PUBLISHER: TrendForce | PRODUCT CODE: 1713736

PUBLISHER: TrendForce | PRODUCT CODE: 1713736

2025 Development Trends in LED Grow Lights and Major Application Sectors

[Insight] TrendForce: Global LED Grow Light Market Size Projected to Reach USD 2.056 Billion by 2029

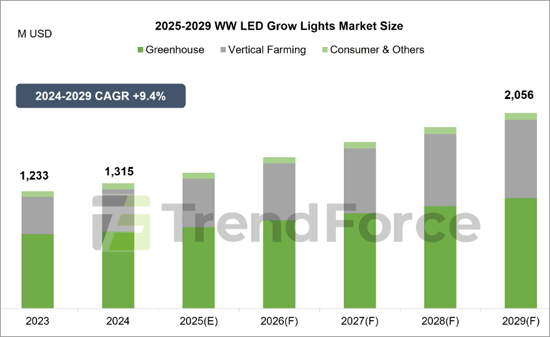

According to TrendForce's " 2025 Development Trends in LED Grow Lights and Major Application Sectors" report, the LED grow light market is rebounding in 2024, driven by recovering demand for greenhouse of fruits and vegetables and renewed investments in small and medium-sized vertical farms. The market size for LED grow lights in 2024 is estimated at USD 1.315 billion. Looking ahead, factors such as increasing LED adoption, replacement of older technologies with high-efficiency products boasting improved Photosynthetic Photon Efficacy (PPE) and Photosynthetic Photon Flux Density (PPFD), and advancements in adjustable multi-channel lighting are expected to fuel growth. Significant investments in emerging agricultural technologies are also encouraging growers to adopt LED solutions, pushing the market to a projected USD 2.056 billion by 2029, with a compound annual growth rate (CAGR) of 9.4% from 2024 to 2029.

The report highlights that greenhouse (including non-stacked indoor farming) account for the largest share of LED grow light applications, followed by vertical farms and the consumer segment. In 2024, greenhouses represent over 60% of the market, while vertical farms contribute more than 30%. With ongoing investments in agricultural innovation, vertical farms are expected to see a growing share of demand in the coming years.

01. Market Opportunities in Greenhouse Applications (including non-stacked indoor Farming)

Demand in this application market is still dominated by the replacement of High-Pressure Sodium (HPS) lamps with LEDs, primarily due to the significant energy-saving benefits of LED technology. The market focus has shifted towards high-power solutions above 600W, with products in the 600W to 1500W range gradually becoming the mainstream configuration. The overall level of Photosynthetic Photon Efficacy (PPE) has increased to 3.0-4.5 micro-mol/J, which not only boosts plant growth efficiency but also lowers overall production costs.

In 2024, demand for LED grow lights in indoor cannabis cultivation has declined, but interest in high-value crops like tomatoes, strawberries, grapes, and flowers has surged. These crops, which require strict freshness standards, are increasingly grown locally to minimize transportation costs. TrendForce estimates that greenhouse applications accounted for 61.5% of the LED grow light market in 2024, down slightly from 2023 but still dominant. This segment is projected to grow to USD 1.158 billion by 2029, with a CAGR of 7.5% from 2024 to 2029.

Leading brands such as Philips, Fluence, Gavita, Agrolux, Acuity, Lumatek, Hortilux, Heliospectra, and California Lightworks are capitalizing on this trend by offering products with optimized spectral recipes and adjustable multi-channel controls. In addition to the standard 120-degree beam angle, wider angles of 140 and 150 degrees are gaining popularity.

02. Market Opportunities in Small and Medium-Sized Vertical Farming Applications

After a two-year period of recalibration, the vertical farming sector showed signs of recovery in 2024, with small and medium-sized farms driving growth. Factors such as rising demand for localized cultivation, a focus on fresh and healthy produce, and government subsidies are supporting profitability in this segment. These farms include smaller-scale operations, container farms serving urban communities, and in-store farms operated by supermarkets and retailers, all contributing to sustainable demand growth.

Container farms are gaining traction in urban areas, island resorts (e.g., Sri Lanka), schools, and resource-scarce regions like Alaska. In-store farms are expanding into shops, hotels, restaurants, and even maritime vessels, such as tankers using Agwa Farm products managed by Synergy Marine Group. Beyond leafy greens, high-value crops like strawberries and onions, as well as plants for breeding, are increasingly cultivated. TrendForce projects this market segment to reach USD 822 million by 2029, with a CAGR of 13.1% from 2024 to 2029.

03. Market Opportunities in Consumer Applications

According to TrendForce's latest data, the rising demand for indoor residential gardening and decorative plants across Europe and the Americas has driven increased sales of consumer LED grow lights., combined with accessible e-commerce platforms, has boosted sales of consumer-grade LED grow lights. In 2024, this segment accounted for 4.8% of the total market.

Looking ahead, continued passion for residential gardening in Europe and the Americas and the launch of innovative LED grow light products are set to drive further market growth. TrendForce forecasts this market to grow to USD 76 million by 2029, with a CAGR of 3.7% from 2024 to 2029.

Table of Contents

Chapter 1: Global LED Grow Lights Market Trend

- LED Performance for Horticultural Lighting

- LED Main Applications for Horticultural Lighting

- Analysis on Major LED Horticultural Lighting Applications

- Technical Requirements for Main Applications of LED Horticultural Lighting

- LED Grow Lights: Analysis on Current Product Technology Developments and Trends

- Distribution of Major Crops in the Horticultural Lighting Market

- The Most Promising Plant-Based Lighting Applications

- Drivers of Growth in the LED Horticultural Lighting Market

- Policy and Regulations

- 2025-2029 Global LED Grow Lights Market Size Analysis

- 2025-2029 Global LED Grow Lights Market Size Analysis- Value Based: By Application

- 2025-2029 LED Grow Lights Market Size Analysis- Value Based: by Region

Chapter 2: Trend Analysis on Grow Lights in Greenhouse

- Market Size Analysis of LED Grow Lights in Greenhouse

- Regional Market Analysis of LED Grow Lights for Greenhouse

- LED Lighting Specs and Prices for Greenhouses: Fruits, Vegetables, and Floral Crops

- LED Lighting Specs and Prices for Indoor Farming: Cannabis

- Case Study: Applications for Greenhouses across Europe

- Case Study: Applications for Greenhouses across North America

Chapter 3: Trend Analysis on Grow Lights in Vertical Farming

- Market Size Analysis of LED Grow Lights in Vertical Farming

- Regional Market Analysis of LED Grow Lights for Vertical Farming

- Product Specs and Price Analysis of LED Grow Lights for Vertical Farming

- Current Developments of the Vertical Farming Market

- Types of Small- and Medium-Scale Vertical Farming Applications and Major Market Analysis

- Case Study: Applications for Vertical Farming across North America

- Case Study: Applications for Vertical Farming across Europe

- Case Study: Applications for Vertical Farming across Asia

Chapter 4: Trend Analysis on Grow Lights in Consumer Farming

- Market Size Analysis of LED Grow Lights in Consumer Farming

- 2024-2025 Regional Market Analysis of LED Grow Lights for Consumer Farming

- Product Specs and Price Analysis of LED Grow Lights for Consumer

Chapter 5: Key Supply Chain Market Analysis

- 2025-2029 Agricultural Lighting LED Market Value

- Specification Analysis of Horticultural Lighting LED Products from Major Manufacturers

- 2025 Analysis: Horticultural Lighting LED Specifications and Prices 660nm Red Light Products

- 2025 Analysis: Horticultural Lighting LED Specifications and Prices White Light Products

- Horticultural LED Lighting Market Supply Chain Update

- 2023-2024 Agricultural Lighting LED Manufacturers Revenue Ranking

- 2023-2024 Agricultural Lighting LED Manufacturer Market Share

- LED Horticultural Lighting Manufacturer Landscape