4.2.5 INVESTMENT ACTIVITY ADDITIONAL COMMENTS

- 4.2.6 RARE GASES - XE, KR, NE - SUPPLY VS. DEMAND BALANCE - OVERVIEW

- 4.2.6.1 SPECIALTY GAS MARKET: 5-YEAR SUPPLY & DEMAND, SELECT GASES

- 4.2.6.2 SUPPLY VS. DEMAND BALANCE - NEON

- 4.2.6.3 SUPPLY VS. DEMAND BALANCE - NEON (CONTINUED)

- 4.2.6.4 SUPPLY VS. DEMAND BALANCE - XENON

- 4.2.6.5 SUPPLY VS. DEMAND BALANCE - KRYPTON

- 4.2.7 HELIUM SUPPLY V. DEMAND

- 4.2.7.1 SUPPLY VS. DEMAND BALANCE - HELIUM

- 4.2.7.2 SUPPLY VS. DEMAND BALANCE - REGIONAL HELIUM SUPPLY

- 4.2.7.3 HELIUM SUPPLY RISK BY COUNTRY 2030

- 4.2.7.4 KEY PLAYERS IN THE HELIUM SUPPLY CHAIN

- 4.2.8 SUPPLY VS. DEMAND BALANCE - NF3, NITROGEN TRIFLUORIDE

- 4.2.8.1 ELECTRONIC GASES MARKET OUTLOOK - NF3

- 4.2.9 SUPPLY VS. DEMAND BALANCE - WF6, TUNGSTEN HEXAFLUORIDE

- 4.3 PRICING TRENDS

- 4.3.1 PRICING TRENDS - NEON

- 4.3.2 PRICING TRENDS - XENON

- 4.3.3 PRICING TRENDS - KRYPTON

- 4.3.4 HELIUM PRICE TREND & FORECAST

- 4.4 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 4.4.1 ELECTRONIC GASES GENERAL TECHNOLOGY OVERVIEW

- 4.4.2 ELECTRONIC GASES TECHNOLOGY TRENDS

- 4.4.3 SPECIALTY/EMERGING MATERIAL AND APPLICATIONS

- 4.4.4 WF6 MARKET DEMAND, POTENTIAL DISPLACEMENT BY MOLYBDENUM

- 4.4.5 ALE ETCH GAS LISTING

- 4.4.6 SUMMARY OF TECHNICAL TRENDS AND OPPORTUNITIES

- 4.5 REGIONAL CONSIDERATIONS

- 4.6 EHS AND TRADE/LOGISTIC ISSUES

- 4.6.1 RUSSIA INVASION OF UKRAINE

- 4.6.2 YEMEN'S HOUTHI ATTACKS IN THE RED SEA AND GULF OF ADEN DISRUPT GLOBAL SHIPPING

- 4.6.3 NEW MIDDLE EAST CONFLICT COULD DISRUPT GLOBAL TECH SUPPLY CHAIN AND INTEL'S EXPANSION PLANS

- 4.6.4 PANAMA CANAL HISTORIC DROUGHT

- 4.6.5 EHS ISSUES

- 4.6.6 EHS ISSUES

- 4.6.7 TRADE/LOGISTICS ISSUES

- 4.7 ANALYST ASSESSMENT OF ELECTRONIC GASES MARKET TRENDS

5 SUPPLY-SIDE MARKET LANDSCAPE

- 5.1 ELECTRONIC GASES MARKET SHARE

- 5.1.1 INDUSTRIAL GASES MARKET SHARE

- 5.2 CURRENT QUARTER TOP-5 GLOBAL ELECTRONIC GASES SUPPLIERS' ACTIVITIES & REPORTED REVENUES

- 5.2.1 US SUPPLIER RANKING

- 5.3 LINDE PLC FULL YEAR 2023 AND Q4 - ROBUST EARNINGS GROWTH DESPITE SALES DECLINE, FORECASTS CONTINUED STRONG PERFORMANCE

- 5.3.1 AIR LIQUIDE'S Q4 AND 2023 REVENUES WEIGHED BY DECLINING ENERGY PRICES, BUT SHOWING POSITIVE METRICS

- 5.3.2 MERCK'S ELECTRONICS SECTOR FACES 4% ORGANIC SALES DECLINE IN Q3 2023, IMPACTED BY SEMICONDUCTOR SLOWDOWN AND MARKET PRESSURES

- 5.3.3 TAIYO NIPPON SANSO REVENUES Q3 RESULTS

- 5.4 REGIONAL TRENDS- KOREA

- 5.4.1 REGIONAL TRENDS- JAPAN

- 5.4.2 REGIONAL TRENDS- CHINA

- 5.4.3 REGIONAL TRENDS - RUSSIA

- 5.4.4 REGIONAL TRENDS- USA

- 5.4.5 REGIONAL TRENDS- EU

- 5.5 M&A ACTIVITY AND PARTNERSHIPS

- 5.5.1 M&A ACTIVITY AND PARTNERSHIPS

- 5.6 PLANT CLOSURES / DIVESTITURES

- 5.7 NEW ENTRANTS

- 5.8 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.9 TECHCET ANALYST ASSESSMENT OF ELECTRONIC GAS SUPPLIERS

6 SUB-TIER SUPPLY CHAIN, ELECTRONIC GASES

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 BULK GASES AND THEIR SOURCES

- 6.1.2 FLUORSPAR SUPPLY

- 6.1.2.1 FLUORSPAR WORLD RESERVES

- 6.1.2.2 FLUORSPAR SUPPLY, DEMAND AND PRICING IMPACTS

- 6.1.3 BROMINE SUPPLY

- 6.2 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES

- 6.3 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 SUPPLIER PROFILES

- Air Liquide

- Air Products

- Air Water

- Cryoin Engineering

- DuPont

- ...AND 20+ MORE

8 APPENDIX

- 8.1 GASES USED BY MULTIPLE INDUSTRIES

- 8.1.1 SPECIALTY GAS INDUSTRY MATRIX

- 8.1.2 GASES USED FOR SEMICONDUCTOR DEVICE MANUFACTURING

- 8.1.3 GASES USED IN THE DISPLAY INDUSTRY

- 8.2 SUPPLIER LISTING BY GAS TYPE

- 8.2.1 HYDRIDES

- 8.2.2 SILICON PRECURSORS (SILANES)

- 8.2.3 ETCHANTS/CHAMBER CLEAN

- 8.2.4 DEPOSITION/MISC

- 8.2.5 BULK GASES

- 8.3 ETCH GAS ROADMAPS

- 8.3.1 ETCH ROADMAPS 1 OF 3

- 8.3.2 ETCH ROADMAPS 2 OF 3

- 8.3.3 ETCH ROADMAPS 3 OF 3

LIST OF FIGURES

- FIGURE 1.1: ELECTRONIC GAS MARKET

- FIGURE 1.2: HELIUM DEMAND 2023 - 7.4 BCF

- FIGURE 1.3: TOTAL ELECTRONIC GAS MARKET SHARE 2023, US$6.01B

- FIGURE 1.4: TOTAL INDUSTRIAL GAS MARKET SHARE 2023, US$104B

- FIGURE 1.5: TOP-5 ELECTRONIC GASES MAKERS' QUARTERLY COMBINED SALES (LINDE, AL, AP, RESONAC, TNSC)

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.5: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.6: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.7: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.8: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.9: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.10: ESTIMATED GLOBAL FAB SPENDING 2022-2027

- FIGURE 3.11: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.12: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.13: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.14: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.15: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.18: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.19: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: ELECTRONIC GAS MARKET

- FIGURE 4.2: HELIUM DEMAND 2023 - 7.4 BCF

- FIGURE 4.3: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND

- FIGURE 4.4: NEON SUPPLY/DEMAND FORECAST

- FIGURE 4.5: GLOBAL NEON REVENUES

- FIGURE 4.6: XENON SUPPLY/DEMAND FORECAST

- FIGURE 4.7: GLOBAL XENON REVENUES

- FIGURE 4.8: KRYPTON SUPPLY/DEMAND FORECAST

- FIGURE 4.9: GLOBAL KRYPTON REVENUES

- FIGURE 4.10: HELIUM SUPPLY & DEMAND (BCF)

- FIGURE 4.11: HELIUM DEMAND BY APPLICATION 2023 - 5.9 BCF

- FIGURE 4.12: WW HELIUM CAPACITY BY REGION 2023 VS. 2028 (BCF)

- FIGURE 4.13: HELIUM SUPPLY RISK BY COUNTRY 2030

- FIGURE 4.14: NF3 SUPPLY/DEMAND FORECAST

- FIGURE 4.15: WF6 SUPPLY/DEMAND FORECAST

- FIGURE 4.16: WORLDWIDE NOBLE GASES ASP TREND

- FIGURE 4.17: MO PRECURSORS

- FIGURE 4.18: PLASMA AND THERMAL ALE PROCESSES

- FIGURE 4.19: 2023 SEMICONDUCTOR ELECTRONIC GASES REVENUE SHARE BY REGION

- FIGURE 4.20: GREENHOUSE GAS PROTOCOL, DETAILED CATEGORIES

- FIGURE 4.21: SCOPE 3 EMISSIONS FOR SEMICONDUCTOR COMPANIES

- FIGURE 4.22: CO2-EQUIVALENT EMISSIONS FOR TYPICAL FAB

- FIGURE 5.1: TOTAL ELECTRONIC GAS MARKET SHARE 2023, US$6.01B

- FIGURE 5.2: TOTAL INDUSTRIAL GAS MARKET SHARE 2023, US$104 B

- FIGURE 5.3: TOP-5 ELECTRONIC GASES MAKERS' QUARTERLY COMBINED SALES (LINDE, AL, AP, RESONAC, TNSC)

- FIGURE 5.4: AIR LIQUIDE'S Q4 AND 2023 REVENUES

- FIGURE 5.5: MERCK'S 2023 REVENUES

- FIGURE 5.6: TAIYO NIPPON SANSO REVENUES Q3 RESULTS

- FIGURE 5.7: KOREA SEMICONDUCTOR DEVELOPMENT PLAN

- FIGURE 6.1: LEADING COUNTRIES BASED ON MINE PRODUCTION OF FLUORSPAR WORLDWIDE IN 2023

- FIGURE 6.2: WW RESERVES OF FLUORSPAR IN 2023, BY COUNTRY (US$/KILOTONNE)

- FIGURE 6.3: FLUORSPAR PRICE IN US 2014-2023 (US$/KILOTONNE)

- FIGURE 6.4: WW BROMINE SUPPLY 2023 (KILOTONNES)

- FIGURE 8.1: ELECTRONIC SPECIALTY GASES

- FIGURE 8.2: BULK GASES

LIST OF TABLES

- TABLE 1.1: ELECTRONIC GASES(S) GROWTH OVERVIEW

- TABLE 1.2: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 1.3: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: ELECTRONIC GASES SUPPLIER MANUFACTURING LOCATIONS

- TABLE 4.2: OVERVIEW OF ANNOUNCED 2023/2024 ELECTRONIC GASES SUPPLIER INVESTMENTS

- TABLE 4.3: REGIONAL SUMMARY OF GAS MARKET

- TABLE 4.4: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND

- TABLE 4.5: SUPPLIERS WITH LOCATIONS IN AREAS OF HIGH RISK

- TABLE 4.6: GAS TRENDS AND OPPORTUNITIES BY DEVICE TYPE

- TABLE 5.1: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 5.2: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 5.3: ESTIMATED SUPPLY CHAIN SUPPLIER RANKING

- TABLE 6.1: BULK AND INERT GAS APPLICATION AND SOURCE DESCRIPTION

- TABLE 8.1: SPECIALTY GAS INDUSTRY MATRIX

- TABLE 8.2: GASES USED IN FPD MANUFACTURING

- TABLE 8.3: HYDRIDE GAS SUPPLIERS

- TABLE 8.4: SILICON PRECURSOR SUPPLIERS

- TABLE 8.5: ETCHANT GAS SUPPLIERS

- TABLE 8.6: DEPOSITION/MISC. GAS SUPPLIERS

- TABLE 8.7: BULK GAS SUPPLIERS

- TABLE 8.8: ETCH ROADMAPS

- TABLE 8.9: ETCH ROADMAPS

- TABLE 8.10: ETCH ROADMAPS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.